Home Owner Insurance Companies

Homeowner insurance is an essential aspect of protecting one's most valuable asset—their home. This comprehensive guide delves into the world of home insurance, providing an in-depth analysis of the companies, policies, and strategies to ensure you make informed decisions when safeguarding your home and belongings.

Navigating the Landscape of Home Insurance Companies

The market for home insurance is diverse and dynamic, offering a wide range of options for homeowners. Understanding the key players and their unique offerings is crucial to finding the best fit for your specific needs. Let’s explore some of the prominent home insurance companies and their distinctive features.

Allstate: A Comprehensive Approach

Allstate is a well-known player in the insurance industry, offering a comprehensive suite of services. With a focus on customer satisfaction, they provide a wide range of coverage options, including:

- Standard Homeowner’s Insurance: Covers the structure of your home and personal belongings against perils such as fire, theft, and natural disasters.

- Renters Insurance: Protects renters against theft, damage, and liability claims.

- Condo Insurance: Tailored coverage for condo owners, providing protection for the interior of the unit and personal belongings.

- Landlord Insurance: Designed for property owners, offering liability protection and coverage for rental properties.

Allstate’s innovative approach includes the use of digital tools and resources, such as the Allstate Digital Locker, which helps customers keep an inventory of their belongings, making the claims process more efficient.

State Farm: A Trusted Companion

State Farm is renowned for its personalized service and extensive network of local agents. They offer a comprehensive range of insurance products, including:

- Homeowner’s Insurance: Provides coverage for dwellings, personal property, and liability.

- Renters Insurance: Protects tenants against theft, liability, and personal property damage.

- Condominium Insurance: Tailored to cover the interior space of condos and personal belongings.

- Landlord Insurance: Designed to protect rental properties and provide liability coverage.

State Farm’s unique selling point lies in its commitment to community involvement and personalized service. They offer discounts for multiple policies and provide resources to help homeowners prepare for and recover from disasters.

Liberty Mutual: Customized Coverage

Liberty Mutual is a leading insurance provider known for its customizable insurance plans. They offer a range of products, including:

- Home Insurance: Provides coverage for dwellings, personal property, and liability, with the option to tailor coverage to your specific needs.

- Renters Insurance: Protects renters against theft, liability, and personal property damage, with the ability to customize coverage limits.

- Condo Insurance: Tailored coverage for condo owners, including protection for personal belongings and liability.

- Landlord Insurance: Designed for rental property owners, offering coverage for the building and its contents, as well as liability protection.

Liberty Mutual’s Identity Theft Protection add-on is a unique feature, providing coverage for expenses incurred due to identity theft, a growing concern for many homeowners.

Progressive: Innovation in Insurance

Progressive is a forward-thinking insurance company, known for its digital-first approach and innovative products. Their offerings include:

- Home Insurance: Provides standard coverage for dwellings, personal property, and liability, with the option to add endorsements for specific needs.

- Renters Insurance: Protects renters against theft, liability, and personal property damage, with the ability to customize coverage.

- Condo Insurance: Tailored coverage for condo owners, including protection for personal belongings and liability.

- Landlord Insurance: Designed for rental property owners, offering comprehensive coverage for the building and its contents.

Progressive’s HomeQuote Explorer is a unique tool that allows homeowners to explore coverage options and compare quotes online, providing a convenient and transparent process.

Travelers: A Century of Experience

Travelers is a renowned insurance company with over a century of experience in the industry. Their expertise lies in offering:

- Homeowner’s Insurance: Comprehensive coverage for dwellings, personal property, and liability, with the option to customize coverage.

- Renters Insurance: Protects renters against theft, liability, and personal property damage, with flexible coverage limits.

- Condo Insurance: Tailored coverage for condo owners, including protection for personal belongings and liability.

- Landlord Insurance: Designed for rental property owners, offering coverage for the building and its contents, as well as liability protection.

Travelers’ Identity Fraud Expense Reimbursement coverage is a valuable addition, providing reimbursement for expenses incurred due to identity theft.

