Term Life Insurance Term

Term life insurance is a fundamental pillar of financial planning, offering individuals and families a crucial safety net during life's unpredictable moments. With a range of options available, understanding the nuances of term life insurance is essential for making informed decisions that align with your specific needs and circumstances.

In this comprehensive guide, we delve into the world of term life insurance, exploring its definition, key features, and the diverse range of plans it encompasses. By examining real-world examples and providing expert insights, we aim to empower readers with the knowledge to navigate this essential aspect of financial security.

Understanding Term Life Insurance: A Comprehensive Overview

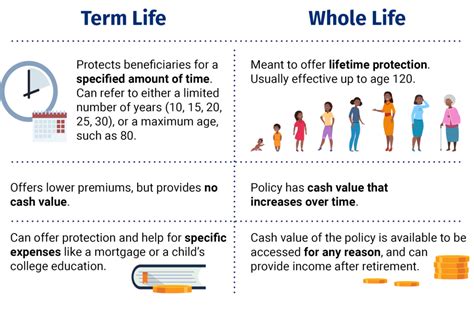

Term life insurance is a type of policy that provides coverage for a specified period, known as the term. Unlike permanent life insurance, which offers lifelong coverage, term life insurance is designed to meet temporary needs, such as protecting your family during your working years or covering specific financial obligations.

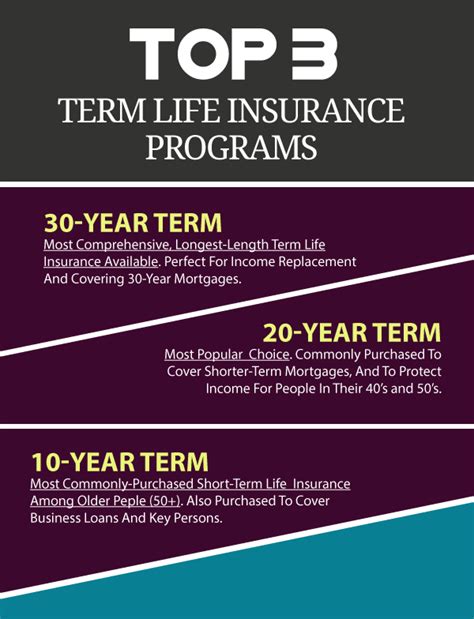

The term of a policy can vary, typically ranging from 10 to 30 years, and the premium remains constant throughout this period. This simplicity makes term life insurance an attractive option for individuals seeking cost-effective coverage during specific life stages.

Key Features of Term Life Insurance

Term life insurance offers several key features that make it a popular choice for many:

- Affordability: With fixed premiums, term life insurance is often more budget-friendly compared to permanent life insurance policies.

- Flexibility: Policies can be tailored to meet individual needs, allowing for coverage adjustments as life circumstances change.

- Guaranteed Death Benefit: In the event of the policyholder’s death during the term, the beneficiaries receive a tax-free lump sum payment.

- Renewable and Convertible Options: Many policies offer the ability to renew or convert to a permanent life insurance plan, providing long-term protection.

Types of Term Life Insurance

Within the realm of term life insurance, several types cater to different needs and preferences. Here’s a breakdown of the most common varieties:

- Level Term: Offers a fixed death benefit and premium for the entire term.

- Increasing Term: Provides a death benefit that increases over time, typically to match inflation.

- Decreasing Term: The death benefit decreases over the term, often used to cover specific financial obligations like a mortgage.

- Return of Premium Term: If the policyholder outlives the term, they receive all or a portion of the premiums paid.

- Guaranteed Issue Term: Designed for individuals with health concerns, it provides coverage without a medical exam but often has higher premiums.

| Term Type | Death Benefit | Premium |

|---|---|---|

| Level Term | Fixed | Constant |

| Increasing Term | Increases | Higher |

| Decreasing Term | Decreases | Lower |

| Return of Premium Term | Fixed | Higher |

| Guaranteed Issue Term | Fixed | Higher |

Real-World Examples: Term Life Insurance in Action

To illustrate the practical application of term life insurance, let’s explore a few scenarios:

Protecting Young Families

Sarah, a 30-year-old mother of two, purchases a 20-year level term life insurance policy with a $1 million death benefit. This ensures that if Sarah were to pass away during this period, her family would receive the financial support needed to maintain their lifestyle and cover expenses like child care and education.

