Life Insurence

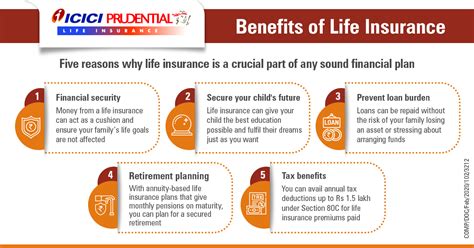

Life insurance is an essential financial tool that provides individuals and their families with peace of mind and security during uncertain times. It serves as a safety net, offering financial protection and support in the event of unforeseen circumstances, such as the untimely passing of a loved one. With a range of policy options available, life insurance has evolved to cater to diverse needs, ensuring that individuals can tailor their coverage to match their specific requirements.

In this comprehensive guide, we delve into the intricate world of life insurance, exploring its various aspects, from the fundamental concepts to the latest innovations and industry trends. By the end of this article, readers will possess a profound understanding of life insurance, empowering them to make informed decisions regarding their financial future and the well-being of their loved ones.

Understanding the Fundamentals of Life Insurance

At its core, life insurance is a contract between an individual (the policyholder) and an insurance company. The policyholder pays regular premiums, and in return, the insurance provider agrees to pay a specified sum of money (the death benefit) to the designated beneficiaries upon the policyholder’s death.

This financial safety net is designed to provide beneficiaries with the means to cover immediate and long-term expenses, such as funeral costs, outstanding debts, and ongoing living expenses. Life insurance policies can also be structured to offer additional benefits, including accelerated death benefits for terminal illnesses or critical illness coverage.

Types of Life Insurance Policies

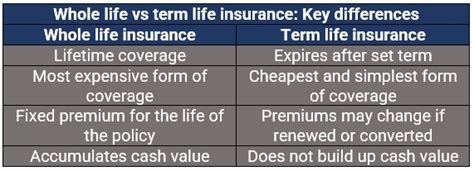

Life insurance policies come in various forms, each catering to different needs and financial situations. The two primary types are term life insurance and permanent life insurance.

Term Life Insurance: This type of policy offers coverage for a specified period, typically ranging from 10 to 30 years. It is often the most affordable option, as it provides pure death benefit protection without any cash value accumulation. Term life insurance is ideal for individuals seeking temporary coverage to protect their loved ones during specific life stages, such as raising children or paying off a mortgage.

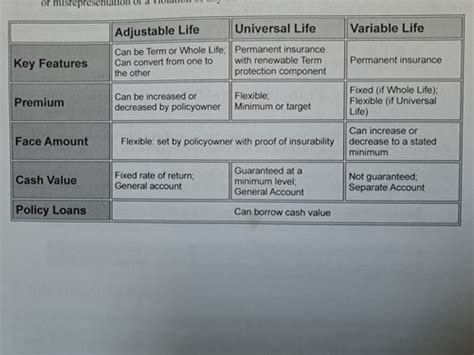

Permanent Life Insurance: As the name suggests, this policy provides lifetime coverage, offering a death benefit and a cash value component that grows over time. The two main subtypes of permanent life insurance are whole life insurance and universal life insurance. Whole life insurance offers a fixed premium and guaranteed death benefit, while universal life insurance provides more flexibility in premium payments and death benefit amounts.

| Policy Type | Premium Payment | Death Benefit | Cash Value |

|---|---|---|---|

| Term Life | Fixed for the term | Specific period | None |

| Whole Life | Fixed | Lifetime | Yes, guaranteed growth |

| Universal Life | Flexible | Lifetime | Yes, flexible growth |

The Application and Underwriting Process

Obtaining a life insurance policy involves an application and underwriting process. During the application stage, individuals provide personal and health-related information, and in some cases, undergo a medical examination to assess their risk profile. The underwriting process involves evaluating this information to determine the policy’s terms and conditions, including the premium amount and any potential exclusions.

It's important to note that the underwriting process can vary based on the type of policy and the insurance company. Some insurers offer simplified issue policies, which require minimal medical information and may involve a phone interview or health questionnaire instead of a full medical exam. On the other hand, fully underwritten policies involve a comprehensive evaluation of the applicant's health and lifestyle.

Factors Influencing Life Insurance Rates

Life insurance premiums are influenced by several factors, including the applicant’s age, gender, health status, and lifestyle habits. Generally, younger individuals enjoy lower premiums due to their lower risk profile, while those with health issues or risky habits may face higher rates or policy exclusions.

Additionally, the type and amount of coverage, as well as the policy's term, impact the premium. For instance, permanent life insurance policies often have higher premiums compared to term life insurance due to their lifetime coverage and cash value accumulation.

