What Is The Fee For Not Having Health Insurance

The Financial Impact of Not Having Health Insurance: Understanding the Costs and Penalties

In today’s healthcare landscape, the decision to forgo health insurance can have significant financial implications. As a knowledgeable expert in the field, I aim to delve into the specifics of the fees and penalties associated with not having health insurance, shedding light on the potential costs individuals may face. This comprehensive guide will explore the various aspects of this issue, providing an in-depth analysis to help readers make informed decisions regarding their healthcare coverage.

The concept of health insurance mandates and associated penalties has been a topic of debate and policy implementation in many countries, including the United States. Understanding these mandates and their financial consequences is crucial for individuals to navigate the healthcare system effectively and avoid unnecessary financial burdens.

Health Insurance Mandates and Penalties

Many nations have introduced health insurance mandates to ensure a certain level of coverage for their citizens. These mandates typically require individuals to have adequate health insurance or face financial penalties. The primary goal is to promote universal healthcare coverage and prevent individuals from waiting until they are sick to purchase insurance, a practice known as adverse selection.

The specific details of these mandates and penalties vary across jurisdictions. Let's explore some real-world examples to understand the potential costs associated with not having health insurance.

The United States: Individual Mandate and Penalties

In the United States, the Patient Protection and Affordable Care Act (ACA), commonly known as Obamacare, introduced an individual mandate requiring most individuals to have qualifying health insurance coverage. Those who did not comply with this mandate faced financial penalties.

The penalty for not having health insurance under the ACA was calculated as a percentage of household income or a fixed amount, whichever was higher. For example, in 2018, the penalty was either 2.5% of an individual's household income or $695 per adult and $347.50 per child (up to a maximum of $2,085), whichever was greater. These amounts were subject to annual adjustments.

However, it's important to note that the individual mandate under the ACA was effectively eliminated as of January 1, 2019, due to changes made by the Tax Cuts and Jobs Act. Since then, there has been no federal penalty for not having health insurance.

Other Countries' Approaches

In other countries, the approach to health insurance mandates and penalties varies. Some countries have a more centralized healthcare system, where insurance is provided through a single public payer, and individuals are automatically enrolled. In such cases, the focus may be on ensuring that individuals maintain their coverage and pay their premiums.

For instance, in the United Kingdom, the National Health Service (NHS) provides healthcare coverage to all residents. While there are no explicit penalties for not having health insurance, individuals may face financial consequences if they are unable to pay their NHS contributions or if they seek treatment in private facilities.

Similarly, in countries like Canada, which has a single-payer healthcare system, there is no explicit individual mandate. However, provinces may have their own regulations regarding healthcare coverage, and individuals may be required to pay for certain services or medications not covered by the public system.

Financial Implications of Not Having Health Insurance

Beyond the potential penalties, not having health insurance can lead to significant financial challenges when unexpected medical expenses arise. Here are some key financial implications to consider:

Medical Bills and Out-of-Pocket Costs

Without health insurance, individuals are responsible for paying the full cost of their medical care, including doctor visits, hospital stays, prescription medications, and diagnostic tests. These expenses can quickly add up, especially in cases of serious illnesses or accidents.

For example, a routine surgery without insurance coverage could cost thousands of dollars, and emergency medical treatments can result in even higher bills. These out-of-pocket costs can be financially devastating for individuals and families, leading to significant debt and financial strain.

Limited Access to Healthcare Services

Lack of health insurance may also limit an individual's access to healthcare services. Healthcare providers may be less willing to treat uninsured patients due to the financial risk involved. This can result in delayed or denied care, especially for non-emergency situations.

Uninsured individuals may face challenges in finding doctors who accept patients without insurance, and they may have limited options for specialized care or advanced treatments. This can lead to worsening health conditions and potentially life-threatening situations.

Impact on Personal and Family Finances

The financial burden of medical expenses can have a profound impact on an individual's personal and family finances. Uninsured individuals may struggle to afford necessary medications, leading to non-adherence to treatment plans and potential health complications.

