Medical Insurance Mo

Welcome to this in-depth exploration of the world of medical insurance in Mongolia, a topic of vital importance for both locals and expatriates residing in this beautiful landlocked country. Mongolia, with its unique culture, vast landscapes, and diverse healthcare system, presents a challenging yet rewarding environment for navigating medical insurance options. This article aims to provide an extensive guide, shedding light on the intricacies of medical insurance coverage in Mongolia, and offering practical insights for those seeking to safeguard their health and well-being.

Understanding the Healthcare Landscape in Mongolia

Mongolia boasts a healthcare system that has undergone significant transformations in recent years, striving to improve accessibility and quality of care for its population. The system is a blend of traditional and modern medical practices, with a strong focus on preventive care and a growing emphasis on specialized treatments. Understanding this landscape is crucial for anyone considering medical insurance, as it forms the backdrop against which insurance policies are designed and implemented.

The healthcare system in Mongolia is largely decentralized, with primary healthcare services provided by local clinics and community health centers. These facilities offer a range of services, from basic medical care to more specialized treatments. However, for more complex procedures and advanced diagnostics, patients often need to turn to private hospitals or travel to urban centers, particularly Ulaanbaatar, the capital city.

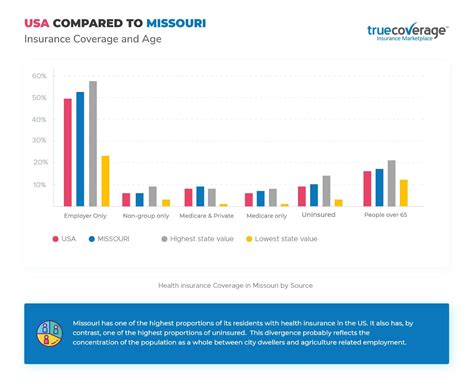

One of the key challenges in Mongolia's healthcare system is the uneven distribution of medical resources. While urban areas have access to a wider range of medical services and specialists, rural areas often face shortages of healthcare professionals and facilities. This disparity underscores the importance of medical insurance, which can help bridge these gaps and ensure equitable access to healthcare services for all.

Types of Medical Insurance in Mongolia

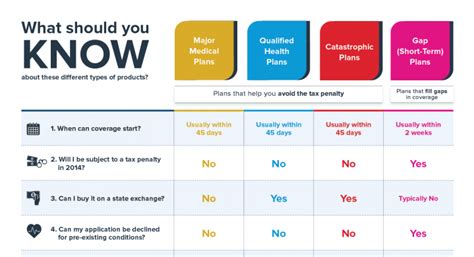

Medical insurance in Mongolia can be categorized into several types, each designed to cater to different segments of the population and their specific healthcare needs. Understanding these categories is essential for making informed decisions about insurance coverage.

Public Health Insurance

Public health insurance in Mongolia is provided through the National Health Insurance Fund (NHIF). This fund covers a comprehensive range of healthcare services, including inpatient and outpatient treatments, pharmaceuticals, and emergency care. All Mongolian citizens and registered residents are eligible for public health insurance, which is financed through a combination of government funding and contributions from employed individuals and their employers.

The NHIF's coverage extends to a wide network of healthcare providers, both public and private, across the country. This ensures that insured individuals have access to a diverse range of medical services, promoting competition among healthcare providers and potentially leading to improved quality of care.

Private Health Insurance

Private health insurance in Mongolia is an attractive option for those seeking more comprehensive coverage or specialized services. Private insurance plans offer a higher level of flexibility and customization, allowing individuals to choose specific benefits and coverage limits that align with their unique healthcare needs and preferences.

Private insurers in Mongolia typically provide a range of plans, from basic coverage for essential healthcare services to more comprehensive plans that include specialized treatments, dental care, and even alternative medicine practices. These plans often have higher premium costs but can provide significant benefits, particularly for those with pre-existing conditions or those seeking access to advanced medical technologies.

Expatriate Health Insurance

For expatriates living and working in Mongolia, specialized expatriate health insurance plans are available. These plans are designed to cater to the unique healthcare needs of this population, often offering more comprehensive coverage than standard private insurance plans. Expatriate insurance plans typically include coverage for emergency medical evacuations, which can be crucial for those living in remote areas or far from advanced medical facilities.

Expatriate insurance plans also often provide access to a global network of healthcare providers, ensuring that insured individuals can receive medical care even when they are traveling outside of Mongolia. This added layer of protection is particularly valuable for expatriates, who may need to access medical services in multiple countries.

