Dental Insurance With Medicare

Dental care is an essential aspect of overall health, and as we age, maintaining good oral hygiene becomes even more critical. For individuals enrolled in Medicare, understanding the options for dental insurance coverage is key to ensuring access to necessary dental services. This article aims to provide an in-depth analysis of dental insurance with Medicare, covering the various aspects, benefits, and considerations to help individuals make informed decisions about their oral health.

Understanding Medicare and Dental Coverage

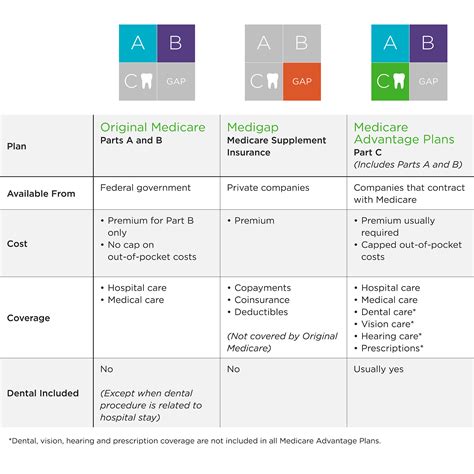

Medicare, the federal health insurance program primarily for individuals aged 65 and older, is divided into different parts, each covering specific health services. It’s important to note that traditional Medicare (Parts A and B) does not cover routine dental care, including services like cleanings, fillings, root canals, or dentures.

However, there are ways to obtain dental coverage under Medicare. This article will explore these options, offering a comprehensive guide to help navigate the complexities of dental insurance with Medicare.

Medicare Advantage Plans (Part C)

Medicare Advantage Plans, also known as Part C, are an alternative to traditional Medicare. These plans are offered by private insurance companies and must cover all the services that Original Medicare covers. Many Medicare Advantage Plans include additional benefits, such as dental coverage, vision care, and prescription drugs. This makes them an attractive option for individuals seeking comprehensive health coverage, including dental care.

Dental Benefits in Medicare Advantage Plans

The dental benefits offered in Medicare Advantage Plans can vary significantly. Some plans provide basic dental coverage, which may include services like annual cleanings, X-rays, and certain preventive treatments. Other plans may offer more comprehensive dental coverage, including restorative services like fillings and extractions. It’s important to carefully review the specifics of each plan’s dental coverage to ensure it aligns with your oral health needs.

Additionally, some Medicare Advantage Plans have annual limits on dental benefits, while others may require a waiting period before certain dental procedures are covered. Understanding these limitations and requirements is crucial when choosing a plan.

Enrolling in Medicare Advantage

To enroll in a Medicare Advantage Plan, you must be enrolled in Medicare Part A and Part B and live in the service area of the plan you wish to join. The Annual Election Period (AEP), typically from October 15 to December 7, is the best time to enroll in a new Medicare Advantage Plan. During this period, you can make changes to your coverage without special permission.

It's important to note that Medicare Advantage Plans can change from year to year, so it's essential to review your plan's details annually to ensure it continues to meet your health and dental needs.

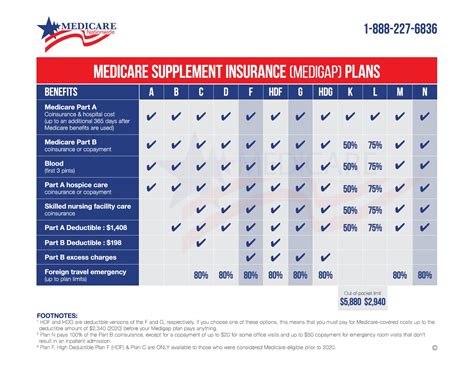

Medicare Supplemental Insurance (Medigap)

Medigap, or Medicare Supplement Insurance, is designed to fill in the gaps in Original Medicare coverage. While Medigap plans do not typically cover routine dental care, they can provide financial protection for certain dental services if you receive them in a hospital setting.

