Affordable Family Insurance

Finding affordable and comprehensive insurance coverage for your family is a crucial yet often daunting task. With the right approach and understanding of the market, it is possible to secure quality protection for your loved ones without breaking the bank. This comprehensive guide will navigate you through the intricate world of family insurance, offering insights and strategies to help you make informed decisions and unlock the best value for your family's needs.

Understanding Family Insurance Needs

Family insurance encompasses a range of policies designed to protect you and your loved ones from various financial risks. From health emergencies to unexpected accidents, these policies provide a safety net to ensure your family’s financial stability. However, with the plethora of options available, it’s essential to tailor your insurance coverage to your unique circumstances.

For instance, if you have young children, health insurance with pediatric coverage and family discounts could be a priority. On the other hand, if you're planning for the future, life insurance and disability coverage might take precedence. Understanding these nuances is the first step towards securing the right family insurance plan.

Health Insurance: Prioritizing Your Family’s Wellbeing

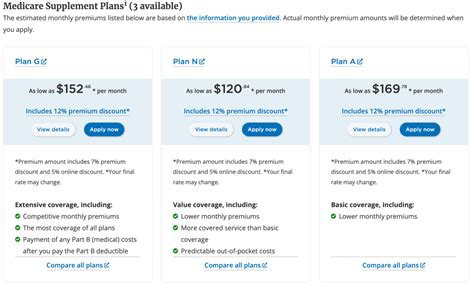

Health insurance is a cornerstone of family insurance, providing coverage for medical expenses, from routine check-ups to unexpected illnesses or accidents. When choosing a health insurance plan, consider factors such as the age and health status of family members, the need for specialist care, and the cost of premiums and deductibles.

Look for plans that offer a good balance between coverage and affordability. Some insurers provide family discounts, which can significantly reduce the overall cost. Additionally, consider the network of healthcare providers associated with the plan to ensure your preferred doctors and hospitals are covered.

| Health Insurance Plan | Premium Cost | Deductible | Network Size |

|---|---|---|---|

| BlueCross Family Plan | $450/month | $2,000 | Over 1 million providers |

| Aetna Family Health | $400/month | $1,500 | Nationwide coverage |

| Cigna Family Care | $500/month | $2,500 | In-network and out-of-network options |

Life Insurance: Protecting Your Family’s Future

Life insurance is an essential component of family insurance, providing financial security for your loved ones in the event of your untimely demise. The primary purpose is to replace your income, ensuring your family can maintain their standard of living and meet their financial obligations.

When selecting a life insurance policy, consider the amount of coverage you need, the type of policy (term or whole life), and the cost of premiums. Term life insurance offers coverage for a specific period, while whole life insurance provides lifelong coverage. The choice depends on your family's needs and financial situation.

| Life Insurance Policy | Premium Cost | Coverage Period | Benefits |

|---|---|---|---|

| StateLife 20-Year Term | $50/month | 20 years | Renewable, convertible to whole life |

| WholeLife Advantage | $150/month | Lifetime | Cash value accumulation, flexible benefits |

| Legacy Term | $75/month | 30 years | Increasing coverage option |

Disability Insurance: Safeguarding Your Income

Disability insurance is often overlooked but is an essential part of a comprehensive family insurance plan. It provides income protection in the event you become unable to work due to illness or injury. This coverage ensures your family can continue to meet their financial commitments, even if you’re temporarily or permanently unable to earn an income.

When choosing a disability insurance policy, consider the benefit amount (usually a percentage of your income), the waiting period before benefits kick in, and the length of coverage. Some policies offer own-occupation coverage, which pays benefits if you're unable to perform your specific job duties.

| Disability Insurance Policy | Premium Cost | Benefit Amount | Waiting Period |

|---|---|---|---|

| Secure Income | $100/month | 60% of income | 90 days |

| Protect Plus | $150/month | 70% of income | 30 days |

| Essential Coverage | $75/month | 50% of income | 180 days |

Maximizing Value: Strategies for Affordable Family Insurance

Securing affordable family insurance is about more than just finding the lowest premiums. It’s about understanding your coverage needs, shopping around for the best deals, and employing strategies to reduce costs without compromising on quality.

Bundling Policies: The Power of Combination

One effective strategy to reduce the cost of family insurance is to bundle multiple policies with the same insurer. Many insurance companies offer discounts when you combine policies, such as home, auto, and life insurance. This not only simplifies your insurance management but also saves you money.

