New York Car Insurance

Car insurance is a crucial aspect of vehicle ownership, and in a bustling metropolis like New York City, it takes on an even greater significance. With its dense population, busy streets, and unique driving conditions, understanding and navigating the world of New York car insurance is essential for any driver residing in the Big Apple. In this comprehensive guide, we will delve into the intricacies of New York car insurance, covering everything from the state's laws and regulations to the factors that influence premiums and the steps you can take to secure the best coverage for your needs.

Understanding New York’s Car Insurance Landscape

New York State has implemented a range of laws and regulations to ensure that drivers are adequately insured and to protect all road users. These rules govern everything from the types of coverage required to the rights and responsibilities of drivers involved in accidents. Familiarizing yourself with these laws is the first step toward becoming a knowledgeable and responsible driver in New York.

Compulsory Insurance Requirements

In New York, car insurance is not just a good idea—it’s the law. The state mandates that all registered vehicles carry a minimum level of liability insurance to cover potential damages to others in the event of an accident. The specific requirements are as follows:

- Bodily Injury Liability: 25,000 per person and 50,000 per accident.

- Property Damage Liability: 10,000 per accident.</li> <li><strong>Uninsured/Underinsured Motorist Coverage</strong>: 25,000 per person and $50,000 per accident.

- Collision Coverage: Pays for damages to your vehicle if you’re involved in an accident, regardless of fault.

- Comprehensive Coverage: Covers damages to your vehicle due to non-accident-related incidents like theft, vandalism, or natural disasters.

- Medical Payments Coverage: Provides additional medical expense coverage for you and your passengers, regardless of fault.

- Rental Car Reimbursement: Covers the cost of a rental car if your vehicle is in the shop due to an insured incident.

These limits represent the minimum amount of coverage you must carry to comply with state law. However, it's important to note that these amounts may not be sufficient to cover the costs of serious accidents. Many drivers choose to increase their liability limits to provide greater financial protection.

No-Fault Insurance and Personal Injury Protection (PIP)

New York operates under a no-fault insurance system, which means that, regardless of who is at fault in an accident, your own insurance provider will cover your medical expenses and lost wages up to the limits of your policy. This coverage is known as Personal Injury Protection (PIP) and is a mandatory component of all New York car insurance policies. The minimum PIP coverage in New York is $50,000 per person.

Other Optional Coverages

While the aforementioned coverages are compulsory, New York drivers can also choose to add optional coverages to their policies to enhance their protection. These may include:

Factors Influencing New York Car Insurance Premiums

The cost of car insurance in New York can vary significantly from one driver to another. Insurance providers consider a multitude of factors when determining premiums, and understanding these factors can help you make informed decisions about your coverage and potentially save money.

Vehicle and Driver Information

The make, model, and year of your vehicle play a significant role in determining your insurance rates. Factors like the vehicle’s safety features, repair costs, and theft rates can all impact your premiums. Additionally, your personal driving history, including your accident and violation records, is a key consideration. A clean driving record can lead to lower rates, while a history of accidents or violations may result in higher premiums.

Coverage and Deductibles

The types and limits of coverage you choose will directly affect your insurance costs. As mentioned earlier, increasing your liability limits can provide greater protection but will also increase your premiums. Similarly, adding optional coverages like collision and comprehensive insurance will typically result in higher overall costs. However, it’s important to strike a balance between coverage and affordability to ensure you’re adequately protected.

Location and Usage

Where you live and how you use your vehicle can significantly impact your insurance rates. In New York, drivers in urban areas like New York City often face higher premiums due to increased traffic congestion, higher accident rates, and a greater risk of vehicle theft. Additionally, the distance you drive each year and the purpose of your driving (commuting, pleasure, or business) can also influence your rates.

Demographic Factors

Insurance providers may consider demographic factors such as age, gender, marital status, and occupation when calculating premiums. Younger drivers, particularly those under 25, often face higher rates due to their perceived higher risk of accidents. Similarly, certain occupations may be associated with higher or lower risk profiles, which can impact insurance costs.

