Collision Insurance Meaning

Collision insurance is an essential component of vehicle insurance policies, designed to protect policyholders in the event of a collision involving their insured vehicle. This type of coverage is crucial for individuals who want to safeguard themselves against the financial burdens that can arise from damaging their own vehicle, whether through a collision with another vehicle, an object, or even a rollover accident.

In the United States, collision insurance is one of the most commonly purchased types of auto insurance, alongside liability coverage. While liability insurance is often mandated by law and covers the policyholder's legal responsibility for bodily injury and property damage caused to others in an accident, collision insurance is an optional coverage that specifically addresses damage to the policyholder's own vehicle.

Understanding Collision Insurance

Collision insurance, as the name suggests, provides coverage for damage to the insured vehicle resulting from a collision. This coverage applies regardless of who is at fault in the accident. In other words, even if the policyholder is not deemed responsible for the collision, their collision insurance will still cover the damage to their vehicle.

The extent of coverage provided by collision insurance can vary depending on the policy and the insurance provider. Typically, collision coverage includes:

- Damage to the insured vehicle: This includes damage to the body, engine, wheels, and other components of the car that result from a collision.

- Rollover accidents: If the insured vehicle rolls over due to an accident, collision insurance will cover the damage.

- Damage from hitting an object: This coverage applies when the insured vehicle collides with an object like a tree, fence, building, or any other stationary object.

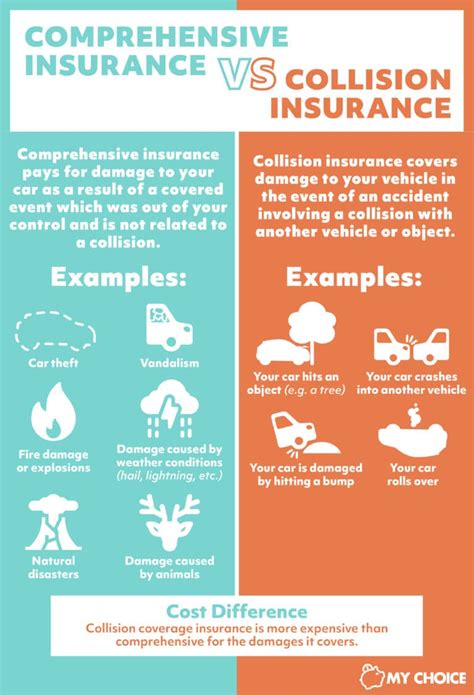

However, it's important to note that collision insurance does not cover damage resulting from certain events, such as:

- Vandalism: Damage caused by intentional acts of vandalism or malicious mischief is typically not covered by collision insurance. This type of damage is often covered under comprehensive insurance, which is a separate type of coverage.

- Theft: If the insured vehicle is stolen, the damage caused by the theft is not covered by collision insurance. Instead, this scenario is usually addressed by comprehensive insurance or specific theft coverage.

- Weather-related damage: Collision insurance does not cover damage caused by natural disasters or weather events, such as hail damage, flood damage, or damage from falling trees during a storm. This type of coverage is typically provided by comprehensive insurance.

How Collision Insurance Works

When a policyholder files a claim for collision damage, the insurance company will typically inspect the vehicle to assess the extent of the damage. The insurer will then estimate the cost of repairs and offer a settlement amount based on this estimate.

It's important to understand that collision insurance typically comes with a deductible, which is the amount the policyholder must pay out of pocket before the insurance coverage kicks in. Deductibles can vary depending on the policy and the insurance provider, but a common deductible for collision insurance is $500.

For example, if the estimated cost of repairs for the collision damage is $3,000 and the policyholder's deductible is $500, the insurance company will pay $2,500, while the policyholder is responsible for the $500 deductible.

Total Loss Situations

In some cases, the damage to the vehicle may be so extensive that it is considered a total loss. This means that the cost of repairs exceeds the vehicle’s actual cash value (ACV), which is the market value of the vehicle at the time of the accident.

If the vehicle is deemed a total loss, the insurance company will typically pay the policyholder the ACV of the vehicle, minus the deductible. For instance, if the ACV of the vehicle is $10,000 and the deductible is $500, the insurance company would pay $9,500 to the policyholder in the event of a total loss.

