Texas Affordable Health Insurance

Finding affordable health insurance is a crucial aspect of financial planning and maintaining overall well-being, especially in a vast state like Texas. With a diverse population and varying healthcare needs, understanding the options and navigating the complex world of health insurance can be a challenging task. This comprehensive guide aims to shed light on the specific landscape of affordable health insurance in Texas, offering practical insights and expert advice to help individuals and families make informed decisions.

Understanding the Health Insurance Market in Texas

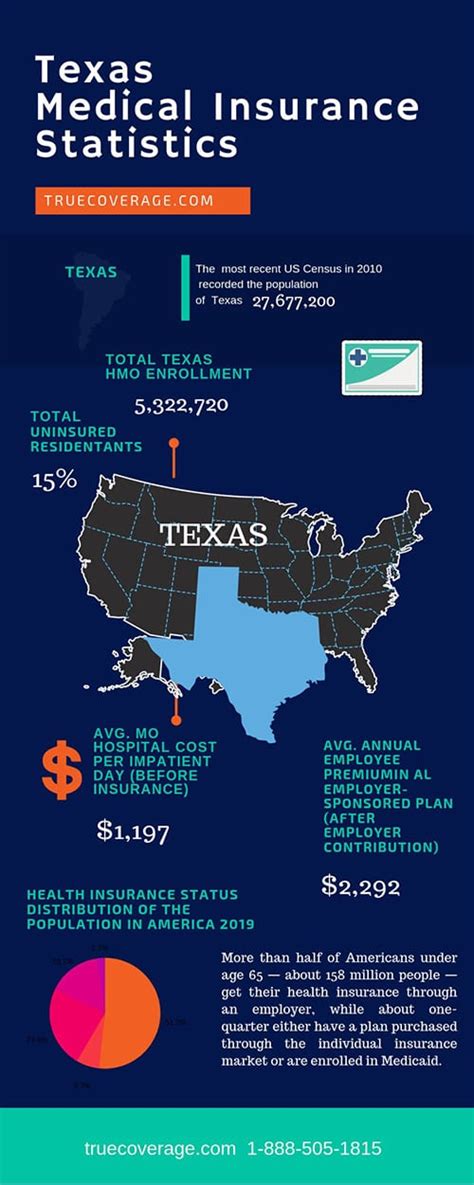

Texas boasts a unique healthcare landscape, influenced by its size, population diversity, and independent spirit. The state’s healthcare system is a complex interplay of private insurers, government-funded programs, and a thriving marketplace. Understanding this landscape is the first step towards making informed choices about health insurance coverage.

The Role of Government Programs

Texas participates in federal healthcare initiatives, such as Medicaid and the Children’s Health Insurance Program (CHIP). These programs provide essential coverage to eligible low-income families, pregnant women, and individuals with disabilities. Additionally, the state offers CHIP Perinatal, which provides prenatal and postnatal care to expectant mothers who qualify.

| Program | Eligibility Criteria |

|---|---|

| Medicaid | Varies based on age, disability, pregnancy, and income. As of 2023, individuals earning up to 138% of the federal poverty level may qualify. |

| CHIP | Uninsured children up to age 19 from families earning up to 211% of the federal poverty level. Premium costs are based on family income. |

| CHIP Perinatal | Expectant mothers who qualify for Medicaid or CHIP and have a pregnancy-related condition. |

Private Insurance Options

Texas has a robust private insurance market, with numerous providers offering a range of plans. These plans typically cover essential health benefits, including hospitalization, emergency services, and prescription drugs. Private insurers often provide additional benefits tailored to specific needs, such as dental, vision, and mental health coverage.

When choosing a private insurance plan, it's crucial to consider factors such as monthly premiums, deductibles, copays, and the network of healthcare providers. The state's insurance marketplace, HealthCare.gov, provides a comprehensive platform for comparing plans and offers resources for understanding insurance terminology and coverage options.

Navigating the Affordable Care Act (ACA) in Texas

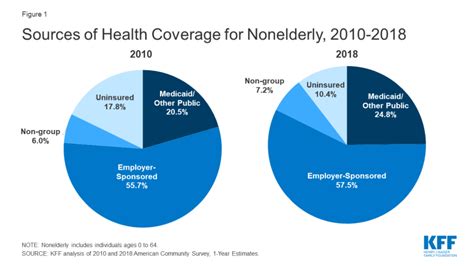

The Affordable Care Act (ACA), commonly known as Obamacare, has had a significant impact on the availability and affordability of health insurance in Texas. The ACA introduced measures to expand coverage, regulate insurance practices, and provide financial assistance to eligible individuals.

Health Insurance Marketplace

Texas residents can access the Health Insurance Marketplace through HealthCare.gov to compare and enroll in health insurance plans. The marketplace offers a variety of plans from different insurers, with coverage options tailored to individual needs. The ACA also introduced tax credits to help offset the cost of insurance premiums, making coverage more affordable for those with lower incomes.

| Key Features of the Health Insurance Marketplace |

|---|

| Compare plans and premiums from different insurers in one place. |

| Access to tax credits and cost-sharing reductions for eligible individuals. |

| Open Enrollment Period for 2024: November 15, 2023 - January 15, 2024. Outside this period, enrollment is typically only allowed under special circumstances. |

Essential Health Benefits and Coverage

The ACA mandates that all health insurance plans offered through the marketplace must cover essential health benefits. These include ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services, and more. This ensures that individuals receive comprehensive coverage, regardless of their chosen plan.

