Insurance Company In California

In the vast landscape of California, a state known for its diverse industries and thriving economy, insurance plays a crucial role in protecting individuals, businesses, and communities. The insurance sector in California is a dynamic and highly regulated environment, with a wide range of companies offering various types of coverage to meet the needs of its residents and businesses. This article aims to provide an in-depth analysis of the insurance industry in California, exploring its unique characteristics, key players, and the impact it has on the Golden State's economy.

The Insurance Landscape in California

California, with its thriving population and diverse economic sectors, presents a unique and challenging environment for the insurance industry. The state’s diverse geography, ranging from coastal cities to mountainous regions, along with its susceptibility to natural disasters such as earthquakes and wildfires, poses significant risks that insurance companies must navigate.

The insurance market in California is highly competitive, with a mix of national, regional, and local carriers vying for market share. This competition often leads to innovative products and services, ensuring that Californians have access to a wide range of insurance options. The state's Department of Insurance plays a pivotal role in regulating the industry, ensuring fair practices, consumer protection, and maintaining the solvency of insurance companies.

Key Players in the California Insurance Market

The insurance industry in California is dominated by a mix of large, national carriers and smaller, specialized providers. Some of the prominent players include:

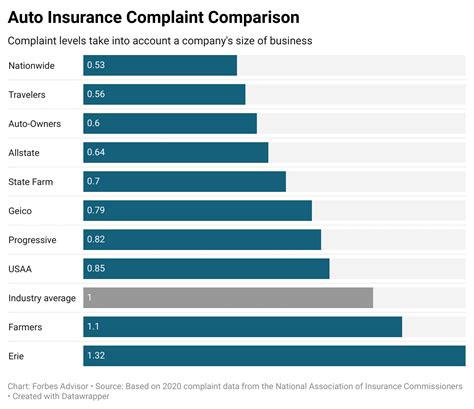

- State Farm: A well-established and trusted name in the insurance industry, State Farm offers a comprehensive range of products, including auto, home, life, and health insurance. With a strong focus on customer service, State Farm has built a solid reputation in California and beyond.

- Allstate: Known for its innovative products and marketing strategies, Allstate provides auto, home, life, and business insurance. The company's "You're in Good Hands" campaign has become synonymous with reliability and trust.

- Farmers Insurance Group: Farmers Insurance is a leading provider of auto, home, and business insurance in California. The company's "We Know From Experience" slogan reflects its expertise in understanding the unique risks faced by Californians.

- Liberty Mutual: Liberty Mutual offers a wide array of insurance products and services, catering to both individuals and businesses. With a focus on personalized coverage, the company has gained a strong foothold in the California market.

- Progressive Insurance: Progressive is a well-known name in the auto insurance industry, offering competitive rates and innovative features such as usage-based insurance. The company's commitment to technology and customer convenience has made it a popular choice among Californians.

These companies, along with numerous others, contribute to the vibrant and competitive insurance landscape in California. Each brings its own unique strengths, products, and customer-centric approaches to the market, ensuring that Californians have a wide range of options to choose from.

Insurance Products and Services in California

The insurance industry in California offers a comprehensive suite of products and services to meet the diverse needs of its residents and businesses. Here’s an overview of some key insurance types available in the Golden State:

Auto Insurance

Auto insurance is a fundamental requirement for all vehicle owners in California. The state mandates a minimum level of liability coverage to protect against bodily injury and property damage in the event of an accident. However, many Californians opt for additional coverage, such as collision, comprehensive, and personal injury protection (PIP) to ensure comprehensive protection.

| Coverage Type | Description |

|---|---|

| Liability | Covers bodily injury and property damage caused to others in an accident. |

| Collision | Pays for repairs or replacement of your vehicle after an accident, regardless of fault. |

| Comprehensive | Covers damage to your vehicle caused by non-collision events, such as theft, vandalism, or natural disasters. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for you and your passengers, regardless of fault. |

California's Department of Motor Vehicles (DMV) plays a crucial role in ensuring that all vehicle owners have the required insurance coverage. The DMV conducts periodic checks and may require proof of insurance during vehicle registration or renewal processes.

