Lowest Rate Car Insurance

When it comes to car insurance, finding the lowest rates can be a daunting task, especially with the myriad of options available in the market. However, with the right knowledge and a strategic approach, you can secure the best coverage at the most competitive prices. This comprehensive guide will delve into the factors that influence car insurance rates, explore the different types of coverage, and provide expert tips to help you secure the lowest rate possible for your vehicle.

Understanding the Factors That Impact Car Insurance Rates

The cost of car insurance is influenced by a combination of personal, vehicle, and environmental factors. These factors are used by insurance providers to assess the level of risk associated with insuring a particular driver and vehicle. By understanding these influences, you can make informed decisions to potentially reduce your insurance premiums.

Personal Factors

Your personal circumstances play a significant role in determining your car insurance rates. Insurance companies consider factors such as your age, gender, driving history, and credit score when calculating your premium. Generally, younger drivers, especially males under the age of 25, are considered high-risk and may face higher insurance premiums. Additionally, a clean driving record with no accidents or traffic violations can lead to lower rates, as it indicates a lower risk of future claims.

Your credit score is another crucial factor. Insurance providers often use credit-based insurance scores to assess your financial responsibility. A higher credit score may result in lower insurance rates, as it indicates a lower risk of non-payment or filing claims.

Vehicle Factors

The type of vehicle you own and its usage can also impact your insurance rates. Generally, sports cars, luxury vehicles, and SUVs tend to have higher insurance premiums due to their higher repair costs and potential for accidents. Conversely, sedans and compact cars are often more affordable to insure. The age and safety features of your vehicle also play a role. Older vehicles with advanced safety features like anti-lock brakes, airbags, and crash avoidance systems may attract lower insurance rates.

The primary use of your vehicle is another consideration. If you primarily use your car for commuting to work or running errands, your insurance rates may be lower compared to someone who uses their vehicle for business purposes or long-distance travel.

Environmental Factors

Environmental factors, such as your location and the crime rate in your area, can also influence your car insurance rates. Areas with higher crime rates or a history of natural disasters may result in higher premiums, as they pose a greater risk of theft or damage to vehicles. Additionally, the traffic density and accident rates in your area can also impact your insurance costs.

Insurance providers also consider the average cost of repairs in your area and the availability of repair facilities. Areas with higher repair costs or limited access to repair shops may lead to increased insurance rates.

Types of Car Insurance Coverage

Car insurance policies offer a range of coverage options to protect you and your vehicle. Understanding these different types of coverage is essential to ensure you have the right protection at the best price.

Liability Coverage

Liability coverage is the most basic and legally required form of car insurance in many states. It provides financial protection in the event you are found at fault for an accident that causes injuries or property damage to others. This coverage consists of two main components: bodily injury liability and property damage liability.

- Bodily Injury Liability: Covers medical expenses and lost wages for individuals injured in an accident that you caused.

- Property Damage Liability: Pays for the repair or replacement of property damaged in an accident that you caused, including other vehicles, fences, buildings, or personal property.

Collision and Comprehensive Coverage

Collision and comprehensive coverage are optional forms of insurance that provide additional protection for your vehicle. Collision coverage pays for the repair or replacement of your vehicle if it is damaged in an accident, regardless of fault. Comprehensive coverage, on the other hand, covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, natural disasters, or collisions with animals.

Medical Payments and Personal Injury Protection

Medical payments coverage, also known as MedPay, and Personal Injury Protection (PIP) are designed to cover medical expenses for you and your passengers in the event of an accident, regardless of fault. These coverages can help pay for hospital visits, doctor appointments, medication, and other related medical costs.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist coverage (UM/UIM) provides protection in the event you are involved in an accident with a driver who either has no insurance or has insufficient insurance coverage to pay for the damages they caused. This coverage can help cover medical expenses, lost wages, and other related costs.

Other Coverage Options

There are several other optional coverage options available, including rental car reimbursement, gap insurance, and roadside assistance. These coverages can provide added peace of mind and financial protection in specific situations.

Tips to Secure the Lowest Rate Car Insurance

Now that we have a comprehensive understanding of the factors that influence car insurance rates and the different types of coverage available, let’s explore some expert tips to help you secure the lowest rate possible.