Comparative Analysis of Medical Insurance Options

When considering medical insurance options in Mongolia, it’s essential to conduct a comprehensive comparative analysis. This process involves evaluating various insurance plans based on a range of factors, including coverage limits, provider networks, premium costs, and additional benefits. By comparing these elements, individuals can make informed decisions about which insurance plan best suits their healthcare needs and budget.

Coverage Limits and Benefits

Coverage limits refer to the maximum amount an insurance plan will pay for a specific healthcare service or treatment. These limits can vary significantly between insurance plans, with some plans offering more generous coverage for certain services while others may have lower limits or exclude certain treatments altogether.

For example, while most insurance plans in Mongolia cover basic healthcare services, such as doctor visits and laboratory tests, the coverage for specialized treatments like dialysis or cancer therapies can vary widely. Some plans may offer unlimited coverage for these treatments, while others may have annual or lifetime limits. Understanding these coverage limits is crucial for individuals with specific healthcare needs or pre-existing conditions.

Provider Networks and Accessibility

The network of healthcare providers an insurance plan works with is another critical factor to consider. Some insurance plans have exclusive contracts with specific hospitals or clinics, while others have more extensive networks that include a broader range of providers. The size and diversity of the provider network can impact an individual’s access to healthcare services, particularly in rural areas where medical facilities may be limited.

In addition to the number of providers in the network, it's also important to consider the quality of care provided by these facilities. Some insurance plans may partner with top-tier hospitals or specialists, ensuring access to the highest standard of medical care. Others may have more cost-effective options, balancing quality and affordability.

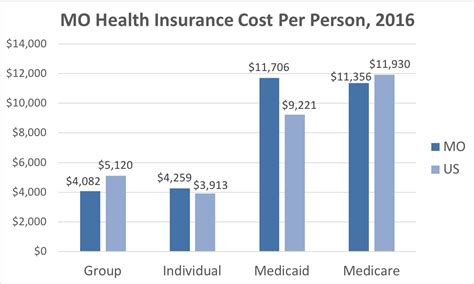

Premium Costs and Financial Considerations

The premium cost of an insurance plan is a key factor in the decision-making process. Premiums can vary significantly between insurance plans, with public health insurance generally being more affordable than private or expatriate plans. However, it’s important to remember that lower premiums often come with trade-offs, such as higher deductibles or more limited coverage.

When comparing premium costs, it's essential to consider the overall financial implications of each plan. This includes not only the monthly or annual premium but also potential out-of-pocket expenses, such as deductibles, co-pays, and co-insurance. These additional costs can quickly add up, especially for individuals who require frequent medical care or have complex healthcare needs.

Performance Analysis and Key Metrics

Conducting a performance analysis of medical insurance plans in Mongolia involves evaluating key metrics and indicators that reflect the effectiveness and efficiency of these plans. This analysis can provide valuable insights into the overall quality of insurance coverage and help identify areas for improvement.

Claim Settlement Ratio

The claim settlement ratio is a critical metric for evaluating the performance of medical insurance plans. This ratio represents the percentage of claims that are successfully settled by the insurance company. A high claim settlement ratio indicates that the insurance company is effectively managing its claims process, promptly resolving disputes, and providing timely payouts to policyholders.

A low claim settlement ratio, on the other hand, may suggest that the insurance company is facing challenges in managing its claims, leading to delays in payouts or even disputes with policyholders. This can be a significant concern for individuals, as it may impact their ability to access timely healthcare services or receive reimbursements for medical expenses.

Customer Satisfaction and Grievance Handling

Customer satisfaction is a key indicator of the overall quality of an insurance plan. Insurance companies that prioritize customer satisfaction often have more effective communication channels, provide clear and concise policy information, and offer efficient claims processes. High customer satisfaction rates can indicate that policyholders are generally pleased with their insurance coverage and the services provided by the insurer.

Conversely, low customer satisfaction rates may suggest that policyholders are facing challenges with their insurance plans, such as complex or unclear policy terms, lengthy claims processes, or unsatisfactory grievance handling procedures. These issues can impact an individual's overall experience with their insurance plan and may influence their decision to renew or switch providers.

Financial Stability and Solvency

The financial stability and solvency of an insurance company are crucial factors in evaluating the long-term viability of medical insurance plans. Insurance companies with strong financial health are better equipped to manage risks, honor their policy commitments, and provide stable insurance coverage over the long term.

Financial stability can be assessed through various metrics, including the insurer's capital adequacy, profitability, and overall financial health. These indicators provide insights into the insurer's ability to manage its liabilities, such as policyholder claims, and ensure that it can meet its financial obligations in the future.

