How Does Life Insurance Works

Life insurance is a vital financial tool that provides a safety net for individuals and their loved ones. It is a contract between an insurance policyholder and an insurance company, where the insurer promises to pay a sum of money to the beneficiaries in the event of the policyholder's death. This article will delve into the intricacies of how life insurance works, exploring its various types, key components, and the benefits it offers.

Understanding the Basics of Life Insurance

Life insurance serves as a financial protection plan, ensuring that the policyholder’s dependents or beneficiaries receive a specified sum upon their death. This sum, known as the death benefit, can provide financial security and help cover various expenses, including funeral costs, outstanding debts, and everyday living expenses. The primary purpose of life insurance is to alleviate the financial burden that may arise from the loss of a primary income earner.

Life insurance policies are tailored to individual needs and circumstances. The policyholder pays a premium, typically on a monthly or annual basis, to the insurance company. These premiums are calculated based on several factors, including the policyholder's age, health status, lifestyle, and the desired coverage amount. The insurance company, in turn, assumes the risk of paying out the death benefit and manages the policy's terms and conditions.

Types of Life Insurance Policies

There are several types of life insurance policies available, each designed to meet different financial goals and needs. Understanding the distinctions between these types is crucial when choosing the right policy.

Term Life Insurance

Term life insurance is the most basic and common type of life insurance. It provides coverage for a specified period, known as the term, typically ranging from 10 to 30 years. During this term, the policyholder pays regular premiums, and if they pass away within the term, their beneficiaries receive the death benefit. However, if the policyholder outlives the term, the coverage expires, and no benefit is paid out.

Term life insurance is often chosen for its affordability and flexibility. It is ideal for individuals who seek coverage for a specific period, such as while their children are young or during their working years. The policy can be customized to fit the policyholder's needs, and the death benefit amount can be adjusted as circumstances change.

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, provides coverage for the policyholder’s entire life, as long as the premiums are paid. Unlike term insurance, whole life insurance accumulates cash value over time, which can be borrowed against or withdrawn by the policyholder. This cash value grows tax-deferred and can be used for various financial needs, such as funding retirement or covering unexpected expenses.

Whole life insurance offers a guaranteed death benefit and fixed premiums throughout the policyholder's life. It is often chosen by individuals seeking long-term financial protection and those who value the potential for cash value growth. However, whole life insurance tends to be more expensive than term insurance due to its comprehensive coverage and cash value component.

Universal Life Insurance

Universal life insurance is a flexible form of permanent life insurance that allows policyholders to adjust their premiums and death benefit amounts over time. It combines the coverage of whole life insurance with the flexibility of term insurance. The policyholder can increase or decrease their premium payments and death benefit based on their changing financial circumstances and needs.

Universal life insurance also accumulates cash value, which can be used for various purposes. The policyholder can choose how their premiums are allocated between the death benefit and the cash value, providing a level of control over their policy's performance. This type of insurance is suitable for individuals seeking customization and the ability to adapt their coverage as their life evolves.

Key Components of a Life Insurance Policy

A life insurance policy consists of several key components that work together to provide comprehensive coverage. Understanding these components is essential for making informed decisions about your policy.

Premiums

Premiums are the regular payments made by the policyholder to the insurance company to maintain their coverage. The amount of the premium is determined by various factors, including the policyholder’s age, health, lifestyle, and the desired coverage amount. Premiums can be paid monthly, quarterly, semi-annually, or annually, depending on the policy and the policyholder’s preference.

Death Benefit

The death benefit is the primary reason for having life insurance. It is the sum of money that the insurance company pays to the policyholder’s beneficiaries upon their death. The death benefit amount is chosen by the policyholder and can be adjusted based on their financial needs and goals. It is important to ensure that the death benefit is sufficient to cover the policyholder’s desired financial obligations.

Policyholders and Beneficiaries

The policyholder is the individual who purchases the life insurance policy and pays the premiums. They have the power to choose the type of policy, the death benefit amount, and the beneficiaries. Beneficiaries, on the other hand, are the individuals or entities designated by the policyholder to receive the death benefit upon their death. Policyholders can name multiple beneficiaries and allocate specific percentages of the death benefit to each.

Policy Terms and Conditions

Every life insurance policy comes with a set of terms and conditions that outline the rights and responsibilities of both the policyholder and the insurance company. These terms cover various aspects, including the premium payment schedule, the coverage period, the death benefit amount, and any exclusions or limitations. It is crucial for policyholders to carefully read and understand these terms to ensure they meet their expectations.

The Claims Process

In the unfortunate event of the policyholder’s death, the beneficiaries must initiate the claims process to receive the death benefit. The claims process typically involves the following steps:

- Notifying the Insurance Company: The first step is to notify the insurance company of the policyholder's death. This can be done by contacting the company's customer service or claims department and providing the necessary details.

- Submitting Required Documentation: The insurance company will require certain documents to process the claim. These may include a certified copy of the death certificate, proof of the policyholder's identity, and any other supporting documents specified in the policy.

- Claim Review and Approval: The insurance company will review the claim and verify the policyholder's coverage and eligibility for the death benefit. This process may involve additional documentation or investigations.

