Ally Auto Insurance

In the ever-evolving world of automotive finance and insurance, it's essential to understand the options available to consumers. Ally Auto Insurance, a subsidiary of Ally Financial Inc., has made a significant impact on the market with its innovative approach to vehicle coverage. With a focus on customer-centric solutions and digital convenience, Ally Auto Insurance has carved a niche for itself, offering a unique experience to policyholders. This article delves into the world of Ally Auto Insurance, exploring its services, advantages, and impact on the industry.

A Comprehensive Overview of Ally Auto Insurance

Ally Auto Insurance is a leading provider of automotive insurance, offering a comprehensive range of policies tailored to meet the diverse needs of vehicle owners. The company’s expertise lies in its ability to provide flexible and affordable coverage options, making it a popular choice for many car enthusiasts and everyday drivers alike.

Ally Financial, the parent company, has a rich history in the financial sector, with roots dating back to the early 20th century. Over the years, the company has evolved, adapting to the changing landscape of the automotive and financial industries. This evolution has led to the creation of Ally Auto Insurance, a brand that embodies innovation and customer satisfaction.

The Benefits of Choosing Ally Auto Insurance

One of the standout features of Ally Auto Insurance is its customer-centric approach. The company understands that each driver has unique needs and preferences, and thus, it offers a highly customizable insurance experience. Policyholders can choose from a wide array of coverage options, including liability, comprehensive, collision, and various add-ons to suit their specific requirements.

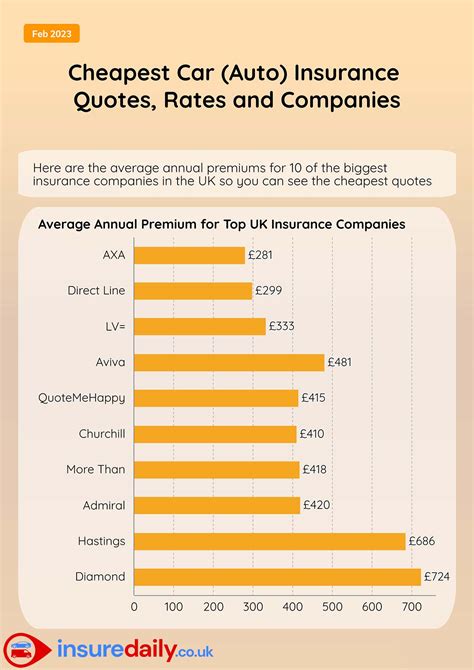

Furthermore, Ally Auto Insurance is renowned for its competitive pricing. The company strives to provide the best value for money, ensuring that its policies are affordable without compromising on quality. This commitment to affordability has made Ally Auto Insurance accessible to a broad spectrum of consumers, including those who may have faced challenges obtaining coverage in the past.

In addition to its customizable and affordable nature, Ally Auto Insurance excels in its digital offerings. The company has embraced technology, developing a user-friendly online platform that allows customers to manage their policies with ease. From quoting and purchasing insurance to making claims and tracking progress, the entire process is streamlined and accessible.

Ally Auto Insurance’s Impact on the Industry

Ally Auto Insurance’s innovative approach has had a significant impact on the insurance industry. By prioritizing customer satisfaction and digital convenience, the company has set a new standard for what consumers can expect from their insurance providers. This has led to a shift in the industry, with other companies following suit and adopting more customer-friendly practices.

Moreover, Ally Auto Insurance's success has highlighted the importance of flexibility and affordability in the automotive insurance market. The company's ability to cater to a wide range of drivers, from first-time buyers to seasoned car owners, has demonstrated that there is a substantial demand for personalized and accessible insurance solutions.

Ally Auto Insurance has also played a crucial role in promoting financial literacy among its customers. The company's educational resources and tools, such as its online learning center and financial calculators, empower policyholders to make informed decisions about their insurance and overall financial health.

The Ins and Outs of Ally Auto Insurance Policies

Ally Auto Insurance offers a comprehensive range of policies to cater to the diverse needs of its customers. Here’s a detailed breakdown of the key coverage options available:

Liability Coverage

Liability insurance is a fundamental component of any auto insurance policy. It provides protection in the event that the policyholder is found at fault in an accident, covering the costs of bodily injury and property damage claims made against them. Ally Auto Insurance offers various liability limits, allowing policyholders to choose the level of coverage that best suits their needs and budget.

Comprehensive Coverage

Comprehensive insurance is designed to protect policyholders from a wide range of non-collision incidents. This includes coverage for events such as theft, vandalism, natural disasters, and damage caused by animals. Comprehensive coverage is particularly valuable for individuals who want peace of mind knowing that their vehicle is protected from unforeseen circumstances.

Collision Coverage

Collision insurance is essential for drivers who want protection in the event of a collision with another vehicle or object. This coverage pays for the repair or replacement of the policyholder’s vehicle, regardless of who is at fault. Ally Auto Insurance offers collision coverage with various deductibles, giving policyholders the flexibility to choose a plan that aligns with their financial preferences.