Evidence-Based Future Implications

Looking ahead, the future of medical insurance in Mongolia is shaped by a range of factors, including evolving healthcare needs, technological advancements, and policy changes. By examining these factors through an evidence-based lens, we can gain insights into the potential implications for medical insurance coverage in the country.

Rising Healthcare Costs

One of the key challenges facing the medical insurance industry in Mongolia is the rising cost of healthcare. As medical technologies advance and the demand for specialized treatments increases, the cost of healthcare services is expected to rise. This trend can place significant pressure on insurance companies, potentially leading to higher premiums or more limited coverage options.

To mitigate the impact of rising healthcare costs, insurance companies may need to explore innovative solutions, such as partnering with healthcare providers to negotiate more favorable rates or investing in preventative healthcare initiatives to reduce the overall demand for costly treatments. Additionally, promoting health literacy and encouraging healthy lifestyle choices among the population can help reduce the burden of chronic diseases, which are often associated with higher healthcare costs.

Technological Advancements and Digital Health

The rapid advancement of technology is revolutionizing the healthcare industry, and Mongolia is no exception. The integration of digital health technologies, such as telemedicine and health tracking apps, has the potential to transform the way healthcare services are delivered and accessed.

For insurance companies, embracing digital health solutions can offer numerous benefits. Telemedicine, for instance, can improve access to healthcare services, particularly in remote areas, and reduce the need for costly in-person consultations. Health tracking apps and wearable devices can provide insurers with valuable data on policyholders' health and lifestyle, enabling more accurate risk assessment and potentially leading to more tailored insurance plans.

Policy Changes and Regulatory Landscape

The regulatory landscape in Mongolia is subject to change, and policy shifts can have a significant impact on the medical insurance industry. Changes in healthcare regulations, tax policies, or insurance mandates can influence the structure and cost of insurance plans, as well as the benefits they provide.

Insurance companies need to stay abreast of these policy changes and adapt their strategies accordingly. For example, if the government introduces new mandates for insurance coverage, such as expanding the scope of essential health benefits, insurers will need to adjust their plans to comply with these regulations. Similarly, changes in tax policies can impact the financial viability of insurance plans, requiring insurers to carefully consider their pricing strategies.

Conclusion

In conclusion, navigating the world of medical insurance in Mongolia requires a comprehensive understanding of the healthcare landscape, the various insurance options available, and the key metrics that define insurance plan performance. By conducting a thorough comparative analysis and staying informed about future implications, individuals can make informed decisions about their insurance coverage, ensuring that they have the protection they need to access quality healthcare services.

As the healthcare system in Mongolia continues to evolve, the role of medical insurance becomes increasingly crucial. Insurance plans provide a vital safety net, helping individuals manage the financial burden of healthcare and ensuring access to the medical services they require. With the right insurance coverage, individuals can focus on their health and well-being, knowing that they are protected against the uncertainties of medical costs.

Whether you're a local resident or an expatriate living in Mongolia, choosing the right medical insurance plan is a critical decision. By arming yourself with knowledge and staying up-to-date with the latest developments in the medical insurance industry, you can make choices that align with your healthcare needs and financial situation, ultimately leading to a healthier and more secure future.

What are the key benefits of public health insurance in Mongolia?

+Public health insurance in Mongolia, provided by the National Health Insurance Fund (NHIF), offers a range of benefits. These include coverage for a wide range of healthcare services, from basic medical care to specialized treatments, pharmaceuticals, and emergency care. The NHIF’s network of healthcare providers is extensive, ensuring access to a diverse range of medical services across the country. Additionally, public health insurance is generally more affordable than private insurance plans, making it accessible to a broader segment of the population.

How do private health insurance plans differ from public insurance in Mongolia?

+Private health insurance plans in Mongolia offer more flexibility and customization compared to public insurance. These plans allow individuals to choose specific benefits and coverage limits that align with their unique healthcare needs and preferences. While private plans often have higher premium costs, they can provide significant benefits, particularly for those with pre-existing conditions or specialized healthcare needs. Private insurers typically provide a range of plans, from basic coverage to more comprehensive options that include specialized treatments, dental care, and alternative medicine practices.

What should expatriates consider when choosing medical insurance in Mongolia?

+Expatriates living in Mongolia should consider specialized expatriate health insurance plans, which are designed to cater to their unique healthcare needs. These plans often offer more comprehensive coverage, including emergency medical evacuations, which can be crucial for those living in remote areas or far from advanced medical facilities. Expatriate insurance plans also typically provide access to a global network of healthcare providers, ensuring that insured individuals can receive medical care even when they are traveling outside of Mongolia. Additionally, expatriates should carefully evaluate the coverage limits, provider networks, and financial considerations of each plan to find the best fit for their needs and budget.