Commercial Insurance Coverage

In today's dynamic business landscape, the importance of robust commercial insurance coverage cannot be overstated. It is a vital tool that helps businesses mitigate risks, protect their assets, and ensure long-term viability. This comprehensive guide aims to shed light on the intricacies of commercial insurance, exploring its diverse aspects and offering valuable insights for businesses to make informed decisions about their insurance strategies.

Understanding Commercial Insurance

Commercial insurance, also known as business insurance, is a broad term encompassing various types of coverage designed to protect businesses against potential losses and liabilities. It serves as a safety net, offering financial protection against risks that could potentially cripple or even shut down a business. From natural disasters and property damage to liability claims and cyber attacks, commercial insurance policies are tailored to meet the unique needs of different industries and businesses.

Key Components of Commercial Insurance Coverage

Commercial insurance is not a one-size-fits-all solution. It is highly customizable, allowing businesses to select coverage options that align with their specific risks and requirements. Here are some of the essential components that form the foundation of commercial insurance:

Property Insurance

Property insurance is a cornerstone of commercial coverage, safeguarding a business’s physical assets. It provides protection against damages to buildings, equipment, inventory, and other tangible assets due to events like fires, storms, vandalism, or theft. Property insurance can also cover the cost of temporary relocation if a business’s premises become uninhabitable due to a covered event.

| Policy Type | Coverage Details |

|---|---|

| Special Form | Covers a wide range of perils except those specifically excluded in the policy. |

| Basic Form | Provides coverage for named perils only. |

| Differences in Conditions (DIC) | Fills gaps in standard property insurance policies, offering additional coverage for specific risks. |

Liability Insurance

Liability insurance is another critical aspect of commercial coverage, protecting businesses from claims arising from injuries, property damage, or other harm caused to third parties. This coverage is particularly important for businesses that interact directly with the public or have employees. It can help cover legal costs and any damages awarded in a lawsuit.

- General Liability: Covers common liability risks such as slips and falls, product liability, and advertising injuries.

- Professional Liability (Errors & Omissions): Protects businesses that provide professional services against claims of negligence, errors, or omissions in their work.

- Product Liability: Insures businesses that manufacture, sell, or distribute products against claims of product defects or failures.

Business Interruption Insurance

Business interruption insurance is designed to help businesses stay afloat financially during periods when their operations are disrupted due to covered events. It can provide income protection and cover ongoing expenses, ensuring the business can continue paying employees and meeting other financial obligations.

Workers’ Compensation Insurance

Workers’ compensation insurance is a legal requirement in many jurisdictions and provides coverage for employees who suffer work-related injuries or illnesses. It covers medical expenses, lost wages, and rehabilitation costs, ensuring employees receive necessary care and support while also protecting the business from potential lawsuits.

Cyber Liability Insurance

In today’s digital age, cyber liability insurance has become increasingly crucial. It provides protection against risks associated with data breaches, hacking, ransomware attacks, and other cyber incidents. This coverage can help businesses mitigate financial losses, cover legal expenses, and manage the aftermath of a cyber attack.

Additional Coverages

Beyond the core components, commercial insurance policies can be further customized with additional coverages to address industry-specific risks. These might include:

- Business Auto Insurance: Covers vehicles owned by the business, including trucks, vans, and cars used for business purposes.

- Commercial Umbrella Insurance: Provides excess liability coverage beyond the limits of other policies, offering an extra layer of protection.

- Crime Insurance: Protects businesses against employee theft, fraud, and other criminal acts that could result in financial loss.

Tailoring Commercial Insurance to Your Business

When it comes to commercial insurance, a one-size-fits-all approach is rarely effective. Every business has unique characteristics, risks, and needs. Here’s how businesses can tailor their insurance coverage to ensure it aligns with their specific requirements:

Risk Assessment

Conducting a thorough risk assessment is the first step in customizing commercial insurance. This involves identifying potential hazards and vulnerabilities specific to the business, such as natural disasters common to the area, the likelihood of theft or vandalism, or industry-specific risks like product liability or cyber attacks. By understanding these risks, businesses can prioritize coverage options that address their most pressing concerns.

Industry-Specific Considerations

Different industries face distinct challenges and risks. For instance, a manufacturing business may require product liability insurance, while a technology startup might prioritize cyber liability coverage. Understanding the unique aspects of your industry is crucial in selecting the right insurance mix. Industry-specific insurance packages are often available, offering tailored coverage that addresses common risks within a particular sector.

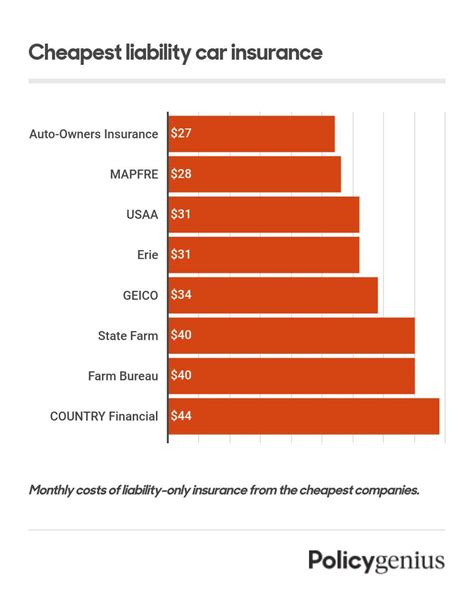

Coverage Limits and Deductibles

When customizing commercial insurance, businesses should carefully consider the coverage limits and deductibles. Higher coverage limits provide more extensive protection but often come with a higher premium. Conversely, higher deductibles can reduce premiums but mean the business will pay more out-of-pocket in the event of a claim. Finding the right balance between coverage and cost is essential to ensure the policy remains affordable while providing adequate protection.

