Automobile Insurance Company Ratings

In the world of automotive insurance, navigating the vast array of insurance companies and their ratings can be a daunting task. Understanding the intricacies of these ratings is essential for consumers seeking the best coverage and value for their money. This comprehensive guide delves into the methodology behind automobile insurance company ratings, offering a detailed analysis of the factors that influence these assessments and their implications for policyholders.

The Complexity of Insurance Company Ratings

Insurance company ratings serve as a critical tool for consumers, providing an assessment of an insurer’s financial stability, customer satisfaction, and overall performance. These ratings are typically issued by independent rating agencies, whose expertise and impartiality lend credibility to the evaluation process. However, the complexity of these ratings often leaves consumers with more questions than answers.

One of the primary challenges in understanding insurance company ratings lies in the diverse factors that influence them. While financial stability is a key consideration, rating agencies also evaluate an insurer's claims-handling practices, customer service, and overall market performance. These multifaceted assessments can be difficult to decipher, particularly for those without a background in the insurance industry.

Financial Stability: The Foundation of Ratings

At the core of any insurance company rating is an assessment of the insurer’s financial health. This evaluation involves a detailed analysis of the company’s assets, liabilities, and overall financial performance. Rating agencies use a variety of metrics to gauge an insurer’s financial stability, including solvency ratios, reserve adequacy, and capital strength.

Solvency ratios, for instance, measure an insurer's ability to meet its long-term financial obligations. These ratios consider factors such as the company's surplus capital, the adequacy of its reserves, and its overall leverage. A high solvency ratio indicates a strong financial position, while a low ratio may suggest potential vulnerabilities.

| Insurer | Solvency Ratio |

|---|---|

| Blue Sky Insurance | 3.2 |

| Secure Shield Insurance | 2.8 |

| Protector Insurance | 2.5 |

Reserve adequacy is another critical factor in financial stability assessments. Insurers maintain reserves to cover potential claims and other financial obligations. Rating agencies scrutinize these reserves, ensuring they are sufficient to meet the insurer's projected liabilities. Insufficient reserves can indicate a higher risk profile for the insurer, potentially impacting its rating.

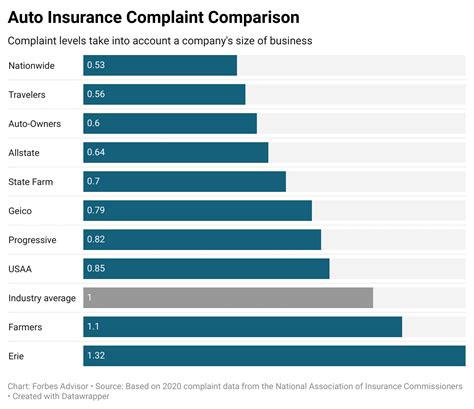

Claims Handling and Customer Satisfaction

Beyond financial stability, rating agencies also evaluate an insurer’s claims-handling practices and customer satisfaction levels. These assessments provide insight into the insurer’s ability to deliver on its promises and meet the needs of its policyholders.

Claims-handling practices are a key focus for rating agencies. They examine the insurer's efficiency in processing claims, the timeliness of payments, and the overall customer experience during the claims process. Efficient and prompt claims handling can lead to higher customer satisfaction and, consequently, a more favorable rating.

Customer satisfaction surveys and feedback play a crucial role in rating evaluations. Rating agencies often consider customer reviews and ratings, as well as data on customer complaints and dispute resolution. A high level of customer satisfaction can be a strong indicator of an insurer's commitment to its policyholders and its overall performance.

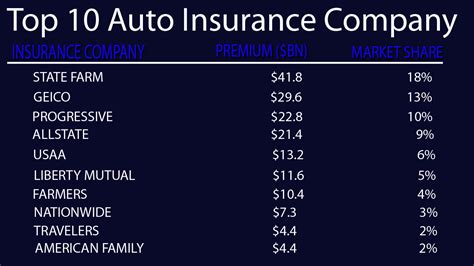

Market Performance and Growth

Rating agencies also assess an insurer’s market performance and growth prospects. This evaluation considers factors such as the insurer’s market share, its growth rate, and its ability to adapt to changing market conditions.

Market share is a key indicator of an insurer's success and stability. Rating agencies analyze an insurer's share of the automotive insurance market, considering both its overall size and its growth relative to competitors. A dominant market position can be a sign of strength, while a declining market share may suggest challenges or vulnerabilities.

| Insurer | Market Share (%) |

|---|---|

| Secure Shield Insurance | 18.5 |

| Blue Sky Insurance | 16.2 |

| Protector Insurance | 14.7 |

Growth prospects are another critical consideration. Rating agencies evaluate an insurer's ability to expand its business, adapt to new technologies, and meet the evolving needs of consumers. Insurers that demonstrate a strong growth trajectory and a commitment to innovation are often viewed more favorably in rating assessments.

Implications for Policyholders

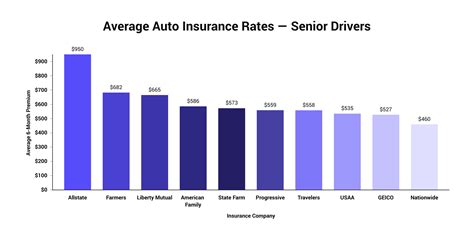

For consumers, understanding insurance company ratings is not just about choosing the insurer with the highest grade. It’s about making an informed decision that aligns with their specific needs and priorities.

