Best Deals On Auto Insurance

Finding the best deals on auto insurance can be a daunting task, especially with the plethora of options available in the market. With so many insurance providers and policies to choose from, it's easy to get overwhelmed. However, securing an affordable and comprehensive auto insurance policy is crucial to protect your financial well-being and ensure peace of mind while driving. In this comprehensive guide, we will delve into the world of auto insurance, exploring the factors that influence rates, the steps to find the best deals, and the key considerations to make an informed decision.

Understanding Auto Insurance Rates

Auto insurance rates are influenced by a variety of factors, each playing a crucial role in determining the cost of your policy. By understanding these factors, you can make more informed choices and potentially secure better deals. Here’s a breakdown of the key elements that impact auto insurance rates:

Vehicle Type and Usage

The type of vehicle you drive and how you use it significantly affect your insurance rates. Insurers consider factors such as the make, model, and age of your vehicle, as well as its safety features and repair costs. Additionally, your driving habits and the purpose of using your vehicle (e.g., commuting, business, or pleasure) can impact your rates. For instance, if you use your car primarily for long-distance commuting, your insurance rates may be higher due to the increased risk of accidents on highways.

Driver Profile and History

Your driving record and personal profile are crucial in determining your auto insurance rates. Insurers carefully evaluate your driving history, including any accidents, traffic violations, and claims made in the past. A clean driving record with no accidents or violations typically leads to lower insurance rates. Additionally, your age, gender, and marital status can influence your rates, as these factors are statistically linked to driving behavior and risk profiles.

Location and Risk Factors

The geographical location where you reside and drive your vehicle plays a significant role in determining your insurance rates. Insurers consider factors such as crime rates, traffic congestion, and the frequency of accidents in your area. High-risk areas with a history of frequent accidents or thefts may result in higher insurance premiums. Additionally, weather conditions and natural disasters prevalent in your region can impact your rates, as they may increase the likelihood of damage to your vehicle.

Coverage and Policy Options

The level of coverage you choose for your auto insurance policy directly affects your rates. Different coverage options, such as liability, collision, comprehensive, and personal injury protection (PIP), offer varying levels of protection and have corresponding costs. Opting for higher coverage limits and additional policy features, like rental car reimbursement or roadside assistance, will generally result in increased premiums. However, it’s essential to strike a balance between the coverage you need and the cost to ensure you’re adequately protected without overpaying.

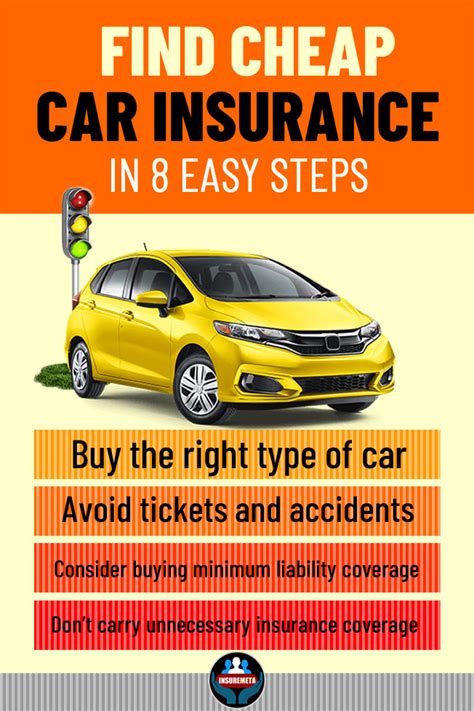

Tips to Find the Best Auto Insurance Deals

Now that we’ve explored the factors influencing auto insurance rates, let’s delve into some practical tips to help you find the best deals and save money on your policy:

Shop Around and Compare Quotes

One of the most effective ways to find the best auto insurance deals is to compare quotes from multiple providers. Each insurer has its own rating system and criteria for assessing risk, so rates can vary significantly between companies. Use online comparison tools or directly contact insurance providers to obtain quotes based on your specific needs and circumstances. By comparing multiple quotes, you can identify the most competitive rates and choose the provider that offers the best value for your money.

Utilize Online Resources and Reviews

The internet is a powerful tool when it comes to researching and evaluating auto insurance options. Take advantage of online resources, such as insurance company websites, review platforms, and comparison websites, to gather information and insights. Read reviews from current and past customers to gauge the satisfaction and experiences of others with different insurance providers. This can help you identify reputable companies, understand their customer service quality, and assess their overall value proposition.

Understand Your Coverage Needs

Before shopping for auto insurance, it’s crucial to understand your specific coverage needs. Assess your financial situation, driving habits, and the risks you want to mitigate. Consider factors such as the value of your vehicle, your ability to cover out-of-pocket expenses in the event of an accident, and any legal requirements in your state or country. By clearly defining your coverage needs, you can tailor your policy to strike the right balance between cost and protection.