Additional Coverages and Add-Ons

In addition to the standard liability, comprehensive, and collision coverages, Ally Auto Insurance provides a range of optional add-ons to enhance policyholders’ protection. These include:

- Rental Car Reimbursement: Covers the cost of renting a vehicle while the policyholder's car is being repaired or replaced.

- Gap Coverage: Protects policyholders from financial loss if their vehicle is totaled or stolen, ensuring they receive the full value of the car, even if it has depreciated.

- Roadside Assistance: Provides emergency services such as towing, battery jump-starts, and flat tire changes.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for the policyholder and their passengers, regardless of fault.

By offering these additional coverages, Ally Auto Insurance ensures that policyholders can customize their policies to meet their specific needs and gain added peace of mind on the road.

Performance Analysis: Ally Auto Insurance in Action

Ally Auto Insurance’s performance is a testament to its commitment to customer satisfaction and industry leadership. Here’s an in-depth look at how the company excels in key areas:

Claim Handling Efficiency

One of the critical aspects of an insurance provider’s performance is its claim handling process. Ally Auto Insurance has implemented a streamlined and efficient system, ensuring that policyholders receive timely and fair settlements. The company’s digital platform allows for quick and easy claim submissions, and its dedicated claims team works diligently to resolve issues promptly.

Furthermore, Ally Auto Insurance's extensive network of repair shops and preferred vendors ensures that policyholders have access to high-quality repairs and services. This network, combined with the company's focus on customer service, results in a smooth and stress-free claims experience.

Customer Satisfaction and Retention

Ally Auto Insurance consistently ranks highly in customer satisfaction surveys, reflecting its commitment to providing an exceptional experience. The company’s customer-centric approach, coupled with its competitive pricing and digital convenience, has led to high retention rates. Policyholders appreciate the personalized service and the ease of managing their policies online, contributing to Ally Auto Insurance’s success in retaining customers.

Financial Stability and Growth

Ally Financial, the parent company of Ally Auto Insurance, has a strong financial foundation, which translates to stability for its insurance arm. The company’s prudent financial management and focus on long-term growth have allowed it to weather economic downturns and emerge as a leading provider in the automotive insurance market.

Ally Auto Insurance's financial stability is evident in its consistent growth over the years. The company has expanded its reach, offering its services to an increasing number of customers while maintaining a solid financial position. This stability provides policyholders with the assurance that their insurance provider is here to stay and will continue to deliver on its promises.

The Future of Ally Auto Insurance: Trends and Predictions

As the automotive and insurance industries continue to evolve, Ally Auto Insurance is well-positioned to adapt and thrive. Here are some insights into the future trends and predictions for the company:

Embracing Technology and Digital Innovation

Ally Auto Insurance has already demonstrated its commitment to technology with its user-friendly digital platform. In the future, the company is likely to further enhance its digital offerings, leveraging advancements in artificial intelligence, machine learning, and data analytics. This could include more personalized insurance recommendations, streamlined claim processes, and even the introduction of telematics-based insurance, where driving behavior is monitored to provide tailored coverage.

Expanding Product Offerings

While Ally Auto Insurance has established itself as a leading provider of automotive insurance, the company may explore expanding its product portfolio. This could include offering insurance for other types of vehicles, such as motorcycles, RVs, or even electric scooters, catering to the diverse transportation needs of its customers.

Focus on Sustainability and Environmental Initiatives

With growing concerns about climate change and environmental sustainability, Ally Auto Insurance may align its practices with these issues. This could involve offering incentives for policyholders who drive electric or hybrid vehicles, promoting eco-friendly driving habits, or even investing in carbon offset programs to reduce the company’s environmental footprint.

Partnerships and Collaborations

Ally Auto Insurance may explore strategic partnerships and collaborations to enhance its services and reach. This could involve partnering with automotive manufacturers to offer exclusive insurance packages for new car buyers or collaborating with ride-sharing platforms to provide insurance solutions tailored to the gig economy.

How do I get a quote for Ally Auto Insurance?

+Obtaining a quote from Ally Auto Insurance is simple and can be done online or over the phone. Visit their official website and navigate to the ‘Get a Quote’ section, where you’ll be guided through a series of questions about your vehicle, driving history, and desired coverage. Alternatively, you can contact their customer service team for assistance.

What are the payment options for Ally Auto Insurance policies?

+Ally Auto Insurance offers flexible payment options to cater to different preferences. Policyholders can choose to pay their premiums monthly, semi-annually, or annually. Additionally, the company accepts various payment methods, including credit cards, debit cards, electronic checks, and even cash payments at authorized locations.

Can I bundle my auto insurance with other policies from Ally Financial?

+Yes, Ally Financial encourages policyholders to bundle their auto insurance with other financial products offered by the company. By bundling multiple policies, such as auto, home, or life insurance, you may be eligible for significant discounts and streamlined management of your insurance needs.

How does Ally Auto Insurance handle claims for totaled vehicles?

+In the event that your vehicle is declared a total loss due to an accident or other covered event, Ally Auto Insurance will guide you through the claims process. This typically involves an assessment of the vehicle’s damage, determination of its actual cash value, and a settlement offer. Policyholders can choose to accept the offer or explore other options, such as gap coverage or purchasing a new vehicle.