Car Insurance For Car

Navigating the world of car insurance can be a daunting task, especially for those who are new to the process or looking to make a change. With countless options and variables to consider, it's essential to have a comprehensive understanding of the coverage options available. This article aims to provide an expert-level guide to car insurance, covering everything from the basics to advanced strategies, ensuring you make informed decisions about your automotive coverage.

Understanding the Fundamentals of Car Insurance

Car insurance is a legal contract between you and an insurance provider, designed to protect you financially in the event of an accident, theft, or other vehicle-related incidents. It’s a crucial aspect of vehicle ownership, providing peace of mind and ensuring you’re prepared for the unexpected. Here’s a breakdown of the fundamental components of car insurance:

Liability Coverage

Liability coverage is the cornerstone of any car insurance policy. It covers the costs associated with injuries or property damage you cause to others in an accident. This includes medical expenses, lost wages, and legal fees. Most states have minimum liability requirements, but it’s generally recommended to opt for higher limits to ensure adequate protection.

| Liability Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages of injured parties. |

| Property Damage Liability | Pays for repairs or replacement of damaged property due to the insured's negligence. |

Comprehensive and Collision Coverage

While liability coverage protects you from financial losses caused to others, comprehensive and collision coverage focuses on your vehicle’s protection. Comprehensive coverage provides a safety net against non-collision incidents like theft, vandalism, natural disasters, or hitting an animal. Collision coverage, on the other hand, covers damages to your vehicle in the event of a collision with another vehicle or object.

| Coverage Type | Description |

|---|---|

| Comprehensive Coverage | Covers damages caused by events other than collisions, including theft, fire, and natural disasters. |

| Collision Coverage | Pays for repairs or replacement of your vehicle after a collision with another vehicle or object. |

Medical Payments Coverage

Medical payments coverage, often referred to as MedPay, is designed to cover the medical expenses of you and your passengers in the event of an accident, regardless of fault. It provides a quick and straightforward way to access medical care without waiting for liability claims to be resolved.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is a vital aspect of car insurance, especially in states with a high percentage of uninsured drivers. This coverage steps in when the at-fault driver doesn’t have sufficient insurance to cover the damages. It ensures you’re protected financially, even in the face of negligent drivers.

Assessing Your Car Insurance Needs

Determining the right level of car insurance coverage involves a careful assessment of your unique circumstances and needs. Here are some key factors to consider:

Vehicle Value and Age

The value and age of your vehicle play a significant role in determining your insurance needs. If you own a new or high-value vehicle, comprehensive and collision coverage are essential to protect your investment. For older vehicles, you might consider dropping collision and comprehensive coverage if the cost of repairs exceeds the vehicle’s value.

Driving History and Habits

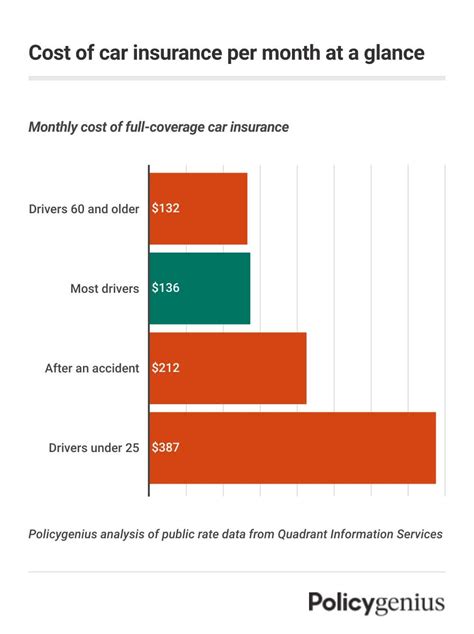

Your driving history and habits are key indicators of your risk profile. If you have a clean driving record and practice safe driving habits, you may qualify for lower premiums. On the other hand, a history of accidents or traffic violations could lead to higher insurance costs.

Financial Stability and Risk Tolerance

Assessing your financial stability and risk tolerance is crucial. If you have substantial assets, you may want to opt for higher liability limits to protect your financial well-being. Conversely, if you’re comfortable with a higher deductible, you can lower your insurance premiums.

State Laws and Requirements

Every state has its own set of car insurance laws and requirements. Understanding these laws is essential to ensure you meet the minimum legal standards. Some states, for instance, require personal injury protection (PIP) coverage, which provides medical benefits to you and your passengers regardless of fault.

Optimizing Your Car Insurance Coverage

Once you have a solid understanding of your insurance needs, it’s time to explore strategies to optimize your coverage and potentially save on premiums. Here are some expert tips to consider:

Bundling Policies

Bundling your car insurance with other policies, such as home or renters insurance, can lead to significant savings. Insurance providers often offer multi-policy discounts, rewarding customers for their loyalty and trust.

