Insurance For Motorcycle Cost

Motorcycle insurance is a vital aspect of responsible riding, providing financial protection and peace of mind to riders and their passengers. The cost of this insurance coverage can vary significantly based on numerous factors, including the type of bike, rider's profile, and the level of coverage chosen. Understanding these variables is essential for riders looking to secure adequate protection without breaking the bank. This comprehensive guide delves into the factors influencing motorcycle insurance costs, offering insights to help riders make informed decisions about their coverage.

Understanding the Factors that Influence Motorcycle Insurance Costs

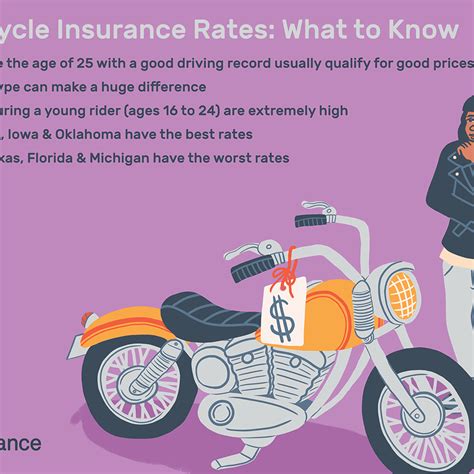

Several key factors contribute to the overall cost of motorcycle insurance. These include the type of bike, its engine size, and the purpose for which it's used. For instance, larger engine sizes and high-performance bikes generally attract higher insurance premiums due to their association with higher speeds and potential risks. Additionally, the rider's age, riding experience, and claims history are significant considerations. Younger riders with less experience typically face higher insurance costs, as they are statistically more prone to accidents. Furthermore, any prior claims can impact future insurance rates, with a history of accidents or violations potentially leading to increased premiums.

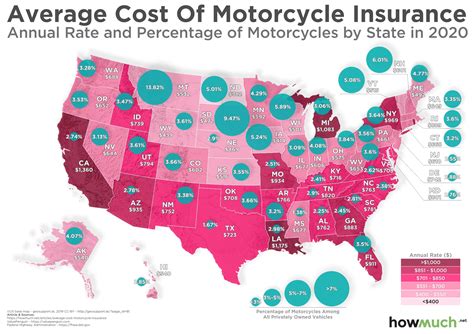

The geographical location of the rider also plays a role in determining insurance costs. Insurance providers consider the local environment, including weather conditions, traffic density, and crime rates, when calculating premiums. Areas with higher accident rates or a greater risk of theft may result in higher insurance costs. Moreover, the type of coverage chosen is a crucial factor. Comprehensive coverage, which includes protection against theft, fire, and other damages, is typically more expensive than liability-only coverage, which only covers damages caused to others.

The Impact of Coverage Options on Insurance Costs

Motorcycle insurance policies offer a range of coverage options, and the choice of coverage significantly affects the overall cost. As mentioned, comprehensive coverage provides the broadest protection, covering damages to the bike, as well as personal injury and property damage caused to others. This level of coverage typically comes at a higher premium, as it offers more extensive protection. On the other hand, liability-only coverage is more affordable, as it only covers damages caused to others, not the rider's own bike. While this option may save on insurance costs, it leaves the rider vulnerable to financial risks if their bike is damaged or stolen.

Other coverage options include collision coverage, which pays for damages to the bike resulting from an accident, regardless of fault; uninsured/underinsured motorist coverage, which protects the rider if involved in an accident with a driver who doesn't have sufficient insurance; and medical payments coverage, which covers medical expenses for the rider and any passengers in the event of an accident.

Each of these coverage types has its own associated costs, and the decision to include or exclude them from a policy can significantly impact the overall insurance premium. Riders should carefully consider their specific needs and risks to determine the best coverage options for their situation.

| Coverage Type | Description | Cost Impact |

|---|---|---|

| Comprehensive | Protects against theft, fire, and other damages | Higher premiums |

| Liability-only | Covers damages caused to others | Lower premiums |

| Collision | Pays for damages to the bike in an accident | Moderate to higher premiums |

| Uninsured/Underinsured Motorist | Protects against accidents with drivers lacking sufficient insurance | Moderate premiums |

| Medical Payments | Covers medical expenses for the rider and passengers | Moderate premiums |

Discounts and Strategies to Reduce Motorcycle Insurance Costs

While various factors can influence insurance costs, riders can employ several strategies to potentially reduce their premiums. One effective approach is to bundle motorcycle insurance with other policies, such as auto or home insurance. Many insurance providers offer discounts for customers who insure multiple vehicles or properties with them. Additionally, maintaining a clean driving record is crucial, as it can lead to significant savings over time. Most insurance companies offer safe rider discounts for riders who have not had any accidents or violations for a certain period, typically three to five years.

