Cost For Home Insurance

Home insurance is a vital aspect of protecting one's financial well-being and ensuring peace of mind. It provides coverage for a wide range of potential risks, from natural disasters to accidental damages, and can safeguard homeowners against significant financial losses. However, the cost of home insurance is a topic that often raises questions and concerns. Understanding the factors that influence these costs and how to navigate the market can empower homeowners to make informed decisions and secure the best coverage for their needs.

The Landscape of Home Insurance Costs

The cost of home insurance is not a one-size-fits-all proposition; it can vary significantly based on numerous factors. These factors include the location of the property, the type and age of the home, the coverage limits chosen, and even personal factors like the homeowner’s claims history and credit score. For instance, homes located in areas prone to natural disasters like hurricanes or wildfires will typically command higher insurance premiums to reflect the increased risk.

Furthermore, the type of home can also influence insurance costs. Condominiums, for example, often have different coverage needs and associated costs compared to single-family homes or mobile homes. Similarly, the age of the home can be a factor, with older homes potentially requiring more extensive (and costly) coverage to address issues like outdated electrical systems or plumbing.

Location, Location, Location

One of the most significant influencers of home insurance costs is the location of the property. Insurance companies assess the risks associated with different regions, taking into account factors like crime rates, the prevalence of natural disasters, and the proximity to emergency services. For example, homes in high-crime areas or regions prone to earthquakes or floods will likely face higher insurance premiums.

| Location Type | Average Annual Premium |

|---|---|

| Urban Areas | $1,500 - $2,000 |

| Suburban Areas | $1,200 - $1,600 |

| Rural Areas | $800 - $1,200 |

Coverage Considerations

The coverage limits chosen by the homeowner are another key determinant of insurance costs. Homeowners can opt for varying levels of coverage, from basic policies that cover the structure of the home to more comprehensive plans that also include personal belongings and additional living expenses in the event of a disaster.

Additionally, certain add-ons or endorsements can be purchased to enhance coverage. For instance, homeowners living in areas prone to hurricanes might opt for windstorm coverage, while those with valuable art collections might choose to add a rider for personal property coverage. These additional coverages can significantly increase the cost of the policy.

Navigating the Market: Tips for Affordable Home Insurance

Given the range of factors that influence home insurance costs, it’s essential for homeowners to be proactive in their approach to securing coverage. Here are some strategies to help navigate the market and find affordable home insurance:

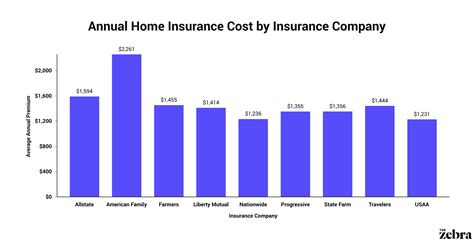

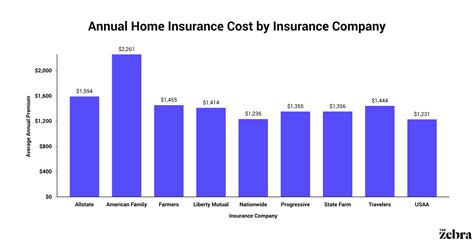

- Compare Quotes: Obtain quotes from multiple insurance providers to compare costs and coverage. This can help homeowners identify the best value for their needs.

- Bundle Policies: Consider bundling home insurance with other policies, such as auto insurance. Many providers offer discounts for customers who bundle multiple policies, making it a cost-effective strategy.

- Increase Deductibles: Opting for a higher deductible can lower insurance premiums. However, it's important to ensure that the deductible amount is manageable in the event of a claim.

- Review Coverage Regularly: As life circumstances change, so might insurance needs. Regularly reviewing and updating coverage can ensure that homeowners are neither over-insured nor under-insured.

- Utilize Discounts: Many insurance providers offer discounts for a range of factors, including loyalty, safety features in the home, and even certain professional affiliations. It's worth exploring these options to reduce insurance costs.

