Car Renting Insurance

Car renting insurance is a crucial aspect of the rental car industry, offering peace of mind to both renters and rental companies. With an increasing number of people opting for rental cars, understanding the various insurance options and their implications has become essential. This comprehensive guide will delve into the world of car renting insurance, exploring its types, benefits, and considerations to help you make informed decisions.

The Importance of Car Renting Insurance

When you rent a car, you take on the responsibility of operating a vehicle that is not yours. Car renting insurance serves as a safety net, protecting you from financial liabilities that may arise due to accidents, theft, or damage to the rental vehicle. It provides coverage for a range of scenarios, ensuring that you can enjoy your journey without worrying about unexpected expenses.

Types of Car Renting Insurance

Car renting insurance comes in various forms, each designed to address specific concerns. Understanding these types is crucial to choosing the right coverage for your needs.

Collision Damage Waiver (CDW)

Collision Damage Waiver, often referred to as CDW, is a popular choice among renters. It provides coverage for damage to the rental car itself, including collisions, vandalism, and theft. With CDW, the rental company waives their right to hold you liable for any damage to the vehicle, up to a certain limit. This type of insurance is especially beneficial for those who want comprehensive protection during their rental period.

Loss Damage Waiver (LDW)

Loss Damage Waiver, or LDW, goes a step further than CDW. In addition to covering physical damage to the rental car, LDW also protects against losses due to theft or vandalism. This means that if your rental vehicle is stolen or vandalized, you won’t be held responsible for the financial loss. LDW is an attractive option for renters who want maximum peace of mind and protection against a wide range of potential issues.

Liability Insurance

Liability insurance is a crucial component of car renting insurance. It covers the costs associated with bodily injury or property damage to third parties involved in an accident. This type of insurance protects you from lawsuits and compensates others for their losses. Most rental companies require renters to carry liability insurance, as it is a legal requirement in many jurisdictions.

Personal Accident Insurance (PAI)

Personal Accident Insurance, or PAI, is designed to provide coverage for the renter and their passengers in the event of an accident. It offers compensation for medical expenses, loss of income, and other related costs. PAI is particularly beneficial for travelers who may not have adequate health insurance coverage while abroad. By opting for PAI, you can ensure that you and your travel companions are protected in the event of an unfortunate incident.

Supplemental Liability Insurance (SLI)

Supplemental Liability Insurance, or SLI, offers additional coverage beyond the basic liability insurance provided by rental companies. It increases the liability limits, providing greater protection in the event of a serious accident. SLI is ideal for renters who want to ensure they have ample coverage for potential third-party claims, especially if they are driving a high-value rental vehicle.

Considerations and Tips for Car Renting Insurance

When navigating the world of car renting insurance, it’s important to keep certain considerations in mind to make the most informed choices.

Check Your Existing Insurance Coverage

Before purchasing car renting insurance, review your existing insurance policies. Many auto insurance policies extend coverage to rental cars, so you may already have some protection in place. Additionally, some credit card companies offer rental car insurance benefits when you use their card to pay for the rental. Understanding your existing coverage can help you avoid unnecessary duplicates and save money.

Understand Policy Exclusions

Car renting insurance policies often come with exclusions and limitations. It’s crucial to carefully read the fine print to understand what is and isn’t covered. Common exclusions may include damage to certain parts of the vehicle, off-road driving, or accidents that occur under the influence of alcohol. Being aware of these exclusions will help you make informed decisions and avoid surprises later on.

Consider Your Rental Location and Duration

The location and duration of your rental can impact the type and cost of insurance you need. Certain destinations may have higher risks of theft or damage, influencing the coverage you should prioritize. Additionally, the length of your rental period can affect the overall cost of insurance. It’s wise to assess these factors and choose insurance options that align with your specific circumstances.

