Star Health Insurance Company

Star Health Insurance Company, or simply Star Health, is a renowned name in the Indian healthcare industry, offering a wide range of insurance products and services to cater to the diverse needs of its customers. With a strong presence across the country, Star Health has established itself as a trusted provider of comprehensive health insurance solutions. In this comprehensive article, we will delve into the world of Star Health Insurance, exploring its offerings, benefits, and the impact it has had on the healthcare landscape in India.

A Comprehensive Overview of Star Health Insurance

Star Health Insurance Company, headquartered in Hyderabad, India, was founded in 2006 with a vision to revolutionize the healthcare insurance sector. Since its inception, the company has grown exponentially, becoming one of the leading private health insurance providers in the country. Star Health’s commitment to customer satisfaction and innovative insurance solutions has positioned it as a preferred choice for individuals, families, and corporate entities seeking comprehensive healthcare coverage.

Product Portfolio: Catering to Diverse Needs

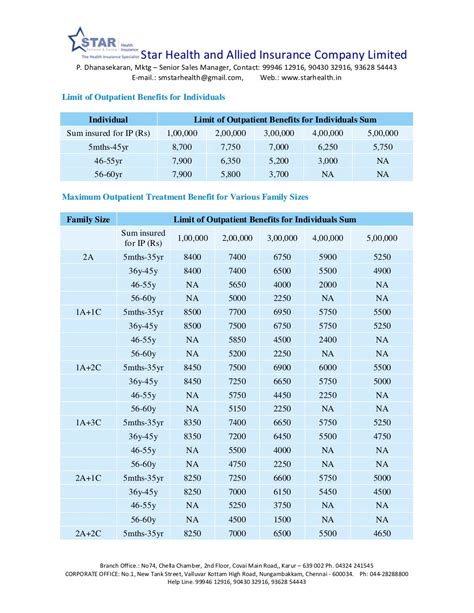

Star Health Insurance offers a diverse range of products designed to meet the unique requirements of its customers. Here’s an overview of some of their key insurance offerings:

- Individual Health Insurance Plans: These plans provide comprehensive coverage for individuals and their families. Star Health offers plans with various sum insured options, covering hospitalization expenses, pre- and post-hospitalization costs, and even domiciliary treatments.

- Family Health Insurance Plans: Recognizing the importance of family, Star Health has designed plans specifically for families. These plans ensure that the entire family is covered under a single policy, providing peace of mind and financial security.

- Senior Citizen Health Insurance Plans: With an aging population, Star Health understands the specific healthcare needs of senior citizens. Their dedicated plans for seniors offer tailored benefits, including coverage for pre-existing illnesses and hospitalization expenses.

- Group Health Insurance Plans: Corporate entities can opt for Star Health's group insurance plans, which provide comprehensive coverage for employees and their families. These plans promote employee well-being and contribute to a healthy workforce.

- Critical Illness Insurance Plans: In addition to traditional health insurance, Star Health offers critical illness plans. These plans provide financial support in the event of a critical illness, ensuring that individuals can focus on their recovery without worrying about medical expenses.

Key Features and Benefits

Star Health Insurance stands out for its commitment to providing value-added benefits to its policyholders. Here are some of the key features and advantages associated with Star Health’s insurance plans:

- Cashless Hospitalization: Star Health has a wide network of network hospitals across India, allowing policyholders to avail of cashless hospitalization services. This feature ensures that individuals can receive timely medical treatment without the hassle of arranging funds beforehand.

- No-Claim Bonus: Star Health rewards its policyholders with a no-claim bonus, which provides an increase in the sum insured or a discount on the renewal premium. This incentive encourages individuals to maintain a healthy lifestyle and reduces the financial burden of insurance.

- Pre- and Post-Hospitalization Coverage: Star Health's plans extend coverage beyond hospitalization, providing benefits for pre- and post-hospitalization expenses. This ensures that individuals are financially protected during the entire treatment process.

- Restoration Benefit: In the unfortunate event of a claim, Star Health offers a restoration benefit, which provides additional coverage after the initial sum insured is exhausted. This feature ensures that policyholders have continued protection during times of medical emergencies.

- Free Health Check-ups: To promote preventive care, Star Health offers free health check-ups to its policyholders. These check-ups help individuals stay on top of their health and detect any potential issues early on.

Performance and Impact

Star Health Insurance’s performance and impact on the Indian healthcare industry are significant. The company’s focus on innovation, customer-centric approach, and commitment to quality have contributed to its success and growth.