Moreover, unexpected medical bills can disrupt savings plans, impact credit scores, and even lead to bankruptcy. The financial strain can affect an individual's ability to meet other financial obligations, such as rent, utilities, and education expenses.

Options for Affordable Healthcare Coverage

To avoid the financial pitfalls associated with not having health insurance, it is essential to explore affordable coverage options. Here are some strategies to consider:

Employer-Sponsored Health Insurance

Many individuals obtain health insurance through their employers. Employer-sponsored plans often provide comprehensive coverage at a reduced cost, as employers contribute to the premiums. Exploring employment opportunities that offer health benefits can be a viable option for obtaining affordable insurance.

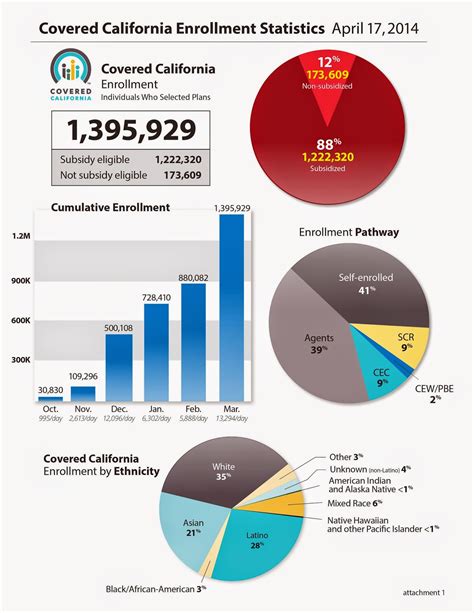

Government-Sponsored Programs

In many countries, government-sponsored programs provide healthcare coverage to eligible individuals. These programs may be targeted at specific populations, such as low-income individuals, the elderly, or those with disabilities. Researching and applying for these programs can help individuals access necessary healthcare services without incurring significant financial burdens.

Private Insurance Plans

For those who do not qualify for employer-sponsored or government-sponsored insurance, private insurance plans are an option. While these plans may have higher premiums, they can still provide essential coverage. It is crucial to compare different plans, assess individual needs, and choose a plan that offers the best value for money.

High-Deductible Health Plans (HDHPs)

High-deductible health plans are a type of insurance plan that offers lower premiums but higher deductibles. These plans may be suitable for individuals who are generally healthy and do not anticipate frequent medical expenses. HDHPs can be paired with Health Savings Accounts (HSAs), allowing individuals to save pre-tax dollars for future medical costs.

Conclusion: Making Informed Healthcare Decisions

Understanding the financial implications of not having health insurance is crucial for individuals to make informed decisions about their healthcare coverage. While the specific details of health insurance mandates and penalties vary across jurisdictions, the potential costs and consequences of being uninsured are significant.

By exploring affordable coverage options and staying informed about healthcare policies, individuals can take control of their healthcare journey and protect themselves from financial hardship. It is essential to assess personal needs, research available plans, and make choices that align with one's health and financial goals.

Remember, healthcare coverage is not just about accessing medical services; it is about safeguarding your financial well-being and ensuring peace of mind during unexpected health challenges.

FAQ

Are there any exceptions to the health insurance mandate penalties?

+Yes, certain individuals may be exempt from health insurance mandate penalties. Exemptions vary by jurisdiction but may include religious objections, financial hardship, or membership in specific healthcare sharing ministries. It’s important to research and understand the specific exemptions applicable to your situation.

What happens if I face financial difficulties and cannot afford health insurance premiums?

+If you encounter financial difficulties, it’s crucial to explore options for financial assistance. Many countries offer programs or subsidies to help individuals with low incomes afford health insurance. Researching these programs and applying for financial aid can help alleviate the burden of insurance premiums.

Can I purchase health insurance after facing a medical emergency if I didn’t have coverage beforehand?

+The ability to purchase health insurance after a medical emergency varies depending on the jurisdiction and insurance provider. In some cases, there may be a waiting period or exclusions for pre-existing conditions. It’s advisable to consult with insurance providers and understand their policies regarding post-emergency coverage.