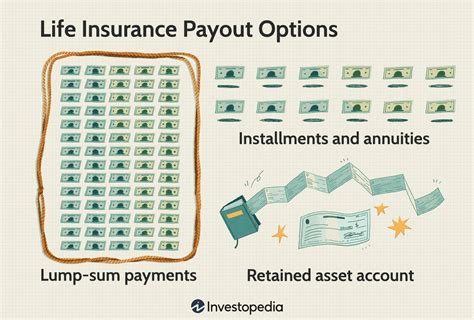

- Payout of Death Benefit: Once the claim is approved, the insurance company will pay out the death benefit to the designated beneficiaries. The payout can be made in a lump sum or through structured payments, depending on the policy terms.

Benefits of Life Insurance

Life insurance offers a range of benefits that go beyond providing financial protection. Here are some key advantages of having a life insurance policy:

- Financial Security for Loved Ones: Life insurance ensures that your loved ones are financially secure in the event of your death. The death benefit can cover immediate expenses, such as funeral costs, and provide ongoing financial support for their daily needs and long-term goals.

- Debt Repayment: Life insurance can be used to repay outstanding debts, such as mortgages, car loans, or credit card balances. This helps alleviate the financial burden on your loved ones and prevents them from inheriting your debts.

- Income Replacement: For individuals who are the primary income earners in their households, life insurance provides a replacement for their lost income. This ensures that their family can maintain their standard of living and continue to meet their financial obligations.

- Legacy and Estate Planning: Life insurance can be a valuable tool for estate planning. It can help fund inheritance taxes, cover probate costs, and ensure the smooth transfer of assets to your beneficiaries.

- Cash Value Accumulation: Whole life and universal life insurance policies offer the potential for cash value accumulation. This accumulated value can be used for various purposes, such as funding retirement, paying for children's education, or covering unexpected expenses.

Considerations and Tips for Choosing Life Insurance

When selecting a life insurance policy, it is essential to consider your specific needs and financial goals. Here are some tips to guide you through the process:

- Determine Your Coverage Needs: Assess your financial obligations and the amount of coverage required to meet those needs. Consider factors such as outstanding debts, ongoing expenses, and future financial goals.

- Choose the Right Type of Policy: Evaluate your short-term and long-term financial goals to determine whether a term, whole life, or universal life insurance policy is the best fit for you. Consider your budget, the length of coverage needed, and the potential for cash value accumulation.

- Compare Quotes and Premiums: Obtain quotes from multiple insurance companies to compare premiums and coverage options. Consider the financial stability and reputation of the insurance companies to ensure your policy's long-term viability.

- Understand the Policy's Terms: Carefully read and understand the policy's terms and conditions. Pay attention to the coverage period, the death benefit amount, any exclusions or limitations, and the premium payment schedule.

- Choose Your Beneficiaries Wisely: Select your beneficiaries thoughtfully, considering your current and future relationships. You can designate primary and contingent beneficiaries and allocate the death benefit accordingly.

Future Implications and Evolving Trends

The life insurance industry is continuously evolving to meet the changing needs and expectations of policyholders. Here are some future implications and trends to consider:

- Digitalization and Technology: The life insurance industry is embracing digital technologies to enhance the customer experience. Online platforms and mobile apps are making it easier for policyholders to manage their policies, track their coverage, and make payments. Additionally, the use of artificial intelligence and data analytics is improving risk assessment and policy customization.

- Increased Focus on Health and Wellness: Insurance companies are recognizing the importance of health and wellness in determining risk and premium rates. Some policies now offer incentives and discounts for maintaining a healthy lifestyle, such as regular exercise, healthy eating, and participation in wellness programs.

- Customizable and Flexible Policies: Insurers are introducing more flexible and customizable policies to meet the diverse needs of policyholders. These policies allow for adjustments in coverage and premiums as life circumstances change, providing greater control and adaptability.

- Integration with Financial Planning: Life insurance is increasingly being integrated into comprehensive financial planning strategies. Financial advisors are incorporating life insurance into retirement planning, estate planning, and wealth management to provide a holistic approach to financial security.

Conclusion

Life insurance is a vital financial tool that provides peace of mind and financial protection for individuals and their loved ones. By understanding the different types of policies, key components, and benefits, you can make informed decisions about your coverage. Whether you choose term, whole life, or universal life insurance, ensuring your financial obligations are met and your loved ones are cared for is essential.

As the life insurance industry continues to evolve, embracing technology and adapting to changing needs, policyholders can expect even more personalized and flexible coverage options. By staying informed and actively managing your life insurance policy, you can secure your financial future and the future of your loved ones.

How much life insurance coverage do I need?

+The amount of life insurance coverage you need depends on various factors, including your financial obligations, income, and the number of dependents you have. A general rule of thumb is to have coverage that is 10 to 15 times your annual income. However, it’s best to consult a financial advisor to determine the appropriate coverage amount based on your unique circumstances.

Can I change my beneficiaries after purchasing a life insurance policy?

+Yes, you can typically change your beneficiaries at any time. Most life insurance policies allow policyholders to update their beneficiary information by completing a change of beneficiary form. It’s important to keep your beneficiary designations up to date to ensure your wishes are honored.

Are there any tax benefits associated with life insurance policies?

+Life insurance policies can offer tax benefits, particularly with whole life and universal life policies. The cash value accumulation within these policies grows tax-deferred, and policyholders may be able to take tax-free loans or withdrawals from the cash value. However, it’s essential to consult a tax professional to understand the specific tax implications for your situation.