Loss Prevention and Risk Management Strategies

While insurance is crucial for risk management, it should not be the sole focus. Implementing effective loss prevention and risk management strategies can significantly reduce the likelihood and impact of potential losses. This might include investing in security systems, employee training, and safety protocols. By minimizing risks, businesses can often negotiate more favorable insurance terms and lower premiums.

The Role of Insurance Brokers and Carriers

Navigating the complex world of commercial insurance often requires the expertise of insurance brokers and carriers. Here’s how these professionals can assist businesses in securing the right coverage:

Insurance Brokers

Insurance brokers are independent professionals who work on behalf of their clients to find the best insurance solutions. They have access to a wide range of insurance carriers and can shop around for the most suitable policies. Brokers can provide valuable advice on coverage options, help negotiate terms, and often have the expertise to handle complex insurance needs. They can also assist with claims management, ensuring businesses receive the full benefits of their policies.

Insurance Carriers

Insurance carriers, also known as insurance companies, are the entities that underwrite and issue insurance policies. They assess risks, set premiums, and provide coverage. While businesses can work directly with carriers to purchase insurance, brokers often have established relationships with multiple carriers, allowing them to offer a broader range of options. Carriers may specialize in certain industries or types of coverage, so it’s beneficial to choose a carrier with expertise in the specific risks faced by your business.

The Claims Process and Post-Loss Considerations

Despite all efforts to prevent losses, sometimes accidents or unforeseen events occur, and businesses need to file insurance claims. Understanding the claims process and taking steps to mitigate post-loss impacts is crucial for a swift and successful recovery.

Filing an Insurance Claim

When a covered loss occurs, businesses should promptly notify their insurance broker or carrier. The claims process typically involves the following steps:

- Notification: Inform the insurer about the loss as soon as possible.

- Documentation: Gather and provide detailed documentation of the loss, including photos, videos, and any relevant records.

- Claims Assessment: The insurer will evaluate the claim, determine coverage, and estimate the payout.

- Resolution: The insurer will either approve or deny the claim, and if approved, provide payment or arrange for repairs/replacements.

Post-Loss Considerations

After a loss, businesses should take steps to mitigate further damage and begin the recovery process. This might include:

- Securing the Property: Taking immediate action to prevent further damage, such as boarding up windows or repairing roofs.

- Salvaging Valuable Assets: Retrieving and protecting important documents, equipment, and inventory.

- Business Continuity: Implementing temporary measures to keep the business operational, such as relocating to a temporary location or using backup systems.

- Communication: Keeping employees, customers, and stakeholders informed about the situation and recovery plans.

The Future of Commercial Insurance

The commercial insurance landscape is evolving, driven by technological advancements, changing risk profiles, and emerging threats. Here are some key trends and considerations for the future of commercial insurance:

Digital Transformation

The insurance industry is increasingly embracing digital technologies, from online policy management and claims submission to the use of artificial intelligence for risk assessment and fraud detection. This digital transformation offers businesses more efficient and convenient ways to manage their insurance needs and can lead to more accurate risk assessment and pricing.

Climate Change and Natural Disasters

Climate change is expected to lead to more frequent and severe natural disasters, posing a significant risk to businesses. Insurance companies are adapting by offering specialized coverage for climate-related risks and developing models to more accurately assess these risks. Businesses should consider how climate change might impact their operations and ensure they have adequate coverage.

Emerging Risks

The rise of new technologies and business models also brings new risks. For instance, the growth of e-commerce and online sales has led to an increase in cyber attacks and data breaches. As businesses continue to innovate, insurance carriers will need to develop new coverage options to address these emerging risks.

Risk Mitigation and Resilience

In addition to providing financial protection, insurance carriers are increasingly focused on helping businesses mitigate risks and build resilience. This includes offering risk management tools, resources, and training to help businesses identify and address potential hazards. By partnering with insurance carriers on risk mitigation strategies, businesses can often reduce their insurance premiums and improve their overall resilience.

What is the difference between commercial insurance and personal insurance?

+

Commercial insurance is designed to protect businesses and their assets, whereas personal insurance primarily covers individuals and their personal belongings. Commercial policies are more comprehensive and can cover a wider range of risks, including liability claims, property damage, and business interruption. Personal insurance, on the other hand, typically focuses on protecting individuals against risks like home or auto accidents, health issues, or personal liability.

How can I determine the right amount of coverage for my business?

+

Determining the right amount of coverage involves a thorough risk assessment. Consider the value of your assets, the potential impact of a loss on your operations, and the financial resources you have to cover losses out-of-pocket. Consulting with an insurance broker can also be beneficial, as they can guide you in selecting appropriate coverage limits and deductibles.

What are some common exclusions in commercial insurance policies?

+

Common exclusions in commercial insurance policies may include war, nuclear incidents, intentional acts, pollution, and certain types of natural disasters like earthquakes or floods, unless specifically added as an endorsement. It’s important to review your policy’s exclusions carefully to ensure you understand what risks are not covered.

How often should I review and update my commercial insurance policy?

+

It’s recommended to review your commercial insurance policy annually or whenever significant changes occur in your business, such as expanding operations, adding new products or services, or relocating. Regular reviews ensure that your coverage remains aligned with your current risks and needs.

What steps can I take to reduce my commercial insurance premiums?

+

There are several strategies to reduce commercial insurance premiums. These include implementing effective loss prevention measures, improving safety protocols, and maintaining a good loss history. Additionally, bundling multiple policies with the same insurer can often result in discounts. Working with an insurance broker can also help you explore options for more cost-effective coverage.