Car Insurance Cars

Car insurance is an essential aspect of vehicle ownership, offering financial protection and peace of mind to drivers around the world. With countless options and varying policies, choosing the right car insurance can be a daunting task. This comprehensive guide aims to demystify the process, providing an in-depth analysis of car insurance, its key components, and how to navigate the market effectively. By understanding the nuances of car insurance, drivers can make informed decisions to secure the best coverage for their needs.

Understanding Car Insurance: A Comprehensive Overview

Car insurance is a contract between an individual and an insurance provider, wherein the insurer agrees to compensate the policyholder for covered losses or damages in exchange for a premium. This contractual agreement serves as a safety net, ensuring drivers are financially protected in the event of accidents, theft, or other covered incidents. The complexity of car insurance lies in the multitude of coverage options and the unique circumstances of each driver.

Key Components of Car Insurance Policies

Car insurance policies typically consist of several core components, each offering distinct coverage and benefits. These components include:

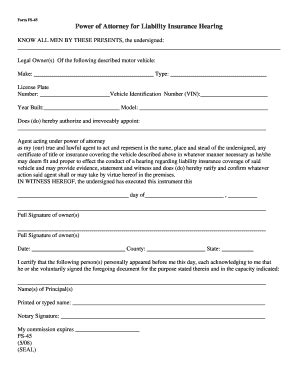

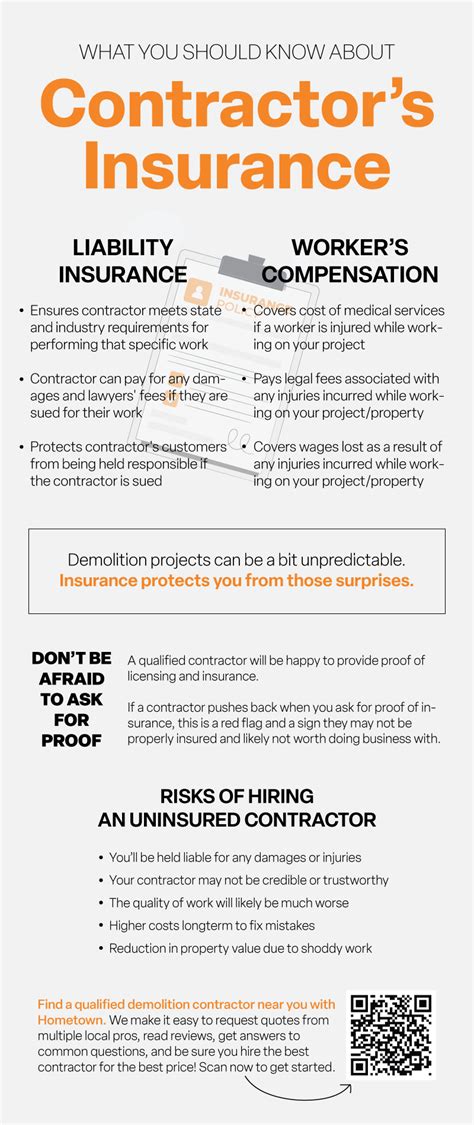

- Liability Coverage: This is the most basic form of car insurance, covering bodily injury and property damage caused by the policyholder to others. It is mandatory in most states and serves as a legal requirement for vehicle registration.

- Collision Coverage: This optional coverage pays for repairs to the policyholder’s vehicle after an accident, regardless of fault. It provides protection against costly repair bills and is particularly beneficial for newer or financed vehicles.

- Comprehensive Coverage: Comprehensive coverage protects against damages caused by incidents other than collisions, such as theft, vandalism, natural disasters, or animal collisions. It is often paired with collision coverage to provide a comprehensive protection package.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for medical expenses incurred by the policyholder and their passengers after an accident, regardless of fault. It ensures prompt medical attention and can cover a range of expenses, including hospital stays, rehabilitation, and even funeral costs.

- Uninsured/Underinsured Motorist Coverage: This coverage protects policyholders in the event of an accident with a driver who has no insurance or insufficient insurance. It provides compensation for bodily injury and property damage, ensuring policyholders are not left with the full financial burden.

Additionally, car insurance policies may offer optional add-ons and endorsements to tailor coverage to specific needs. These can include rental car coverage, roadside assistance, gap insurance, and custom equipment coverage, among others.

| Coverage Type | Description |

|---|---|

| Liability | Covers bodily injury and property damage to others |

| Collision | Pays for repairs to the policyholder's vehicle after an accident |

| Comprehensive | Protects against non-collision incidents, including theft and natural disasters |

| Medical Payments/PIP | Covers medical expenses for the policyholder and passengers after an accident |

| Uninsured/Underinsured Motorist | Provides compensation if involved in an accident with an uninsured/underinsured driver |

The Car Insurance Market: Navigating the Options

The car insurance market is highly competitive, with numerous providers offering a vast array of policies and coverage options. Navigating this market requires a thorough understanding of your needs and a comparative analysis of different providers. Here’s a step-by-step guide to help you choose the right car insurance:

Step 1: Assess Your Needs

Before shopping for car insurance, take the time to assess your specific needs. Consider factors such as the make and model of your vehicle, your driving history, and the level of coverage you desire. Are you looking for the most comprehensive protection, or are you seeking a more budget-friendly option? Understanding your needs will help narrow down your options and ensure you get the coverage that best suits your circumstances.