Market Share and Growth

Star Health has consistently increased its market share in the Indian health insurance sector. With a strong distribution network and a dedicated sales force, the company has reached a wide customer base. Its innovative products and competitive pricing have attracted individuals and businesses alike, leading to sustained growth.

| Year | Market Share (%) | Premium Income (INR) |

|---|---|---|

| 2018 | 4.8 | 2,100 Crore |

| 2019 | 5.2 | 2,450 Crore |

| 2020 | 5.6 | 2,800 Crore |

These figures showcase Star Health's steady growth and its ability to capture a significant market share.

Customer Satisfaction and Brand Reputation

Star Health’s dedication to customer satisfaction has earned it a positive reputation in the industry. The company’s focus on providing efficient claim settlement processes, personalized customer support, and a seamless insurance experience has resulted in high customer retention rates. Positive feedback and reviews from policyholders further reinforce Star Health’s brand reputation as a reliable and trusted insurance provider.

Digital Transformation and Technological Advancements

Star Health has embraced digital transformation to enhance its operations and provide a superior customer experience. The company has invested in cutting-edge technology to streamline its processes, making insurance more accessible and convenient for its customers.

Online Policy Purchase and Management

Star Health’s official website offers a user-friendly interface, allowing individuals to purchase insurance policies online. The online platform provides a seamless experience, enabling customers to compare plans, calculate premiums, and complete the purchase process efficiently. Policyholders can also manage their policies online, access policy documents, and track their claim status.

Mobile Applications

Star Health has developed mobile applications for both iOS and Android users. These apps provide a convenient way for policyholders to access their policy details, file claims, and stay updated with the latest insurance-related information. The mobile apps contribute to a digital-first approach, ensuring that customers can manage their insurance policies on the go.

Telemedicine Integration

In a bid to promote telemedicine and provide remote healthcare access, Star Health has integrated telemedicine services into its offerings. Policyholders can now avail of telemedicine consultations, receive medical advice, and even order medications online. This integration aligns with the company’s commitment to innovation and improving healthcare accessibility.

Future Outlook and Industry Impact

Star Health Insurance’s future prospects are promising, and the company is well-positioned to continue its growth trajectory. With a focus on technological advancements, customer-centric approaches, and innovative product offerings, Star Health is set to play a pivotal role in shaping the Indian healthcare insurance landscape.

Expanding Product Portfolio

Star Health is continuously exploring new avenues to meet the evolving needs of its customers. The company is likely to introduce additional insurance products, such as travel insurance, personal accident insurance, and even specialized plans for specific medical conditions. By diversifying its product portfolio, Star Health aims to cater to a broader customer base and address unique healthcare requirements.

Partnerships and Collaborations

Star Health has already established partnerships with various healthcare providers, hospitals, and diagnostic centers. These collaborations enhance the company’s network and provide policyholders with access to a wider range of medical facilities. In the future, Star Health may explore strategic alliances with international healthcare providers, further expanding its reach and offering global healthcare solutions.

Focus on Preventive Care

With an increasing awareness of preventive care, Star Health is likely to emphasize the importance of wellness and healthy living. The company may introduce incentives and rewards for policyholders who actively participate in preventive health programs. By promoting a culture of wellness, Star Health can contribute to a healthier population and reduce the overall burden of healthcare expenses.

Conclusion

Star Health Insurance Company has emerged as a prominent player in the Indian healthcare insurance sector, offering a comprehensive range of insurance solutions. Its commitment to innovation, customer satisfaction, and technological advancements has positioned it as a trusted partner for individuals and businesses alike. As the company continues to evolve and adapt to the changing healthcare landscape, Star Health is poised to make a lasting impact, ensuring that its policyholders receive the best possible healthcare coverage and support.

What is the claim settlement ratio of Star Health Insurance?

+Star Health Insurance has consistently maintained a high claim settlement ratio, indicating its efficiency in processing and settling claims. The company’s claim settlement ratio for the financial year 2020-2021 was an impressive 89.6%, showcasing its commitment to prompt and fair claim settlements.

How can I renew my Star Health Insurance policy online?

+Renewing your Star Health Insurance policy online is a straightforward process. You can visit the official Star Health website, log in to your account, and follow the renewal instructions. The online renewal process is convenient and allows you to manage your policy efficiently.

Does Star Health Insurance cover pre-existing illnesses?

+Yes, Star Health Insurance offers specific plans that provide coverage for pre-existing illnesses. These plans have waiting periods, and once the waiting period is over, the policyholder can avail of coverage for their pre-existing conditions. It is important to declare all pre-existing illnesses during the policy purchase process.