Catastrophic Health Insurance Over 60

Catastrophic health insurance, often referred to as high-deductible health plans, has gained attention as an alternative option for individuals aged 60 and above who are seeking cost-effective healthcare coverage. While traditional health insurance plans offer comprehensive coverage, catastrophic health insurance takes a different approach by providing protection against extreme medical expenses while typically offering lower premiums. For older adults, this type of insurance can be an appealing option, especially for those who prioritize flexibility and control over their healthcare expenses.

In this comprehensive guide, we will delve into the world of catastrophic health insurance, specifically tailored for individuals over the age of 60. We will explore the unique features, benefits, and considerations of these plans, offering an in-depth analysis to help you make informed decisions about your healthcare coverage. From understanding the basic structure of catastrophic health insurance to comparing it with traditional plans and examining real-world examples, this article aims to provide valuable insights into this growing trend in the healthcare industry.

Understanding Catastrophic Health Insurance for Seniors

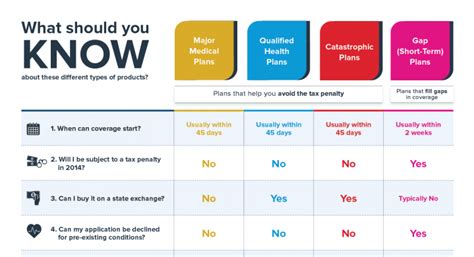

Catastrophic health insurance plans are designed to offer a safety net for individuals facing unexpected and severe medical conditions or accidents. Unlike regular health insurance plans, which typically cover a broad range of medical services, catastrophic plans have a much higher deductible. This means that policyholders must pay a significant portion of their medical expenses out of pocket before the insurance coverage kicks in.

For older adults, who may have specific healthcare needs and a higher risk of developing chronic conditions, catastrophic health insurance can provide a sense of financial security while allowing them to maintain control over their healthcare decisions. These plans are particularly attractive to those who are generally healthy and wish to avoid high monthly premiums associated with comprehensive coverage.

Key Features of Catastrophic Health Insurance Plans

Catastrophic health insurance plans often include the following features:

- High Deductible: The defining characteristic of catastrophic health insurance is its high deductible. This means policyholders must meet a substantial out-of-pocket expense threshold before the insurance coverage takes effect. Deductibles can range from several thousand dollars to tens of thousands of dollars, depending on the plan and the insurer.

- Limited Coverage: These plans typically provide coverage only for major medical events, such as hospitalization, emergency room visits, and significant procedures. Routine check-ups, preventive care, and prescription medications are often not covered or are covered at a lower level.

- Out-of-Pocket Maximum: While catastrophic plans have high deductibles, they also have an out-of-pocket maximum. This is the most you will pay for covered services in a year, after which the insurance company covers 100% of eligible expenses. This maximum helps protect policyholders from excessive financial burdens in the event of a severe illness or injury.

- Preventive Care Benefits: Despite their limited scope, many catastrophic health insurance plans offer some coverage for preventive care services. These may include annual wellness visits, immunizations, and certain screenings, which can help detect health issues early on.

It's important to note that the specific features and benefits of catastrophic health insurance plans can vary widely between insurers and regions. It's crucial to carefully review the plan details and understand the coverage limits and exclusions before making a decision.

The Appeal of Catastrophic Health Insurance for Seniors

Catastrophic health insurance plans have gained popularity among seniors for several compelling reasons:

Cost Savings

The primary appeal of catastrophic health insurance is its potential for cost savings. With lower monthly premiums compared to traditional health insurance plans, seniors can allocate their financial resources more efficiently. This is especially beneficial for those on fixed incomes or who prioritize other financial goals, such as retirement savings or travel expenses.

| Plan Type | Average Monthly Premium |

|---|---|

| Traditional Health Insurance | $500 - $1,000 |

| Catastrophic Health Insurance | $150 - $400 |

By opting for a catastrophic plan, seniors can save hundreds of dollars each month, providing financial relief and peace of mind.