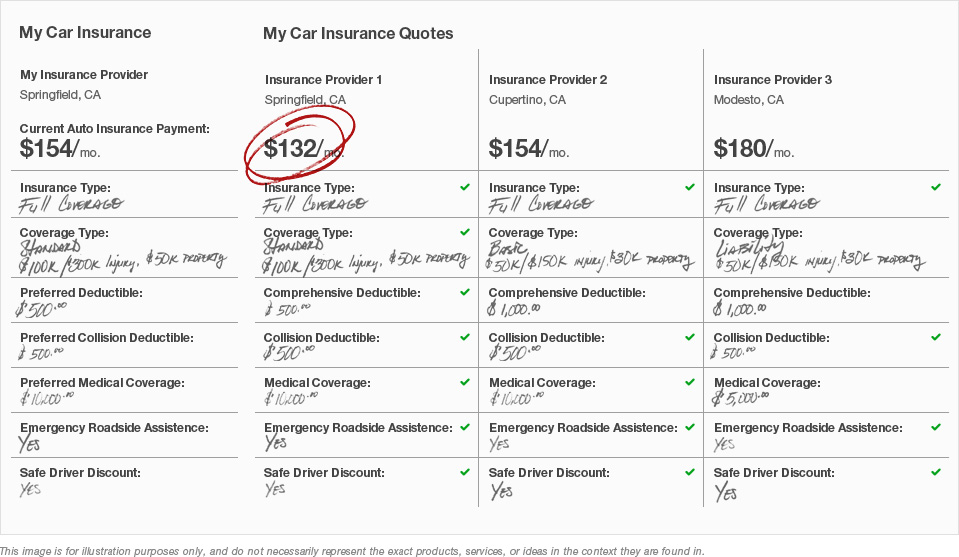

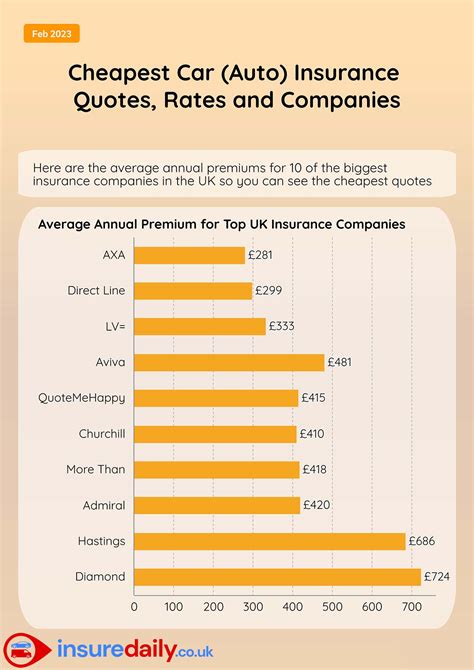

Compare Rental Company Policies

Different rental companies may offer varying insurance policies and packages. It’s beneficial to compare these options to find the best fit for your needs. Consider factors such as coverage limits, deductibles, and any additional perks or discounts offered. By comparing policies, you can ensure you’re getting the most comprehensive coverage at a competitive price.

Explore Pre-existing Insurance Options

Some travel insurance policies and membership programs offer pre-existing car renting insurance options. These policies can provide comprehensive coverage at a more affordable rate than purchasing insurance directly from the rental company. It’s worth exploring these options to potentially save money while maintaining adequate protection.

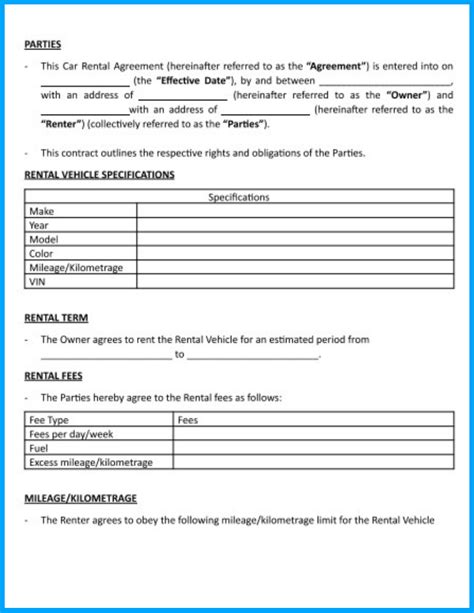

Review Rental Agreements Thoroughly

Before signing any rental agreement, take the time to thoroughly review the terms and conditions, especially those related to insurance. Understand your responsibilities and the rental company’s expectations. Clarify any doubts or ambiguities with the rental agent to ensure you are fully aware of your rights and obligations.

Real-Life Scenarios and Case Studies

To better illustrate the impact of car renting insurance, let’s explore a few real-life scenarios and case studies.

Case Study: Collision Damage Waiver in Action

Imagine you’re on a road trip across the country and encounter an unexpected accident. Despite your best efforts, you collide with another vehicle, resulting in significant damage to the rental car. With a Collision Damage Waiver in place, you can breathe easy knowing that the rental company will cover the repairs, up to the policy limits. This scenario highlights the value of CDW, providing financial protection and peace of mind during a stressful situation.

