Cheapest Insurance Car Insurance

Securing affordable car insurance is a top priority for many drivers, as it not only protects your vehicle and finances but also ensures compliance with legal requirements. In this comprehensive guide, we delve into the world of car insurance, uncovering the best strategies to find the cheapest insurance options available. From understanding the factors that influence premiums to exploring cost-saving tips, we aim to empower you with the knowledge to make informed decisions and drive with peace of mind.

Understanding the Factors that Affect Car Insurance Costs

When it comes to car insurance, various factors play a crucial role in determining the cost of your premium. By comprehending these factors, you can make strategic choices to minimize expenses. Here’s an in-depth look at the key elements that influence car insurance rates:

Vehicle Type and Age

The type and age of your vehicle significantly impact insurance costs. Generally, newer and more expensive cars tend to attract higher premiums due to their replacement and repair expenses. On the other hand, older vehicles, especially those with lower market values, often enjoy more affordable insurance rates. Consider factors like make, model, safety features, and repair costs when assessing insurance options.

| Vehicle Type | Average Insurance Premium |

|---|---|

| Sports Car | $1,800 - $3,000 annually |

| Sedan | $1,200 - $1,800 annually |

| SUV | $1,300 - $2,000 annually |

| Electric Car | $1,000 - $1,500 annually |

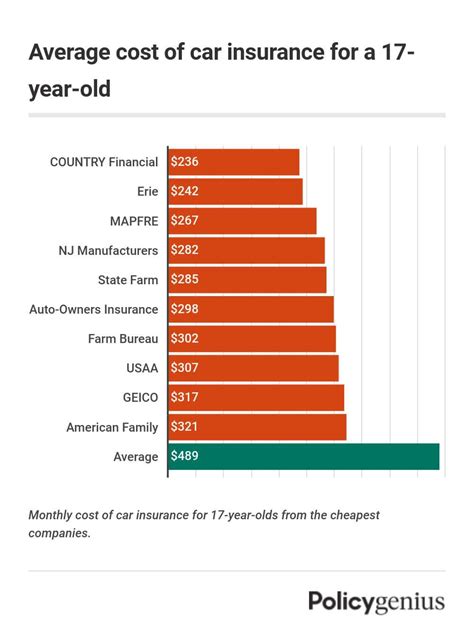

Driver’s Age and Experience

Your age and driving experience are vital factors in insurance calculations. Young drivers, particularly those under 25, often face higher premiums due to their perceived higher risk profile. Similarly, older drivers may experience rate increases if they have a history of accidents or claims. Building a solid driving record and maintaining continuous insurance coverage can help reduce costs over time.

Location and Usage

The location where you reside and the purpose of your vehicle’s usage also affect insurance rates. Urban areas typically have higher premiums due to increased traffic congestion and accident risks. Additionally, using your vehicle for business purposes or commuting long distances can lead to higher rates. Consider carpooling or utilizing public transportation to reduce mileage and insurance costs.

Coverage Options

The level of coverage you choose plays a pivotal role in determining your insurance costs. Comprehensive and collision coverage, while offering extensive protection, tend to be more expensive. On the other hand, opting for liability-only coverage, which provides legal protection but no vehicle damage coverage, can result in lower premiums. Assess your needs and risk tolerance to select the appropriate coverage level.

| Coverage Type | Average Premium |

|---|---|

| Comprehensive and Collision | $1,500 - $2,500 annually |

| Liability-only | $500 - $1,000 annually |

Discounts and Bundles

Insurance companies frequently offer discounts to attract and retain customers. Common discounts include safe driver, multi-policy, and good student discounts. Additionally, bundling your car insurance with other policies, such as homeowners or renters insurance, can lead to substantial savings. Explore these options to maximize your cost-cutting potential.