Home Insurance

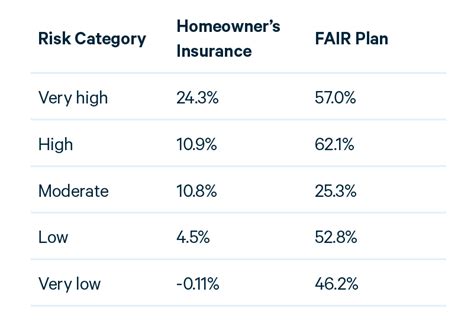

Home insurance is essential for protecting one of the most significant investments for many Californians - their homes. The state’s unique natural disaster risks, including earthquakes and wildfires, make home insurance even more critical. Here’s a breakdown of the key coverage options:

| Coverage Type | Description |

|---|---|

| Dwelling Coverage | Covers the structure of your home against damage or destruction caused by covered perils, such as fire, windstorm, or vandalism. |

| Personal Property Coverage | Protects your personal belongings, such as furniture, electronics, and clothing, against theft, damage, or destruction. |

| Liability Coverage | Provides protection against claims of bodily injury or property damage caused by you or a family member on your property. |

| Additional Living Expenses | Covers the cost of temporary housing and additional living expenses if your home becomes uninhabitable due to a covered loss. |

When it comes to home insurance, it's crucial to assess your specific needs and risks. For instance, Californians living in earthquake-prone areas may require additional coverage for earthquake damage, which is often not included in standard home insurance policies.

Life Insurance

Life insurance is a vital financial tool that provides peace of mind and financial protection for your loved ones in the event of your untimely demise. In California, life insurance comes in various forms, catering to different needs and preferences:

| Life Insurance Type | Description |

|---|---|

| Term Life Insurance | Provides coverage for a specified term, typically 10, 20, or 30 years. It offers pure death benefit protection without any cash value accumulation. |

| Whole Life Insurance | Provides lifetime coverage with a fixed premium and builds cash value over time. It offers a combination of death benefit protection and savings component. |

| Universal Life Insurance | Offers flexibility in terms of premium payments and death benefit amounts. It combines death benefit protection with an investment component, allowing policyholders to adjust coverage based on their changing needs. |

| Variable Life Insurance | Similar to universal life insurance, but with the added feature of allowing policyholders to invest their cash value in a variety of investment options, such as stocks, bonds, or mutual funds. |

When choosing life insurance, it's essential to consider factors such as your financial goals, the number of dependents you have, and your overall financial situation. Consulting with a qualified insurance agent or financial advisor can help you make an informed decision.

Health Insurance

Health insurance is a critical aspect of healthcare access and financial protection in California. The state has made significant strides in expanding healthcare coverage, particularly with the implementation of the Affordable Care Act (ACA) and the creation of Covered California, the state’s health insurance marketplace.

Covered California offers a range of health insurance plans from various carriers, providing Californians with affordable and comprehensive coverage options. These plans typically include essential health benefits, such as ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services, and more.

In addition to Covered California, Californians have the option to obtain health insurance through their employers, Medicaid (Medi-Cal in California), Medicare, or individual market plans. The state's robust healthcare infrastructure and diverse insurance options ensure that residents have access to the care they need.

The Impact of Insurance on California’s Economy

The insurance industry plays a pivotal role in California’s economy, contributing significantly to its growth and stability. Here’s an overview of the industry’s impact:

Employment and Economic Growth

The insurance sector is a major employer in California, providing jobs to thousands of individuals across the state. From insurance agents and brokers to underwriters, claims adjusters, and customer service representatives, the industry offers a wide range of career opportunities. These jobs contribute to the overall economic growth and prosperity of the state.

Moreover, insurance companies often invest in local communities, supporting local businesses and charities, and contributing to the overall economic vitality of the regions they operate in.

