Insurance Requirements

Insurance is an integral part of modern life, providing financial protection and peace of mind to individuals, businesses, and communities. The diverse nature of insurance coverage and the varying legal frameworks across jurisdictions make insurance requirements a complex yet critical topic to explore. This comprehensive guide delves into the world of insurance mandates, shedding light on their importance, the underlying principles, and their practical implications.

Understanding the Basics: What Are Insurance Requirements?

Insurance requirements, in essence, are the set of rules, regulations, and legal obligations that dictate the necessity and scope of insurance coverage for various entities and activities. These mandates are established by governments, regulatory bodies, and industry standards to ensure adequate protection against potential risks and losses. The specific requirements can vary widely depending on the type of insurance, the industry, and the geographical location.

For instance, in the automotive industry, most jurisdictions mandate that vehicle owners carry liability insurance to cover potential damages or injuries caused by their vehicles. Similarly, businesses operating in high-risk sectors like construction or manufacturing may be required to have comprehensive insurance policies covering their operations, employees, and third-party liabilities.

Key Principles of Insurance Requirements

Several fundamental principles underpin insurance requirements, shaping the regulatory landscape and ensuring a balanced approach to risk management:

- Risk Mitigation: Insurance requirements aim to minimize the financial impact of unforeseen events, whether they are natural disasters, accidents, or health emergencies. By mandating insurance coverage, regulatory bodies ensure that individuals and businesses have the means to recover from losses and continue their operations.

- Social Responsibility: Compulsory insurance policies promote social responsibility by ensuring that those affected by an insured event receive financial compensation. This principle is particularly evident in areas like motor vehicle insurance, where liability coverage ensures that victims of accidents are not left without support.

- Financial Stability: Insurance mandates contribute to the financial stability of industries and economies. By requiring insurance, regulatory bodies ensure that businesses have the resources to withstand unexpected losses and continue contributing to the economy. This stability is crucial, especially in sectors that are essential to the functioning of society, such as healthcare or transportation.

The Scope of Insurance Requirements

Insurance requirements extend across a broad spectrum of activities and industries, each with its unique set of mandates and considerations. Understanding the scope of these requirements is essential for individuals, businesses, and professionals navigating the insurance landscape.

Individual Insurance Requirements

At an individual level, insurance requirements can vary based on personal circumstances and the activities one engages in. For example, homeowners may be required to have insurance coverage for their property, while renters might need to secure renters’ insurance to protect their belongings.

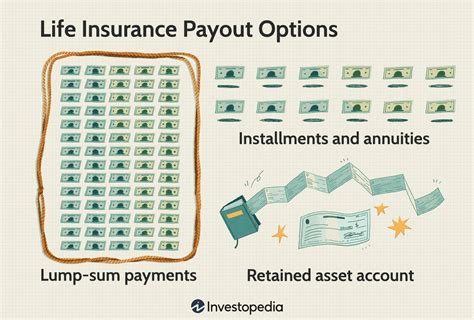

In the realm of personal health and well-being, many countries have implemented mandatory health insurance schemes. These schemes ensure that individuals have access to necessary medical care without facing financial ruin. Additionally, life insurance is often recommended to provide financial security for loved ones in the event of the policyholder's death.

| Insurance Type | Common Requirements |

|---|---|

| Homeowner's Insurance | Coverage for property damage, liability, and sometimes flood or earthquake insurance. |

| Renter's Insurance | Protection for personal belongings and liability coverage. |

| Health Insurance | Comprehensive coverage for medical expenses, often with specific plan requirements. |

| Life Insurance | Term or whole life policies to provide financial support to beneficiaries. |

Business Insurance Requirements

Businesses, regardless of size or industry, face a myriad of insurance requirements to protect their operations, assets, and stakeholders. The specific mandates can vary based on the nature of the business, its location, and the potential risks involved.

For instance, businesses in the construction industry might need to secure comprehensive general liability insurance, workers' compensation insurance, and specific coverage for heavy machinery or equipment. On the other hand, a tech startup might focus on professional liability insurance to protect against potential lawsuits arising from their products or services.

| Industry | Common Insurance Requirements |

|---|---|

| Construction | General liability, workers' compensation, and equipment insurance. |

| Healthcare | Malpractice insurance, general liability, and cyber insurance. |

| Retail | Product liability, property insurance, and business interruption coverage. |

| Technology | Professional liability, cyber insurance, and intellectual property protection. |

The Role of Insurance in Risk Management

Insurance plays a pivotal role in risk management, offering a systematic approach to identifying, assessing, and mitigating potential risks. By understanding the insurance landscape and adhering to the required mandates, individuals and businesses can proactively manage their exposure to risk and ensure financial stability.