Flexibility and Control

Catastrophic health insurance plans give seniors more control over their healthcare decisions. With a higher deductible, policyholders can choose when and how to utilize their healthcare services. This flexibility allows them to prioritize their health needs and make informed choices about their medical care, especially if they have specific conditions or preferences for certain providers.

Protection Against Major Medical Expenses

Despite their limited coverage, catastrophic health insurance plans provide essential protection against major medical expenses. For seniors, who may face an increased risk of serious health issues, having a safety net in place can be invaluable. The high deductible ensures that policyholders are financially prepared for unexpected hospitalizations, surgeries, or other costly procedures, preventing potential financial devastation.

Comparing Catastrophic Health Insurance with Traditional Plans

When considering catastrophic health insurance, it’s essential to compare it with traditional health insurance plans to make an informed decision. While catastrophic plans offer cost savings and flexibility, traditional plans provide more comprehensive coverage and may be a better fit for certain individuals.

Comprehensive Coverage vs. Catastrophic Protection

Traditional health insurance plans aim to cover a wide range of medical services, including preventive care, routine check-ups, prescription medications, and specialized treatments. These plans typically have lower deductibles and out-of-pocket expenses, making them more suitable for individuals who require frequent medical attention or have existing health conditions.

In contrast, catastrophic health insurance plans focus on protecting policyholders from extreme financial burdens resulting from major medical events. They are best suited for individuals who are generally healthy, prioritize cost savings, and are willing to accept higher out-of-pocket expenses in exchange for lower premiums.

Cost Comparison

The cost of health insurance plans can vary significantly based on factors such as age, location, and the level of coverage desired. While catastrophic health insurance plans often have lower monthly premiums, traditional plans may offer more comprehensive coverage for a slightly higher cost.

| Plan Type | Average Monthly Premium | Coverage Level |

|---|---|---|

| Catastrophic Health Insurance | $150 - $400 | Limited coverage, high deductible |

| Traditional Health Insurance | $500 - $1,000 | Comprehensive coverage, lower deductible |

Personalized Healthcare Needs

When deciding between catastrophic and traditional health insurance, it’s crucial to consider your unique healthcare needs. If you have specific medical conditions or require regular access to healthcare services, a traditional plan may be more suitable. However, if you prioritize cost savings and are generally healthy, a catastrophic plan could be an excellent option.

Real-World Examples: Success Stories and Considerations

Let’s explore some real-world scenarios to better understand how catastrophic health insurance plans can benefit seniors.

The Story of Jane

Jane, a 65-year-old retiree, decided to opt for a catastrophic health insurance plan after carefully considering her healthcare needs. As a generally healthy individual with no major medical concerns, Jane chose a plan with a high deductible and lower monthly premiums. This allowed her to save money each month, which she could allocate towards other financial goals, such as traveling and enjoying her retirement.

Fortunately, Jane remained healthy and did not require significant medical attention. However, when she did need emergency surgery due to a sudden health issue, her catastrophic health insurance plan covered the majority of the expenses, protecting her from financial ruin. Jane's story highlights the potential benefits of catastrophic health insurance for seniors who prioritize cost savings and have minimal healthcare needs.

The Experience of John

John, a 62-year-old with a history of chronic conditions, chose a traditional health insurance plan despite the higher monthly premiums. His decision was driven by his need for regular medical care and the peace of mind that came with comprehensive coverage. John’s plan covered his routine check-ups, medications, and specialized treatments, ensuring that his healthcare needs were well-managed.

John's story emphasizes the importance of considering personalized healthcare needs when choosing between catastrophic and traditional health insurance. For individuals with specific medical conditions or those who require frequent access to healthcare services, a traditional plan may be the more suitable option.

Choosing the Right Health Insurance Plan

When selecting a health insurance plan, whether it’s a catastrophic or traditional option, it’s essential to consider your individual circumstances and healthcare needs. Here are some key factors to keep in mind:

Health Status and Needs

Evaluate your current and potential future health status. If you have pre-existing conditions or require regular medical attention, a traditional health insurance plan may be more beneficial. However, if you are generally healthy and prioritize cost savings, a catastrophic plan could be a wise choice.