Bundle Your Insurance Policies

Many insurance providers offer discounts when you bundle multiple policies with them. If you have other insurance needs, such as homeowners, renters, or life insurance, consider bundling these policies with your auto insurance. By doing so, you may be eligible for significant discounts, as insurers often reward customers who consolidate their insurance needs with a single provider. This can result in substantial savings on your overall insurance expenses.

Explore Discounts and Savings Opportunities

Insurance providers offer various discounts and savings opportunities to attract and retain customers. These discounts can significantly reduce your insurance premiums. Some common discounts include safe driver discounts, good student discounts, loyalty discounts, and multi-car discounts. Additionally, certain occupations or memberships may qualify you for specialized discounts. Research the discounts available with different insurance providers and ensure you meet the eligibility criteria to take advantage of these savings opportunities.

Consider High Deductibles and Higher Coverage Limits

When choosing your auto insurance policy, carefully consider the deductible and coverage limits. A higher deductible (the amount you pay out of pocket before your insurance coverage kicks in) can result in lower premiums. However, it’s essential to strike a balance between affordability and financial protection. Similarly, opting for higher coverage limits can provide greater financial security in the event of a severe accident or comprehensive loss. Assess your financial situation and risk tolerance to make an informed decision regarding deductibles and coverage limits.

Choosing the Right Auto Insurance Provider

Finding the best auto insurance deal is not solely about securing the lowest premiums. It’s equally important to choose a reputable and reliable insurance provider that offers excellent customer service and claims handling. Here are some key considerations when selecting an auto insurance provider:

Financial Stability and Reputation

Before committing to an insurance provider, assess their financial stability and reputation in the industry. Look for companies with a strong financial standing, as this ensures they have the resources to pay out claims promptly and efficiently. Check ratings from reputable agencies, such as AM Best or Standard & Poor’s, to gauge the financial health of the insurer. Additionally, research customer reviews and feedback to understand their track record of paying claims and providing satisfactory customer service.

Customer Service and Claims Handling

Excellent customer service and efficient claims handling are crucial aspects of a good auto insurance provider. Assess the insurer’s reputation for prompt and fair claim settlements. Read reviews and seek recommendations from friends and family to gauge their experiences with different providers. Choose an insurer with a dedicated and knowledgeable customer service team, offering easy accessibility and prompt response times. Ensure they provide multiple channels for communication, such as phone, email, and online portals, to facilitate efficient claim processing and customer support.

Policy Features and Add-ons

Different auto insurance providers offer a range of policy features and add-ons to enhance your coverage. Evaluate the policy options and features provided by each insurer to determine which ones align with your specific needs. Look for providers that offer flexible coverage options, such as customizable deductibles, accident forgiveness programs, or gap insurance for leased vehicles. Additionally, consider add-ons like roadside assistance, rental car coverage, or personal injury protection (PIP) to enhance your protection and peace of mind.

Online Tools and Resources

In today’s digital age, many insurance providers offer convenient online tools and resources to enhance the customer experience. Assess the insurer’s website and mobile app for user-friendliness, ease of navigation, and the availability of online services. Look for features such as online policy management, real-time claim tracking, and digital payment options. These digital tools can streamline your insurance experience, making it easier to manage your policy, access important information, and file claims efficiently.

Common Pitfalls to Avoid

While searching for the best auto insurance deals, it’s important to be cautious and avoid common pitfalls that can lead to suboptimal choices or unexpected expenses. Here are some potential pitfalls to watch out for:

Insufficient Coverage

One of the biggest mistakes you can make is opting for insufficient coverage to save money on premiums. While it may seem like a cost-effective choice in the short term, inadequate coverage can leave you financially vulnerable in the event of an accident or loss. Assess your needs thoroughly and ensure your policy provides adequate liability coverage, collision coverage, and comprehensive coverage to protect your assets and financial well-being.

Neglecting to Read the Fine Print

Insurance policies can be complex, and the fine print often contains important details that can impact your coverage and benefits. Take the time to carefully read and understand the policy terms and conditions before making a decision. Pay attention to exclusions, limitations, and any clauses that may affect your coverage in specific situations. By thoroughly reviewing the fine print, you can avoid unexpected surprises and ensure your policy meets your expectations.

Overlooking Hidden Fees and Charges

Some insurance providers may advertise low premiums but have hidden fees or charges that can significantly increase your overall costs. Be vigilant and inquire about any additional fees, such as administrative fees, policy cancellation fees, or surcharges for specific coverage options. By being aware of these potential charges, you can make a more informed decision and avoid unexpected expenses down the line.