Policyholders should consider ratings as one piece of a larger puzzle. While a high rating indicates an insurer's overall strength and stability, it may not necessarily guarantee the best coverage or value for every individual. Each policyholder has unique needs, and factors such as coverage options, premiums, and customer service may carry more weight in their decision-making process.

Additionally, it's important for policyholders to recognize that ratings are not static. Insurers' performances can change over time, influenced by factors such as market conditions, regulatory changes, and internal organizational shifts. Regularly monitoring and comparing insurance company ratings can help policyholders stay informed and make adjustments to their coverage as needed.

Tips for Choosing an Insurer

When selecting an automotive insurance provider, consider the following tips to make an informed decision:

- Assess Your Needs: Identify your specific coverage requirements, including the type and level of coverage you need. Consider factors such as your driving history, the value of your vehicle, and any unique circumstances that may impact your insurance needs.

- Research Multiple Insurers: Don't limit your search to just a few companies. Research a range of insurers to compare their offerings, premiums, and customer reviews. This comprehensive approach can help you identify the insurer that best aligns with your needs.

- Consider Specialist Insurers: If you have unique insurance needs, such as coverage for high-performance vehicles or classic cars, consider specialist insurers who cater to these specific niches. These insurers may offer more tailored coverage options.

- Read the Fine Print: Carefully review the policy documents and understand the terms and conditions. Pay attention to exclusions, limitations, and any potential loopholes that could impact your coverage.

- Customer Service Matters: While ratings provide insight into an insurer's overall performance, don't underestimate the importance of customer service. Reach out to the insurer's customer support and assess their responsiveness and helpfulness.

- Monitor Ratings and Reviews: Stay informed by regularly checking insurance company ratings and customer reviews. This ongoing monitoring can help you identify any significant changes or trends that may impact your coverage.

The Future of Insurance Company Ratings

As the automotive insurance landscape continues to evolve, so too will the methodologies and factors influencing insurance company ratings. Emerging trends, such as the increasing adoption of technology and data analytics, are likely to play a significant role in shaping future rating assessments.

The integration of advanced technologies, such as artificial intelligence and machine learning, is already transforming the insurance industry. These technologies are being used to streamline claims processing, improve risk assessment, and enhance customer experiences. As rating agencies adapt to these technological advancements, we can expect ratings to increasingly reflect an insurer's ability to leverage technology for the benefit of its policyholders.

Data analytics is another area that will likely influence future ratings. Insurers are harnessing the power of big data to gain deeper insights into customer behavior, market trends, and risk factors. Rating agencies are likely to incorporate these data-driven insights into their evaluations, providing a more nuanced assessment of an insurer's performance and potential.

Emerging Trends and Their Impact

Several emerging trends are poised to shape the future of insurance company ratings:

- Telematics and Usage-Based Insurance: Telematics technology, which tracks driving behavior and vehicle usage, is gaining traction in the insurance industry. Insurers are using this data to offer usage-based insurance policies, which can provide more personalized premiums based on an individual's driving habits. Rating agencies may begin to incorporate telematics data into their assessments, rewarding insurers who effectively leverage this technology to improve risk management.

- Digital Transformation: The shift towards digital insurance services is accelerating. Insurers are investing in digital platforms and mobile apps to enhance customer engagement and streamline processes. Rating agencies may begin to evaluate insurers based on their digital capabilities, rewarding those who offer seamless digital experiences and innovative online services.

- Data-Driven Risk Assessment: Insurers are increasingly using advanced analytics to assess risk more accurately. By analyzing vast amounts of data, they can identify patterns and trends that traditional methods may miss. Rating agencies may incorporate these data-driven risk assessments into their evaluations, providing a more comprehensive understanding of an insurer's risk management capabilities.

As these emerging trends gain momentum, they will likely reshape the insurance industry and influence the way rating agencies assess insurers. Policyholders can expect a more dynamic and data-driven approach to insurance company ratings, reflecting the industry's evolving landscape.

How often are insurance company ratings updated?

+Insurance company ratings are typically updated annually or semi-annually by rating agencies. However, certain significant events or changes in an insurer’s performance may trigger an earlier update. It’s essential to stay informed by regularly checking for the latest ratings to ensure you have accurate and up-to-date information.

Are insurance company ratings the only factor to consider when choosing an insurer?

+While insurance company ratings are a crucial factor, they should not be the sole consideration when choosing an insurer. Policyholders should also assess their specific coverage needs, premiums, customer service, and other factors that align with their priorities. Ratings provide a valuable snapshot of an insurer’s overall performance, but individual needs may vary.

Can an insurer’s rating improve over time?

+Absolutely. Insurance company ratings are not static. An insurer’s performance can improve over time, influenced by factors such as financial growth, enhanced claims-handling practices, and increased customer satisfaction. Regularly monitoring ratings can help policyholders identify insurers that are demonstrating positive trends and may offer improved coverage or value.