Insurance Quote For House

Welcome to this comprehensive guide on navigating the often complex world of insurance quotes for your home. As a homeowner, ensuring the protection and security of your property is a top priority. This expert-led article will delve into the intricacies of obtaining an insurance quote, providing you with the knowledge and tools to make informed decisions about your home's coverage.

Understanding Insurance Quotes for Your House

Securing an insurance quote for your house is a crucial step in safeguarding your biggest investment. Insurance policies are designed to protect homeowners from financial loss due to various unforeseen events, such as natural disasters, theft, or accidental damage. Obtaining an accurate quote is essential to ensure you have adequate coverage without overspending.

The process of acquiring an insurance quote involves assessing your home's unique characteristics and your specific needs. It is a detailed evaluation that considers factors like the location, construction materials, age of the property, and any additional features or amenities. This comprehensive approach ensures that the quote provided is tailored to your circumstances.

Factors Influencing Your Insurance Quote

Several key factors come into play when determining the cost of your home insurance quote. Understanding these elements is vital to making informed choices about your coverage and managing your insurance expenses effectively.

- Location: The geographical location of your home plays a significant role. Areas prone to natural disasters like hurricanes, floods, or wildfires may incur higher insurance costs due to the increased risk.

- Construction Materials and Age: The materials used to build your home and its age are important considerations. Older homes may require specialized coverage, while modern construction materials can offer certain advantages in terms of durability and resistance to damage.

- Home Size and Design: The size and design of your home can impact the quote. Larger homes generally require more coverage, and unique architectural features may attract additional costs or require specific coverage.

- Personalized Coverage Needs Your individual needs and preferences for coverage can significantly influence the quote. Options such as liability coverage, personal property coverage, and additional living expenses coverage can be tailored to your requirements.

Obtaining an Accurate Insurance Quote

To ensure you receive an accurate insurance quote, it is essential to provide detailed and honest information about your home and its features. This transparency is crucial to avoid any surprises or gaps in coverage when it matters most.

When seeking quotes from insurance providers, consider the following steps:

- Gather Essential Information: Compile all relevant details about your home, including its address, construction materials, age, and any recent improvements or renovations.

- Assess Your Coverage Needs: Evaluate your personal requirements for coverage. Consider the value of your belongings, any specific risks in your area, and the level of liability protection you desire.

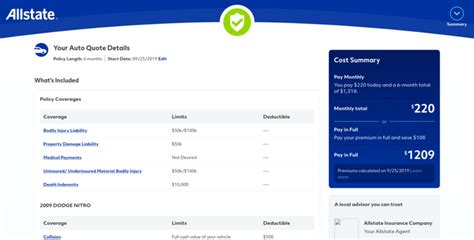

- Compare Multiple Quotes: Obtain quotes from several reputable insurance companies. Comparing options allows you to identify the best coverage at the most competitive price.

- Understand Policy Terms: Carefully review the policy terms and conditions, ensuring you understand the coverage limits, deductibles, and any exclusions or restrictions.

- Seek Professional Guidance: Consult with an insurance broker or agent who can provide expert advice tailored to your situation. They can help navigate the complexities of insurance and ensure you have adequate coverage.

Exploring Different Types of Home Insurance

Home insurance is not a one-size-fits-all solution. There are various types of policies available, each designed to cater to specific needs and circumstances. Understanding the different options is crucial to making an informed decision about your home’s coverage.

Standard Homeowners Insurance

Standard homeowners insurance, also known as HO-3 insurance, is the most common type of policy. It provides broad coverage for your home and personal belongings against a range of perils, including fire, theft, and vandalism. This type of insurance typically covers the structure of your home, personal property, and provides liability protection.

Special Form Homeowners Insurance

Special form homeowners insurance, or HO-5 insurance, offers more comprehensive coverage than the standard policy. It provides broader protection for your personal belongings and typically includes coverage for additional living expenses if you need to relocate temporarily due to a covered loss.