Analyzing Performance and Customer Satisfaction

When choosing a home insurance company, it’s essential to consider their performance and customer satisfaction ratings. Here’s a brief overview of key metrics to help you make an informed decision.

Financial Strength and Stability

Financial stability is a crucial factor when selecting an insurance company. A financially strong company can ensure timely claim payouts and provide long-term security. Here’s a table comparing the financial strength ratings of the discussed insurance companies:

| Company | Financial Strength Rating |

|---|---|

| Allstate | A+ (Superior) |

| State Farm | A++ (Superior) |

| Liberty Mutual | A (Excellent) |

| Progressive | A (Excellent) |

| Travelers | A+ (Superior) |

Customer Satisfaction and Claims Handling

Customer satisfaction and the efficiency of claims handling are vital aspects of any insurance company. Here’s a breakdown of customer satisfaction ratings and claims handling processes for each company:

- Allstate: Known for its Claims Satisfaction Guarantee, ensuring prompt and fair claim settlements. Customer satisfaction ratings are consistently high, with a focus on personalized service.

- State Farm: Highly regarded for its local agent network and personalized service. Customers praise the company’s responsiveness during claims processes.

- Liberty Mutual: Offers a 24⁄7 Claims Hotline and a dedicated team to handle claims promptly. Customer satisfaction is generally positive, with a focus on customized coverage.

- Progressive: Known for its innovative approach, Progressive provides an Online Claims Center for convenient claim submissions. Customer feedback highlights the company’s efficient and transparent claims process.

- Travelers: With over a century of experience, Travelers prides itself on its Claim Management Excellence program, ensuring efficient and fair claim settlements. Customer satisfaction ratings are strong, with a focus on long-term relationships.

Understanding the Fine Print: Policy Features and Coverage

Home insurance policies can vary significantly in terms of coverage and features. It’s crucial to understand the nuances of each policy to ensure you’re adequately protected. Here’s a deeper dive into some key policy aspects.

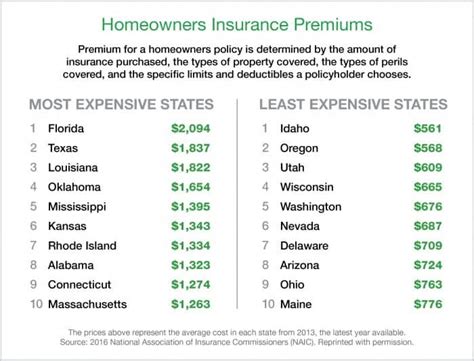

Coverage Limits and Deductibles

Coverage limits determine the maximum amount an insurance company will pay for a covered loss, while deductibles are the amount you pay out of pocket before the insurance coverage kicks in. It’s essential to choose limits and deductibles that align with your specific needs and budget.

Here’s a table comparing the coverage limits and deductibles for the discussed insurance companies:

| Company | Coverage Limits | Deductibles |

|---|---|---|

| Allstate | Customizable | Standard and Wind/Hail Deductibles |

| State Farm | Customizable | Standard and Optional Higher Deductibles |

| Liberty Mutual | Customizable | Standard and Customizable Deductibles |

| Progressive | Customizable | Standard and Optional Higher Deductibles |

| Travelers | Customizable | Standard and Optional Higher Deductibles |

Perils Covered and Exclusions

Home insurance policies typically cover a range of perils, including fire, theft, and natural disasters. However, it’s crucial to understand the exclusions, as certain events or damages may not be covered. Here’s an overview of the perils covered and exclusions for each company:

- Allstate: Covers fire, theft, and natural disasters, but excludes flood damage and earthquake damage (unless added as an endorsement). Also excludes damage caused by wear and tear, insects, and rodents.

- State Farm: Provides coverage for fire, theft, and natural disasters, but excludes flood damage and earthquake damage. Exclusions include damage caused by pests, insects, and rodents.

- Liberty Mutual: Covers fire, theft, and natural disasters, with the option to add flood and earthquake coverage. Exclusions include damage caused by insects, rodents, and certain types of water damage.

- Progressive: Offers coverage for fire, theft, and natural disasters, with the option to add flood and earthquake coverage. Exclusions include damage caused by insects, rodents, and certain types of water damage, as well as intentional damage.

