Bike Insurance Rates

Bike insurance is an essential aspect of cycling, offering financial protection and peace of mind to riders. With the rising popularity of cycling for both recreational and commuting purposes, understanding the rates and factors influencing bike insurance is crucial. This article aims to delve into the world of bike insurance rates, providing a comprehensive guide for cyclists seeking to navigate this complex yet vital topic.

Understanding Bike Insurance Rates

Bike insurance rates are influenced by a myriad of factors, each playing a unique role in determining the overall cost of coverage. These factors can be broadly categorized into personal, bike-related, and environmental elements.

Personal Factors

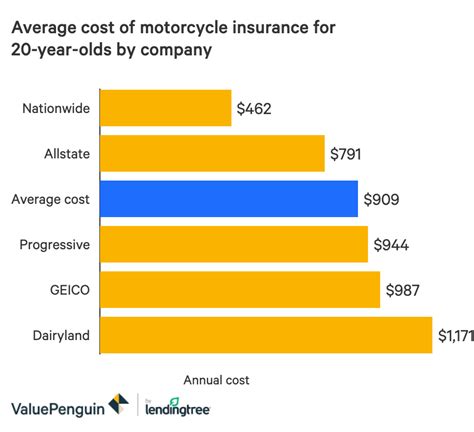

The cyclist’s age, gender, and location significantly impact insurance rates. Younger riders, particularly those under 25, often face higher premiums due to their perceived higher risk profile. Similarly, gender-based differences in insurance rates exist, with some insurers charging slightly more for male riders, especially in high-risk age groups.

Location also plays a pivotal role, as areas with higher crime rates or a history of bike-related incidents may result in elevated insurance costs. Additionally, the rider's claim history and credit score can influence rates, with a history of claims or a poor credit score potentially leading to higher premiums.

Bike-Related Factors

The type of bike, its value, and the level of coverage required all impact insurance rates. High-end bikes, such as those used in professional racing or off-road cycling, often command higher insurance premiums due to their expense and the potential for more severe damage.

The coverage level, including whether the policy covers theft, damage, or both, also affects rates. Comprehensive policies that provide coverage for a wide range of scenarios typically come with higher premiums. Additionally, the inclusion of additional benefits, such as personal accident cover or legal liability protection, can further increase the cost of insurance.

Environmental Factors

Environmental factors, such as the weather and road conditions, can influence insurance rates. Areas prone to severe weather events, such as hurricanes or floods, may see higher insurance costs due to the increased risk of damage to bikes. Similarly, regions with a high incidence of road accidents or theft may also result in elevated insurance premiums.

The time of year can also play a role, with insurers potentially offering discounts during off-peak cycling seasons when the risk of incidents is perceived to be lower.

Comparing Bike Insurance Policies

When comparing bike insurance policies, it’s essential to consider not just the cost but also the coverage provided. Some policies may offer a lower premium but provide limited coverage, while others may offer a more comprehensive package at a slightly higher cost.

Coverage Options

Bike insurance policies typically offer a range of coverage options, including:

- Theft Protection: Covers the cost of replacing a stolen bike or its parts, often with a deductible.

- Damage Coverage: Provides financial assistance for repairs or replacement in case of accidents or mechanical failures.

- Liability Protection: Protects the rider from legal claims and expenses arising from accidents caused by the rider.

- Personal Accident Cover: Offers compensation for injuries sustained in cycling-related accidents.

- Emergency Assistance: Provides assistance in case of a breakdown or accident, including transport to the nearest repair shop or medical facility.

It's crucial to assess your specific needs and choose a policy that offers the right balance of coverage and cost. For instance, a recreational cyclist may prioritize theft protection and liability cover, while a professional racer might opt for more comprehensive damage coverage and personal accident insurance.

Policy Add-ons and Customization

Many bike insurance policies allow for customization through add-ons or optional extras. These can include:

- Equipment Coverage: Extends coverage to cycling-related equipment, such as helmets, clothing, and accessories.

- Travel Insurance: Provides coverage for bike-related travel, including trips to races or cycling vacations.

- Event Coverage: Offers protection for bikes used in cycling events, covering damage or theft during the event.

- Legal Expenses: Provides financial assistance for legal fees related to cycling incidents.

While these add-ons can enhance the policy's coverage, they also increase the premium. It's essential to carefully consider which add-ons are necessary and which may be an unnecessary expense.

Tips for Lowering Bike Insurance Rates

While bike insurance rates are influenced by various factors beyond the rider’s control, there are strategies to potentially lower insurance costs.

