Allstate Quote Insurance

Welcome to a comprehensive guide on Allstate Quote Insurance, a leading provider of insurance solutions in the United States. In this article, we will delve into the world of Allstate's online quoting process, exploring its features, benefits, and how it empowers individuals to take control of their insurance needs. With a focus on convenience, personalization, and expert guidance, Allstate's online quoting platform offers a seamless experience for customers seeking tailored insurance coverage.

The Allstate Quote Insurance Experience: A Revolution in Insurance Quoting

In today’s fast-paced world, the demand for accessible and efficient insurance solutions is higher than ever. Allstate understands this need and has developed an innovative online quoting platform that transforms the traditional insurance quote process into a user-friendly and informative journey. Let’s uncover the key elements that make Allstate’s Quote Insurance experience stand out.

Personalized Quoting: Tailoring Coverage to Your Needs

Allstate’s Quote Insurance platform is designed with personalization at its core. Unlike generic quotes, Allstate takes into account your unique circumstances and preferences to offer tailored coverage options. Here’s how it works:

- Step 1: Input Your Details - Begin by providing basic information about yourself, such as your name, address, and contact details. This initial step ensures that Allstate can deliver quotes that are relevant to your specific situation.

- Step 2: Choose Your Coverage - Allstate presents a range of insurance options, allowing you to select the types of coverage you require. Whether you're seeking auto, home, life, or business insurance, the platform guides you through the process, explaining each option clearly.

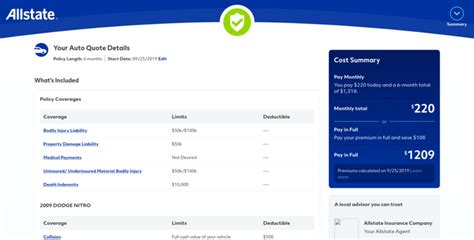

- Step 3: Customize Your Policy - This is where Allstate's expertise shines. Based on your selections, the platform provides a detailed breakdown of coverage limits, deductibles, and optional add-ons. You can adjust these parameters to align with your budget and specific needs, ensuring you receive a policy that's perfectly suited to you.

| Coverage Type | Description |

|---|---|

| Auto Insurance | Comprehensive coverage for vehicle-related incidents, including liability, collision, and comprehensive protection. |

| Home Insurance | Protection for your home and its contents, covering damages, theft, and liability. |

| Life Insurance | Financial security for your loved ones, offering death benefit coverage and optional riders. |

| Business Insurance | Customized coverage for small businesses, including property, liability, and business interruption insurance. |

Instant Quotes: Real-Time Convenience

One of the standout features of Allstate’s Quote Insurance is its ability to provide instant quotes. Instead of waiting days for a response, you receive a comprehensive quote within minutes. This real-time convenience allows you to make informed decisions quickly and efficiently.

The instant quoting process is made possible by Allstate's advanced technology and data analytics. By leveraging historical data and industry insights, the platform can accurately assess your insurance needs and provide a precise quote, saving you valuable time and effort.

Expert Guidance: Navigating Insurance with Confidence

Allstate understands that insurance can be complex, and making the right choices can be challenging. That’s why their Quote Insurance platform is backed by a team of expert insurance advisors. These professionals are available to provide guidance and support throughout the quoting process, ensuring you understand your options and make informed decisions.

Whether you have questions about coverage limits, deductibles, or specific policy features, Allstate's advisors are just a click or call away. They offer personalized advice, helping you navigate the sometimes-confusing world of insurance with confidence and clarity.

Seamless Policy Management: A Smooth Insurance Journey

Allstate’s Quote Insurance doesn’t end with the initial quote. The platform offers a seamless transition to policy management, allowing you to take control of your insurance coverage at every stage.

- Policy Review - After receiving your quote, you can easily review the details of your proposed policy. This includes coverage limits, premiums, and any applicable discounts. Allstate provides a transparent breakdown, ensuring you understand the full scope of your coverage.

- Policy Purchase - If you're satisfied with your quote, the platform guides you through a secure and straightforward policy purchase process. You can choose your preferred payment method and receive immediate confirmation of your coverage.

- Policy Updates and Adjustments - Allstate's platform allows you to manage your policy post-purchase. You can make updates, adjust coverage limits, or add new coverage types as your needs evolve. This flexibility ensures your insurance remains aligned with your changing circumstances.

The Benefits of Allstate Quote Insurance

Allstate’s Quote Insurance platform offers a range of benefits that enhance the insurance experience for customers. Here are some key advantages:

- Convenience - The online quoting process saves time and effort, allowing you to obtain quotes and manage your insurance from the comfort of your home or on the go.

- Personalization - Allstate's tailored approach ensures you receive quotes that are specifically designed to meet your unique insurance needs, providing a more accurate and cost-effective solution.

- Expert Support - Access to insurance advisors means you're never alone in the quoting process. Their guidance ensures you make informed choices, providing peace of mind and confidence in your insurance decisions.

- Real-Time Quoting - Instant quotes mean you can make decisions quickly, eliminating the wait time often associated with traditional insurance quoting processes.

- Seamless Policy Management - The ability to manage your policy online simplifies the entire insurance journey, from quote to purchase to ongoing adjustments.

Conclusion: Embracing a Modern Insurance Experience

Allstate’s Quote Insurance platform revolutionizes the way individuals interact with insurance. By offering a personalized, convenient, and expert-backed quoting process, Allstate empowers customers to take control of their insurance needs with confidence and ease. Whether you’re seeking auto, home, life, or business insurance, Allstate’s online quoting platform provides a seamless and informative experience, ensuring you find the coverage that’s right for you.

How accurate are the quotes provided by Allstate’s Quote Insurance platform?

+Allstate’s quotes are based on extensive data analysis and industry expertise. While they are highly accurate, it’s important to note that final policy terms and premiums may vary based on individual circumstances and any additional information provided during the application process.

Can I compare quotes from different insurance providers on Allstate’s platform?

+Currently, Allstate’s Quote Insurance platform focuses on providing tailored quotes for Allstate policies. However, you can easily compare Allstate’s quotes with those from other providers to ensure you’re getting the best value for your insurance needs.

What happens if I need to make changes to my policy after purchasing it through Allstate’s platform?

+Allstate’s platform allows for easy policy management. You can log in to your account, make the necessary adjustments, and review the updated policy details. Any changes will be reflected in your policy and premium, ensuring your coverage remains up-to-date.