Drive Insurance Quote

Securing affordable and comprehensive drive insurance is essential for every vehicle owner. The process of obtaining a drive insurance quote can be daunting, with numerous factors influencing the final cost. Understanding these factors and exploring various options can help you make an informed decision and find the best coverage for your needs. This comprehensive guide aims to provide an in-depth analysis of the drive insurance quote process, offering expert insights and practical tips to navigate this crucial aspect of vehicle ownership.

The Importance of Drive Insurance

Drive insurance, often referred to as auto insurance or car insurance, is a critical financial safeguard for vehicle owners. It provides protection against a range of potential risks and liabilities associated with driving, including accidents, theft, and damage to property. The primary goal of drive insurance is to offer financial security and peace of mind, ensuring that policyholders can manage the costs arising from unforeseen events on the road.

In many jurisdictions, drive insurance is a legal requirement. It's not just about meeting the law, though; it's about ensuring you're prepared for the unexpected. Whether it's a minor fender bender or a more significant accident, drive insurance can help cover the costs of repairs, medical expenses, and even legal fees. Additionally, comprehensive drive insurance plans often include benefits like roadside assistance and rental car coverage, adding an extra layer of convenience and support.

Factors Influencing Drive Insurance Quotes

The cost of your drive insurance quote is influenced by a multitude of factors. These factors are carefully considered by insurance providers to assess the level of risk associated with insuring your vehicle. Here’s an overview of some key considerations:

Vehicle Type and Usage

The make, model, and year of your vehicle play a significant role in determining your insurance quote. Insurance providers consider the safety features, repair costs, and overall popularity of different vehicles. For instance, a luxury sports car may attract a higher premium due to its higher replacement and repair costs. Additionally, the primary usage of your vehicle, whether for personal or business purposes, can impact your quote.

| Vehicle Category | Average Premium |

|---|---|

| Sports Cars | $2,500 - $3,000 annually |

| Sedans | $1,500 - $2,000 annually |

| SUVs | $1,800 - $2,200 annually |

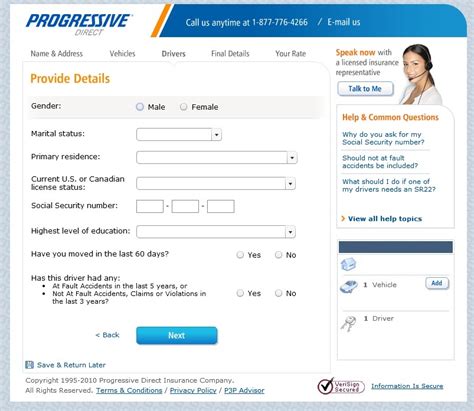

Driver Profile

Your driving history and personal information are vital in assessing your insurance risk. Insurance providers consider factors such as your age, gender, driving experience, and claim history. Younger drivers, especially those under 25, often face higher premiums due to their relative lack of experience on the road. Similarly, a history of accidents or traffic violations can significantly impact your insurance quote.

Location and Usage

Where you live and how you use your vehicle can also affect your insurance costs. Insurance providers analyze local crime rates, accident statistics, and weather conditions to assess the risk level in your area. Additionally, the number of miles you drive annually can influence your quote. Higher mileage may indicate a greater risk of accidents or wear and tear on your vehicle.

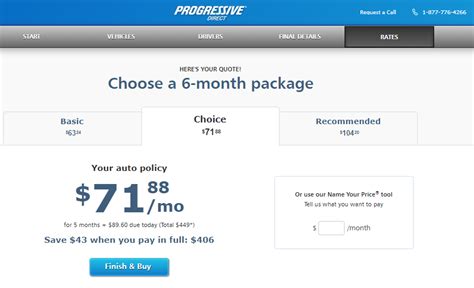

Coverage and Deductibles

The level of coverage you choose and the deductibles you select will directly impact your insurance quote. Comprehensive coverage, which includes protection for a wide range of scenarios, will typically result in a higher premium. Conversely, choosing a higher deductible (the amount you pay out of pocket before your insurance kicks in) can lower your monthly premium.