Mortgage Protection

John, a 45-year-old homeowner, takes out a 15-year decreasing term policy to match the remaining term of his mortgage. This policy provides a death benefit that gradually decreases, mirroring the outstanding mortgage balance. In the event of John’s death, the policy would cover the remaining mortgage, ensuring his family can stay in their home.

Business Continuity

David, a small business owner, opts for a 10-year increasing term policy to protect his business during a crucial growth phase. As the business expands, the increasing death benefit provides a safety net, ensuring that David’s partners or family can continue operations if he were to pass away during this period.

Performance Analysis and Expert Insights

Term life insurance has proven to be a valuable tool for individuals seeking cost-effective protection during specific life stages. Its flexibility and affordability make it an attractive option for a wide range of demographics.

According to industry data, the term life insurance market has experienced steady growth, with an increasing number of policyholders opting for longer terms to provide comprehensive coverage. This trend highlights the evolving nature of financial planning and the importance of adapting insurance strategies to changing life circumstances.

Expert Tips for Choosing the Right Term Life Insurance

When navigating the term life insurance landscape, consider these expert tips:

- Evaluate your specific needs and financial goals to determine the appropriate term and coverage amount.

- Compare multiple policies and insurers to find the best fit for your budget and requirements.

- Consider the renewal or conversion options to ensure long-term protection.

- Review your policy regularly and adjust as your life circumstances change.

Future Implications and Industry Trends

As the insurance industry continues to evolve, term life insurance is expected to remain a cornerstone of financial planning. With advancements in technology and data analysis, insurers are increasingly able to offer personalized policies that cater to individual needs.

The rise of digital platforms and online insurance brokers has also made term life insurance more accessible and convenient for consumers. These platforms often provide instant quotes and streamlined application processes, further enhancing the appeal of term life insurance.

The Role of Technology in Term Life Insurance

Technology is transforming the term life insurance landscape, offering enhanced efficiency and convenience for both insurers and policyholders. Here’s how:

- Digital Applications: Online platforms allow for quick and easy policy applications, often without the need for medical exams.

- Instant Quotes: Real-time quote generators provide policyholders with immediate estimates, facilitating informed decision-making.

- Policy Management: Digital dashboards enable policyholders to manage their policies, make payments, and access important documents.

- Data-Driven Underwriting: Advanced analytics and data modeling improve risk assessment, leading to more accurate premium calculations.

Conclusion: Navigating the Term Life Insurance Landscape

Term life insurance is a powerful tool for individuals and families seeking financial security during specific life stages. By understanding the various types and features of term life insurance, you can make informed decisions that align with your unique circumstances.

As the insurance industry continues to evolve, embracing technological advancements and data-driven approaches, term life insurance remains a flexible and cost-effective solution for protecting your loved ones and securing your financial future.

What is the average cost of term life insurance?

+The cost of term life insurance varies based on factors such as age, health, coverage amount, and the term chosen. On average, a 30-year-old non-smoker can expect to pay around 20 to 30 per month for a $500,000 policy. However, prices can range widely, so it’s essential to obtain multiple quotes to find the best fit for your budget.

Can I renew my term life insurance policy?

+Many term life insurance policies offer the option to renew at the end of the initial term. However, renewal premiums are typically higher as they reflect the increased risk associated with advancing age. It’s crucial to review your policy’s renewal terms and consider the long-term financial implications.

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage simply expires, and you no longer have protection. However, some policies offer a return of premium feature, where a portion or all of the premiums paid are refunded if the policyholder survives the term. It’s essential to review your policy’s terms and understand the implications.