Insurance Quotes Get

Insurance quotes are a fundamental aspect of the insurance industry, playing a pivotal role in the process of securing financial protection for individuals and businesses. These quotes provide an estimate of the cost of insurance coverage, allowing prospective policyholders to compare options and make informed decisions. With the ever-evolving landscape of insurance, understanding the intricacies of insurance quotes is essential for both consumers and professionals in the field. This comprehensive guide aims to delve into the world of insurance quotes, exploring the factors that influence them, the process of obtaining accurate quotes, and the strategies to optimize the experience for all parties involved.

The Significance of Insurance Quotes

Insurance quotes serve as the gateway to understanding the financial commitment required for insurance coverage. They are a tool that empowers individuals and businesses to assess the viability of different insurance plans, ensuring they receive adequate protection at a reasonable cost. In the dynamic insurance market, where policies and premiums can vary significantly, having access to accurate and transparent quotes is crucial for making informed choices.

The significance of insurance quotes extends beyond the initial selection process. It is a continuous process that requires regular evaluation and adjustment to ensure that insurance coverage remains aligned with the evolving needs and circumstances of policyholders. As life events, such as marriage, the birth of a child, or a change in business operations, occur, insurance quotes must reflect these changes to provide adequate coverage. This ongoing evaluation process ensures that policyholders are neither over-insured nor under-insured, striking a balance between financial security and cost-effectiveness.

Factors Influencing Insurance Quotes

The world of insurance is intricate, and numerous factors contribute to the calculation of insurance quotes. These factors are diverse, ranging from the personal characteristics of individuals to the specific details of their lifestyles and the broader economic landscape. Understanding these influences is key to grasping the variability of insurance quotes and making strategic decisions when it comes to insurance coverage.

Individual Factors

At the core of insurance quotes are the individual factors that uniquely define each policyholder. These include age, gender, health status, and occupation. For instance, younger individuals are often considered lower-risk and may receive more favorable quotes, while certain occupations that involve higher levels of risk, such as construction or emergency services, may result in higher premiums.

Health status is another critical individual factor. Pre-existing medical conditions or a history of illnesses can significantly impact insurance quotes. Insurance providers carefully evaluate health records to assess the potential risk associated with insuring an individual, which directly influences the quote they provide.

Lifestyle Factors

Lifestyle choices also play a pivotal role in determining insurance quotes. Activities such as smoking, extreme sports participation, or even frequent international travel can increase the perceived risk level of an individual, leading to higher insurance premiums. Conversely, adopting a healthy lifestyle, such as regular exercise and a balanced diet, can sometimes result in more favorable quotes as these choices often indicate a lower risk profile.

Policy Details

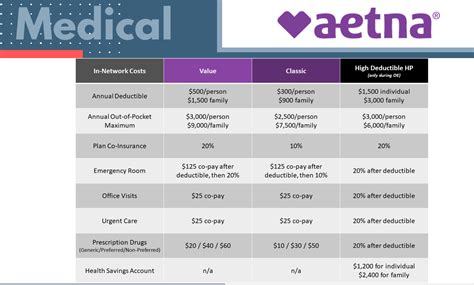

The specifics of the insurance policy being sought also significantly influence the quote. Factors such as the type of coverage (e.g., health, auto, life, or property insurance), the level of coverage desired (e.g., comprehensive or basic), and any additional benefits or riders can all affect the quote. For instance, a high-deductible health insurance plan might offer lower premiums, but the policyholder would need to pay more out-of-pocket before the insurance coverage kicks in.

Economic and Environmental Factors

Beyond individual and policy factors, broader economic and environmental circumstances also come into play. Inflation, interest rates, and the overall state of the economy can impact insurance quotes. Additionally, environmental factors such as natural disasters, crime rates, or even the geographic location of an individual or business can affect the perceived risk and, consequently, the insurance quote.

Obtaining Accurate Insurance Quotes

Securing accurate insurance quotes is a critical step in the insurance journey. It ensures that individuals and businesses can make well-informed decisions about their insurance coverage, avoiding both underinsurance and overinsurance scenarios. The process of obtaining accurate quotes involves a careful balance of transparency, thoroughness, and strategic approach.

The Role of Insurance Agents

Insurance agents are key facilitators in the process of obtaining accurate insurance quotes. These professionals possess a deep understanding of the insurance market, various policy options, and the unique needs of their clients. They guide prospective policyholders through the quote process, explaining the intricacies of different policies and helping to tailor coverage to individual requirements.

Insurance agents work closely with their clients to gather all relevant information needed to generate an accurate quote. This includes personal details, lifestyle factors, and the specific coverage needs of the individual or business. By thoroughly understanding their clients' circumstances, agents can provide quotes that are both comprehensive and competitively priced.

Online Quote Tools

In the digital age, online quote tools have become increasingly popular for their convenience and accessibility. These tools allow individuals to input their personal and policy details, and within minutes, they receive a quote from multiple insurance providers. Online quote tools are particularly useful for comparing prices and coverage options, offering a quick and efficient way to assess the insurance market.

However, it's important to note that online quote tools may not always provide the most accurate or comprehensive quotes. They are often designed to offer a broad estimate and may not take into account all the unique factors that can influence an insurance quote. Therefore, while they can be a useful starting point, it's recommended to follow up with an insurance agent to refine and tailor the quote to individual needs.

Comparing Quotes

Comparing insurance quotes is a critical step in the process. It allows individuals and businesses to evaluate the market, ensuring they receive the best value for their insurance coverage. When comparing quotes, it’s essential to consider not just the premium amount but also the coverage details, exclusions, and any additional benefits or riders included in the policy.

While a lower premium might be appealing, it's crucial to ensure that the coverage provided is adequate. Sometimes, a slightly higher premium can offer significantly more comprehensive coverage, which can be more cost-effective in the long run if it means fewer out-of-pocket expenses during a claim.