Credit Score

In many states, including New York, insurance providers are allowed to use your credit score as a factor in determining your insurance premiums. A higher credit score is generally associated with lower insurance rates, as it indicates a lower risk of insurance claims. However, this practice has been the subject of debate, with critics arguing that it can disproportionately affect individuals with lower incomes or those who have experienced financial hardships.

Securing the Best New York Car Insurance

Navigating the complex world of car insurance can be daunting, but with the right approach and a bit of research, you can find the best coverage for your needs at a competitive price. Here are some steps to help you secure the best New York car insurance:

Compare Multiple Quotes

Obtaining quotes from multiple insurance providers is essential to finding the best deal. Compare rates from at least three to five different insurers to get a sense of the market and identify the most competitive options. You can use online quote comparison tools or reach out to individual insurance companies directly.

Understand Your Coverage Needs

Take the time to assess your specific coverage needs. Consider factors like the value of your vehicle, your personal injury protection needs, and any unique circumstances that might impact your risk profile. For example, if you frequently drive in high-risk areas or have a history of accidents, you may want to prioritize comprehensive coverage.

Review Your Policy Regularly

Insurance needs can change over time, so it’s important to review your policy annually or whenever your circumstances change significantly. This includes life events like getting married, having children, or purchasing a new vehicle. Regular policy reviews can help you identify opportunities to adjust your coverage or switch to a more suitable provider.

Consider Bundling Policies

If you own multiple vehicles or have other insurance needs (such as homeowners or renters insurance), consider bundling your policies with the same provider. Many insurance companies offer discounts for customers who bundle their insurance, which can lead to significant savings.

Shop Around for Discounts

Insurance providers offer a variety of discounts to attract and retain customers. Common discounts include safe driver discounts, good student discounts, loyalty discounts, and multi-policy discounts. Make sure to inquire about all available discounts when shopping for insurance and provide any relevant information to qualify for these savings.

Maintain a Clean Driving Record

One of the most effective ways to keep your insurance premiums low is to maintain a clean driving record. Avoid accidents and violations, and if you have a young driver in your household, encourage them to practice safe driving habits. A clean driving record can lead to significant savings over time.

Conclusion

Navigating the world of New York car insurance can be challenging, but with the right knowledge and approach, you can secure the coverage you need at a price that fits your budget. By understanding the state’s insurance laws, the factors that influence premiums, and the steps you can take to find the best coverage, you can make informed decisions and drive with peace of mind. Remember, car insurance is more than just a legal requirement—it’s a vital aspect of responsible driving and financial protection.

What is the average cost of car insurance in New York?

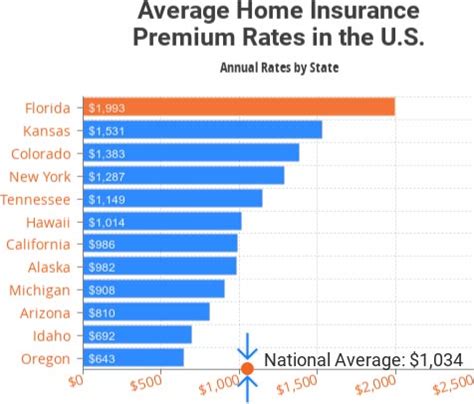

+The average cost of car insurance in New York varies based on numerous factors, including the driver’s age, location, driving record, and the coverage limits chosen. According to recent data, the average annual premium for a minimum liability-only policy in New York is around 1,200, while a full-coverage policy with higher liability limits can cost upwards of 2,500 per year. It’s important to note that these are just averages, and your actual premium could be higher or lower based on your specific circumstances.

Are there any discounts available for New York car insurance?

+Yes, New York car insurance providers offer a range of discounts to help drivers save on their premiums. These may include discounts for safe driving, good student grades, bundling multiple policies (such as auto and home insurance), and loyalty discounts for long-term customers. It’s worth shopping around and asking insurance agents about the discounts they offer to ensure you’re getting the best possible rate.

How can I reduce my New York car insurance premiums?

+There are several strategies you can employ to reduce your New York car insurance premiums. These include maintaining a clean driving record, increasing your deductible (the amount you pay out of pocket before insurance kicks in), comparing quotes from multiple insurers, and taking advantage of any applicable discounts. Additionally, regularly reviewing and adjusting your coverage to match your needs can help keep costs down.