How Much Does House Insurance Cost

House insurance, also known as homeowners insurance, is a crucial aspect of protecting your home and finances. It provides coverage for various risks and liabilities associated with owning a house, offering financial security and peace of mind. The cost of house insurance can vary significantly based on numerous factors, and understanding these variables is essential for homeowners to make informed decisions about their coverage.

Factors Influencing House Insurance Costs

Several factors contribute to the overall cost of house insurance, and these can differ based on location, property characteristics, and personal circumstances. Let’s delve into some of the key factors that impact insurance premiums.

Location and Regional Risks

The geographical location of your home plays a significant role in determining insurance costs. Regions prone to natural disasters like hurricanes, tornadoes, earthquakes, or wildfires typically have higher insurance premiums. For instance, homes located in flood-prone areas often require additional flood insurance, which can significantly increase the overall cost. Similarly, areas with high crime rates may have higher premiums due to the increased risk of theft or vandalism.

Furthermore, the regional cost of living and construction can influence insurance rates. In areas with a higher cost of living, the cost of rebuilding a home after a disaster is generally more expensive, leading to higher insurance premiums. This factor is particularly relevant in densely populated urban areas or regions with high property values.

| Region | Average Annual Premium |

|---|---|

| Urban Center | $2,500 |

| Suburban Area | $1,800 |

| Rural Setting | $1,200 |

Property Characteristics and Age

The characteristics of your home, including its age, size, and construction materials, significantly impact insurance costs. Older homes often require more extensive coverage due to potential structural issues or outdated electrical systems, which can increase premiums. Similarly, larger homes generally have higher insurance costs because there’s more to insure, including a greater risk of damage or theft.

The construction materials used in your home can also affect insurance rates. Homes built with brick or stone may have lower premiums compared to those constructed with wood, as brick and stone are generally more durable and resistant to fire and weather damage.

Coverage Options and Deductibles

The level of coverage you choose for your home insurance policy is another critical factor in determining costs. Comprehensive policies that provide coverage for a wide range of risks, including theft, fire, and natural disasters, will typically have higher premiums. On the other hand, basic policies that cover only the most common risks may be more affordable but offer limited protection.

The deductible, which is the amount you agree to pay out of pocket before your insurance coverage kicks in, also influences the cost of your policy. Opting for a higher deductible can lower your monthly premiums, as you're taking on more financial responsibility in the event of a claim. However, it's important to choose a deductible that you can afford to pay if needed.

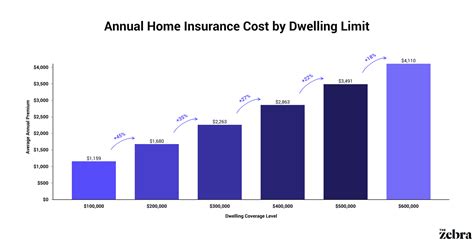

Average House Insurance Costs by Region

The average cost of house insurance can vary widely across different regions in the United States. Here’s a breakdown of average annual premiums based on various locations:

| Region | Average Annual Premium |

|---|---|

| Northeast | $1,800 |

| Midwest | $1,500 |

| South | $1,300 |

| West | $1,600 |

It's important to note that these averages are estimates and can vary significantly based on the specific location within each region and other individual factors. For a more accurate estimate, it's advisable to obtain quotes from multiple insurance providers.

Tips for Lowering House Insurance Costs

While the cost of house insurance is influenced by various factors beyond your control, there are several strategies you can employ to potentially reduce your premiums. Here are some tips to consider:

- Bundle Policies: Many insurance companies offer discounts when you bundle multiple policies, such as homeowners insurance with auto insurance. This can lead to significant savings on your overall insurance costs.

- Improve Home Security: Investing in home security measures like alarm systems, motion-activated lighting, or reinforced doors and windows can deter burglars and reduce the risk of theft. Many insurance companies offer discounts for such improvements.

- Review Coverage Regularly: Regularly review your insurance policy to ensure you're not overinsured or underinsured. As your home's value and your personal circumstances change, your insurance needs may evolve. Adjusting your coverage accordingly can help keep costs down.

- Shop Around and Compare Quotes: Don't settle for the first insurance quote you receive. Obtain quotes from multiple providers to compare rates and coverage options. This allows you to choose the policy that best suits your needs at the most competitive price.

- Maintain a Good Credit Score: Insurance companies often use credit scores as a factor in determining premiums. Maintaining a good credit score can potentially lead to lower insurance rates.

Conclusion: Understanding and Managing House Insurance Costs

The cost of house insurance is influenced by a myriad of factors, from your location and home characteristics to the level of coverage you choose. While some factors are beyond your control, such as the regional risk of natural disasters, there are strategies you can employ to potentially lower your insurance premiums.

By understanding the key factors that impact insurance costs and taking proactive measures to reduce risks, you can make informed decisions about your coverage. Remember to regularly review your policy, compare quotes from multiple providers, and consider implementing security measures to potentially lower your premiums. With careful planning and a comprehensive understanding of your insurance needs, you can protect your home and finances effectively.

FAQ

What is the average cost of house insurance in the United States?

+

The average cost of house insurance in the United States is approximately $1,300 per year. However, this average can vary significantly based on factors such as location, property characteristics, and the level of coverage chosen.

Can I get a discount on my house insurance premium?

+

Yes, there are several ways to potentially lower your house insurance premiums. These include bundling policies, improving home security, reviewing coverage regularly, shopping around for quotes, and maintaining a good credit score.

How often should I review my house insurance policy?

+

It’s recommended to review your house insurance policy annually or whenever your circumstances change significantly. This ensures that your coverage remains adequate and that you’re not paying for unnecessary premiums.

What factors can increase my house insurance premiums?

+

Several factors can lead to higher house insurance premiums, including living in a disaster-prone area, having an older or larger home, choosing a lower deductible, or opting for a more comprehensive coverage plan.