Step 2: Research Insurance Providers

Once you have a clear idea of your needs, it’s time to research insurance providers. Start by checking out the top car insurance companies in your region. Look for providers that offer a range of coverage options and have a solid reputation for customer service and claims handling. Online reviews and ratings can be a valuable resource, providing insights into the experiences of other policyholders.

Step 3: Compare Quotes and Coverage

Obtain quotes from multiple insurance providers to compare not only the cost of premiums but also the coverage offered. Make sure to compare policies with similar coverage limits to ensure an accurate comparison. Look beyond the premium price and consider the overall value of the policy, including the deductibles, coverage limits, and any additional perks or discounts offered.

Step 4: Review Policy Details

Before committing to a policy, carefully review the fine print. Understand the exclusions and limitations of the coverage, as well as any potential gaps in protection. Ensure that the policy aligns with your needs and provides the level of protection you desire. If you have any questions or concerns, don’t hesitate to reach out to the insurance provider for clarification.

Step 5: Consider Discounts and Perks

Many insurance providers offer discounts and perks to policyholders. These can include discounts for safe driving, bundling multiple policies, or installing safety features in your vehicle. Some providers also offer loyalty discounts or rewards programs. Take advantage of these opportunities to reduce your premiums and enhance your coverage.

Step 6: Choose the Right Provider

Based on your research, comparisons, and review of policy details, choose the insurance provider that best meets your needs. Consider not only the cost and coverage but also the reputation and customer service of the provider. Remember, car insurance is a long-term investment, so it’s important to feel confident in your choice.

The Future of Car Insurance: Trends and Innovations

The car insurance industry is evolving, driven by technological advancements and changing consumer needs. Here are some key trends and innovations shaping the future of car insurance:

Telematics and Usage-Based Insurance

Telematics technology allows insurance providers to track driving behavior and offer personalized premiums based on actual driving habits. Usage-based insurance, or pay-as-you-drive policies, are becoming increasingly popular, as they reward safe drivers with lower premiums. This trend is expected to continue, with more insurers adopting telematics to offer fairer and more accurate pricing.

Connected Car Technology

The rise of connected car technology, including advanced driver-assistance systems (ADAS) and autonomous vehicles, is set to revolutionize car insurance. These technologies can collect data on driving behavior, vehicle performance, and even crash avoidance, providing insurers with valuable insights. This data can be used to develop more accurate risk assessments and potentially reduce premiums for drivers who adopt these advanced safety features.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are transforming the way insurance claims are processed and handled. These technologies can analyze large amounts of data quickly and accurately, speeding up the claims process and reducing costs. AI-powered chatbots and virtual assistants are also enhancing customer service, providing policyholders with instant support and answers to their queries.

Insurtech Innovations

The rise of insurtech startups is bringing innovative solutions to the car insurance market. These startups are leveraging technology to offer more efficient, personalized, and affordable insurance products. From on-demand insurance for short-term rentals to peer-to-peer insurance models, insurtech is challenging traditional insurers and driving competition, ultimately benefiting consumers.

Conclusion: Making Informed Choices for Your Car Insurance

Choosing the right car insurance is a critical decision that can have a significant impact on your financial well-being. By understanding the key components of car insurance policies, navigating the competitive market, and staying abreast of industry trends and innovations, you can make informed choices that best suit your needs. Remember, car insurance is not a one-size-fits-all solution, and tailoring your coverage to your specific circumstances is key to ensuring adequate protection.

What is the average cost of car insurance?

+The average cost of car insurance varies significantly based on factors such as location, driving history, and the type of vehicle. According to recent data, the national average for car insurance premiums is approximately $1,674 per year. However, it’s important to note that this is just an average, and your personal rate may be higher or lower depending on your individual circumstances.

How can I save money on car insurance?

+There are several ways to save money on car insurance. Firstly, compare quotes from multiple providers to find the best rates. Additionally, consider bundling your car insurance with other policies, such as home or renters insurance, to potentially reduce your premiums. Maintaining a clean driving record and installing safety features in your vehicle can also lead to discounts. Finally, be mindful of your mileage and consider usage-based insurance policies that reward low-mileage drivers.

What should I do if I’m involved in an accident?

+If you’re involved in an accident, the first step is to ensure your safety and the safety of others involved. Call the police to report the accident and obtain a police report. Exchange information with the other driver(s), including names, contact details, and insurance information. Take photos of the accident scene and any visible damages. Notify your insurance provider as soon as possible to begin the claims process. It’s important to cooperate with your insurer and provide accurate information to ensure a smooth claims process.