For example, if you have a home and auto insurance policy with InsureCo, you might be eligible for a discount on your life insurance policy with the same provider. This discount can add up over time, making it a financially savvy move.

Shopping Around: Comparing Quotes and Benefits

The insurance market is highly competitive, and insurers offer a wide range of plans with varying benefits and costs. It’s essential to shop around and compare quotes from multiple providers to find the best value for your family’s needs.

Online comparison tools can be a great starting point. These platforms allow you to input your information once and receive multiple quotes from different insurers. However, it's important to go beyond the premium cost and consider the coverage limits, deductibles, and any additional benefits or exclusions.

Understanding Discounts and Incentives

Insurance companies often offer a variety of discounts and incentives to attract new customers and reward loyalty. These can include:

- Multi-Policy Discounts: As mentioned, bundling multiple policies with the same insurer can lead to significant savings.

- Loyalty Discounts: Some insurers reward long-term customers with discounted premiums or additional benefits.

- Safe Driver Discounts: For auto insurance, safe driving records can lead to lower premiums.

- Health and Lifestyle Discounts: Life insurance providers may offer lower premiums for healthy lifestyles, such as non-smokers or those who maintain a healthy weight.

- Education Discounts: Some insurers provide discounts for college graduates or those with advanced degrees.

Managing Costs with Deductibles and Coverage Limits

When choosing insurance policies, the deductibles and coverage limits play a significant role in determining your premium cost. Generally, higher deductibles and lower coverage limits result in lower premiums, while the opposite is true for lower deductibles and higher coverage limits.

It's a balancing act. You want to ensure your coverage is adequate to protect your family's financial interests, but you also don't want to overpay for coverage you may never need. Consider your family's financial situation and risk tolerance when making these decisions.

Regularly Review and Adjust Your Coverage

Family insurance needs are not static; they evolve as your family’s circumstances change. Regularly reviewing and adjusting your coverage is essential to ensure you’re not over- or under-insured. Major life events such as marriage, birth of a child, purchasing a home, or a significant change in income can impact your insurance needs.

For instance, after the birth of a child, you may want to increase your life insurance coverage to ensure your family is adequately protected. On the other hand, if your children move out and become financially independent, you may be able to reduce your coverage and save on premiums.

Conclusion: A Secure Future for Your Family

Securing affordable family insurance is a crucial step towards financial security and peace of mind. By understanding your family’s unique needs, shopping around for the best deals, and employing cost-saving strategies, you can unlock the best value for your insurance coverage.

Remember, insurance is not a one-size-fits-all solution. It's a personalized approach to protecting what matters most. With the right knowledge and approach, you can navigate the insurance market confidently and secure the best protection for your family's future.

What is the average cost of family insurance in the United States?

+The average cost of family insurance can vary significantly depending on factors such as location, age, and the type of coverage. For health insurance, the average monthly premium for a family plan can range from 500 to 1,500. Life insurance premiums can vary based on the coverage amount and policy type, with term life insurance typically costing less than whole life insurance. It’s essential to shop around and compare quotes to find the best value for your specific needs.

How can I find the best family insurance plan for my needs?

+To find the best family insurance plan, start by assessing your family’s unique needs and priorities. Consider factors such as your health status, the number of dependents, and your financial situation. Then, shop around and compare quotes from multiple insurers, paying attention to coverage limits, deductibles, and any additional benefits or exclusions. Don’t hesitate to negotiate with insurers to get the best deal.

Are there any government programs that can help with family insurance costs?

+Yes, there are government programs available to help with family insurance costs, particularly for health insurance. The Affordable Care Act (ACA) offers tax credits and subsidies to help lower- and middle-income families afford health insurance. Additionally, some states have their own programs to provide low-cost or no-cost health insurance to eligible families. It’s worth exploring these options to see if you qualify.

What should I do if I can’t afford the insurance quotes I’m getting?

+If you’re finding insurance quotes to be unaffordable, there are a few steps you can take. First, review your coverage needs and consider if you can reduce your coverage to lower your premiums. You can also explore government programs and subsidies, as mentioned earlier. Additionally, consider negotiating with insurers or seeking assistance from an insurance broker who can help you find more affordable options.