Ppo Dental Insurance California

PPO dental insurance is a popular choice for many residents of California, offering a flexible and comprehensive approach to dental care. In this comprehensive guide, we will delve into the world of PPO dental plans, exploring their benefits, coverage options, and how they can be a valuable investment for individuals and families seeking quality dental healthcare.

Understanding PPO Dental Insurance in California

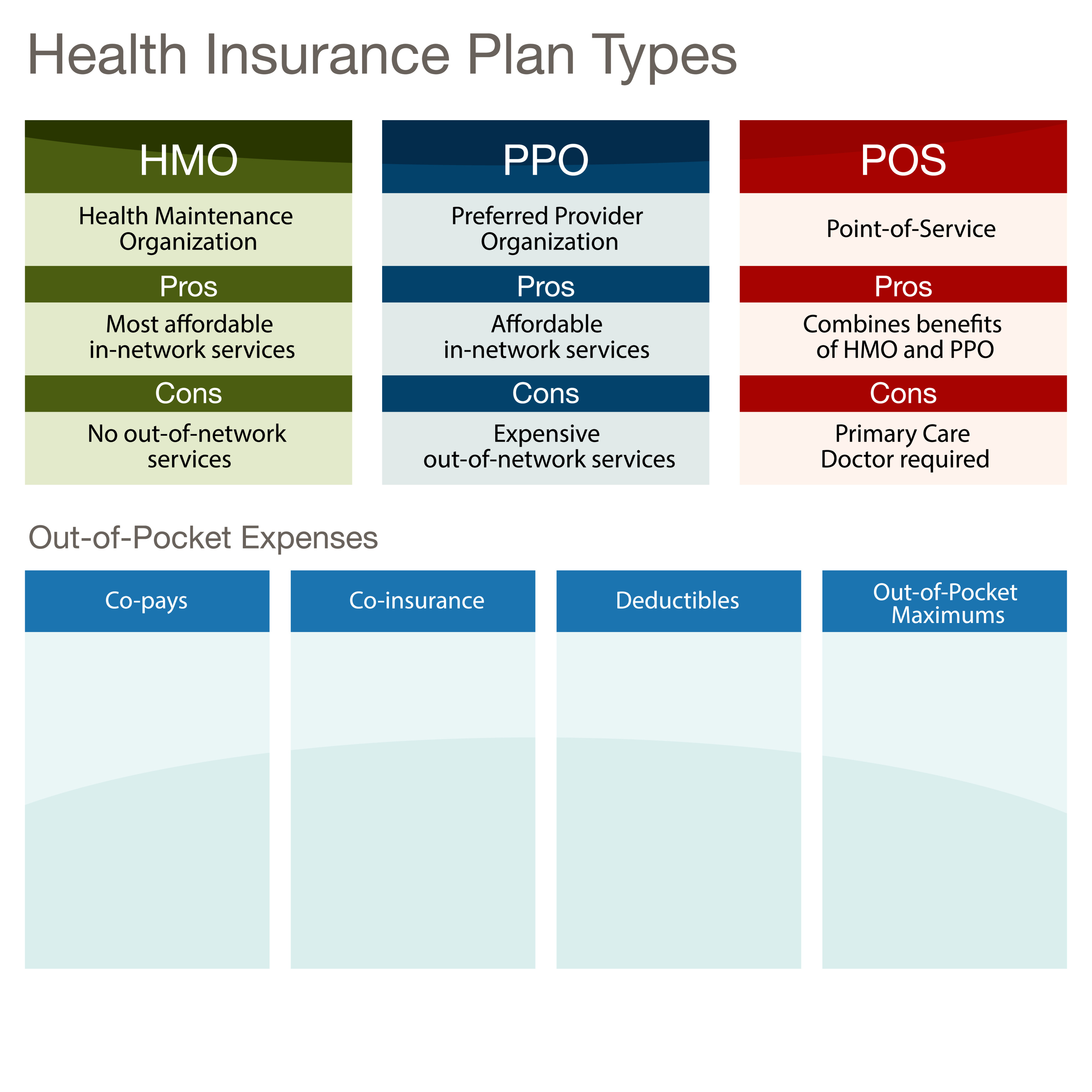

PPO stands for Preferred Provider Organization, and it is a type of dental insurance plan that provides policyholders with a wide network of dental providers to choose from. This flexibility allows individuals to select dentists and specialists within the network, offering convenience and control over their dental care.

In California, PPO dental insurance plans are widely available and cater to the diverse needs of the state's population. With a strong emphasis on preventive care and oral health, these plans aim to make dental services accessible and affordable for Californians.

Key Features of PPO Dental Plans

PPO dental insurance plans in California offer several key features that make them an attractive option for residents:

- Network of Providers: PPO plans provide policyholders with a vast network of dentists and specialists. This means you have the freedom to choose your preferred dental care providers, ensuring personalized and convenient care.

- Flexible Coverage: These plans offer flexibility in terms of coverage. You can choose from a range of options, including basic preventive care, major procedures, and even orthodontic treatments. This allows you to customize your plan based on your specific dental needs and budget.

- No Referrals Required: Unlike some other insurance plans, PPOs do not typically require referrals to see specialists. This saves time and simplifies the process of accessing specialized dental care.

- Out-of-Network Options: While PPO plans encourage the use of in-network providers, they also provide coverage for out-of-network services. However, the cost-sharing arrangements may differ, and you may be responsible for a higher portion of the fees.

- Preventive Care Focus: PPO plans place a strong emphasis on preventive dental care. They often cover routine check-ups, cleanings, X-rays, and other preventive services at little to no cost to the policyholder. This proactive approach helps identify and address dental issues early on, preventing more complex and costly problems down the line.