Risk Assessment and Insurance Coverage

The first step in effective risk management is a thorough assessment of potential risks. This involves identifying hazards, evaluating their likelihood and potential impact, and determining the best strategies to mitigate them. Insurance coverage is a key component of this process, providing a financial safety net to protect against identified risks.

For instance, a business operating in a flood-prone area might assess the risk of flood damage and take measures to mitigate it. This could include implementing flood prevention measures and securing adequate insurance coverage to protect against potential losses. By combining preventive measures with insurance, businesses can significantly reduce the financial impact of unforeseen events.

Insurance as a Risk Transfer Mechanism

Insurance acts as a mechanism for transferring risk from individuals and businesses to insurance companies. By purchasing insurance policies, policyholders essentially transfer the financial burden of potential losses to the insurer. This transfer of risk is a fundamental concept in insurance, allowing individuals and businesses to focus on their core activities without the constant worry of financial ruin.

Consider a small business owner who purchases business interruption insurance. In the event of a covered loss, such as a fire or a natural disaster, the insurance policy will provide financial support to cover the business's operating expenses and lost income during the recovery period. This transfer of risk allows the business owner to concentrate on rebuilding and continuing operations without the added stress of financial strain.

The Future of Insurance Requirements

The insurance landscape is continually evolving, driven by technological advancements, changing societal needs, and emerging risks. As we navigate the complexities of the digital age and face new challenges like climate change and cybersecurity threats, insurance requirements are adapting to keep pace.

Emerging Trends in Insurance Requirements

Several key trends are shaping the future of insurance requirements:

- Digital Transformation: The insurance industry is embracing digital technologies, from online policy management to advanced data analytics. This digital transformation is expected to enhance efficiency, streamline processes, and improve risk assessment and mitigation strategies.

- Environmental and Climate Risks: With the increasing frequency and severity of natural disasters, insurance requirements are evolving to address environmental and climate-related risks. This includes more comprehensive coverage for events like floods, hurricanes, and wildfires, as well as new insurance products tailored to address the unique risks posed by climate change.

- Cybersecurity and Data Privacy: As digital technologies become integral to business operations, cybersecurity risks are rising. Insurance requirements are expanding to include coverage for data breaches, cyber attacks, and other digital threats. This ensures that businesses have the necessary resources to recover from such incidents and protect their customers' data.

Navigating the Evolving Insurance Landscape

Staying abreast of changing insurance requirements and emerging trends is essential for individuals and businesses. By proactively engaging with insurance providers and staying informed about industry developments, policyholders can ensure they have the appropriate coverage to protect against evolving risks.

Conclusion: The Importance of Insurance Requirements

Insurance requirements are a critical aspect of modern life, offering protection, stability, and peace of mind to individuals, businesses, and communities. By understanding the scope and principles of insurance mandates, individuals and businesses can make informed decisions about their insurance coverage, ensuring they are adequately protected against the risks they face.

As the insurance landscape continues to evolve, staying informed and adapting to changing requirements is key to effective risk management. With the right insurance coverage, individuals and businesses can focus on their goals and aspirations, knowing they have the financial support to weather life's uncertainties.

FAQs

What happens if I don’t meet the insurance requirements for my industry or activity?

+

Failing to meet insurance requirements can have significant legal and financial consequences. Regulatory bodies may impose fines or penalties for non-compliance, and businesses or individuals may face legal action if they are unable to provide the required insurance coverage. It’s crucial to understand the specific requirements for your industry and ensure you have the necessary coverage to avoid these issues.

Are insurance requirements the same across all states or countries?

+

No, insurance requirements can vary significantly between different jurisdictions. Each state or country may have its own set of laws and regulations governing insurance coverage. It’s essential to research and understand the specific requirements for your location to ensure compliance.

How often should I review my insurance coverage to ensure it meets the required standards?

+

Regularly reviewing your insurance coverage is crucial to ensure it remains up-to-date and compliant with changing requirements. As your personal or business circumstances evolve, so might your insurance needs. It’s recommended to review your coverage annually and consult with an insurance professional to make any necessary adjustments.