Disability Insurance Policy

Disability insurance, often referred to as DI or disability income insurance, is a crucial aspect of financial planning that is often overlooked. This type of insurance provides individuals with a safety net during periods of disability, ensuring they can continue to meet their financial obligations and maintain their standard of living. In this comprehensive article, we will delve into the intricacies of disability insurance policies, exploring their importance, coverage options, and the key considerations to make when selecting the right policy for your needs.

Understanding Disability Insurance Policies

Disability insurance policies are designed to protect individuals against the financial consequences of an illness or injury that prevents them from working and earning an income. These policies provide a regular income stream, known as disability benefits, to policyholders who become disabled and meet the specific criteria outlined in their policy.

The primary purpose of disability insurance is to safeguard an individual's earning capacity, ensuring they can cover their essential expenses, such as mortgages, rent, utilities, and daily living costs, even when they are unable to work due to a disability. By providing a source of income, disability insurance policies offer peace of mind and financial security during challenging times.

Types of Disability Insurance Coverage

Disability insurance policies can be broadly categorized into two main types: short-term disability insurance (STD) and long-term disability insurance (LTD). Each type serves a specific purpose and caters to different durations of disability.

Short-Term Disability Insurance (STD)

Short-term disability insurance policies are designed to provide coverage for temporary disabilities that typically last from a few weeks to several months. These policies are often purchased by individuals who have relatively short waiting periods, such as a few days or weeks, before benefits begin to be paid. STD policies are ideal for covering disabilities resulting from accidents, illnesses, or surgeries that require a short recovery period.

One of the key advantages of short-term disability insurance is its affordability. Premiums for STD policies are generally lower compared to long-term disability insurance, making it accessible to a wider range of individuals. Additionally, STD policies often have more flexible eligibility requirements, making it easier for people with pre-existing conditions or certain health issues to obtain coverage.

Long-Term Disability Insurance (LTD)

Long-term disability insurance policies, on the other hand, are intended to provide coverage for more prolonged disabilities that can last for years or even a lifetime. These policies typically have longer waiting periods, often ranging from several months to a year, before benefits commence. LTD policies are designed to protect individuals against the financial impact of disabilities that prevent them from working in their chosen profession or any occupation for an extended period.

Long-term disability insurance offers comprehensive protection and is especially beneficial for individuals who have high earning potential or those in professions with a higher risk of long-term disability. The benefits provided by LTD policies can significantly reduce the financial burden associated with long-term disabilities, covering expenses such as medical treatments, rehabilitation costs, and ongoing living expenses.

Key Considerations for Choosing a Disability Insurance Policy

When selecting a disability insurance policy, several crucial factors must be taken into account to ensure you choose a policy that aligns with your specific needs and circumstances.

Occupation and Income

One of the primary considerations is your occupation and income level. Different occupations carry varying levels of risk for disability. For instance, individuals in physically demanding jobs or those with higher exposure to hazards may face a greater risk of injury or illness. It is essential to choose a policy that adequately covers the potential risks associated with your profession.

Additionally, your income level plays a significant role in determining the appropriate level of coverage. Disability insurance policies often provide a percentage of your pre-disability income as benefits. Therefore, it is crucial to assess your current and potential future earnings to ensure the policy's benefits will adequately meet your financial needs during a disability.

Waiting Period and Benefit Duration

The waiting period, also known as the elimination period, is the time between the onset of disability and when the policy begins paying benefits. This period can vary widely among policies, ranging from a few days to several months. It is essential to choose a waiting period that aligns with your financial reserves and the likelihood of your disability lasting beyond this period.

Similarly, the benefit duration, or the length of time for which the policy will provide benefits, is another critical consideration. Short-term disability insurance policies typically have shorter benefit durations, while long-term policies can provide benefits for extended periods, sometimes even until retirement age. Choosing the right benefit duration ensures that you have adequate coverage for the expected length of your disability.

Definition of Disability

Disability insurance policies often define disability differently, and it is crucial to understand these definitions when selecting a policy. Some policies may have more restrictive definitions, requiring complete inability to work in any occupation, while others may offer more flexible definitions, allowing for partial disability or specific occupation-related impairments.

Understanding the definition of disability in your chosen policy is essential to ensure that your specific circumstances will be covered. It is advisable to carefully review the policy's language and consult with an insurance professional to clarify any doubts regarding the definition of disability.

