Average Price For Home Insurance

In the realm of financial planning and asset protection, understanding the cost of essential services like home insurance is paramount. This article aims to provide an in-depth analysis of the average price for home insurance, a crucial aspect for homeowners and prospective buyers. By delving into various factors that influence insurance premiums, we will offer a comprehensive guide to help individuals make informed decisions about their home insurance coverage.

Understanding the Factors Influencing Home Insurance Premiums

The price of home insurance is not a one-size-fits-all scenario; it is influenced by a multitude of factors, each contributing to the overall cost. These factors include but are not limited to:

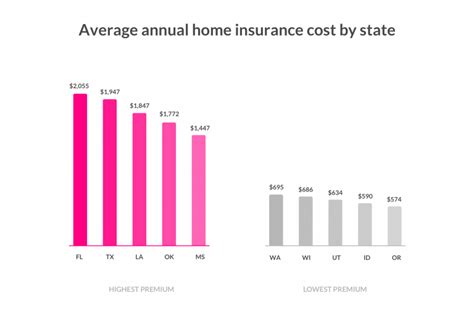

- The location of the property: Insurance rates can vary significantly based on geographical factors. Areas prone to natural disasters like hurricanes, floods, or earthquakes often have higher premiums. Similarly, regions with high crime rates may also experience increased insurance costs.

- The value and age of the home: The replacement cost of the home, its age, and the materials used in its construction all play a role in determining insurance premiums. Older homes may require higher coverage due to the cost of replacing outdated materials and systems.

- The policyholder’s claims history: Insurance companies consider an individual’s claims history when calculating premiums. Those with a history of frequent claims may face higher rates, as they are considered a higher risk.

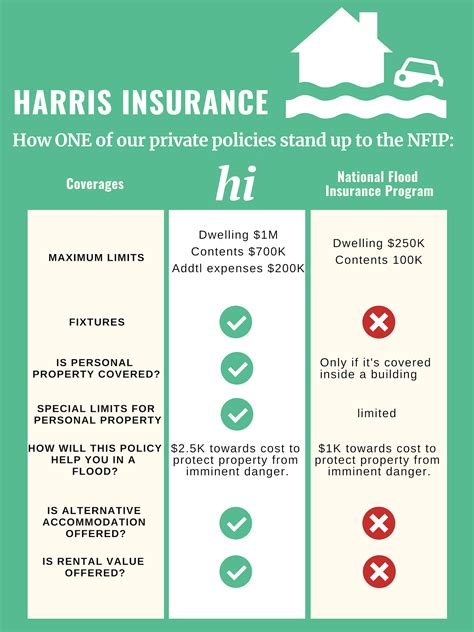

- The level of coverage desired: The type and amount of coverage an individual chooses will directly impact the cost of their insurance. Different policies offer varying levels of protection, and the more comprehensive the coverage, the higher the premium.

- The insurance company and policy terms: Different insurance companies offer different rates and policy terms. It’s essential to compare quotes from multiple providers to ensure the best value for your insurance needs.

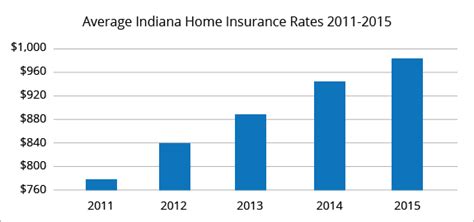

Exploring the Average Cost of Home Insurance

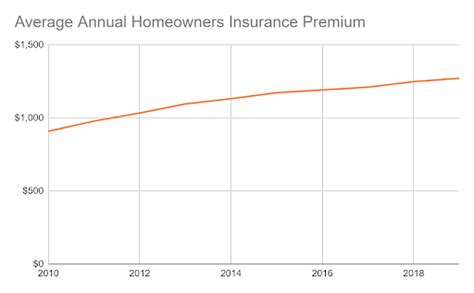

Given the myriad of factors that influence home insurance premiums, it’s challenging to pinpoint an exact average cost. However, we can provide a general overview based on industry data and trends. According to recent studies, the average annual premium for home insurance in the United States is approximately $1,300.

| Region | Average Annual Premium |

|---|---|

| Northeast | $1,500 |

| Midwest | $1,200 |

| South | $1,400 |

| West | $1,100 |

It's important to note that these averages are just a starting point. The actual cost of your home insurance can vary significantly based on the factors mentioned earlier. For instance, a homeowner in a high-risk area for natural disasters may pay significantly more than the regional average, while a homeowner in a low-risk area may pay less.

