Aaa Insurance Pay Bill

Making timely payments for your insurance policies is essential to ensure uninterrupted coverage and avoid any lapses in protection. Aaa Insurance, a leading provider of insurance services, offers its customers convenient and flexible payment options to facilitate an easy and hassle-free payment process. In this comprehensive guide, we will delve into the various methods Aaa Insurance offers for paying your insurance bills, providing step-by-step instructions and valuable insights to ensure a smooth and efficient payment experience.

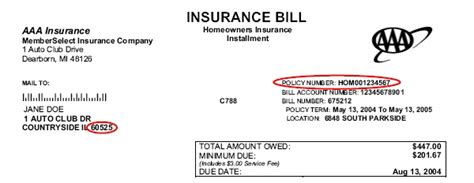

Understanding Your Aaa Insurance Bill

Before diving into the payment methods, it's crucial to understand the components of your Aaa Insurance bill. Typically, an insurance bill includes the following:

- Policy Number: A unique identifier for your insurance policy, which helps Aaa Insurance track your payments and coverage details.

- Billing Period: The duration for which the bill covers, usually a month or a quarter.

- Premium Amount: The cost of your insurance coverage for the specified billing period.

- Due Date: The date by which your payment should be received to avoid any late fees or penalties.

- Payment Options: A list of available methods to pay your bill, such as online, by phone, or through mail.

Familiarizing yourself with these details on your bill will help you navigate the payment process more effectively. Now, let's explore the various payment methods offered by Aaa Insurance.

Online Payment

One of the most convenient and popular ways to pay your Aaa Insurance bill is through their online payment portal. Here's a step-by-step guide to help you make a seamless online payment:

-

Access the Aaa Insurance Website: Visit the official Aaa Insurance website using a web browser. Ensure you are on the authentic website by checking for the correct URL and secure connection (https://).

-

Locate the Payment Portal: On the homepage, look for a "Make a Payment" or "Pay Your Bill" button or link. It is often found in the top navigation bar or a prominent place on the homepage.

-

Log In to Your Account: If you have an Aaa Insurance online account, log in using your username and password. If you don't have an account, you can create one by following the prompts on the website. Creating an account provides additional benefits like viewing your policy details, tracking payments, and managing your insurance portfolio.

-

Enter Payment Details: Once logged in, you will be directed to the payment page. Here, you need to provide the following information:

- Your policy number (as mentioned on your bill)

- The amount you wish to pay (usually the full premium amount, but you can also make partial payments)

- Your preferred payment method (credit/debit card, bank account, or other available options)

-

Review and Confirm Payment: Carefully review the payment details, including the amount, payment method, and any additional fees (if applicable). Ensure all the information is correct and complete. Once satisfied, confirm the payment by clicking the "Submit" or "Pay Now" button.

-

Receive Confirmation: After confirming your payment, you will receive an on-screen confirmation message and an email notification (if you have provided an email address). This confirmation serves as a receipt for your payment. It is advisable to save or print this confirmation for your records.

Tips for Online Payment

- Ensure you are using a secure internet connection, especially when entering sensitive financial information.

- Keep your policy number and payment details handy to streamline the payment process.

- If you encounter any issues during the online payment process, reach out to Aaa Insurance's customer support for assistance.

- Consider setting up automatic payments to ensure timely payments and avoid late fees.

Pay by Phone

For those who prefer a more personal touch or have difficulty with online payments, Aaa Insurance offers the option to pay your bill over the phone. Here's how you can make a payment using this method:

-

Locate the Customer Service Phone Number: On your insurance bill or the Aaa Insurance website, you will find a dedicated phone number for customer service or billing inquiries. This number is usually toll-free and available 24/7.

-

Call the Customer Service Line: Dial the provided phone number and follow the automated prompts or wait for a customer service representative to answer your call.

-

Provide Your Policy Information: When connected to a representative, they will ask for your policy number and other details to verify your identity and access your account.

-

Choose the Payment Option: The representative will guide you through the payment process. You can choose to pay using a credit/debit card, bank account, or other available options. Provide the required payment details accurately.

-

Confirm Payment: After entering your payment details, the representative will verify the information and confirm the payment. You will receive a confirmation number or reference for your records.

-

Receive Payment Confirmation: Following the payment confirmation, you will receive an email or a letter in the mail as a written confirmation of your payment. Keep this confirmation for your records and future reference.

Phone Payment Tips

- Have your policy number and payment details ready before calling to save time.

- Be prepared to provide your credit/debit card or bank account information securely over the phone.

- If you encounter any issues during the phone payment process, don't hesitate to ask the representative for assistance.

- Consider setting up recurring payments over the phone to ensure consistent coverage without the hassle of manual payments.

Mail-in Payment

Aaa Insurance also accepts payments through traditional mail. While it may take a few extra days for your payment to reach the company, this method is suitable for those who prefer a more old-school approach or have limited access to online or phone services.

Step-by-Step Guide to Mail-in Payment

-

Prepare Your Payment: Gather the following items to prepare your payment:

- Your insurance bill or a copy of it, which includes your policy number and due date.

- A check or money order made payable to Aaa Insurance. Ensure the amount matches the premium due.

- A self-addressed stamped envelope (if you want a receipt for your records).