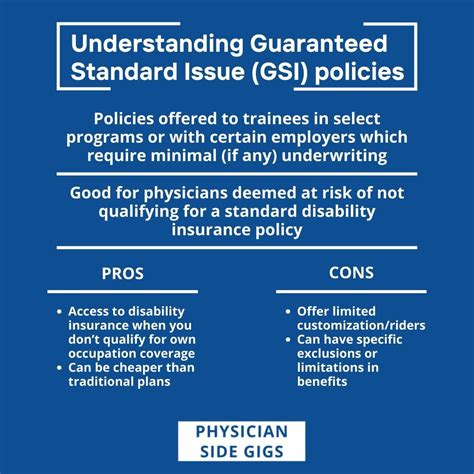

Exclusions and Limitations

All disability insurance policies come with certain exclusions and limitations. These may include pre-existing conditions, specific types of disabilities, or activities that are not covered by the policy. It is crucial to review the policy's fine print and understand any exclusions or limitations to ensure you are not caught off guard if a disability arises from an excluded cause.

Additionally, some policies may have caps or maximum benefit amounts. These limits can impact the overall financial protection provided by the policy. It is essential to choose a policy with adequate coverage limits to ensure you receive sufficient benefits during a disability.

The Importance of Early Planning

Disability insurance is an essential component of a comprehensive financial plan, and it is crucial to consider it early on in your career or when making significant life changes. By purchasing disability insurance while you are young and healthy, you can often secure more favorable terms and lower premiums. Additionally, early planning ensures that you have adequate coverage in place before any unexpected disabilities occur.

It is important to note that certain occupations or industries may have specific disability insurance options or group policies available. Exploring these options can provide cost-effective coverage tailored to your profession.

Disability Insurance and Tax Considerations

The tax implications of disability insurance policies can vary depending on the type of policy and how it is purchased. In general, disability insurance premiums are tax-deductible for self-employed individuals and business owners. However, the tax treatment of disability benefits can be more complex.

For most individuals, disability benefits are considered taxable income and are subject to federal and state income taxes. However, there are certain exceptions, such as when disability benefits are received through an employer-provided plan that meets specific requirements. It is advisable to consult with a tax professional to understand the tax implications of your specific disability insurance policy.

Claim Process and Support

In the unfortunate event of a disability, understanding the claim process and having access to support can be crucial. Disability insurance policies typically require policyholders to provide medical documentation and proof of disability to initiate a claim. It is essential to review the policy's claim procedures and ensure you have all the necessary documentation ready to facilitate a smooth claims process.

Many insurance companies offer support services, such as case managers or rehabilitation specialists, who can assist policyholders throughout the claims process and provide guidance on returning to work or managing their disability.

The Future of Disability Insurance

The disability insurance industry is constantly evolving to meet the changing needs of individuals and the workforce. With advancements in technology and a growing awareness of the importance of financial planning, disability insurance policies are becoming more accessible and tailored to specific industries and occupations.

One emerging trend is the integration of disability insurance with other financial products, such as life insurance or retirement plans. This integration allows individuals to streamline their financial planning and obtain comprehensive protection under a single policy.

Additionally, disability insurance providers are increasingly focusing on preventative measures and wellness programs. These initiatives aim to reduce the incidence of disabilities by promoting healthy lifestyles and providing resources for policyholders to maintain their well-being.

| Disability Insurance Type | Coverage Duration |

|---|---|

| Short-Term Disability (STD) | Few weeks to several months |

| Long-Term Disability (LTD) | Months to lifetime, until retirement age |

Frequently Asked Questions

How much does disability insurance cost?

+The cost of disability insurance can vary based on several factors, including your age, occupation, income, and the level of coverage you choose. Generally, premiums are higher for individuals with higher incomes and more risky occupations. It is advisable to obtain quotes from multiple insurers to find the most competitive rates for your specific circumstances.

Can I get disability insurance if I have a pre-existing condition?

+Yes, it is possible to obtain disability insurance with a pre-existing condition. However, the availability and terms of coverage may depend on the severity and nature of the condition. Some insurers may exclude coverage for specific pre-existing conditions, while others may offer coverage with certain limitations or at a higher premium.

What happens if my disability lasts longer than my policy’s benefit duration?

+If your disability extends beyond the benefit duration of your policy, you may have limited options. Some policies offer the option to renew or extend coverage, but this may come at a higher premium. It is important to carefully consider the benefit duration when selecting a policy to ensure it aligns with your potential disability needs.

Can I combine disability insurance with other financial products?

+Yes, disability insurance can often be combined with other financial products, such as life insurance or retirement plans. This integration allows for a more comprehensive financial protection package and can provide additional benefits, such as tax advantages or streamlined administrative processes.