Risk Mitigation and Financial Stability

Insurance companies play a crucial role in mitigating risks and promoting financial stability in California. By providing coverage for a wide range of potential losses, insurance companies help individuals, businesses, and communities recover from unexpected events, such as natural disasters, accidents, or illnesses.

For instance, after a devastating wildfire, insurance companies step in to help homeowners rebuild their homes and replace their belongings, contributing to the long-term recovery and resilience of affected communities. Similarly, auto insurance provides financial protection in the event of accidents, ensuring that individuals can receive medical treatment and repair their vehicles without incurring significant out-of-pocket expenses.

Incentivizing Safety and Preventive Measures

Insurance companies often incentivize safety measures and preventive actions, which can lead to reduced risks and lower insurance premiums. For instance, homeowners who install fire-resistant roofing or smoke detectors may be eligible for discounts on their home insurance policies. Similarly, drivers who maintain a clean driving record and complete defensive driving courses may qualify for lower auto insurance rates.

These incentives encourage individuals and businesses to take proactive steps to mitigate risks, ultimately contributing to a safer and more resilient California.

The Future of Insurance in California

The insurance industry in California is poised for continued growth and innovation, driven by several key factors. Here’s a glimpse into the future of insurance in the Golden State:

Technological Advancements

The rapid advancement of technology is transforming the insurance industry in California and beyond. Insurance companies are leveraging artificial intelligence, machine learning, and data analytics to streamline processes, enhance risk assessment, and improve customer experiences.

For instance, usage-based insurance (UBI) programs, which use telematics devices to track driving behavior and offer personalized premiums, are gaining popularity. These programs reward safe drivers with lower insurance rates, incentivizing responsible driving habits and reducing road accidents.

Focus on Sustainability and Resilience

In the face of increasing natural disasters and climate change, insurance companies in California are increasingly focusing on sustainability and resilience. They are developing innovative products and services to help individuals and businesses prepare for and recover from catastrophic events.

This includes offering coverage for emerging risks, such as cyber attacks and data breaches, as well as providing resources and guidance on disaster preparedness and recovery.

Embracing Digital Transformation

The insurance industry is undergoing a digital transformation, with companies embracing online platforms, mobile apps, and digital tools to enhance customer engagement and streamline operations. Californians can now easily compare insurance policies, purchase coverage online, and manage their policies digitally, making the insurance process more convenient and efficient.

Regulatory Changes and Consumer Protection

The California Department of Insurance continues to play a vital role in regulating the industry and protecting consumers. As the insurance landscape evolves, the department will likely implement new regulations and guidelines to ensure fair practices, consumer protection, and market stability.

Additionally, the department may focus on promoting financial literacy and education, empowering Californians to make informed insurance decisions and understand their coverage options.

Conclusion

The insurance industry in California is a dynamic and vital sector, offering protection, financial stability, and peace of mind to individuals, businesses, and communities. With its diverse range of insurance products, competitive market, and regulatory oversight, California’s insurance landscape is well-equipped to meet the unique challenges and opportunities that lie ahead.

As the state continues to innovate and adapt to changing risks and technological advancements, the insurance industry will play a pivotal role in ensuring the Golden State's resilience and economic prosperity.

What is the minimum auto insurance coverage required in California?

+California requires a minimum of 15,000 bodily injury liability per person, 30,000 bodily injury liability per accident, and $5,000 property damage liability per accident. However, many experts recommend carrying higher limits to provide adequate protection.

How can I find affordable health insurance in California?

+Californians can explore their options through Covered California, the state’s health insurance marketplace. This platform offers a range of affordable plans from various carriers, making it easier to find a plan that fits your budget and coverage needs.

What factors determine life insurance premiums in California?

+Life insurance premiums in California are influenced by factors such as age, gender, health status, occupation, and lifestyle. Generally, younger individuals with healthier lifestyles and safer occupations tend to have lower premiums.