Another strategy to consider is taking a motorcycle safety course. These courses, often approved by state agencies or insurance providers, can not only enhance riding skills but also lead to insurance discounts. Insurance companies view riders who have completed these courses as less risky, as they have demonstrated a commitment to safety and a better understanding of riding techniques. Furthermore, storing the bike in a secure location, such as a garage, can also reduce insurance costs, as it lowers the risk of theft or damage.

Lastly, shopping around and comparing quotes from different insurance providers is essential. Each company has its own methodology for calculating premiums, and the rates can vary significantly. By obtaining multiple quotes, riders can find the best combination of coverage and cost that suits their needs.

Case Studies: Real-World Examples of Motorcycle Insurance Costs

To provide a clearer picture of how these factors can influence insurance costs, let's consider some real-world examples. For a 30-year-old rider with a clean driving record, insuring a Harley-Davidson Sportster with comprehensive coverage might cost around $500 to $800 annually. In contrast, insuring a basic 250cc cruiser with liability-only coverage could be as low as $200 to $400 per year. These examples demonstrate the significant impact of the type of bike, coverage chosen, and rider's profile on insurance costs.

Another scenario could involve a younger rider, say 22 years old, with a recent speeding ticket. Insuring a high-performance superbike might cost upwards of $1,500 to $2,000 annually with comprehensive coverage, given the rider's age and violation history. On the other hand, insuring a basic scooter with liability-only coverage could be closer to $500 to $800 per year. These examples highlight the role of risk assessment in determining insurance costs, with higher-risk profiles typically facing higher premiums.

These case studies illustrate the complexity and variability of motorcycle insurance costs. While the examples provided offer a general guide, the actual cost can vary widely based on individual circumstances and the insurance provider's specific rates and policies.

The Future of Motorcycle Insurance: Technological Advances and Changing Trends

The landscape of motorcycle insurance is continually evolving, driven by technological advancements and changing consumer trends. One notable trend is the increasing use of telematics, which involves installing a small device in the bike that tracks riding behavior. This technology allows insurance providers to offer usage-based insurance, where premiums are calculated based on actual riding habits rather than general assumptions. For example, a rider who only uses their bike for weekend recreational rides might qualify for lower premiums compared to someone who commutes daily.

Additionally, the rise of electric motorcycles is expected to impact insurance costs. While electric bikes are generally safer and more environmentally friendly, they often come with higher price tags, which can influence insurance premiums. On the other hand, the reduced maintenance and operational costs of electric bikes might lead to savings in insurance, as they are less prone to certain types of mechanical failures.

Furthermore, the growing popularity of ride-sharing services and bike rentals is expected to influence insurance models. As more riders opt for these shared mobility options, insurance providers will need to adapt their policies to accommodate this changing landscape. This could involve the development of new insurance products specifically tailored to these services, ensuring riders are adequately covered while using shared bikes.

Conclusion: Navigating the Complex World of Motorcycle Insurance Costs

Motorcycle insurance is a complex topic, influenced by a multitude of factors. From the type of bike and coverage chosen to the rider's profile and geographical location, each aspect plays a role in determining insurance costs. Understanding these factors is crucial for riders to make informed decisions about their insurance coverage, balancing the need for protection with financial considerations.

As we've explored in this guide, the cost of motorcycle insurance can vary significantly, and riders can employ various strategies to reduce their premiums. Whether it's through bundling policies, maintaining a clean driving record, or taking advantage of discounts, there are numerous ways to potentially lower insurance costs. Additionally, staying informed about the latest trends and technological advancements in the insurance industry can provide valuable insights into future cost trends and coverage options.

Ultimately, the goal is to secure adequate insurance coverage at a reasonable cost. By staying informed, comparing quotes, and understanding the factors that influence insurance costs, riders can make confident decisions about their motorcycle insurance. Remember, while insurance may be a necessary expense, it's also a vital aspect of responsible riding, offering protection and peace of mind on the open road.

How often should I review my motorcycle insurance policy?

+It’s a good practice to review your insurance policy annually or whenever your circumstances change significantly. This ensures that your coverage remains adequate and that you’re not paying for coverage you don’t need.

Can I get insurance for my classic or vintage motorcycle?

+Yes, classic and vintage motorcycles can be insured. However, the insurance process for these bikes can be more complex due to their unique value and the potential for specialized parts. It’s recommended to work with an insurance provider that specializes in classic vehicle coverage.

What should I do if I’m involved in an accident while riding my motorcycle?

+If you’re involved in an accident, the first priority is to ensure your safety and the safety of others involved. Call emergency services if needed. Then, document the accident by taking photos, collecting contact information from witnesses, and writing down a detailed description of the incident. Notify your insurance provider as soon as possible to begin the claims process.