Australia Health Insurance

Australia's healthcare system is renowned for its high standards and accessibility, and at the heart of this system is private health insurance. Understanding the intricacies of Australia's health insurance landscape is crucial for both residents and visitors, as it can significantly impact one's healthcare experience and financial planning. This comprehensive guide aims to demystify Australia's health insurance system, offering an in-depth analysis of its features, benefits, and potential pitfalls.

Understanding the Basics of Australia’s Health Insurance System

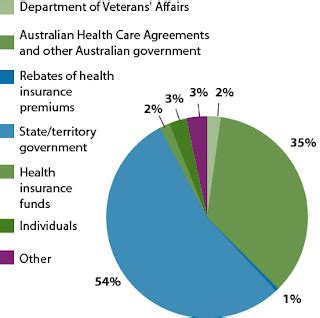

Australia’s healthcare system operates on a two-tiered model, with both public and private healthcare services. The public healthcare system, funded by the government through taxes, provides universal healthcare coverage to all Australian citizens and permanent residents. This includes access to public hospitals, Medicare benefits, and a range of essential healthcare services.

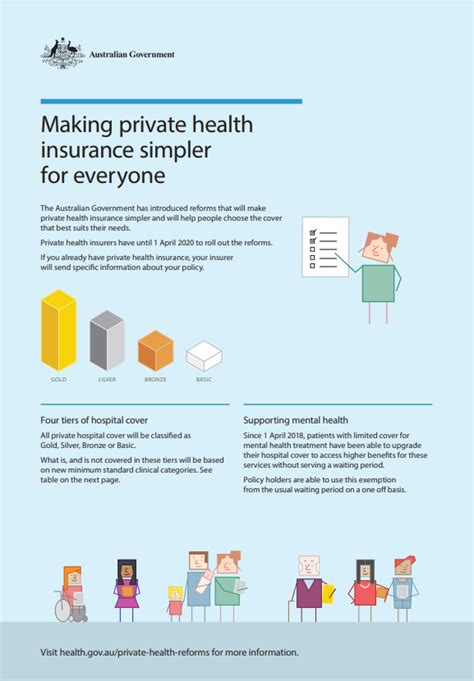

On the other hand, private health insurance in Australia offers additional coverage and benefits that go beyond what is provided by the public system. It is a voluntary system, allowing individuals to choose the level of coverage they require and desire. Private health insurance in Australia is regulated by the Private Health Insurance Administration Council (PHIAC), ensuring that insurers provide a standard level of service and coverage.

The Australian government actively encourages the uptake of private health insurance through a series of incentives. These include the Medicare Levy Surcharge, which applies to high-income earners without private hospital cover, and the Lifetime Health Cover, which offers a discount for those who take out private hospital cover before turning 70.

Types of Private Health Insurance Policies

Private health insurance policies in Australia can be broadly categorized into two types: hospital cover and extras cover (also known as ancillary or general treatment cover). Hospital cover provides financial protection for treatments and procedures that require hospitalization, such as surgery, childbirth, and specialist consultations. Extras cover, on the other hand, provides benefits for a range of non-hospital services, including dental care, optical services, physiotherapy, and alternative therapies.

Within these categories, insurers offer a range of policy options with varying levels of coverage and benefits. For instance, hospital cover policies can be comprehensive, offering coverage for most medical procedures, or limited, providing coverage only for specific treatments or conditions. Similarly, extras cover policies can vary significantly, with some policies offering generous benefits for a wide range of services, while others may have more restrictive coverage.

| Policy Type | Description |

|---|---|

| Hospital Cover | Provides financial protection for in-hospital treatments and procedures. |

| Extras Cover | Offers benefits for non-hospital services such as dental, optical, and physiotherapy. |

Key Considerations When Choosing a Private Health Insurance Policy

Selecting the right private health insurance policy is a critical decision that requires careful consideration. Here are some key factors to keep in mind when comparing and choosing a policy:

Assessing Your Healthcare Needs

Understanding your current and potential future healthcare needs is essential. Consider your age, health status, and any pre-existing conditions. For example, if you have a family history of certain illnesses or require regular medical treatments, you may need a more comprehensive hospital cover. On the other hand, if you have specific dental or optical needs, a robust extras cover might be a priority.

Policy Exclusions and Waiting Periods

All private health insurance policies in Australia have exclusions and waiting periods. Exclusions are specific treatments, services, or conditions that are not covered by the policy. Waiting periods, on the other hand, are the length of time you must be insured before you can claim for certain services or conditions. It’s crucial to review these carefully to ensure you understand what is and isn’t covered, and when you can access those benefits.