Benefits of PPO Dental Insurance

Choosing a PPO dental insurance plan in California can offer a range of benefits, including:

- Choice of Dentists: With a PPO plan, you have the freedom to select your preferred dentist or specialist, ensuring you receive care from a provider you trust and feel comfortable with.

- Convenience: The extensive network of PPO providers means you can easily find a dentist close to your home or workplace, making it convenient to schedule appointments and receive timely dental care.

- Cost Savings: PPO plans often come with discounted rates for in-network providers. This can result in significant cost savings, especially for individuals and families who require regular dental check-ups and treatments.

- Comprehensive Coverage: PPO plans provide coverage for a wide range of dental services, from basic preventive care to complex procedures. This ensures that you have access to the necessary treatments to maintain optimal oral health.

- Flexibility for Specialized Care: If you have specific dental needs, such as orthodontics or periodontal treatments, PPO plans allow you to seek specialized care without the hassle of changing insurance providers.

- Peace of Mind: By investing in a PPO dental plan, you gain peace of mind knowing that your dental health is protected. Regular check-ups and early intervention can prevent serious dental issues, reducing the risk of pain, discomfort, and expensive emergency treatments.

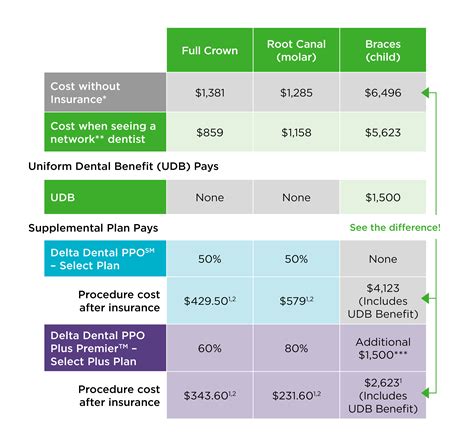

Coverage Options and Costs

PPO dental insurance plans in California offer a variety of coverage options to cater to different needs and budgets. Here’s a breakdown of some common coverage tiers:

| Coverage Tier | Description | Estimated Annual Premium |

|---|---|---|

| Basic | Covers essential preventive care, including cleanings, X-rays, and basic procedures. May have higher deductibles and coinsurance. | 300 - 500 |

| Standard | Includes basic coverage plus additional benefits like minor restorative procedures and limited orthodontic coverage. Offers a balance between cost and coverage. | 500 - 800 |

| Comprehensive | Provides extensive coverage for a wide range of dental services, including major procedures, extensive orthodontic treatment, and specialized care. Ideal for individuals with complex dental needs. | 800 - 1200 |

It's important to note that these estimates are approximate and can vary based on factors such as age, location, and the specific insurance provider. Additionally, deductibles, coinsurance, and maximum annual limits may apply, so it's crucial to carefully review the plan details before enrolling.

Choosing the Right PPO Dental Plan

When selecting a PPO dental insurance plan in California, consider the following factors to find the best fit for your needs:

- Dental Needs: Assess your current and future dental needs. If you have ongoing dental issues or require specialized care, opt for a plan with comprehensive coverage.

- Network Providers: Research the network of dentists and specialists included in the plan. Ensure that your preferred providers are in-network to maximize your cost savings and convenience.

- Cost and Budget: Evaluate the annual premiums, deductibles, and out-of-pocket expenses associated with each plan. Choose a plan that aligns with your budget while providing the necessary coverage.

- Plan Benefits: Review the specific benefits and coverage limits of each plan. Look for features like orthodontic coverage, emergency services, and prescription drug benefits if they are important to you.

- Reviews and Reputation: Check online reviews and ratings to gauge the satisfaction and experience of other policyholders. This can provide valuable insights into the plan’s reliability and customer service.

Maximizing Your PPO Dental Insurance

To make the most of your PPO dental insurance plan, consider these tips:

- Stay Informed: Familiarize yourself with your plan’s coverage details, including what is covered, deductibles, and any limitations. This knowledge will help you make informed decisions about your dental care.

- Choose In-Network Providers: Whenever possible, select in-network dentists and specialists to take advantage of discounted rates and minimize out-of-pocket expenses.

- Utilize Preventive Care: Make the most of your plan’s preventive care benefits. Regular check-ups, cleanings, and early intervention can prevent more complex and costly dental issues.

- Communicate with Your Dentist: Discuss your dental goals and concerns with your dentist. They can provide personalized recommendations and help you navigate your insurance coverage effectively.

- Review Your Plan Annually: As your dental needs evolve, review your insurance plan annually to ensure it continues to meet your requirements. You may find that upgrading or downgrading your plan is beneficial.

Conclusion

PPO dental insurance plans in California offer a flexible and comprehensive approach to oral healthcare. By providing a wide network of providers and customizable coverage options, these plans empower individuals to take control of their dental well-being. With the right PPO plan, Californians can access quality dental care, maintain healthy smiles, and enjoy the peace of mind that comes with proactive dental health management.

FAQ

Can I use any dentist with a PPO plan in California?

+

Yes, PPO plans offer flexibility in choosing your dentist. You can select from a network of in-network providers, but you also have the option to visit out-of-network dentists. However, using in-network providers typically results in lower out-of-pocket costs.

Are there any age limits for PPO dental insurance plans in California?

+

No, PPO dental insurance plans in California do not typically have age limits. They are available to individuals of all ages, including children and seniors.

What happens if I need emergency dental care while traveling outside of California with a PPO plan?

+

Most PPO plans offer some level of coverage for emergency dental care, even when you are outside your home state. However, it’s essential to review your plan’s specific details to understand the extent of coverage and any potential limitations.