Understanding the Fine Print

When comparing quotes and selecting a home insurance policy, it’s crucial to understand the fine print. This includes being aware of potential exclusions, limitations, and conditions that might apply to the policy. For instance, some policies might exclude coverage for certain types of natural disasters or have restrictions on coverage for personal belongings.

It's also important to understand the process for making a claim and the timeframes involved. Being aware of these details can help homeowners make informed decisions about their coverage and ensure they are prepared in the event of a claim.

Real-World Examples: Case Studies of Home Insurance Costs

To illustrate the variation in home insurance costs, let’s consider a few real-world examples. These case studies will provide concrete insights into how different factors influence insurance premiums.

Case Study 1: Urban Condo

Consider a homeowner, John, who lives in an urban area and owns a condominium. John’s condo is located in a high-rise building with a shared roof and elevator. The building is located in a relatively safe neighborhood with a low crime rate, but it is situated in an area prone to heavy rainfall and occasional flooding.

John opts for a basic home insurance policy that covers the structure of his condo, including the interior walls, floors, and fixtures. The policy also includes liability coverage and protection for his personal belongings up to a certain limit. John's annual premium for this policy is approximately $1,800.

Case Study 2: Suburban Single-Family Home

Sarah, a homeowner in a suburban area, owns a single-family home built in the 1980s. The home is located in a neighborhood with a moderate crime rate and is at low risk for natural disasters. However, the home’s age and the presence of an older electrical system are factors that might impact insurance costs.

Sarah opts for a comprehensive home insurance policy that covers the structure, personal belongings, and additional living expenses in the event of a disaster. The policy also includes coverage for specific risks like water damage and theft. Sarah's annual premium for this policy is approximately $1,400.

Case Study 3: Rural Mobile Home

Michael, a homeowner in a rural area, owns a mobile home. The home is located in a region that experiences occasional severe weather, including tornadoes and hail storms. Given the potential risks, Michael wants to ensure he has adequate coverage.

Michael opts for a specialized mobile home insurance policy that covers the structure, personal belongings, and provides additional coverage for specific risks like wind damage. The policy also includes liability coverage. Michael's annual premium for this policy is approximately $900.

Future Trends in Home Insurance Costs

The landscape of home insurance is continually evolving, influenced by a range of factors including technological advancements, changing environmental conditions, and shifts in the insurance market. Here are some trends that might impact home insurance costs in the future:

- Increasing Natural Disaster Risks: With the impacts of climate change becoming more pronounced, the risk of natural disasters like floods, wildfires, and hurricanes is expected to rise. This could lead to increased insurance premiums in high-risk areas.

- Technological Advancements: Advances in technology, such as smart home devices and improved building materials, can potentially reduce the risk of certain types of damage and lower insurance costs. However, the cost of these advancements might also impact insurance premiums.

- Market Competition: Increased competition among insurance providers can drive down insurance costs as providers strive to offer competitive rates to attract customers. However, this also means that homeowners will need to be even more diligent in comparing quotes and understanding the coverage offered.

Preparing for the Future

As the landscape of home insurance evolves, homeowners can prepare for potential changes by staying informed and proactive. This includes regularly reviewing insurance policies to ensure they remain adequate and cost-effective, as well as being aware of any changes in personal circumstances or the property that might impact insurance needs.

Additionally, homeowners can explore ways to mitigate risks and potentially reduce insurance costs. This might include investing in home improvements to make the property more resilient to natural disasters or taking steps to improve home security and reduce the risk of theft or vandalism.

How often should I review my home insurance policy?

+It’s recommended to review your home insurance policy at least once a year, or whenever there are significant changes to your home or personal circumstances. This ensures that your coverage remains adequate and up-to-date.

Can I negotiate my home insurance premium?

+While it’s typically not possible to negotiate home insurance premiums directly, you can take steps to reduce your premium. This might include shopping around for quotes, bundling policies, or making improvements to your home to reduce risks.

What factors can I control to reduce my home insurance costs?

+There are several factors that can be controlled to potentially reduce home insurance costs. These include improving home security, installing safety features like smoke detectors and fire sprinklers, and making home improvements to reduce the risk of damage from natural disasters.