Shop Around and Compare Quotes

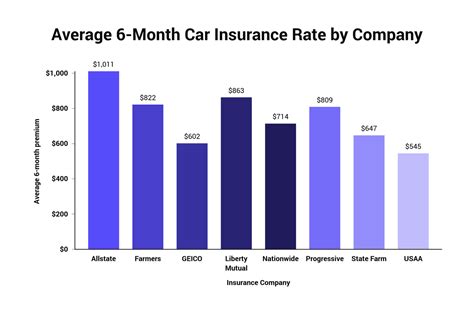

One of the most effective ways to find the lowest car insurance rate is to shop around and compare quotes from multiple providers. Insurance rates can vary significantly between companies, so obtaining quotes from at least three different insurers can help you identify the most competitive rates.

Bundle Your Policies

Many insurance providers offer discounts when you bundle multiple policies together. For instance, you may be able to save money by insuring your car and home with the same company. Bundling your policies can often result in significant savings, so it’s worth exploring this option.

Maintain a Clean Driving Record

A clean driving record is crucial when it comes to securing low car insurance rates. Insurance providers view drivers with a history of accidents or traffic violations as high-risk, which can lead to increased premiums. By maintaining a clean driving record, you can demonstrate your responsibility and potentially qualify for lower rates.

Choose a Higher Deductible

Opting for a higher deductible can lower your insurance premiums. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By selecting a higher deductible, you are assuming more financial responsibility in the event of a claim, which can result in lower monthly premiums.

Explore Discounts

Insurance providers offer a variety of discounts to their policyholders. These discounts can vary depending on the company and your personal circumstances. Some common discounts include good student discounts for young drivers with good grades, safe driver discounts for accident-free driving, and loyalty discounts for long-term customers. By exploring the available discounts and qualifying for as many as possible, you can significantly reduce your insurance premiums.

Maintain a Good Credit Score

As mentioned earlier, your credit score can have a significant impact on your car insurance rates. Insurance providers often use credit-based insurance scores to assess your financial responsibility. Maintaining a good credit score can help you qualify for lower insurance rates, as it indicates a lower risk of non-payment or filing claims.

Consider Telematics-Based Insurance

Telematics-based insurance, also known as usage-based insurance, is an innovative approach to car insurance that uses telematics devices to track your driving behavior. These devices monitor factors such as your driving speed, braking habits, and mileage. By demonstrating safe and responsible driving habits, you may be eligible for lower insurance rates.

Review Your Coverage Regularly

Insurance needs can change over time, so it’s important to regularly review your coverage to ensure it aligns with your current circumstances. As your life changes, your insurance requirements may also change. For instance, if you recently purchased a new car or moved to a different state, your insurance needs may have shifted. By reviewing your coverage regularly, you can make necessary adjustments to ensure you have the right protection at the best price.

Conclusion

Securing the lowest rate car insurance requires a combination of understanding the factors that influence rates, exploring different coverage options, and implementing strategic approaches. By shopping around, comparing quotes, and taking advantage of discounts and special programs, you can significantly reduce your insurance premiums. Remember, the key to finding the best deal is to be an informed consumer and take control of your insurance choices.

Frequently Asked Questions

How can I find out if I’m eligible for any insurance discounts?

+To determine your eligibility for insurance discounts, it’s recommended to speak directly with an insurance agent or representative. They can assess your personal circumstances and provide you with a comprehensive list of discounts you may qualify for. Additionally, many insurance providers offer online tools or calculators that can help you estimate the potential savings based on your specific situation.

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the United States can vary significantly depending on factors such as location, age, and driving history. According to recent studies, the national average for car insurance premiums is around $1,674 per year. However, it’s important to note that this average can fluctuate based on individual circumstances and the specific coverage options chosen.

Can I switch car insurance providers at any time?

+Yes, you can switch car insurance providers at any time. However, it’s important to ensure that you have continuous coverage to avoid any gaps in your insurance history. When switching providers, be sure to compare quotes and understand the terms and conditions of your new policy to ensure a smooth transition.

What should I do if I’m involved in an accident?

+If you’re involved in an accident, it’s crucial to remain calm and take the necessary steps to ensure your safety and the safety of others involved. Firstly, check for injuries and call for medical assistance if needed. Then, exchange contact and insurance information with the other parties involved. It’s important to document the accident scene by taking photos and gathering witness statements. Finally, notify your insurance provider as soon as possible to initiate the claims process.

How often should I review my car insurance policy?

+It’s recommended to review your car insurance policy at least once a year, or whenever your life circumstances change significantly. Regular reviews ensure that your coverage remains up-to-date and aligned with your needs. By staying proactive, you can identify opportunities to adjust your coverage or explore potential cost savings.