Strategies to Find the Cheapest Car Insurance

Now that we’ve examined the factors influencing car insurance costs, let’s explore practical strategies to secure the cheapest insurance options:

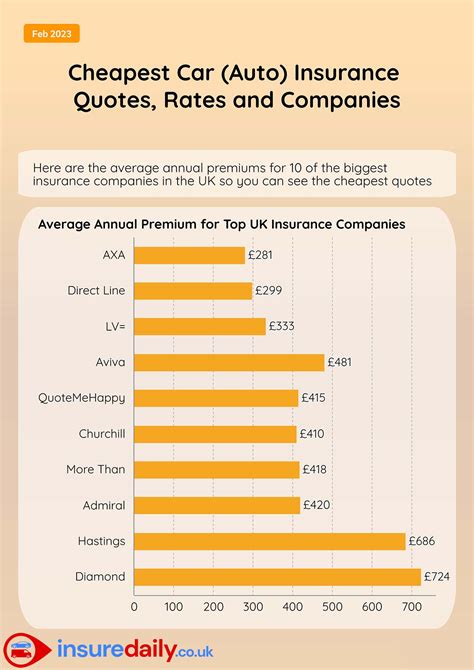

Shop Around and Compare Quotes

The insurance market is highly competitive, and prices can vary significantly between providers. Take the time to compare quotes from multiple insurers to find the most competitive rates. Online comparison tools and insurance brokerages can streamline this process, allowing you to quickly assess multiple options.

Understand Your Coverage Needs

Assess your specific coverage requirements and tailor your policy accordingly. Overinsuring your vehicle can lead to unnecessary expenses, while underinsuring may leave you vulnerable to financial risks. Strike a balance between adequate coverage and affordability by understanding the unique needs of your situation.

Improve Your Driving Record

A clean driving record is a powerful tool in reducing insurance costs. Avoid traffic violations and maintain a safe driving habit to demonstrate your low-risk profile. Insurance companies reward responsible drivers with lower premiums, so focus on developing safe driving practices.

Increase Your Deductible

Opting for a higher deductible can lead to significant savings on your insurance premium. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you assume a larger portion of the financial risk, which translates to lower premiums. However, ensure that you can afford the increased deductible in the event of a claim.

Explore Group Discounts

Many insurance companies offer group discounts for specific associations or organizations. Check if your employer, alumni network, or professional association provides access to group insurance plans. These plans can offer substantial savings, so it’s worth exploring these options.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, uses technology to track your driving behavior and calculate premiums accordingly. These policies reward safe driving habits with lower rates. If you have a clean driving record and are confident in your abilities, usage-based insurance can be a cost-effective option.

Maintain a Good Credit Score

Insurance companies often consider your credit score when determining premiums. Maintaining a good credit score can lead to lower insurance rates. Focus on responsible financial habits, such as timely bill payments and managing debt wisely, to improve your creditworthiness and potentially reduce insurance costs.

Review and Adjust Your Policy Regularly

Insurance needs and costs can change over time. Regularly review your policy to ensure it aligns with your current circumstances and coverage requirements. As your driving record improves or your vehicle ages, you may qualify for better rates or different coverage options. Stay proactive and make necessary adjustments to keep your insurance costs as low as possible.

Conclusion: Empowering Drivers with Affordable Insurance

Finding the cheapest car insurance requires a combination of knowledge, strategic planning, and proactive decision-making. By understanding the factors that influence insurance costs and implementing the strategies outlined in this guide, you can navigate the insurance market with confidence and secure coverage that meets your needs without breaking the bank. Remember, affordable insurance is within reach, and by staying informed and taking control of your insurance choices, you can drive with peace of mind and financial security.

How often should I compare car insurance quotes?

+

It’s advisable to compare quotes annually or whenever your policy renews. Market rates and personal circumstances can change, so regular comparisons ensure you’re always getting the best deal.

What is the average cost of car insurance in the United States?

+

The average cost of car insurance in the US is around $1,674 annually, but rates can vary significantly based on individual factors and location.

Can I get car insurance if I have a poor credit score?

+

Yes, but having a poor credit score may result in higher premiums. Focus on improving your credit over time to potentially reduce insurance costs.