Shop Around and Compare Quotes

Obtaining quotes from multiple insurers is a crucial step in finding the best deal. Insurance providers may offer varying rates for similar coverage, so comparing quotes can help identify the most cost-effective option.

Bundle with Other Policies

Bundling your bike insurance with other policies, such as home or auto insurance, can often lead to discounts. Many insurers offer multi-policy discounts, so it’s worth exploring this option to potentially save on insurance costs.

Choose a Higher Deductible

Opting for a higher deductible can lower insurance premiums. This strategy works best for cyclists who are confident they won’t need to make a claim or who have sufficient savings to cover the deductible in case of an incident.

Maintain a Clean Claim History

A history of claims can impact insurance rates. While it’s sometimes unavoidable to make a claim, cyclists should strive to maintain a clean claim history to avoid potential rate increases.

Utilize Safety Features

Insurers often offer discounts for bikes equipped with certain safety features, such as advanced locks or tracking devices. These features can deter theft and reduce the risk of damage, making the bike a lower-risk proposition for insurers.

The Future of Bike Insurance

The cycling industry is experiencing significant growth, with more people embracing cycling for transportation, fitness, and recreation. This trend is likely to continue, driven by factors such as increasing health consciousness, environmental awareness, and urban planning that prioritizes cycling infrastructure.

Emerging Technologies and Their Impact

Advancements in technology are set to play a significant role in shaping the future of bike insurance. One such innovation is the integration of smart sensors and GPS tracking into bikes and cycling gear. These technologies can provide real-time data on bike usage, location, and condition, offering insurers more accurate risk assessment capabilities.

Additionally, the development of autonomous bike technology and the potential for self-driving bikes could introduce new insurance considerations. While these technologies aim to enhance safety and convenience, they may also bring about unique insurance challenges, such as liability issues and the need for specialized coverage.

The Rise of E-bikes and Their Insurance Implications

The rising popularity of e-bikes is another factor that will likely influence the future of bike insurance. E-bikes, with their higher speeds and additional features, present a different risk profile compared to traditional bikes. Insurers will need to adapt their policies to address the specific risks associated with e-bikes, such as increased liability and potential mechanical failures.

Moreover, the introduction of e-bikes may also impact traditional bike insurance policies. As more people opt for e-bikes, insurers may need to reassess their pricing structures and coverage options to remain competitive and relevant in the market.

Sustainable Practices and Their Role in Insurance

The cycling industry’s focus on sustainability is another area with potential insurance implications. As more cyclists embrace eco-friendly practices, such as repairing and recycling bikes, insurers may explore incentives and discounts for these sustainable behaviors. This could involve offering reduced premiums for cyclists who adopt sustainable cycling practices or utilize eco-friendly bike components.

Conclusion

Bike insurance is a complex yet essential aspect of cycling. Understanding the factors influencing insurance rates, comparing policies, and employing strategies to lower costs are crucial steps for cyclists. As the cycling industry continues to evolve, so too will the landscape of bike insurance, with emerging technologies, the rise of e-bikes, and sustainable practices all set to play a significant role in shaping the future of bike insurance.

FAQ

How often should I review my bike insurance policy?

+It’s recommended to review your bike insurance policy annually or whenever your circumstances change significantly. This ensures that your coverage remains adequate and that you’re not paying for coverage you no longer need.

What factors determine whether my bike is considered a “high-risk” bike for insurance purposes?

+Insurance providers may consider a bike “high-risk” based on factors such as its value, the frequency with which it’s ridden, the locations it’s ridden in, and its theft history. High-end bikes or those frequently used in high-risk areas may be classified as high-risk.

Are there any discounts available for bike insurance policies?

+Yes, several discounts are commonly offered for bike insurance policies. These can include multi-policy discounts when you bundle your bike insurance with other policies, safety equipment discounts for bikes equipped with certain safety features, and loyalty discounts for long-term customers.

What should I do if I need to make a claim on my bike insurance policy?

+If you need to make a claim on your bike insurance policy, the first step is to contact your insurance provider and provide them with all the relevant details of the incident. This typically includes the date, time, and location of the incident, as well as any supporting documentation, such as photos or police reports. It’s important to be honest and accurate in your claim, as any misinformation can lead to your claim being denied.

Can I insure my bike if I use it for both recreational and commuting purposes?

+Yes, you can typically insure your bike for both recreational and commuting purposes under a single policy. However, it’s important to ensure that your policy covers all the activities you intend to use your bike for. Some policies may have specific exclusions or limitations for certain types of riding, so be sure to carefully review your policy documents or consult with your insurance provider to confirm your coverage.