- Travelers: Provides coverage for fire, theft, and natural disasters, with the option to add flood and earthquake coverage. Exclusions include damage caused by insects, rodents, and certain types of water damage, as well as wear and tear.

Strategies for Obtaining the Best Home Insurance

Securing the best home insurance requires a strategic approach. Here are some expert tips to help you navigate the process and make informed decisions.

Shop Around and Compare Quotes

Don’t settle for the first quote you receive. Take the time to shop around and compare quotes from multiple insurance companies. This will give you a better understanding of the market rates and help you identify the best value for your money.

Bundle Policies for Discounts

Many insurance companies offer discounts when you bundle multiple policies, such as home and auto insurance. Bundling can lead to significant savings, so it’s worth considering if you’re in the market for multiple insurance products.

Understand Your Coverage Needs

Before purchasing a home insurance policy, take the time to understand your specific coverage needs. Consider factors such as the replacement cost of your home, the value of your belongings, and any unique risks associated with your location or lifestyle. This will help you choose a policy that provides adequate protection without unnecessary expenses.

Leverage Discounts and Rewards

Insurance companies often offer discounts and rewards to attract and retain customers. These can include discounts for loyal customers, policy renewals, or even for taking proactive measures to protect your home, such as installing security systems or fire prevention devices. Keep an eye out for these incentives and take advantage of them when applicable.

Stay Informed and Educated

The world of insurance can be complex, but staying informed and educated can help you make better decisions. Keep up-to-date with industry news, changes in coverage options, and emerging trends. This knowledge will empower you to choose the right insurance company and policy for your needs.

Future Trends and Innovations in Home Insurance

The home insurance industry is constantly evolving, with new trends and innovations shaping the landscape. Here’s a glimpse into the future of home insurance and how it may impact homeowners.

Digital Transformation

The digital age has brought about significant changes in the insurance industry. Companies are increasingly leveraging technology to enhance the customer experience, streamline processes, and improve efficiency. Expect to see further digital transformation, with more companies offering online platforms for policy management, claims submission, and real-time support.

Personalized Coverage

Insurance companies are moving towards more personalized coverage options, allowing homeowners to tailor their policies to their specific needs. This trend is driven by advancements in data analytics and customer insights, enabling companies to offer customized solutions that better protect homeowners against their unique risks.

Emerging Technologies

The integration of emerging technologies, such as artificial intelligence (AI) and the Internet of Things (IoT), is transforming the home insurance landscape. AI-powered analytics can help insurance companies assess risks more accurately, while IoT devices can provide real-time data on home conditions, leading to more precise coverage and potentially lower premiums.

Sustainability and Green Initiatives

With growing environmental concerns, the insurance industry is exploring ways to promote sustainability. Insurance companies may offer incentives or discounts for homeowners who adopt green practices or install energy-efficient systems. Additionally, the industry may develop coverage options specifically for sustainable homes, further encouraging eco-friendly practices.

Conclusion: Empowering Homeowners with Knowledge

Choosing the right home insurance company and policy is a critical decision that can significantly impact your financial security and peace of mind. By understanding the landscape, analyzing performance and customer satisfaction, and exploring policy features and coverage, you can make an informed choice. Stay informed, leverage the power of technology, and consider the future trends to ensure you’re adequately protected for years to come.

How often should I review my home insurance policy?

+

It’s recommended to review your home insurance policy annually or whenever there are significant changes to your home or lifestyle. Regular reviews ensure your coverage remains up-to-date and adequate for your needs.

What factors influence home insurance rates?

+

Home insurance rates are influenced by various factors, including the location and age of your home, its replacement cost, the value of your belongings, and your claims history. Additionally, factors such as the presence of security systems or fire prevention devices can impact rates.

What should I do if I’m not satisfied with my current home insurance provider?

+

If you’re not satisfied with your current provider, it’s worth exploring other options. Research and compare quotes from multiple companies, and consider switching if you find a better fit for your needs and budget. Remember to carefully review the new policy to ensure it meets your expectations.