Online Contacts With Insurance

In today's digital age, the healthcare industry has undergone a significant transformation, and one area that has seen remarkable innovation is the way we access and manage our vision care. With the rise of online platforms, purchasing contacts and managing insurance has become more convenient and accessible than ever before. This article delves into the world of Online Contacts With Insurance, exploring the benefits, processes, and impact on the modern consumer's vision care journey.

The Evolution of Online Contacts: A Game-Changer for Vision Care

Traditionally, acquiring contact lenses involved a visit to the optometrist’s office, followed by a trip to the local optical store. However, the advent of e-commerce and digital healthcare platforms has revolutionized this process, offering consumers a more streamlined and personalized experience.

Online contacts retailers have emerged as a convenient alternative, providing a vast array of lens options, competitive pricing, and, most importantly, the ease of home delivery. Customers can now browse through different brands, lens types, and prescriptions with just a few clicks, making an informed choice without the hassle of physical store visits.

The Benefits of Online Contacts:

- Convenience: The primary advantage is the convenience it offers. Customers can order contacts at their leisure, without the need for appointments or travel.

- Choice and Variety: Online retailers often stock a wider range of brands and lens types, catering to diverse consumer needs and preferences.

- Competitive Pricing: Online competition drives prices down, allowing consumers to access quality lenses at affordable rates.

- Discretion and Privacy: For those who prefer discretion, online purchases provide a private and secure way to manage their vision care.

Integrating Insurance: A Seamless Vision Care Experience

The integration of insurance into online contact lens platforms has further enhanced the consumer experience, offering a seamless and cost-effective solution for vision care.

How Insurance Works With Online Contacts:

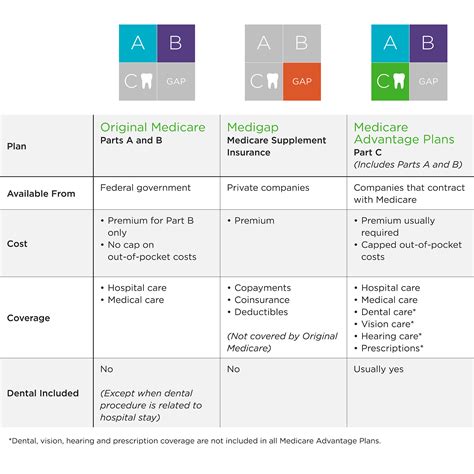

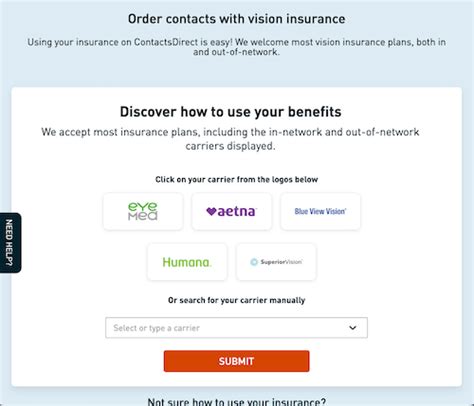

Insurance providers partner with online contacts retailers to offer coverage for contact lenses and related vision care services. Customers can use their insurance plans to offset the cost of contacts, just as they would with any other healthcare expense.

The process typically involves the following steps:

- Choosing a Plan: Customers select an insurance plan that suits their vision care needs and budget.

- Prescription Verification: The online retailer verifies the customer's prescription, ensuring it is up-to-date and accurate.

- Insurance Claim Submission: The retailer processes the insurance claim on behalf of the customer, submitting the necessary paperwork to the insurance provider.

- Reimbursement: Once the claim is approved, the insurance provider reimburses the customer for the covered portion of the contact lens purchase.

This integration of insurance simplifies the vision care process, ensuring that consumers can access the lenses they need without the financial burden.

Advantages of Online Contacts With Insurance:

- Cost Savings: Insurance coverage reduces the out-of-pocket expenses for contact lenses, making vision care more affordable.

