Auto Insurance Monthly Cost

Understanding the cost of auto insurance is essential for every vehicle owner. The monthly expense associated with this coverage can vary significantly based on numerous factors, making it a complex and often confusing topic. In this comprehensive guide, we will delve into the intricacies of auto insurance monthly costs, providing you with an in-depth analysis to help you navigate this critical aspect of vehicle ownership.

The Auto Insurance Landscape: Unraveling the Factors

The cost of auto insurance is influenced by a multitude of factors, each playing a unique role in determining the final premium. From the type of vehicle you drive to your personal driving history, these elements collectively shape the price you pay for coverage. Let’s explore some of the key factors that impact auto insurance costs.

Vehicle Type and Usage

The make, model, and year of your vehicle significantly impact your insurance rates. Generally, newer and more expensive vehicles tend to have higher insurance costs due to their replacement value and advanced safety features. Additionally, the primary use of your vehicle can influence rates; for instance, vehicles used for business purposes or long-distance commuting may incur higher premiums.

| Vehicle Type | Average Monthly Premium |

|---|---|

| Economy Car | $150 - $200 |

| Mid-Range Sedan | $200 - $250 |

| Luxury SUV | $300 - $400 |

Furthermore, the safety features and technology in your vehicle can affect insurance costs. Advanced driver-assistance systems (ADAS) and collision avoidance technologies may reduce your premium, as these features often lead to safer driving experiences.

Driver Profile and History

Your driving record and personal characteristics are crucial in determining your insurance rates. Insurance providers assess factors such as your age, gender, and marital status, as well as your driving history, to gauge the risk they assume by insuring you. For instance, young drivers, particularly males, often face higher premiums due to their perceived higher risk of accidents.

Your driving history is another critical factor. A clean record with no accidents or traffic violations can lead to significant savings on your insurance premium. Conversely, a history of accidents or traffic citations can substantially increase your insurance costs.

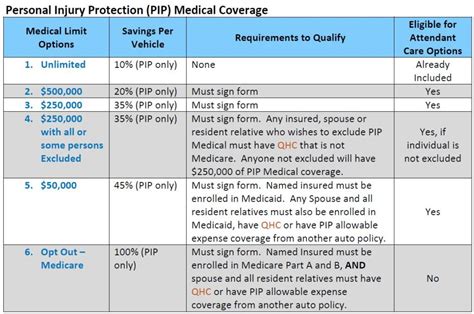

Coverage and Deductibles

The type and extent of coverage you choose for your vehicle also influence your monthly insurance cost. Comprehensive and collision coverage, which provide protection against theft, damage, and accidents, typically carry higher premiums compared to liability-only coverage. The level of coverage you opt for, therefore, directly impacts your monthly insurance expense.

Additionally, your choice of deductibles can affect your monthly costs. A higher deductible, which means you pay more out-of-pocket before your insurance coverage kicks in, can lead to lower monthly premiums. Conversely, a lower deductible often results in higher monthly payments.

Location and Other Factors

Your geographical location plays a significant role in determining your insurance rates. Areas with higher crime rates or more frequent accidents often see higher insurance premiums. Additionally, the number of miles you drive annually can impact your rates, with higher mileage potentially leading to increased costs.

Other factors that can influence your insurance costs include your credit score, the insurance provider you choose, and any additional discounts or packages you opt for. For instance, many insurance companies offer discounts for safe driving, bundling multiple policies, or installing certain safety devices in your vehicle.

Analyzing Monthly Costs: A Real-World Example

To provide a more tangible understanding of auto insurance monthly costs, let’s examine a hypothetical scenario involving a driver named Sarah. Sarah is a 30-year-old female living in a suburban area, driving a mid-range sedan, and seeking comprehensive insurance coverage.

Sarah’s Insurance Journey

Sarah has been driving for over a decade and has a clean driving record. She’s considering purchasing comprehensive insurance coverage, which includes liability, collision, and comprehensive coverage, to protect her vehicle and her finances in the event of an accident or other covered incidents.

