Auto Insurance In Texas

Texas is known for its diverse landscapes, vibrant cities, and, unfortunately, its unique challenges when it comes to auto insurance. With a vast and varied driving environment, from the bustling streets of Houston to the wide-open highways of West Texas, understanding auto insurance in the Lone Star State is crucial for residents and visitors alike. In this comprehensive guide, we'll delve into the specifics of auto insurance in Texas, exploring the factors that influence rates, the coverage options available, and the steps you can take to secure the best protection for your vehicle.

Understanding the Landscape: Auto Insurance Requirements in Texas

Texas has specific regulations regarding auto insurance coverage, and it's essential to understand these requirements to ensure compliance with state laws. Here's a breakdown of the key aspects:

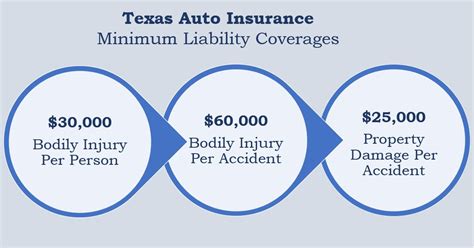

Minimum Liability Coverage

Texas mandates that all drivers carry liability insurance to protect against bodily injury and property damage caused in an at-fault accident. The minimum liability limits are:

- Bodily Injury Liability: $30,000 per person / $60,000 per accident

- Property Damage Liability: $25,000 per accident

While these are the minimum requirements, it's worth considering higher limits to provide more robust protection in the event of a severe accident.

Additional Coverage Options

Beyond the mandatory liability coverage, Texas drivers have the flexibility to choose from a range of optional coverages to tailor their insurance policies to their needs. These include:

- Collision Coverage: Pays for damages to your vehicle if you're involved in an accident, regardless of fault.

- Comprehensive Coverage: Covers damages to your vehicle due to non-accident events like theft, vandalism, weather-related incidents, or collisions with animals.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you're involved in an accident with a driver who has insufficient or no insurance.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of fault.

Factors Influencing Auto Insurance Rates in Texas

Auto insurance rates in Texas can vary significantly depending on several factors. Understanding these influences can help you make informed decisions when choosing a policy and potentially negotiate better rates.

Driving Record

Your driving history plays a pivotal role in determining your insurance rates. A clean driving record with no accidents or violations can lead to lower premiums. Conversely, a history of accidents, DUIs, or traffic violations may result in higher rates or even difficulty obtaining insurance.

Vehicle Type and Usage

The make, model, and year of your vehicle can impact your insurance costs. Generally, newer, more expensive vehicles or those with high-performance engines may incur higher premiums. Additionally, the purpose of your vehicle's usage, such as personal, business, or pleasure, can influence rates.

| Vehicle Type | Average Annual Premium |

|---|---|

| Sedan | $1,200 |

| SUV | $1,350 |

| Sports Car | $1,800 |

Location and Demographics

Where you live and work can significantly affect your insurance rates. Urban areas with higher populations and traffic volumes often result in higher premiums due to increased accident risks. Additionally, your age, gender, and marital status can influence rates, as these factors are statistically linked to driving behavior.

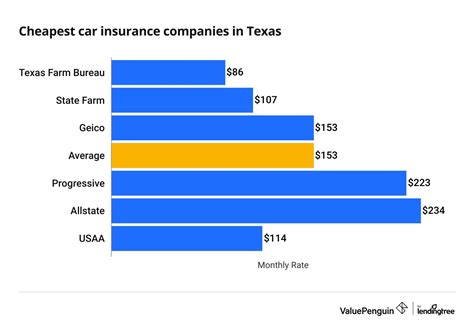

Comparing Auto Insurance Providers in Texas

With numerous insurance providers operating in Texas, comparing options is essential to finding the best coverage at the most competitive rates. Here's an overview of some of the leading auto insurance companies in the state:

State Farm

State Farm is a prominent player in the Texas auto insurance market, offering a wide range of coverage options and competitive rates. They provide comprehensive policies tailored to individual needs and are known for their excellent customer service.

GEICO

GEICO has a strong presence in Texas, offering affordable auto insurance plans with a focus on digital convenience. Their online platform allows for easy policy management and quick claims processing, making them a popular choice among tech-savvy drivers.

USAA

USAA specializes in providing insurance to military members, veterans, and their families. With a strong commitment to customer satisfaction, USAA offers competitive rates and a range of discounts for those who qualify.

Progressive

Progressive is renowned for its innovative approach to auto insurance, offering a wide array of coverage options and discounts. Their Name Your Price® tool allows customers to set their desired monthly premium and find a policy that matches their budget.

Tips for Obtaining the Best Auto Insurance Rates in Texas

Securing the most favorable auto insurance rates in Texas requires a strategic approach. Here are some tips to help you get the best coverage at the lowest possible cost:

Shop Around and Compare

Don't settle for the first insurance quote you receive. Take the time to compare rates and coverage options from multiple providers. Online comparison tools can simplify this process, allowing you to quickly assess various offers.

Bundle Your Policies

Consider bundling your auto insurance with other policies, such as homeowners or renters insurance. Many providers offer discounts for bundling, which can significantly reduce your overall insurance costs.

Maintain a Clean Driving Record

A clean driving record is not only essential for your safety but also for keeping your insurance premiums low. Avoid traffic violations and accidents to ensure you qualify for the best rates.

Explore Discounts

Insurance providers often offer a range of discounts to attract customers. These can include safe driver discounts, multi-policy discounts, good student discounts, and loyalty rewards. Take the time to inquire about the discounts available to you.

Frequently Asked Questions (FAQ)

What happens if I don't have auto insurance in Texas?

+Driving without auto insurance in Texas is illegal and can result in severe penalties, including fines, license suspension, and even vehicle impoundment. It's crucial to maintain continuous insurance coverage to avoid these consequences.

<div class="faq-item">

<div class="faq-question">

<h3>Can I get auto insurance with a suspended license in Texas?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Obtaining auto insurance with a suspended license can be challenging, but it's not impossible. Some insurance providers may offer coverage for drivers with a suspended license, although rates may be higher. It's advisable to address the suspension issue first and then seek insurance.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How often should I review my auto insurance policy in Texas?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>It's a good practice to review your auto insurance policy annually or whenever your circumstances change significantly. This ensures that your coverage remains adequate and that you're not paying for unnecessary features.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any state-specific discounts for auto insurance in Texas?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, Texas offers a few state-specific discounts. For example, the Good Driver Discount Program provides a discount for drivers who have been accident-free for three years. Additionally, some providers offer discounts for Texas residents who complete defensive driving courses.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I get auto insurance without a driver's license in Texas?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>While having a valid driver's license is typically a requirement for auto insurance, some providers may offer coverage for individuals without a license. However, this is a rare scenario and often comes with higher premiums.</p>

</div>

</div>

Understanding the intricacies of auto insurance in Texas is essential for ensuring you have the right coverage at the best possible rates. By staying informed about the state’s regulations, comparing providers, and implementing cost-saving strategies, you can navigate the Texas insurance landscape with confidence and peace of mind.