Factors Affecting Regional Variations

The variation in average home insurance premiums across different regions is primarily influenced by the unique risks and characteristics of each area. For instance, states in the Northeast and South often experience more severe weather events like hurricanes and tornadoes, which can lead to higher insurance costs. Additionally, regions with higher populations and more densely packed housing may have higher premiums due to increased risks associated with proximity.

Impact of Coverage Choices on Premium Costs

The type and amount of coverage an individual selects can have a substantial impact on their insurance premiums. For example, a basic home insurance policy may provide coverage for the structure of the home and personal belongings, but it may not include additional protections like flood or earthquake insurance. If a homeowner resides in an area prone to such natural disasters, they may opt for extended coverage, which can significantly increase their premium.

Tips for Reducing Home Insurance Costs

While the average cost of home insurance may seem daunting, there are strategies homeowners can employ to potentially reduce their premiums. Here are some tips to consider:

- Review your coverage regularly: Ensure your policy aligns with your current needs. If you’ve made significant upgrades to your home or added valuable possessions, you may need to increase your coverage.

- Bundle your insurance policies: Many insurance companies offer discounts when you bundle multiple policies, such as home and auto insurance.

- Increase your deductible: Opting for a higher deductible can lead to lower premiums. However, it’s essential to choose a deductible amount you can afford in the event of a claim.

- Explore discounts: Insurance companies often provide discounts for various reasons, such as loyalty, safety features in your home, or even your profession. It’s worth inquiring about available discounts when obtaining quotes.

- Maintain a good credit score: Insurance companies often consider an individual’s credit score when calculating premiums. A higher credit score can lead to lower insurance costs.

The Future of Home Insurance Pricing

As technology advances and data analytics become more sophisticated, the way insurance companies assess risk and price policies is evolving. Insurers are increasingly using advanced algorithms and risk assessment tools to more accurately price policies based on an individual’s unique circumstances. This shift towards personalized pricing could result in more variability in insurance premiums, with some individuals seeing their costs decrease while others may experience an increase.

Potential Impact of Climate Change on Insurance Costs

Climate change is an increasingly significant factor in the home insurance industry. As extreme weather events become more frequent and severe, the cost of insuring properties in high-risk areas is likely to rise. Insurance companies may need to reassess their risk models and pricing strategies to account for these changing conditions. This could lead to higher premiums for homeowners in regions vulnerable to climate-related disasters.

Technological Innovations in Risk Assessment

The insurance industry is embracing technological advancements to improve risk assessment and pricing. For instance, the use of satellite imagery and drone technology allows insurers to more accurately assess the condition of a property and the surrounding environment. Additionally, the rise of smart home technology provides insurers with valuable data on an individual’s habits and the condition of their home, which can be used to offer more tailored insurance products.

Conclusion: A Comprehensive Approach to Home Insurance

Understanding the average price for home insurance is just one aspect of the broader picture. Homeowners must consider a multitude of factors when selecting insurance coverage, from the unique characteristics of their property to their personal financial situation. By staying informed and actively managing their insurance needs, homeowners can ensure they have the right coverage at a competitive price.

As the insurance landscape continues to evolve, staying up-to-date with industry trends and innovations is essential. Homeowners should regularly review their insurance policies and consider the potential impact of emerging technologies and environmental changes on their coverage needs.

How often should I review my home insurance policy?

+It’s recommended to review your home insurance policy annually or whenever there are significant changes to your home or personal circumstances. This ensures that your coverage remains adequate and up-to-date.

Can I negotiate my home insurance premium?

+While insurance premiums are largely based on calculated risk assessments, you can negotiate with your insurance provider. Discuss your coverage needs and any potential discounts you may be eligible for. It’s also beneficial to shop around and compare quotes from multiple insurers.

What factors can lead to an increase in my home insurance premium?

+Several factors can lead to an increase in your home insurance premium, including filing multiple claims, experiencing a significant change in your home’s value, or moving to a higher-risk area. It’s important to keep your insurer informed of any changes that may impact your policy.