Medigap and Dental Coverage

Medigap plans can help cover dental-related expenses in specific circumstances. For example, if you require dental surgery in a hospital, a Medigap plan can assist with the costs associated with the hospital stay and anesthesia. However, it’s important to understand that Medigap plans do not cover routine dental services performed in a dental office.

When choosing a Medigap plan, it's crucial to consider the dental services you may need and whether these services are covered by Original Medicare and supplemented by the Medigap plan.

Stand-Alone Dental Insurance Plans

For individuals who prefer a more tailored approach to their dental coverage, stand-alone dental insurance plans offer a separate option from Medicare. These plans are purchased directly from private insurance companies and can provide a range of dental benefits, from basic preventive care to more extensive restorative services.

Benefits of Stand-Alone Dental Plans

Stand-alone dental insurance plans offer greater flexibility in choosing your dental care providers, as they often have a larger network of participating dentists compared to Medicare Advantage Plans. Additionally, these plans can be more cost-effective for individuals who require extensive dental work, as they typically have higher annual limits on coverage.

However, it's important to carefully review the specifics of each stand-alone dental plan, including any waiting periods, annual limits, and covered services, to ensure it meets your oral health needs.

Performance Analysis and Real-World Examples

To provide a comprehensive understanding of dental insurance with Medicare, it’s beneficial to analyze real-world examples and performance data.

| Plan Type | Dental Coverage | Annual Limits | Waiting Periods |

|---|---|---|---|

| Medicare Advantage Plan A | Basic: Cleanings, X-rays, Preventive Care | $1,500 | 6 months for major services |

| Medicare Advantage Plan B | Comprehensive: Fillings, Extractions, Root Canals | $2,000 | None |

| Stand-Alone Dental Plan C | Extended: Implants, Orthodontics | $5,000 | 12 months for major services |

The table above provides a comparison of different plan types and their dental coverage offerings. It's important to note that these are examples, and actual coverage details may vary based on the specific plan and insurance company.

Expert Insights and Future Implications

Looking ahead, the future of dental insurance with Medicare is evolving. With an increasing focus on preventive care and the growing understanding of the link between oral health and overall well-being, there may be greater emphasis on dental coverage in Medicare plans in the coming years. This could lead to more comprehensive dental benefits and improved access to dental services for Medicare beneficiaries.

Additionally, the rise of digital health technologies and telehealth services may offer new opportunities for dental care delivery, potentially making dental services more accessible and convenient for individuals with Medicare coverage.

Conclusion

Dental insurance with Medicare offers a range of options to meet the diverse needs of individuals. Whether through Medicare Advantage Plans, Medigap, or stand-alone dental insurance plans, there are strategies to ensure access to necessary dental care. By staying informed and reviewing the specifics of each plan, individuals can make choices that align with their oral health goals and overall well-being.

FAQ

Can I enroll in a Medicare Advantage Plan any time of the year?

+

While you can enroll in a Medicare Advantage Plan outside of the Annual Election Period (AEP), you may face certain limitations. During the AEP, you have the most flexibility to change plans without special permission. Outside of this period, you may need to qualify for a Special Enrollment Period (SEP) due to specific circumstances, such as moving or losing other health coverage.

What if I need extensive dental work, but my Medicare Advantage Plan has a low annual limit?

+

If you anticipate needing extensive dental work, it’s important to carefully review the annual limits of your Medicare Advantage Plan’s dental coverage. Some plans may have higher limits or offer additional coverage options for an extra premium. Alternatively, you may consider a stand-alone dental insurance plan, which often has higher annual limits and may be more cost-effective for extensive dental procedures.

Can I have both a Medicare Advantage Plan and a stand-alone dental insurance plan simultaneously?

+

Yes, it is possible to have both a Medicare Advantage Plan and a stand-alone dental insurance plan. This allows you to benefit from the comprehensive health coverage of the Medicare Advantage Plan, while also having dedicated dental insurance for your oral health needs. However, it’s important to review the specifics of both plans to ensure there are no duplications or conflicts in coverage.