Based on her profile and the type of coverage she desires, we can estimate her monthly insurance premium to fall within the range of $200 to $250. This estimate considers factors such as her age, gender, driving history, vehicle type, and the level of coverage she seeks.

| Coverage Type | Estimated Monthly Premium |

|---|---|

| Liability Only | $120 - $150 |

| Comprehensive | $200 - $250 |

However, this estimate is just a starting point. Sarah can further optimize her insurance costs by exploring various discounts. For example, many insurance providers offer discounts for safe driving, completing defensive driving courses, or bundling her auto insurance with other policies, such as homeowners or renters insurance.

Optimizing Insurance Costs: Sarah’s Strategy

To reduce her monthly insurance premium, Sarah decides to take advantage of some of the available discounts. She completes a defensive driving course, which earns her a safe driver discount, and bundles her auto insurance with her homeowners insurance, resulting in an additional discount.

Additionally, Sarah chooses a higher deductible, which reduces her monthly premium. By increasing her deductible from $500 to $1000, she can expect a reduction in her monthly premium, potentially saving her $20 to $30 per month.

| Strategy | Estimated Savings |

|---|---|

| Safe Driver Discount | $10 - $20 |

| Bundling Discount | $15 - $25 |

| Higher Deductible | $20 - $30 |

Through these strategies, Sarah successfully reduces her monthly insurance premium. By combining discounts and optimizing her coverage choices, she brings her estimated monthly premium down to the range of $160 to $200.

Future Implications: Navigating the Auto Insurance Landscape

As the auto insurance landscape continues to evolve, it’s essential to stay informed and adapt to changing circumstances. Several trends and developments are shaping the future of auto insurance, and understanding these can help you make more informed decisions about your coverage.

The Rise of Telematics and Usage-Based Insurance

Telematics and usage-based insurance are gaining traction in the auto insurance industry. These innovative approaches to insurance pricing use real-time data, often collected through GPS devices or smartphone apps, to assess a driver’s risk profile. By analyzing driving behavior, such as speed, acceleration, and mileage, insurance providers can offer more personalized premiums.

While this technology can lead to higher premiums for risky drivers, it also provides an opportunity for safe drivers to enjoy lower rates. As this technology becomes more widespread, it's likely to play an increasingly significant role in determining insurance costs.

The Impact of Autonomous Vehicles

The advent of autonomous vehicles is expected to have a profound impact on the auto insurance industry. As these vehicles become more prevalent, the nature of accidents and liabilities may change, potentially leading to shifts in insurance coverage and pricing. While it’s difficult to predict the exact implications, it’s likely that insurance policies will need to adapt to cover new risks associated with autonomous driving.

The Role of Technology in Risk Assessment

Advanced technologies, such as artificial intelligence (AI) and machine learning, are increasingly being used by insurance providers to assess risk and price policies. These technologies can analyze vast amounts of data, including historical claims data, to identify patterns and predict future risks. As a result, insurance providers can offer more accurate and personalized premiums.

Furthermore, these technologies can help identify potential fraud and improve the efficiency of insurance processes, from claim assessment to policy administration. The continued integration of technology into the insurance industry is expected to enhance risk assessment capabilities and drive innovation in insurance products.

How often should I review my auto insurance policy and premiums?

+It’s recommended to review your auto insurance policy and premiums at least once a year, or whenever your personal circumstances change significantly. This review can help ensure you’re getting the best value for your money and that your coverage still meets your needs.

What factors can I control to lower my auto insurance costs?

+You can take several steps to lower your auto insurance costs, including maintaining a clean driving record, comparing quotes from multiple insurers, increasing your deductibles, taking advantage of discounts (e.g., safe driver, multi-policy), and considering usage-based insurance if it’s available in your area.

How do insurance companies determine rates for different age groups and genders?

+Insurance companies use statistical data and historical claims information to determine rates for different age groups and genders. They analyze patterns and trends to assess the risk associated with different demographics. While these factors can influence rates, it’s important to note that insurance companies are increasingly moving towards more personalized pricing models.