Best Health Insurance Cheap

Health insurance is an essential aspect of our lives, providing financial protection and access to crucial healthcare services. In today's world, finding an affordable and comprehensive health insurance plan is a priority for many individuals and families. This article aims to delve into the realm of health insurance, exploring the best options available for those seeking affordable coverage. We will discuss the factors that influence insurance costs, provide insights into finding cheap health insurance, and offer valuable tips to ensure you make an informed decision.

Understanding the Factors Affecting Health Insurance Costs

Before we explore the best cheap health insurance options, it's crucial to understand the factors that influence the cost of insurance plans. These factors can vary depending on the country and healthcare system, but some common elements include:

- Age: Younger individuals generally pay lower premiums as they are considered less risky. As we age, our health risks increase, leading to higher insurance costs.

- Pre-existing Conditions: Health conditions that you have prior to purchasing insurance can significantly impact your premiums. Insurers often charge higher rates for individuals with pre-existing conditions, as they pose a higher risk.

- Location: The cost of healthcare services and the availability of medical professionals can vary greatly depending on where you live. This can directly influence the cost of your insurance plan.

- Coverage Type: The level of coverage you choose, such as individual, family, or group plans, can affect the price. Comprehensive plans with extensive coverage will typically cost more.

- Deductibles and Co-pays: Insurance plans with higher deductibles (the amount you pay before insurance coverage kicks in) often have lower premiums. Similarly, plans with higher co-pays (the amount you pay for each service) may have reduced monthly costs.

- Tobacco Use: Many insurance companies charge smokers and tobacco users higher premiums due to the increased health risks associated with tobacco consumption.

Exploring Affordable Health Insurance Options

Now that we have a grasp of the factors influencing health insurance costs, let's explore some of the best options for finding cheap health insurance:

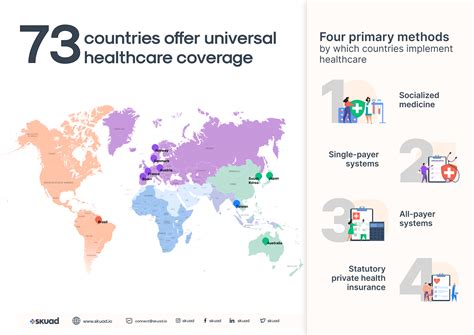

1. Government-Sponsored Programs

Many countries offer government-sponsored health insurance programs designed to provide affordable coverage to eligible individuals and families. These programs often have lower premiums and may offer subsidies to those with limited income. Examples include:

- Medicaid (United States): A federal and state-funded program that provides free or low-cost health coverage to eligible individuals and families with low incomes and resources.

- Medicare (United States): A federal program that provides health insurance for Americans aged 65 and older, as well as certain younger people with disabilities and those with End-Stage Renal Disease.

- National Health Service (United Kingdom): A publicly funded healthcare system that provides free at the point of use healthcare services to all legal residents.

- Medicare (Australia): A universal health insurance scheme that provides access to a range of healthcare services, with most residents eligible for partial or full coverage.

2. Employer-Provided Insurance

If you are employed, your employer may offer group health insurance plans, which can be more affordable than individual plans. Group insurance plans often have lower premiums due to the larger pool of participants, which spreads the risk across more individuals. Additionally, your employer may contribute to the cost of your insurance, making it even more cost-effective.

3. Individual Market Plans

For those who do not qualify for government programs or do not have access to employer-provided insurance, the individual market offers a range of insurance plans. While these plans may have higher premiums than group plans, there are still options for affordable coverage. Here are some tips to find cheap individual market plans:

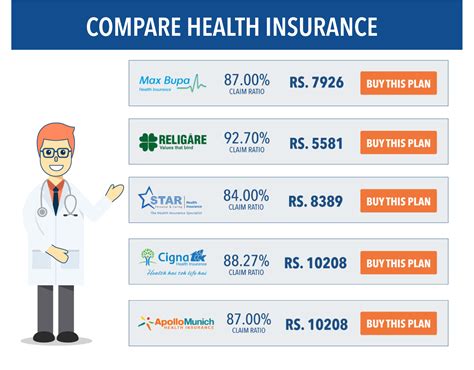

- Compare quotes from different insurance companies. Use online tools or consult an insurance broker to get multiple quotes and find the best deal.