Maximizing Your Life Insurance Coverage

To ensure you receive the most suitable life insurance coverage, it’s crucial to consider your unique circumstances and financial goals. Here are some strategies to help you maximize your policy’s benefits:

- Determine Your Coverage Needs: Assess your financial responsibilities and the level of protection required. Consider factors such as income replacement, outstanding debts, and future financial goals.

- Compare Policies and Providers: Research and compare different life insurance policies and companies to find the best fit for your needs. Look for reputable insurers with a strong financial standing and positive customer reviews.

- Consider Riders and Add-ons: Explore optional riders and add-ons to enhance your policy's benefits. These can include accelerated death benefits, waiver of premium riders, or additional coverage for critical illnesses.

- Review and Adjust Your Policy Regularly: Life circumstances change, so it's essential to review your policy periodically. Update your coverage as needed to align with your changing financial situation and family needs.

The Role of Technology in Life Insurance

The life insurance industry has embraced technological advancements, streamlining the application and policy management processes. Online platforms and digital tools now enable individuals to research, compare, and purchase life insurance policies with ease. Many insurers offer online quoting tools, allowing prospective policyholders to get an estimate of their premiums instantly.

Additionally, technology has enhanced the underwriting process, with insurers utilizing advanced analytics and data-driven approaches to assess risk. This has led to more efficient and accurate underwriting, often resulting in faster policy approvals and better rates for applicants.

Industry Trends and Innovations

The life insurance industry is constantly evolving, driven by changing consumer needs and technological advancements. Here are some key trends and innovations shaping the future of life insurance:

- Digital Transformation: Insurers are investing in digital technologies to enhance the customer experience, from online policy management to digital claim submissions. This shift towards a more digital-centric approach is expected to continue, offering greater convenience and efficiency for policyholders.

- Personalized Coverage: With the advent of big data and analytics, insurers are now able to offer more personalized coverage options. By analyzing individual risk factors and preferences, insurers can tailor policies to meet specific needs, ensuring a better fit for policyholders.

- Wellness and Health-Based Programs: Some insurers are incentivizing policyholders to adopt healthier lifestyles by offering wellness programs and discounts on premiums. These initiatives aim to improve overall health and reduce the risk of early death, benefiting both policyholders and insurers.

- Blockchain and Smart Contracts: The integration of blockchain technology is poised to revolutionize the life insurance industry. Smart contracts, powered by blockchain, can automate and streamline various processes, such as policy issuance, claim settlements, and fraud detection, enhancing efficiency and security.

Conclusion

Life insurance is a vital financial tool that provides individuals and their families with the security and peace of mind to navigate life’s uncertainties. By understanding the fundamentals, types of policies, and industry trends, you can make informed choices to protect your loved ones and secure your financial future. Remember, life insurance is not a one-size-fits-all solution, and it’s essential to tailor your coverage to your unique needs and circumstances.

As you embark on your journey towards financial security, keep in mind that life insurance is just one component of a comprehensive financial plan. Consult with financial advisors and insurance professionals to ensure you have the right coverage in place and that your financial strategies are well-rounded and tailored to your goals.

FAQ

What is the difference between term life insurance and permanent life insurance?

+Term life insurance provides coverage for a specific period, typically 10-30 years, and offers a pure death benefit without any cash value accumulation. On the other hand, permanent life insurance, such as whole life or universal life, offers lifetime coverage and includes a cash value component that grows over time.

How do I choose the right life insurance policy for my needs?

+When selecting a life insurance policy, consider your financial responsibilities, such as income replacement, outstanding debts, and future goals. Compare different policies and providers to find the best fit for your needs, and don’t hesitate to seek advice from financial advisors or insurance professionals.

Can I get life insurance if I have health issues or a pre-existing condition?

+Yes, individuals with health issues or pre-existing conditions can still obtain life insurance. However, the underwriting process may be more comprehensive, and you may be offered a policy with higher premiums or certain exclusions. It’s essential to be transparent about your health condition during the application process.

How often should I review and update my life insurance policy?

+It’s recommended to review your life insurance policy at least once a year or whenever your financial circumstances or family situation changes significantly. This ensures that your coverage remains adequate and aligned with your current needs.

What are some common riders or add-ons available with life insurance policies?

+Common riders and add-ons include accelerated death benefits, which provide access to a portion of the death benefit if the policyholder is diagnosed with a terminal illness. Waiver of premium riders waive premium payments if the policyholder becomes disabled, and additional coverage for critical illnesses can provide financial support in the event of a serious illness diagnosis.