Comparing Premiums and Benefits

Premiums, or the cost of the insurance policy, can vary significantly between insurers and policy types. It’s essential to compare premiums across different providers, but also to consider the benefits offered. A policy with a lower premium might not offer the same level of coverage or benefits as a more expensive policy. Striking a balance between cost and coverage is key.

Reputation and Customer Service of the Insurer

The reputation and customer service record of the insurer should also be considered. Look for insurers with a track record of prompt claim processing and good customer support. Reading reviews and experiences of other policyholders can provide valuable insights into the insurer’s performance and reliability.

| Factor to Consider | Description |

|---|---|

| Healthcare Needs | Assess your current and future healthcare requirements. |

| Policy Exclusions and Waiting Periods | Understand what's not covered and when you can access benefits. |

| Premiums and Benefits | Compare costs and coverage across different policies. |

| Insurer Reputation and Customer Service | Choose insurers with a good track record and reliable customer support. |

The Role of the Private Health Insurance Ombudsman

The Private Health Insurance Ombudsman plays a crucial role in Australia’s health insurance system. This independent body is tasked with resolving complaints and disputes between private health insurers and their policyholders. If you have a complaint about your private health insurance, the Ombudsman can provide free and impartial advice, assistance, and dispute resolution services.

The Ombudsman's role includes investigating and resolving issues such as claim disputes, policy exclusions, and unfair practices by insurers. They can also provide information and guidance on your rights and responsibilities as a policyholder. Their services are a vital safeguard for consumers, ensuring fair treatment and transparency in the private health insurance market.

Key Functions of the Private Health Insurance Ombudsman

- Complaint Resolution: The Ombudsman can help resolve disputes between insurers and policyholders, ensuring fair and prompt outcomes.

- Advice and Information: They provide guidance on private health insurance policies, helping consumers understand their rights and responsibilities.

- Policy Review: The Ombudsman can assist in reviewing policies to ensure they meet consumer needs and comply with regulations.

- Education and Outreach: They engage in public education campaigns to raise awareness about private health insurance and consumer rights.

The Future of Private Health Insurance in Australia

The Australian private health insurance market is evolving, influenced by changing demographics, healthcare trends, and government policies. As the population ages and healthcare costs rise, the demand for comprehensive private health insurance is likely to increase. Insurers are responding to these trends by offering a wider range of policy options and innovative benefits, such as digital health services and wellness programs.

Government initiatives, such as the My Health Record system, are also shaping the future of private health insurance. This digital health record system provides a secure online summary of an individual's health information, accessible by healthcare providers. This can improve the efficiency and quality of healthcare services, particularly for those with complex health needs.

Despite these positive developments, challenges remain. Rising healthcare costs and changing consumer expectations are putting pressure on insurers to offer more competitive policies. Additionally, the impact of the COVID-19 pandemic on the healthcare system and insurance industry is still unfolding, with potential long-term effects on policy coverage and premiums.

Key Trends Shaping the Future

- Digital Health Services: Insurers are integrating digital health technologies to improve accessibility and convenience for policyholders.

- Wellness Programs: Many insurers are now offering wellness initiatives to promote healthy lifestyles and prevent illness.

- Changing Consumer Expectations: Consumers are increasingly seeking more personalized and flexible insurance policies.

- Impact of COVID-19: The pandemic has highlighted the importance of healthcare coverage and may lead to changes in policy design and coverage.

Frequently Asked Questions

What is the Medicare Levy Surcharge and how does it affect private health insurance?

+

The Medicare Levy Surcharge is an additional tax levied on high-income earners without private hospital cover. If your income is above a certain threshold and you don’t have private hospital insurance, you may be required to pay this surcharge. The purpose of this surcharge is to encourage high-income earners to take out private hospital cover, thus reducing pressure on the public healthcare system.

What is the Lifetime Health Cover and how does it work?

+

The Lifetime Health Cover is a discount offered by private health insurers to encourage people to take out private hospital cover before they turn 70. If you take out private hospital cover before your 70th birthday, you can receive a 2% discount on your premiums for each year you’ve been covered. This discount can make a significant difference in the long run, helping to offset the rising cost of healthcare.

How do I choose the right private health insurance policy for my needs?

+

Choosing the right private health insurance policy involves considering several factors. Start by assessing your current and potential future healthcare needs. If you require regular hospital treatments or have specific healthcare requirements, a comprehensive hospital cover might be best. For dental, optical, or other non-hospital services, an extras cover could be more suitable. Remember to compare policies from different insurers, taking into account premiums, benefits, and exclusions.