Case Study: Personal Accident Insurance Benefits

Consider a family vacation where an unfortunate accident occurs, resulting in injuries to both the driver and their passengers. With Personal Accident Insurance, the impacted individuals can receive compensation for their medical expenses and any other related costs. This case study emphasizes the importance of PAI, ensuring that travelers are protected and can focus on their recovery without financial strain.

Case Study: Supplemental Liability Insurance in High-Risk Scenarios

Imagine renting a luxury sports car for a weekend getaway. While enjoying the open road, an accident occurs, resulting in significant damage to both your rental car and the other vehicle involved. With Supplemental Liability Insurance, you can rest assured that your coverage limits are increased, providing greater financial protection in such high-risk scenarios.

Future Implications and Industry Trends

As the rental car industry evolves, so do the insurance options and considerations. Here are some future implications and trends to keep an eye on.

Integration of Technology for Improved Coverage

Advancements in technology are set to revolutionize the car renting insurance landscape. From telematics devices that track driving behavior to real-time accident detection systems, technology is enhancing the accuracy and efficiency of insurance claims. These innovations promise to streamline the claims process and provide more precise coverage options tailored to individual driving habits.

Personalized Insurance Packages

The future of car renting insurance may see the emergence of personalized insurance packages. Rental companies and insurers could offer tailored coverage options based on individual preferences and driving histories. This shift towards customization could provide renters with more flexibility and cost-effective solutions, ensuring they only pay for the coverage they truly need.

Expanded Use of Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is gaining traction in the car renting industry. This model allows insurance rates to be determined based on actual usage, such as the number of miles driven or the duration of the rental. With usage-based insurance, renters can benefit from more affordable rates, especially if they are only renting a vehicle for a short period.

Focus on Sustainable and Eco-Friendly Options

As sustainability becomes a growing concern, the rental car industry is likely to see an increased focus on eco-friendly options. This trend could extend to insurance as well, with insurers offering incentives or discounts for renters who opt for electric or hybrid vehicles. Such initiatives not only promote environmental responsibility but also encourage renters to make more sustainable choices.

Enhanced Customer Education and Transparency

In the future, there may be a greater emphasis on educating renters about the various insurance options available. Rental companies and insurers could provide more transparent information about coverage, exclusions, and pricing. This increased transparency would empower renters to make informed decisions and choose insurance packages that align with their specific needs and budget.

Conclusion

Car renting insurance is an essential aspect of the rental car experience, providing protection and peace of mind for both renters and rental companies. By understanding the different types of insurance, considering key factors, and staying informed about industry trends, you can navigate the world of car renting insurance with confidence. Remember to review your existing coverage, explore pre-existing insurance options, and thoroughly understand policy exclusions to make the most suitable choices for your rental needs.

What is the difference between CDW and LDW?

+CDW (Collision Damage Waiver) covers damage to the rental car itself, while LDW (Loss Damage Waiver) provides more comprehensive protection, including coverage for theft and vandalism. LDW is a step above CDW in terms of coverage, offering peace of mind for a wider range of potential issues.

Is liability insurance mandatory when renting a car?

+Yes, liability insurance is often a legal requirement when renting a car. It protects you from financial liabilities arising from accidents involving third parties. Most rental companies mandate liability insurance, so it’s important to ensure you have adequate coverage.

Can I rely on my credit card’s rental car insurance benefits?

+Credit card rental car insurance benefits can be a valuable source of coverage, but it’s important to check the specific terms and conditions. Some credit cards offer primary or secondary coverage, while others may have limitations or exclusions. It’s best to review your card’s benefits and understand the coverage they provide.

What happens if I decline car renting insurance at the rental counter?

+Declining car renting insurance at the rental counter means you assume full financial responsibility for any damage or loss to the rental vehicle. This can result in significant out-of-pocket expenses if an accident occurs. It’s crucial to carefully consider your options and understand the potential risks before declining insurance.

How can I save money on car renting insurance?

+To save money on car renting insurance, you can explore pre-existing insurance options, such as travel insurance policies or membership benefits. Additionally, consider the length of your rental and opt for insurance packages that align with your specific needs. Comparing rental company policies and understanding your existing coverage can also help you find cost-effective solutions.