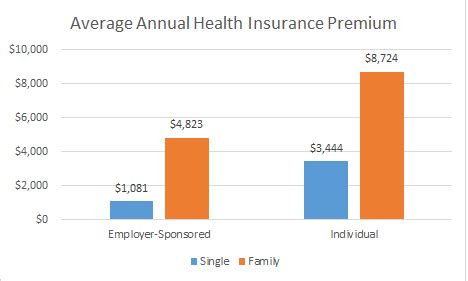

Factors Affecting Collision Insurance Premiums

The cost of collision insurance can vary significantly based on several factors, including:

- Vehicle Value: The value of the insured vehicle plays a significant role in determining collision insurance premiums. Higher-value vehicles generally attract higher premiums.

- Vehicle Type: The make, model, and age of the vehicle can impact premiums. Sports cars and luxury vehicles often have higher collision insurance rates due to their higher repair costs and theft risks.

- Driver's Age and Experience: Younger and less experienced drivers are often charged higher premiums for collision insurance, as they are statistically more likely to be involved in accidents.

- Location: The area where the vehicle is primarily driven and garaged can affect collision insurance rates. Urban areas with higher accident rates and theft risks may result in higher premiums.

- Claims History: Insurers take into account the policyholder's claims history when determining premiums. A history of frequent claims can lead to higher collision insurance rates.

Benefits of Collision Insurance

Collision insurance offers several key benefits to policyholders:

- Financial Protection: It provides financial security by covering the cost of repairs or replacement in the event of a collision, reducing the financial burden on the policyholder.

- Peace of Mind: Policyholders can drive with confidence, knowing that they are protected against the financial consequences of accidents, even if they are not at fault.

- Vehicle Preservation: By promptly repairing damage caused by collisions, collision insurance helps maintain the vehicle's value and safety.

Is Collision Insurance Right for You?

The decision to purchase collision insurance depends on various factors, including the value of your vehicle, your personal financial situation, and your risk tolerance. Here are some considerations to help you decide:

- Vehicle Value: If your vehicle is relatively new or has a high resale value, collision insurance can provide significant protection. However, for older vehicles with low resale value, the cost of collision insurance may outweigh the benefits.

- Financial Capacity: Consider your ability to cover the cost of repairs out of pocket if an accident occurs. If you have sufficient savings or emergency funds, you may choose to forgo collision insurance and self-insure instead.

- Risk Assessment: Evaluate your driving habits and the risks you face on the road. If you drive in high-traffic areas or areas with a higher risk of accidents, collision insurance can provide valuable protection.

Alternatives to Collision Insurance

While collision insurance is a popular choice for many drivers, it is not the only option. Here are some alternatives to consider:

- Comprehensive Insurance: Comprehensive insurance covers damage to the insured vehicle resulting from non-collision events, such as theft, vandalism, weather-related incidents, and more. It provides broader coverage than collision insurance.

- Liability-Only Insurance: This type of insurance covers the policyholder's legal liability for bodily injury and property damage caused to others in an accident. It does not provide coverage for damage to the policyholder's own vehicle.

- Gap Insurance: Gap insurance covers the difference between the ACV of the vehicle and the remaining balance on a lease or loan in the event of a total loss. It is particularly useful for drivers who have leased or financed their vehicles.

Collision Insurance: A Crucial Part of Your Auto Insurance Portfolio

Collision insurance is an essential component of a comprehensive auto insurance portfolio. It provides valuable protection against the financial risks associated with damaging your own vehicle in a collision. By understanding the coverage, benefits, and costs associated with collision insurance, you can make informed decisions about your auto insurance coverage and ensure you have the protection you need on the road.

What is the difference between collision insurance and comprehensive insurance?

+Collision insurance covers damage to the insured vehicle resulting from a collision with another vehicle, object, or rollover accident. Comprehensive insurance, on the other hand, provides coverage for damage caused by non-collision events, such as theft, vandalism, weather-related incidents, and more.

Is collision insurance mandatory?

+Collision insurance is typically an optional coverage, unlike liability insurance, which is often mandated by law. However, some states or lenders may require collision insurance as a condition of financing or leasing a vehicle.

How do I choose the right deductible for my collision insurance policy?

+The choice of deductible depends on your personal financial situation and risk tolerance. A higher deductible can lower your insurance premiums, but it also means you will have to pay more out of pocket if you need to make a claim. Consider your ability to cover the deductible amount in the event of an accident.