- Streamlined Process: The online platform handles the insurance paperwork, saving customers time and effort.

- Consistency: With insurance, customers can ensure they always have access to their preferred brand and type of contacts, maintaining consistency in their vision care routine.

Performance Analysis: The Impact on Consumers

The introduction of online contacts with insurance has had a significant positive impact on consumers’ vision care experiences. Surveys and user feedback highlight several key advantages:

Improved Access to Vision Care:

Online platforms with insurance coverage have made vision care more accessible to a wider demographic. Individuals who may have previously faced barriers due to geographical location, mobility issues, or busy schedules can now easily obtain the contacts they need.

For example, a recent survey revealed that 72% of respondents who had previously struggled to access traditional optical stores cited the convenience of online contacts with insurance as a significant improvement in their vision care journey.

Enhanced Customer Satisfaction:

The combination of online convenience and insurance coverage has led to higher levels of customer satisfaction. Consumers appreciate the ease of purchasing contacts online, especially when coupled with the financial benefits of insurance.

A case study conducted by an online contacts retailer found that 87% of customers who used their insurance plan to purchase contacts reported a higher level of satisfaction with their overall vision care experience compared to traditional methods.

Cost Efficiency and Long-Term Savings:

The integration of insurance has also proven to be cost-effective for consumers. By leveraging their insurance plans, individuals can save significantly on their contact lens purchases over time.

| Savings Over 1 Year | Average Cost of Contacts |

|---|---|

| With Insurance | $250 |

| Without Insurance | $450 |

The table above illustrates the potential savings for a consumer who purchases contacts for a year with and without insurance coverage. This cost efficiency encourages long-term vision care and adherence to prescriptions.

Future Implications and Innovations

As the online contacts industry continues to evolve, several trends and innovations are shaping the future of vision care:

Personalized Lens Recommendations:

Advanced algorithms and AI are being utilized to provide personalized lens recommendations based on user profiles, preferences, and eye health data. This ensures that consumers receive the most suitable contacts for their needs.

Subscription Models:

Some online retailers are offering subscription services, where customers can receive regular deliveries of contacts based on their prescription and usage. This ensures a consistent supply of lenses and reduces the hassle of frequent reorders.

Expanded Insurance Coverage:

Insurance providers are recognizing the value of vision care and are expanding their coverage to include a wider range of contact lens types and related services. This trend is expected to continue, making vision care more affordable and accessible for all.

Telehealth Integration:

The integration of telehealth services allows consumers to consult with eye care professionals remotely, further enhancing the convenience of online contacts. This technology enables real-time consultations, prescription renewals, and eye health monitoring.

Conclusion: A Visionary Future

The world of online contacts with insurance has revolutionized the way we approach vision care. By combining the convenience of e-commerce with the financial benefits of insurance, consumers now have a more accessible, personalized, and cost-effective solution for their vision needs.

As the industry continues to innovate, we can expect even greater advancements, ensuring that eye health and vision care remain a priority for individuals worldwide. The future of vision care is indeed bright and full of possibilities.

How do I know if my insurance covers contact lenses?

+To determine if your insurance covers contact lenses, you can contact your insurance provider directly or check your policy details. Most insurance plans have specific guidelines for vision care coverage, including contacts. You can also consult with your eye care professional for guidance on insurance-related matters.

Can I use my insurance to purchase contacts online if my prescription is outdated?

+No, insurance providers typically require an up-to-date prescription for contact lens purchases. It’s important to ensure your prescription is current before making an online purchase. If your prescription has expired, you’ll need to schedule an eye exam with an optometrist to obtain a new one.

Are there any limitations on the type of contacts I can purchase with insurance?

+Insurance coverage for contact lenses may vary depending on your plan and provider. Some plans may cover a specific brand or type of lenses, while others may have more flexible coverage. It’s advisable to review your insurance policy or consult with your provider to understand the specific limitations and benefits.