Choosing the Right Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premiums, but it’s essential to select a deductible that aligns with your financial comfort level.

Utilizing Telematics and Safe Driver Programs

Some insurance providers offer telematics devices or apps that track your driving habits. These programs can provide discounts based on your safe driving behavior, such as smooth braking and avoiding sudden accelerations. Additionally, many insurance companies offer safe driver programs that reward accident-free periods with reduced premiums.

Exploring Discounts and Special Programs

Insurance providers often offer a wide range of discounts and special programs to attract and retain customers. These can include discounts for good students, senior citizens, military personnel, or even specific professions. It’s worth exploring these options to see if you qualify for any additional savings.

Navigating the Claims Process

Understanding the claims process is essential to ensure a smooth and stress-free experience when you need to file a claim. Here’s a step-by-step guide to help you navigate this process:

Reporting the Incident

As soon as an accident or incident occurs, it’s crucial to report it to your insurance provider. Most insurance companies have dedicated claims hotlines, and some even offer online or app-based reporting options. Provide as much detail as possible about the incident, including any injuries, property damage, and witness information.

Assessing the Damage

Once you’ve reported the incident, your insurance provider will assign an adjuster to assess the damage. The adjuster will review the scene, evaluate the extent of the damage, and provide an estimate for repairs or replacements. It’s essential to cooperate fully with the adjuster to ensure a timely and accurate assessment.

Filing a Claim and Receiving Compensation

After the assessment, you’ll need to file a formal claim with your insurance provider. This typically involves providing additional documentation, such as police reports, medical records, and repair estimates. Once your claim is approved, you’ll receive compensation based on your policy’s terms and conditions. It’s important to understand your policy’s coverage limits and any deductibles that may apply.

Resolving Disputes and Seeking Legal Advice

In some cases, disputes may arise during the claims process. If you feel your claim is being unfairly denied or delayed, it’s essential to understand your rights and options. Many states have insurance regulatory bodies that can provide guidance and assistance. Additionally, seeking legal advice from an experienced insurance attorney can be beneficial in navigating complex claims scenarios.

The Future of Car Insurance

The car insurance industry is evolving rapidly, driven by advancements in technology and changing consumer expectations. Here’s a glimpse into the future of car insurance and how it may impact your coverage:

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior and habits, is expected to play an increasingly significant role in car insurance. Usage-based insurance (UBI) programs, which offer premiums based on real-time driving data, are becoming more common. These programs reward safe drivers with lower premiums, providing a more personalized and fair pricing model.

Artificial Intelligence and Data Analytics

Artificial intelligence (AI) and data analytics are revolutionizing the insurance industry. Insurance providers are leveraging these technologies to enhance fraud detection, streamline claims processes, and offer more accurate risk assessments. This shift towards data-driven decision-making is expected to improve overall efficiency and customer satisfaction.

Autonomous Vehicles and Emerging Risks

The rise of autonomous vehicles presents new challenges and opportunities for the insurance industry. As self-driving cars become more prevalent, the focus may shift from individual driver behavior to vehicle performance and manufacturer liability. Insurance providers are actively researching and developing coverage options to address these emerging risks.

How much car insurance do I need?

+

The amount of car insurance you need depends on various factors, including your state’s legal requirements, the value of your vehicle, and your personal risk tolerance. As a general guideline, it’s recommended to have at least the minimum liability coverage required by your state, but consider opting for higher limits to ensure comprehensive protection.

Can I switch car insurance providers?

+

Absolutely! Switching car insurance providers is a common practice, and it can lead to significant savings or improved coverage. Regularly reviewing and comparing policies from different providers is a wise strategy to ensure you’re getting the best value for your money.

What happens if I don’t have car insurance?

+

Driving without car insurance is illegal in most states and can result in severe penalties, including fines, license suspension, and even jail time. Additionally, you’ll be financially responsible for any damages or injuries you cause in an accident, which can be devastating.

How can I save on car insurance premiums?

+

There are several strategies to save on car insurance premiums, including bundling policies, choosing a higher deductible, taking advantage of discounts and special programs, and maintaining a clean driving record. Regularly reviewing your policy and shopping around for better rates can also lead to significant savings.

What should I do if I’m involved in an accident?

+

If you’re involved in an accident, the first step is to ensure the safety of all involved parties. Call the police to report the incident and exchange information with the other driver(s). Take photos of the scene and any visible damage. Report the accident to your insurance provider as soon as possible, and cooperate fully with the claims process.