Condominium Owners Insurance

Condominium owners insurance, or HO-6 insurance, is specifically designed for condo owners. It covers the interior of your unit, personal property, and provides liability protection. This policy is unique as it considers the shared ownership and responsibilities of condominium living.

Mobile Home Insurance

Mobile home insurance, or manufactured home insurance, is tailored to the unique needs of homeowners with mobile or manufactured homes. This policy covers the structure, personal belongings, and provides liability protection, taking into account the specific risks associated with mobile homes.

Tailoring Your Insurance Coverage

One of the key advantages of home insurance is the ability to customize your coverage to meet your specific needs. By understanding the various coverage options available, you can ensure your policy provides the protection you require without unnecessary expenses.

Dwelling Coverage

Dwelling coverage is the foundation of your home insurance policy. It provides protection for the physical structure of your home, including the walls, roof, and permanent fixtures. This coverage is essential to ensure you can rebuild or repair your home in the event of a covered loss.

Personal Property Coverage

Personal property coverage protects your belongings, such as furniture, electronics, and clothing. This coverage is crucial to replace or repair your possessions if they are damaged or stolen. It is important to understand the limits and sublimits of this coverage to ensure adequate protection for your valuable items.

Liability Coverage

Liability coverage is a vital aspect of home insurance. It protects you from financial loss if you are found legally responsible for injuries or property damage to others. This coverage provides peace of mind, ensuring you are protected in the event of an unexpected accident or lawsuit.

Additional Coverage Options

Beyond the standard coverage, there are additional options to enhance your home insurance policy. These include:

- Flood Insurance: Separate from standard home insurance, flood insurance provides coverage for damage caused by flooding. It is especially important for homes located in high-risk flood zones.

- Earthquake Insurance: Earthquake insurance offers protection against damage caused by seismic activity. It is recommended for homeowners in earthquake-prone areas.

- Personal Umbrella Insurance: This policy provides additional liability coverage beyond the limits of your home insurance policy, offering an extra layer of protection for major claims or lawsuits.

Making Informed Decisions: Choosing the Right Coverage

Selecting the right insurance coverage for your home is a critical decision that requires careful consideration. By understanding your specific needs and the available options, you can make informed choices to ensure your home and belongings are adequately protected.

Assessing Your Risk Profile

Start by evaluating your unique risk profile. Consider the natural disasters or hazards common in your area, as well as any personal factors that may increase your risk, such as owning high-value items or having a home-based business. Understanding your risks will help you determine the level of coverage you require.

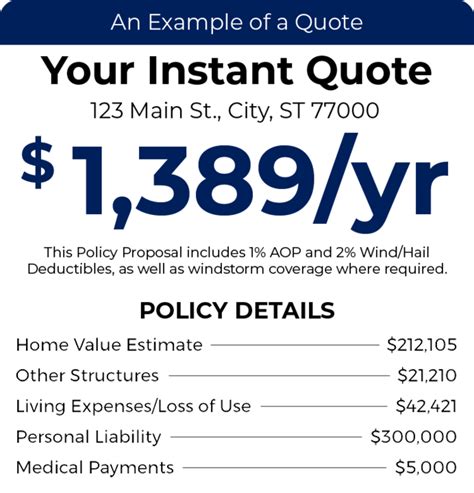

Understanding Coverage Limits

Familiarize yourself with the coverage limits and sublimits of different policies. These limits specify the maximum amount an insurance company will pay for a covered loss. Ensure that the limits align with the replacement cost of your home and the value of your personal belongings.

Comparing Insurance Companies

Research and compare multiple insurance companies to find the best fit for your needs. Consider factors such as financial stability, customer service reputation, and the range of coverage options they offer. Online reviews and ratings can provide valuable insights into the experiences of other policyholders.

Reviewing Your Policy Regularly

Insurance needs can change over time, so it is important to review your policy annually or whenever significant changes occur in your life. This includes major renovations, the acquisition of high-value items, or changes in your personal circumstances. Regular reviews ensure that your coverage remains up-to-date and appropriate.

Navigating the Claims Process

In the unfortunate event of a covered loss, understanding the claims process is essential to ensure a smooth and timely resolution. Knowing what to expect and how to navigate the process efficiently can make a significant difference in your overall experience.