Rushing the Decision-Making Process

Finding the best auto insurance deal requires time and careful consideration. Avoid making impulsive decisions or rushing the process. Take the time to compare quotes, research providers, and evaluate your coverage needs. Rushing into a policy without proper evaluation can lead to regrets or discovering gaps in coverage later on. Remember, auto insurance is a long-term commitment, so it’s essential to make a well-informed choice that aligns with your needs and budget.

Future Implications and Trends

The auto insurance industry is continuously evolving, driven by technological advancements, changing consumer behaviors, and regulatory reforms. Here are some future implications and trends to consider when navigating the world of auto insurance:

Telematics and Usage-Based Insurance

Telematics technology, which uses data from onboard sensors and GPS devices, is transforming the auto insurance industry. Usage-based insurance (UBI) programs utilize telematics data to assess driving behavior and offer personalized insurance rates. These programs reward safe drivers with lower premiums based on their actual driving habits. As UBI becomes more prevalent, it may lead to more personalized and accurate insurance pricing, benefiting cautious and responsible drivers.

Rise of Digital Insurance Platforms

The digital transformation is reshaping the insurance landscape, with an increasing number of insurers adopting online platforms and digital tools. Digital insurance platforms offer convenient and efficient ways to compare policies, purchase coverage, and manage claims. These platforms often provide real-time quotes, streamlined application processes, and user-friendly interfaces. As digital insurance gains traction, it may lead to greater competition, improved customer experiences, and potentially lower insurance costs.

Increased Focus on Data Analytics

Data analytics plays a crucial role in the auto insurance industry, enabling insurers to make more accurate risk assessments and pricing decisions. Advanced analytics techniques, such as machine learning and predictive modeling, are being leveraged to analyze vast amounts of data, including driving behavior, accident statistics, and demographic information. This data-driven approach allows insurers to identify patterns, optimize pricing, and offer more tailored coverage options. As data analytics continues to advance, it may result in more precise and fair insurance pricing for consumers.

Adoption of Autonomous Vehicles

The emergence of autonomous vehicles (AVs) is poised to revolutionize the auto insurance industry. As self-driving cars become more prevalent, the risk profile and liability landscape will undergo significant changes. Insurers will need to adapt their policies and coverage options to address the unique risks associated with AVs. The shift towards AVs may lead to a reduction in accidents and claims, potentially resulting in lower insurance premiums for consumers. However, the insurance industry will need to carefully navigate the regulatory and liability challenges posed by this technological advancement.

Conclusion

Finding the best deals on auto insurance requires a comprehensive understanding of the factors that influence rates, a thorough evaluation of your coverage needs, and a careful selection of a reputable insurance provider. By shopping around, comparing quotes, and leveraging online resources, you can identify the most competitive rates and choose a provider that offers excellent customer service and financial stability. Remember to assess your coverage needs, explore discounts and savings opportunities, and avoid common pitfalls to ensure you’re adequately protected without overpaying.

As the auto insurance industry continues to evolve, staying informed about emerging trends and technological advancements is crucial. Telematics, digital insurance platforms, data analytics, and the adoption of autonomous vehicles are shaping the future of auto insurance. By keeping abreast of these developments, you can make more informed choices and take advantage of the opportunities they present. With the right approach and knowledge, you can secure the best deals on auto insurance, protecting your financial well-being and enjoying peace of mind on the road.

What is the average cost of auto insurance in the United States?

+The average cost of auto insurance in the U.S. varies significantly depending on factors such as location, driving record, and coverage options. According to recent data, the national average annual premium is around 1,674, but this can range from a few hundred dollars to over 3,000 in certain states.

How can I lower my auto insurance premiums?

+There are several strategies to lower your auto insurance premiums. These include shopping around for quotes, maintaining a clean driving record, increasing your deductible, bundling policies, and exploring discounts for safe driving, good grades, or membership in certain organizations.

What factors determine my auto insurance rates?

+Auto insurance rates are influenced by various factors, including your age, gender, driving history, location, type of vehicle, and coverage options. Insurers also consider factors such as credit score, claims history, and the number of miles driven annually.

Can I get auto insurance without a license or a car?

+Obtaining auto insurance without a license or a car can be challenging but not impossible. Some insurers offer non-owner policies for individuals who need coverage for rental cars or borrowed vehicles. Additionally, if you have a valid driver’s license but no car, you may be able to obtain a named non-owner policy to maintain coverage.

What should I do if I’m involved in an accident?

+If you’re involved in an accident, it’s important to remain calm and take the following steps: ensure the safety of all involved parties, call the police to file a report, exchange information with the other driver(s), and notify your insurance company as soon as possible. Cooperate with the insurance claims process and provide accurate information to facilitate a smooth resolution.