-

Write a Payment Remittance: On the back of your check or money order, write your policy number and the billing period for which you are making the payment. This ensures that your payment is correctly allocated to your account.

-

Seal and Address the Envelope: Place your check or money order, along with your insurance bill or a copy, inside the self-addressed stamped envelope. Seal the envelope securely.

-

Mail Your Payment: Send the sealed envelope to the address specified for payments on your insurance bill or the Aaa Insurance website. Ensure you use a reliable mail service and allow sufficient time for your payment to reach the company before the due date.

-

Receive Payment Confirmation: After Aaa Insurance receives your payment, they will process it and send you a confirmation of payment. This confirmation will be mailed to the address associated with your policy.

Mail-in Payment Tips

- Always ensure your payment is made payable to Aaa Insurance to avoid any confusion or delays.

- Include your policy number on the payment remittance to ensure accurate allocation.

- Allow ample time for your payment to reach Aaa Insurance before the due date to avoid late fees.

- If you require a receipt for your records, include a self-addressed stamped envelope with your payment.

Automatic Payment Options

To make your insurance payments even more convenient and hassle-free, Aaa Insurance offers automatic payment options. These options allow you to set up recurring payments, ensuring your insurance coverage remains uninterrupted without the need for manual interventions.

Setting Up Automatic Payments

-

Online Setup: Log in to your Aaa Insurance online account and navigate to the "Payment Options" or "Billing" section. Here, you will find an option to set up automatic payments. Choose your preferred payment method (credit/debit card or bank account) and provide the necessary details.

-

Phone Setup: Call the Aaa Insurance customer service line and request to set up automatic payments. The representative will guide you through the process, verifying your identity and account details. You will need to provide your payment method details and choose the frequency of payments (monthly, quarterly, etc.)

-

Mail Setup: Aaa Insurance may provide a form or instructions for setting up automatic payments through mail. Fill out the form, providing your policy number, payment method details, and the frequency of payments. Mail the completed form to the address specified on the form or the company's website.

Benefits of Automatic Payments

- Ensures timely payments, avoiding late fees and potential coverage lapses.

- Saves time and effort by eliminating the need for manual payments each billing cycle.

- Provides peace of mind, knowing your insurance coverage is always up-to-date.

- Offers flexibility with various payment frequencies to align with your financial preferences.

Payment Due Dates and Late Fees

Aaa Insurance understands that unexpected circumstances may arise, leading to missed payment deadlines. However, it's important to be aware of the payment due dates and the potential consequences of late payments.

Payment Due Dates

Your Aaa Insurance bill will clearly state the due date by which your payment should be received. It is advisable to make your payment a few days before the due date to account for any processing time or potential delays.

Late Payment Fees

If you fail to make your payment by the due date, Aaa Insurance may impose late fees. These fees vary depending on the type of insurance policy and the specific terms and conditions outlined in your policy agreement. It is crucial to review your policy documents to understand the late payment penalties applicable to your policy.

Grace Periods

In some cases, Aaa Insurance may offer a grace period after the due date before imposing late fees. This grace period allows you a short window to make your payment without incurring additional charges. However, it's important to note that grace periods may vary, and some policies may not offer this flexibility. Always refer to your policy documents for accurate information regarding grace periods.

Managing Your Aaa Insurance Account

To stay on top of your insurance coverage and payment obligations, it's beneficial to manage your Aaa Insurance account actively. Here are some tips to help you maintain a seamless relationship with Aaa Insurance:

-

Online Account Management: Create and log in to your online account regularly to access your policy details, view billing history, and manage payments. You can also update your personal information, such as address changes, and review any policy changes or renewals.

-

Payment Reminders: Enable payment reminders through email or text messages to stay informed about upcoming due dates. This helps you plan your finances and ensure timely payments.

-

Review Policy Documents: Regularly review your policy documents, including the terms and conditions, coverage details, and billing information. Understanding your policy inside and out will help you make informed decisions and avoid any surprises.

-

Contact Customer Service: If you have any questions or concerns about your insurance coverage or payment options, don't hesitate to reach out to Aaa Insurance's customer service team. They are there to assist you and provide guidance tailored to your specific needs.

Frequently Asked Questions (FAQ)

Can I pay my Aaa Insurance bill using a credit card?

+

Yes, Aaa Insurance accepts credit card payments for your insurance bills. You can make a credit card payment online through their secure payment portal or over the phone with a customer service representative.

What happens if I miss a payment deadline?

+

If you miss a payment deadline, Aaa Insurance may impose late fees. The specific late fees and grace periods vary depending on your policy and the terms outlined in your policy agreement. It’s important to review your policy documents to understand the potential consequences of late payments.

How do I update my billing address with Aaa Insurance?

+

To update your billing address with Aaa Insurance, you can log in to your online account and navigate to the “Profile” or “Account Information” section. Here, you will find an option to update your address details. Alternatively, you can contact customer service and provide them with your new address information.

Can I make partial payments for my insurance bill?

+

Yes, Aaa Insurance allows partial payments for your insurance bill. When making an online payment or over the phone, you can specify the amount you wish to pay, even if it’s less than the full premium due. However, keep in mind that partial payments may still be subject to late fees if they are made after the due date.