Reporting a Claim

When a loss occurs, it is crucial to report it to your insurance company promptly. Most insurers have a dedicated claims department or a 24⁄7 hotline to assist you. Provide detailed information about the incident, including any supporting documentation or evidence.

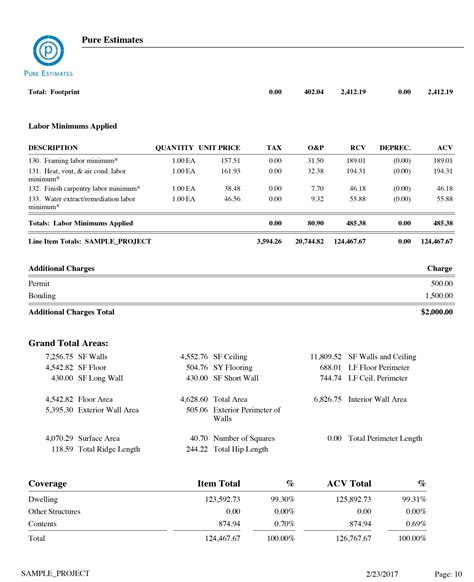

The Claims Adjustment Process

Once you have reported a claim, an insurance adjuster will be assigned to assess the damage and determine the extent of coverage. They will review your policy, inspect the property, and gather necessary information to evaluate the claim. It is important to cooperate fully with the adjuster and provide any requested documentation.

Understanding Your Policy Deductible

A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. It is important to understand your policy’s deductible and how it applies to different types of claims. Some policies offer different deductibles for specific perils, so be aware of these variations.

Receiving Compensation

After the claims adjustment process is complete, you will receive a settlement offer from your insurance company. This offer will be based on the policy terms, the extent of the damage, and the applicable coverage limits. It is important to review the settlement carefully and seek clarification if needed.

Maximizing Your Insurance Experience

Beyond obtaining an insurance quote and selecting the right coverage, there are additional steps you can take to maximize your insurance experience and ensure the protection of your home.

Home Maintenance and Safety

Regular maintenance and safety measures can help prevent potential hazards and reduce the risk of claims. Keep your home well-maintained, address any potential issues promptly, and consider implementing safety features such as smoke detectors, fire extinguishers, and security systems.

Bundling Your Insurance Policies

Bundling your insurance policies, such as home and auto insurance, can often result in significant savings. Many insurance companies offer multi-policy discounts, making it more affordable to protect your home and other assets under one provider.

Understanding Policy Exclusions

Familiarize yourself with the exclusions and limitations of your policy. While home insurance provides comprehensive coverage, there are certain events or damages that are typically not covered. Understanding these exclusions ensures you are aware of any potential gaps in your coverage.

Staying Informed and Prepared

Stay updated on changes in the insurance industry and be aware of any new coverage options or discounts that may become available. Regularly review your policy documents and contact your insurance provider if you have any questions or concerns. Being proactive and informed ensures you are always prepared for any eventuality.

What is the average cost of home insurance in my area?

+The average cost of home insurance can vary significantly depending on your location, the value of your home, and other factors. On average, homeowners in the United States pay around $1,200 per year for home insurance. However, this can range from a few hundred dollars to several thousand dollars depending on your circumstances. It’s recommended to obtain quotes from multiple providers to find the best rate for your specific needs.

How often should I review my home insurance policy?

+It’s advisable to review your home insurance policy annually or whenever significant changes occur in your life. This ensures that your coverage remains up-to-date and aligns with your current needs. Major life events such as renovations, purchasing high-value items, or starting a home-based business may require adjustments to your policy.

What should I do if I’m not satisfied with my insurance provider’s service?

+If you are dissatisfied with your insurance provider’s service, it’s important to voice your concerns. Contact their customer service department and explain your issues. If the matter remains unresolved, you can consider filing a complaint with your state’s insurance regulatory authority. Additionally, seeking advice from an insurance broker or consumer protection agency can be beneficial.