Aarp Trip Insurance

Planning a trip and considering travel insurance? You're not alone. Many travelers, especially those who are members of the American Association of Retired Persons (AARP), seek reliable and comprehensive trip insurance options to protect their travel investments. AARP, known for its dedication to enhancing the lives of older Americans, offers a range of travel insurance plans through its partnership with New York Life Insurance Company. This article will delve into the details of AARP trip insurance, exploring its benefits, coverage options, and how it can provide peace of mind for travelers of all ages.

Understanding AARP Trip Insurance

AARP’s trip insurance program is designed to offer financial protection for travelers who are members of the association. It covers a wide range of potential travel-related issues, providing coverage for trip cancellations, interruptions, delays, and medical emergencies. The program is tailored to meet the unique needs of AARP members, ensuring they can travel with confidence and security.

Key Benefits of AARP Trip Insurance

AARP trip insurance boasts several advantages that set it apart from other travel insurance plans. Here are some of the key benefits:

- Comprehensive Coverage: The insurance plan covers a broad spectrum of travel-related issues, including trip cancellation, interruption, and delay due to various reasons. It also provides medical and emergency assistance, ensuring travelers receive the necessary care during their trip.

- Flexible Plans: AARP offers multiple plan options, allowing travelers to choose the level of coverage that best suits their needs and budget. Whether you’re seeking basic protection or extensive coverage, there’s a plan tailored for you.

- Competitive Pricing: AARP’s partnership with New York Life Insurance Company ensures competitive pricing for its members. The insurance plans are designed to be affordable, making travel protection accessible to a wide range of travelers.

- Specialized Assistance: AARP trip insurance provides access to specialized assistance services, including 24⁄7 emergency medical assistance, travel concierge services, and support for travelers with pre-existing medical conditions. This ensures travelers receive the necessary help and guidance throughout their journey.

Coverage Details

AARP trip insurance offers a comprehensive set of coverage options to protect travelers. Here’s an overview of the key coverage areas:

| Coverage Category | Description |

|---|---|

| Trip Cancellation | Reimburses non-refundable trip costs if the traveler needs to cancel due to covered reasons such as illness, injury, or weather-related events. |

| Trip Interruption | Provides coverage if the traveler needs to return home early due to a covered reason, ensuring they can continue their trip at a later date. |

| Travel Delay | Covers additional expenses incurred due to delays in transportation, providing reimbursement for meals, accommodations, and other related costs. |

| Medical Emergency | Offers medical coverage for accidents or illnesses during the trip, including emergency medical transportation, hospital stays, and medical evacuation if necessary. |

| Baggage and Personal Effects | Provides coverage for lost, stolen, or damaged baggage and personal items, ensuring travelers can replace essential items during their trip. |

AARP Trip Insurance for Pre-Existing Conditions

One of the standout features of AARP trip insurance is its coverage for pre-existing medical conditions. Many travel insurance plans exclude coverage for medical conditions that existed prior to the trip, but AARP offers an optional add-on that provides coverage for these conditions. This add-on is especially beneficial for travelers with ongoing medical issues, ensuring they receive the necessary care while away from home.

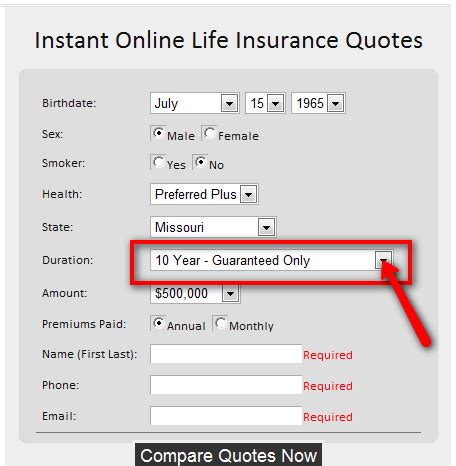

How to Obtain AARP Trip Insurance

Obtaining AARP trip insurance is a straightforward process. Members can access the insurance plans through the New York Life Insurance Company website or by contacting the AARP Member Benefits department. The application process involves providing basic personal and trip information, and travelers can choose the plan that best suits their needs. It’s important to note that coverage typically begins after a 14-day waiting period from the purchase date, so it’s advisable to purchase the insurance plan as soon as possible after booking the trip.

Claims Process

In the event of a covered claim, AARP trip insurance provides a simple and efficient claims process. Travelers can file claims online or by mail, and the insurance company will assess the claim based on the terms and conditions of the policy. It’s essential to keep all relevant documentation, including receipts, medical reports, and trip-related paperwork, to support the claim.

Why Choose AARP Trip Insurance

AARP trip insurance offers a compelling set of benefits for travelers, especially those who are members of the association. The comprehensive coverage, flexible plans, and competitive pricing make it an attractive option for protecting travel investments. Additionally, the specialized assistance services and coverage for pre-existing medical conditions set AARP trip insurance apart, providing a higher level of security and peace of mind for travelers.

Conclusion

As travelers seek to protect their travel plans and investments, AARP trip insurance emerges as a reliable and comprehensive solution. With its partnership with New York Life Insurance Company, AARP offers a range of plans tailored to meet the diverse needs of its members. From trip cancellations to medical emergencies, AARP trip insurance provides the necessary coverage to ensure a stress-free and enjoyable travel experience. Whether you’re a frequent traveler or planning a once-in-a-lifetime trip, AARP trip insurance is a valuable consideration to ensure your journey is protected.

How much does AARP trip insurance cost?

+

The cost of AARP trip insurance varies depending on the plan chosen and the level of coverage selected. Factors such as the trip duration, destination, and traveler’s age also influence the premium. It’s recommended to obtain a quote based on your specific travel plans to determine the exact cost.

What is the cancellation penalty if I decide not to purchase AARP trip insurance after booking my trip?

+

AARP trip insurance offers a 14-day free look period, during which you can review the policy and decide if it meets your needs. If you choose not to continue with the insurance, you can cancel within this period without any penalty. However, it’s important to note that travel cancellation fees may still apply if you cancel your trip after this period.

Does AARP trip insurance cover trip cancellations due to COVID-19 related reasons?

+

Yes, AARP trip insurance offers coverage for trip cancellations due to COVID-19 related reasons, including illness, quarantine requirements, and travel advisories. However, it’s essential to review the policy terms and conditions to understand the specific coverage and any potential exclusions.

Can I add my spouse or traveling companion to my AARP trip insurance plan?

+

Absolutely! AARP trip insurance allows you to add your spouse or traveling companion to your plan. This ensures that both travelers are protected under the same policy, providing peace of mind for your travel companions.

What should I do if I need to file a claim under my AARP trip insurance policy?

+

In the event of a covered claim, it’s important to gather all relevant documentation, including receipts, medical reports, and trip-related paperwork. You can then file a claim online or by mail, following the instructions provided by the insurance company. It’s recommended to act promptly and provide all necessary information to ensure a smooth claims process.