- Consider plans with higher deductibles and co-pays. While these plans may have lower monthly premiums, ensure that you can afford the out-of-pocket costs when needed.

- Look for plans with narrow provider networks. Insurance companies may offer lower premiums for plans that only cover a specific network of healthcare providers.

- Explore health savings accounts (HSAs) or flexible spending accounts (FSAs). These accounts allow you to set aside pre-tax money to pay for qualified medical expenses, reducing your overall out-of-pocket costs.

4. Discounted Insurance Programs

Some insurance companies and organizations offer discounted insurance programs or special plans for specific groups. These programs may provide affordable coverage for individuals who belong to certain organizations or meet specific criteria. Examples include:

- Association Health Plans (AHPs): These are group health insurance plans offered through trade or professional associations. AHPs can provide affordable coverage for small businesses and self-employed individuals.

- Short-Term Health Insurance Plans: These plans offer temporary coverage for individuals between jobs or during periods of transition. While they may have lower premiums, they often have limited coverage and do not cover pre-existing conditions.

- Discounted Plans for Specific Groups: Some insurance companies offer discounted rates for specific groups, such as students, teachers, or military personnel. These plans may have reduced premiums or additional benefits tailored to the needs of the group.

Tips for Choosing the Right Cheap Health Insurance

When selecting a cheap health insurance plan, it's important to consider your specific needs and priorities. Here are some tips to help you make an informed decision:

- Assess your healthcare needs: Consider your current and potential future healthcare requirements. Do you have any pre-existing conditions or chronic illnesses that require regular medical attention? Understanding your healthcare needs will help you choose a plan that provides adequate coverage.

- Compare multiple plans: Don't settle for the first cheap plan you find. Take the time to compare different plans from various insurance companies. Look at the coverage, deductibles, co-pays, and overall costs to find the best fit for your budget and healthcare needs.

- Understand the network of providers: Check if your preferred healthcare providers are included in the insurance plan's network. Out-of-network providers may result in higher out-of-pocket costs.

- Review the plan's exclusions and limitations: Carefully read the fine print to understand what the plan does not cover. Some plans may have exclusions for certain treatments, medications, or specialist services.

- Consider additional benefits: Look for plans that offer additional benefits, such as wellness programs, preventive care coverage, or dental and vision benefits. These extra perks can enhance your overall healthcare experience.

- Evaluate customer service and claims process: Research the insurance company's reputation for customer service and claims handling. A responsive and efficient claims process can make a significant difference when you need to access your benefits.

Performance Analysis and Real-World Examples

To further illustrate the impact of choosing affordable health insurance, let's examine some real-world examples and performance analysis:

| Insurance Plan | Monthly Premium | Deductible | Coverage Highlights |

|---|---|---|---|

| Medicaid (United States) | $0 (varies by state) | Varies | Comprehensive coverage for eligible low-income individuals and families, including medical, dental, and vision care. |

| Medicare Advantage Plan (United States) | $0-$150 (varies by plan) | Varies | Offers additional benefits beyond Original Medicare, including prescription drug coverage and vision/dental benefits. Often includes lower out-of-pocket costs. |

| National Health Service (United Kingdom) | Free at the point of use | N/A | Provides a wide range of healthcare services, including primary care, specialist care, and hospital treatment, with no out-of-pocket costs for legal residents. |

| Catastrophic Health Plan (United States) | $0-$100 (varies by plan) | $8,200 (2023 limit) | Designed for young adults and individuals with limited income. Offers basic coverage with low monthly premiums but has a high deductible. |

Example Scenario: Let's consider a 30-year-old individual with no pre-existing conditions living in the United States. They are looking for an affordable health insurance plan with good coverage. After researching and comparing different options, they decide to enroll in a Medicaid plan offered by their state. With a monthly premium of $0 and a low deductible, this plan provides comprehensive coverage for their healthcare needs, including doctor visits, hospital stays, and prescription medications.