Financial Considerations

Assess your financial situation and determine how much you can afford to spend on health insurance premiums. Compare the costs of different plans, considering both monthly premiums and potential out-of-pocket expenses. Remember that while catastrophic plans may have lower premiums, they can result in higher out-of-pocket costs if major medical events occur.

Provider Network and Coverage

Review the provider network and coverage options of each plan. Ensure that your preferred healthcare providers and specialists are included in the network, especially if you have specific healthcare needs. Consider the plan’s coverage for prescription medications, as this can be a significant expense for many seniors.

Personal Preferences and Lifestyle

Think about your personal preferences and lifestyle. Do you prioritize flexibility and control over your healthcare decisions? Are you comfortable with the idea of paying more out of pocket for major medical events in exchange for lower premiums? Understanding your preferences can help guide your decision-making process.

Future Implications and Trends

The healthcare industry is constantly evolving, and the landscape of health insurance options is no exception. As more seniors opt for catastrophic health insurance plans, several key implications and trends emerge:

Increased Demand for Catastrophic Plans

The growing popularity of catastrophic health insurance plans among seniors indicates a shift in consumer preferences. As individuals become more financially conscious and seek greater control over their healthcare decisions, the demand for these plans is likely to increase. Insurers will need to adapt their offerings to meet this changing demand, potentially leading to more comprehensive and competitive catastrophic health insurance options.

Innovation in Plan Design

To meet the diverse needs of seniors, insurers may explore innovative plan designs that combine elements of both catastrophic and traditional health insurance. These hybrid plans could offer more flexibility and customization, allowing policyholders to choose their level of coverage and deductible based on their personal healthcare needs and financial situation.

Focus on Preventive Care

Despite their limited coverage, catastrophic health insurance plans often include some preventive care benefits. As the importance of preventive care becomes more widely recognized, insurers may expand these benefits to encourage policyholders to take a proactive approach to their health. This could lead to better overall health outcomes and potentially reduce the need for costly medical interventions in the future.

Integration of Technology

The healthcare industry is embracing technology, and health insurance is no exception. Insurers may utilize digital platforms and tools to enhance the customer experience, improve claim processing, and provide more personalized recommendations for policyholders. This integration of technology could make it easier for seniors to navigate their health insurance plans and access the care they need.

Conclusion

Catastrophic health insurance plans offer a unique and appealing option for seniors seeking cost-effective healthcare coverage. While they may not provide the same level of comprehensive coverage as traditional plans, catastrophic insurance can be a smart choice for those who prioritize financial savings and have minimal healthcare needs. As the healthcare industry continues to evolve, we can expect to see further developments and innovations in the design and offerings of catastrophic health insurance plans, ensuring that seniors have access to a range of tailored options to meet their specific healthcare requirements.

What is the average cost of a catastrophic health insurance plan for seniors over 60?

+The average cost of a catastrophic health insurance plan for seniors over 60 can vary based on factors such as location, age, and the specific plan chosen. On average, monthly premiums for catastrophic plans range from 150 to 400, offering significant cost savings compared to traditional health insurance plans.

Are there any age restrictions for purchasing catastrophic health insurance plans?

+While there are no strict age restrictions for purchasing catastrophic health insurance plans, it’s important to note that these plans are generally more suitable for individuals who are generally healthy and have minimal healthcare needs. Seniors over the age of 60 who meet these criteria can benefit from the cost savings and flexibility offered by catastrophic plans.

How do I choose between a catastrophic and traditional health insurance plan?

+When deciding between a catastrophic and traditional health insurance plan, consider your individual healthcare needs and financial situation. If you have specific medical conditions or require regular access to healthcare services, a traditional plan may be more suitable. However, if you prioritize cost savings and are generally healthy, a catastrophic plan could be an excellent option. It’s crucial to carefully review the coverage, deductibles, and out-of-pocket expenses of each plan to make an informed decision.

Can I customize my catastrophic health insurance plan to fit my specific needs?

+While catastrophic health insurance plans generally have a standard structure, some insurers may offer limited customization options. This could include choosing a higher or lower deductible, adding certain benefits, or selecting a specific provider network. It’s essential to review the plan details and speak with your insurance provider to understand the customization options available to you.