How Much Does Private Health Insurance Cost

Private health insurance costs can vary significantly depending on several factors, including the level of coverage desired, the insurer, your age, geographical location, and any pre-existing medical conditions. Understanding these variables and their impact on premiums is essential for making informed decisions about health insurance coverage.

Factors Influencing Private Health Insurance Costs

The cost of private health insurance is influenced by a range of factors. These include the scope and type of coverage selected, which can range from basic hospital coverage to comprehensive plans that include ancillary services and extras. The insurer also plays a role, as different providers offer varying rates and policy options. Additionally, age is a significant factor, with younger individuals generally paying lower premiums due to their lower risk profile. Geographical location can impact costs, as healthcare expenses vary across regions.

One of the most critical factors is the presence of pre-existing medical conditions. Insurers may charge higher premiums or even decline coverage for individuals with certain conditions. This is because pre-existing conditions can lead to higher healthcare utilization and costs. However, in many jurisdictions, insurers are regulated to ensure they offer fair and accessible coverage, often including provisions for those with pre-existing conditions.

Understanding Coverage Types and Levels

Private health insurance plans typically offer various coverage types and levels. The most basic plans provide hospital coverage, which includes the cost of hospital stays, surgical procedures, and emergency treatment. More comprehensive plans, known as extras cover or ancillary cover, offer benefits for services like dental, optical, physiotherapy, and other allied health services. These plans often include a range of options, allowing individuals to choose the level of coverage that suits their needs and budget.

The cost of private health insurance is also influenced by the excess or deductible selected. This is the amount an insured person must pay out-of-pocket before the insurer starts covering costs. Choosing a higher excess can lead to lower premiums, as the insured takes on more financial responsibility. Conversely, lower excesses result in higher premiums but provide more financial protection.

| Coverage Type | Description | Premium Impact |

|---|---|---|

| Hospital Cover | Covers hospital stays and procedures | Generally lower premiums |

| Extras Cover | Includes ancillary services like dental and optical | Higher premiums, depending on scope |

| Ancillary Cover | Comprehensive cover for a range of services | Varies widely based on services included |

The Role of Insurer and Government Regulations

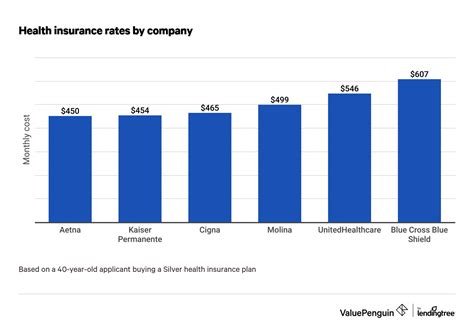

The choice of insurer can significantly impact the cost of private health insurance. Different insurers offer various plans, premiums, and policy features. Some insurers may specialize in certain types of coverage or cater to specific demographics. It’s essential to compare multiple insurers to find the best value for your needs.

Government regulations also play a vital role in controlling the cost and accessibility of private health insurance. Many countries have implemented policies to ensure affordable and accessible healthcare, such as community rating systems, which prevent insurers from charging higher premiums based solely on age or health status. Additionally, some governments offer subsidies or tax benefits to encourage individuals to take out private health insurance.

Calculating and Comparing Premiums

When calculating the cost of private health insurance, it’s crucial to consider not just the premium but also the potential out-of-pocket expenses. These include excesses, co-payments, and any services not covered by your policy. Comparing premiums and policy features across different insurers is essential to finding the best value.

Online comparison tools and brokers can be invaluable resources for researching and comparing private health insurance options. These platforms provide detailed information about different policies, allowing you to assess coverage, premiums, and any additional benefits or exclusions. It's recommended to use multiple comparison tools and seek advice from qualified brokers to ensure a comprehensive understanding of your options.

Potential Savings and Discounts

There are several ways to potentially reduce the cost of private health insurance. One common method is through family or group discounts. Insurers often offer reduced premiums for families or groups of individuals who take out policies together. Additionally, some insurers provide loyalty discounts for long-term customers or pay-on-time discounts for those who make timely premium payments.

Another strategy is to review and adjust your coverage annually. As your circumstances change, your insurance needs may also evolve. Regularly reviewing your policy can help ensure you're not overpaying for coverage you no longer require. Conversely, you may identify additional coverage needs that can be added to your existing policy.

| Savings Opportunity | Description |

|---|---|

| Family/Group Discounts | Reduced premiums for families or groups |

| Loyalty Discounts | Discounts for long-term customers |

| Pay-on-Time Discounts | Discounts for timely premium payments |

| Review and Adjust Coverage | Regularly assess your policy to ensure it aligns with your needs |

Making Informed Decisions

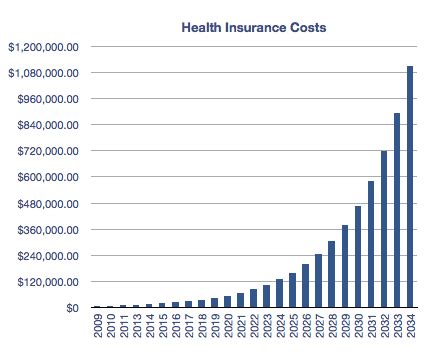

Choosing the right private health insurance involves balancing the cost of premiums with the level of coverage required. It’s essential to consider not just the initial premium but also the potential out-of-pocket expenses and the long-term financial implications. Understanding your healthcare needs and comparing different policy options can help ensure you make an informed decision.

Seeking advice from qualified brokers or financial advisors can provide valuable insights into the best private health insurance options for your circumstances. They can help navigate the complex world of health insurance, ensuring you understand the fine print and make a choice that offers the right balance of cost and coverage.

Frequently Asked Questions

How do I choose the right private health insurance for my needs?

+Choosing the right private health insurance involves assessing your healthcare needs and comparing policies. Consider factors like the level of coverage, premiums, excess, and any additional benefits or exclusions. It’s beneficial to use online comparison tools and seek advice from qualified brokers to ensure you make an informed decision.

Can I get private health insurance if I have a pre-existing medical condition?

+Yes, many insurers offer coverage for individuals with pre-existing conditions. However, the cost and terms of coverage may vary. Some insurers may charge higher premiums or impose waiting periods for certain conditions. It’s important to declare all pre-existing conditions when applying for private health insurance.

What are the benefits of taking out private health insurance?

+Private health insurance offers several benefits, including faster access to healthcare services, choice of healthcare providers, and potential tax benefits. It provides financial protection against unexpected medical expenses and can offer peace of mind knowing you have coverage for a range of healthcare needs.

Are there any government subsidies or tax benefits for private health insurance?

+Yes, many governments offer subsidies or tax benefits to encourage individuals to take out private health insurance. These can include tax offsets, rebates, or premium discounts. It’s important to check with your local government or tax authority to understand the specific benefits available in your region.