Future Implications and Industry Trends

The health insurance industry is constantly evolving, and future trends may impact the availability and cost of affordable coverage. Here are some potential implications and trends to consider:

- Telehealth Expansion: The rise of telehealth services during the COVID-19 pandemic has led to increased accessibility and reduced costs for many healthcare services. As telehealth continues to grow, it may further enhance the affordability and convenience of healthcare, particularly for individuals in remote areas.

- Value-Based Care Models: Many healthcare providers and insurance companies are shifting towards value-based care models, which focus on the quality and outcomes of healthcare services rather than the quantity of services provided. This approach may lead to more efficient and cost-effective healthcare delivery, benefiting patients and insurers alike.

- Technology Integration: The integration of technology in healthcare, such as electronic health records (EHRs) and health apps, can improve efficiency and reduce administrative costs. This, in turn, may result in lower insurance premiums and enhanced patient experiences.

- Healthcare Reform: Government policies and reforms can significantly impact the health insurance industry. Changes in regulations, subsidies, or tax incentives may influence the affordability and accessibility of insurance plans for different populations.

- Prevention and Wellness Focus: A growing emphasis on preventive care and wellness initiatives can lead to healthier populations and reduced healthcare costs. Insurance companies may offer incentives or discounts for individuals who actively participate in wellness programs or maintain healthy lifestyles.

As the healthcare landscape continues to evolve, staying informed about industry trends and changes in government policies is crucial for individuals seeking affordable health insurance. By staying up-to-date with these developments, you can make more informed decisions and take advantage of emerging opportunities to access affordable coverage.

Frequently Asked Questions (FAQ)

How do I know if I’m eligible for government-sponsored health insurance programs?

+Eligibility criteria for government-sponsored programs vary depending on the country and the specific program. In general, factors such as income level, age, citizenship or residency status, and disability status are considered. It’s recommended to research the specific requirements for the programs available in your country and check with the relevant government agencies or healthcare authorities for detailed eligibility guidelines.

What are the advantages of employer-provided health insurance plans?

+Employer-provided health insurance plans often offer several advantages. These plans typically have lower premiums due to the larger pool of participants, which spreads the risk across more individuals. Additionally, employers may contribute to the cost of the insurance, making it more affordable for employees. Group plans often have a wider range of coverage options and may include additional benefits such as dental, vision, and prescription drug coverage.

Are there any disadvantages to choosing cheap health insurance plans with high deductibles?

+While cheap health insurance plans with high deductibles can have lower monthly premiums, there are potential disadvantages to consider. If you have unexpected medical expenses or require frequent healthcare services, the high deductible can result in significant out-of-pocket costs. It’s important to carefully assess your healthcare needs and budget to ensure that you can afford the deductible and any additional out-of-pocket expenses.

How can I save money on my health insurance premiums?

+There are several strategies to save money on health insurance premiums. Firstly, compare quotes from different insurance companies to find the most competitive rates. Consider plans with higher deductibles or co-pays if you can afford the out-of-pocket costs. Explore group plans through your employer or professional associations, as they often offer discounted rates. Additionally, maintain a healthy lifestyle and avoid tobacco use, as this can lead to lower premiums.

What should I do if I can’t afford health insurance at all?

+If you are unable to afford health insurance, it’s important to explore all available options. Check if you are eligible for government-sponsored programs such as Medicaid or Medicare, as these programs offer free or low-cost coverage to eligible individuals. Additionally, some countries have public healthcare systems that provide basic healthcare services to all residents, regardless of their ability to pay. Reach out to healthcare authorities or social services organizations in your area for guidance and assistance in accessing affordable healthcare options.