Special Enrollment Periods and Qualifying Life Events

Outside the regular Open Enrollment Period, individuals may qualify for a Special Enrollment Period (SEP) if they experience certain life events. These events can include losing job-based coverage, getting married or divorced, having a baby or adopting a child, or moving to a new area.

During a SEP, individuals can enroll in a health insurance plan or switch to a different plan. It's important to note that SEPs are time-sensitive, and individuals must act promptly to take advantage of this opportunity. The Texas Department of Insurance provides a guide to special enrollment periods, outlining the qualifying events and the necessary steps to enroll.

Affordable Health Insurance Options for Specific Groups

Texas offers a range of affordable health insurance options tailored to specific groups, ensuring that everyone has access to essential healthcare services.

Medicare

For individuals aged 65 and older or those with certain disabilities, Medicare provides comprehensive healthcare coverage. In Texas, Medicare beneficiaries have access to a variety of plans, including Original Medicare (Parts A and B), Medicare Advantage plans (Part C), and Medicare Prescription Drug Plans (Part D). These plans offer different levels of coverage and cost-sharing, allowing beneficiaries to choose the option that best suits their needs.

Health Insurance for Low-Income Individuals

For Texans with low incomes, the Texas Health and Human Services Commission provides a range of healthcare programs. These programs offer affordable coverage options, ensuring that financial constraints do not become a barrier to accessing essential healthcare services.

| Program | Eligibility Criteria |

|---|---|

| Healthy Texas Women | Uninsured women aged 18-44 with a family income up to 200% of the federal poverty level. Covers routine exams, birth control, pregnancy tests, and more. |

| Family Planning Program | Uninsured women and men aged 18-44 with a family income up to 200% of the federal poverty level. Provides access to family planning services, including exams, birth control, and related procedures. |

| Medicaid for Elderly, Disabled, and Children | Varies based on age, disability, and income. Covers essential healthcare services for eligible individuals. |

Tips for Choosing the Right Health Insurance Plan

Selecting the right health insurance plan can be a daunting task, but with the right approach, it can become a more manageable process. Here are some tips to help you make an informed decision:

- Understand your healthcare needs: Assess your medical history and the healthcare services you anticipate needing. Consider factors like chronic conditions, prescription medications, and anticipated medical procedures.

- Compare plans: Utilize resources like HealthCare.gov to compare different plans based on coverage, cost, and network of providers. Pay attention to details like deductibles, copays, and out-of-pocket maximums.

- Consider your budget: Health insurance plans come with varying premium costs. Choose a plan that aligns with your financial situation, but also ensure that the coverage is sufficient to meet your healthcare needs.

- Network of providers: Ensure that your preferred doctors, hospitals, and specialists are included in the plan's network. Out-of-network care can be costly, so it's essential to verify coverage.

- Read the fine print: Carefully review the plan's benefits summary and any additional documentation. This will help you understand what is and isn't covered, as well as any exclusions or limitations.

Future Trends and Developments in Texas Health Insurance

The landscape of health insurance in Texas is continually evolving, influenced by changing healthcare needs, technological advancements, and policy reforms. Staying informed about these developments can help individuals and families prepare for the future and make proactive decisions about their healthcare coverage.

Digital Transformation in Healthcare

Texas, like many other states, is witnessing a digital transformation in healthcare. Telemedicine and virtual health services are becoming increasingly prevalent, offering convenient and accessible care options. Many insurance providers are embracing digital technologies, allowing for easier claim submissions, online account management, and virtual consultations with healthcare professionals.

Focus on Preventive Care

There is a growing emphasis on preventive care and health maintenance in Texas’s healthcare system. Insurance providers are offering incentives and discounts to encourage policyholders to prioritize preventive measures, such as regular check-ups, vaccinations, and health screenings. This shift towards prevention not only improves overall health outcomes but also helps control healthcare costs in the long run.

Policy Reforms and Potential Changes

The future of health insurance in Texas is closely tied to policy reforms and potential legislative changes. While the ACA remains a cornerstone of the state’s healthcare system, ongoing debates and proposals could shape the availability and affordability of insurance coverage. It’s essential to stay informed about these developments, as they may impact eligibility criteria, coverage options, and financial assistance programs.

In conclusion, navigating the world of affordable health insurance in Texas requires a thorough understanding of the options available and a proactive approach to decision-making. By leveraging resources, staying informed about policy changes, and prioritizing preventive care, Texans can ensure they have access to quality healthcare services without breaking the bank.

How do I know if I’m eligible for government-funded health insurance programs like Medicaid or CHIP in Texas?

+Eligibility for government-funded health insurance programs in Texas is primarily based on income, age, disability, and family size. You can use the Your Texas Benefits Eligibility Quiz to determine if you qualify. Additionally, you can contact the Texas Department of Housing and Community Affairs for more information and guidance.

What happens if I miss the Open Enrollment Period for health insurance in Texas?

+If you miss the Open Enrollment Period, you may still be able to enroll in a health insurance plan during a Special Enrollment Period (SEP). A SEP is triggered by certain life events, such as losing job-based coverage, getting married, or having a baby. You must provide proof of the qualifying event and enroll within a specified timeframe.

Are there any discounts or incentives for choosing certain health insurance plans in Texas?

+Yes, some health insurance plans in Texas offer discounts and incentives. For instance, certain plans may provide reduced premiums for healthy lifestyle choices or participation in wellness programs. Additionally, the Affordable Care Act (ACA) offers tax credits to help offset the cost of premiums for eligible individuals. It’s worth exploring these options to find the most cost-effective plan that suits your needs.