Tips for Obtaining the Best Drive Insurance Quote

Navigating the drive insurance quote process can be made easier with the right strategies. Here are some expert tips to help you secure the most favorable insurance quote:

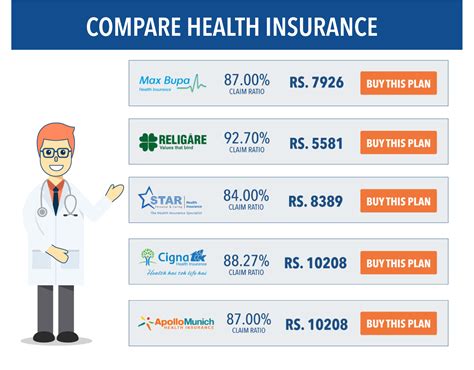

Compare Multiple Providers

Don’t settle for the first insurance quote you receive. Take the time to compare quotes from multiple providers. Insurance companies have different assessment criteria and pricing structures, so shopping around can reveal significant variations in premiums. Online comparison tools can be particularly useful for quickly gathering multiple quotes.

Understand Your Coverage Needs

Before requesting quotes, take the time to understand your specific coverage needs. Consider the value of your vehicle, your personal financial situation, and the risks you want to insure against. This will help you strike the right balance between comprehensive coverage and affordable premiums. Remember, while it’s tempting to opt for the cheapest option, it’s essential to ensure you have adequate protection.

Explore Discounts and Bundles

Insurance providers often offer discounts and bundles to make their policies more attractive. These can include discounts for safe driving, loyalty rewards, or bundling multiple insurance policies (such as home and auto insurance) with the same provider. Researching and inquiring about these options can lead to significant savings on your insurance premium.

Improve Your Driving Record

A clean driving record is a powerful tool for securing a favorable insurance quote. If you have a history of accidents or violations, consider taking steps to improve your driving habits. This could involve completing a defensive driving course, which may lead to a reduced insurance premium. Additionally, maintaining a clean driving record over time can result in substantial long-term savings.

Consider Higher Deductibles

Choosing a higher deductible can be a strategic move to reduce your insurance premium. While it means you’ll pay more out of pocket in the event of a claim, it can significantly lower your monthly or annual insurance costs. However, it’s important to ensure that the chosen deductible is an amount you’re comfortable paying if the need arises.

The Future of Drive Insurance Quotes

The landscape of drive insurance quotes is evolving with advancements in technology and changing consumer needs. Insurance providers are increasingly leveraging data analytics and machine learning to offer more personalized and accurate quotes. This shift towards data-driven underwriting is expected to continue, leading to more efficient and fair pricing models.

Additionally, the rise of connected car technologies and telematics is opening up new avenues for insurance providers to assess risk. These technologies can provide real-time data on driving behavior, allowing for more dynamic and accurate insurance quotes. This trend towards usage-based insurance is expected to gain traction, offering policyholders more control over their insurance costs based on their actual driving habits.

Conclusion

Obtaining a drive insurance quote is a crucial step in ensuring your financial security and peace of mind on the road. By understanding the factors that influence your insurance premium and adopting strategic approaches, you can navigate the quote process with confidence. Remember, while affordability is important, it’s equally crucial to ensure you have adequate coverage for your unique needs. With the right approach, you can strike the perfect balance between cost and protection.

How often should I review my drive insurance policy and quote?

+It’s a good practice to review your drive insurance policy and quote annually or whenever your circumstances change significantly. This ensures that your coverage remains adequate and that you’re not overpaying for unnecessary features.

Can I negotiate my drive insurance quote?

+While insurance quotes are typically based on standardized risk assessments, you can still negotiate with your provider. Discuss your specific needs and circumstances, and inquire about any available discounts or bundle options. Being an informed consumer can often lead to better deals.

What are some common mistakes to avoid when obtaining a drive insurance quote?

+Avoid the mistake of solely focusing on the lowest premium. Ensure you understand the coverage included and that it meets your needs. Additionally, be honest about your driving history and vehicle usage to avoid potential issues with claim settlements in the future.