Optimizing the Insurance Quote Process

The insurance quote process can be optimized to ensure a smooth and efficient experience for all parties involved. By streamlining procedures, enhancing transparency, and utilizing technology, the process can be made more accessible and user-friendly.

Streamlining the Quote Process

Streamlining the insurance quote process involves simplifying and expediting the steps required to obtain a quote. This can be achieved through various strategies, such as implementing digital forms and documentation, reducing the number of required steps, and integrating automation into the process where possible.

By streamlining the quote process, insurance providers can reduce the time and effort required from prospective policyholders, making the process more convenient and attractive. This can lead to increased customer satisfaction and potentially more business as individuals and businesses are more likely to pursue insurance coverage if the process is straightforward and efficient.

Enhancing Transparency

Transparency is a key principle in the insurance industry, and it plays a significant role in the quote process. Prospective policyholders should have a clear understanding of how their quote is calculated, what factors influence it, and what coverage the quote entails. Transparent communication builds trust and ensures that policyholders can make informed decisions about their insurance coverage.

Insurance providers can enhance transparency by providing detailed explanations of the quote process, including any assumptions or estimates used in the calculation. They can also offer clear and concise policy documents that outline the coverage, exclusions, and any additional benefits or riders included in the policy. By being transparent, insurance providers can establish themselves as trusted advisors, fostering long-term relationships with their clients.

Utilizing Technology

Technology plays a pivotal role in optimizing the insurance quote process. Digital tools and platforms can significantly enhance the efficiency and accuracy of quotes, making the process more convenient for both insurance providers and prospective policyholders.

For example, artificial intelligence (AI) and machine learning algorithms can be used to analyze vast amounts of data, including individual factors, lifestyle choices, and policy details, to generate highly accurate and personalized quotes. These technologies can also automate certain aspects of the quote process, such as data collection and analysis, reducing the time and resources required to generate a quote.

The Future of Insurance Quotes

As technology continues to advance and the insurance industry evolves, the future of insurance quotes holds exciting possibilities. The integration of new technologies, such as AI and blockchain, is expected to bring about significant changes in how insurance quotes are calculated and delivered.

AI and Machine Learning

AI and machine learning technologies are already being utilized in the insurance industry to enhance the quote process. These technologies can analyze vast amounts of data, including individual health records, lifestyle choices, and even social media activity, to generate highly personalized and accurate quotes. By continuously learning and adapting, these systems can provide real-time updates to quotes, ensuring that policyholders always have the most current and relevant information.

Blockchain Technology

Blockchain technology, known for its security and transparency, has the potential to revolutionize the insurance industry, including the quote process. By using blockchain, insurance providers can create a secure, tamper-proof record of policyholder data, ensuring that quotes are based on accurate and up-to-date information. This technology can also streamline the quote process by automating certain tasks, such as data verification and policy issuance, reducing the potential for errors and enhancing efficiency.

The Rise of Digital Insurance Platforms

The future of insurance quotes is also closely tied to the growth of digital insurance platforms. These platforms, often powered by advanced technologies like AI and blockchain, offer a one-stop shop for all insurance needs. They provide a seamless experience for prospective policyholders, allowing them to compare quotes, purchase policies, and manage their coverage all in one place.

Digital insurance platforms can also leverage data analytics and machine learning to offer highly personalized insurance solutions. By collecting and analyzing data from various sources, these platforms can provide tailored recommendations and quotes, ensuring that policyholders receive coverage that aligns with their unique needs and circumstances.

Personalized Insurance Solutions

The future of insurance quotes is moving towards a more personalized approach. With the advancement of technology and the collection of vast amounts of data, insurance providers will be able to offer highly tailored insurance solutions. By analyzing individual risk profiles, lifestyle choices, and even genetic information, insurance companies can provide quotes that are uniquely suited to each policyholder.

This shift towards personalized insurance solutions not only benefits policyholders by ensuring they receive the most appropriate coverage, but it also benefits insurance providers by reducing the risk of underinsurance or overinsurance. By accurately assessing individual risk, insurance companies can offer competitive premiums while maintaining a healthy balance sheet.

Conclusion

Insurance quotes are a cornerstone of the insurance industry, providing a vital link between policyholders and their financial protection. By understanding the factors that influence insurance quotes, the process of obtaining accurate quotes, and the strategies for optimizing the quote experience, individuals and businesses can navigate the insurance market with confidence and make informed decisions about their coverage.

As the insurance industry continues to evolve, embracing new technologies and innovative approaches, the future of insurance quotes looks promising. With advancements in AI, blockchain, and digital insurance platforms, the quote process is expected to become even more efficient, accurate, and personalized, ensuring that insurance coverage remains accessible, affordable, and effective for all.

How often should insurance quotes be reviewed and updated?

+Insurance quotes should be reviewed and updated regularly to ensure they remain accurate and reflect any changes in personal circumstances or the insurance market. It is recommended to review quotes at least annually, or whenever there is a significant life event, such as marriage, the birth of a child, or a change in occupation.

Can insurance quotes be negotiated?

+Insurance quotes can sometimes be negotiated, especially when dealing with an insurance agent or broker. By discussing your specific needs and circumstances, you may be able to negotiate a better rate or additional coverage. However, it’s important to note that insurance providers have guidelines and regulations they must follow, so the scope for negotiation may be limited.

What happens if my insurance quote is too high?

+If your insurance quote is higher than you expected or can afford, it’s important to understand why. You can review the quote with your insurance agent or broker to identify any factors that may be driving up the cost, such as high-risk activities or an extensive claims history. In some cases, you may be able to reduce the quote by adjusting the coverage level or exploring alternative insurance providers.