Car Insurance In Australia

Car insurance is an essential aspect of vehicle ownership in Australia, providing peace of mind and financial protection to motorists across the country. With a diverse range of insurance providers offering various coverage options, understanding the Australian car insurance landscape is crucial for making informed decisions. This comprehensive guide aims to delve into the specifics of car insurance in Australia, covering everything from policy types and costs to real-world examples and expert insights.

Understanding Car Insurance in Australia

Car insurance in Australia is a highly regulated industry, governed by the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC). These regulatory bodies ensure that insurance providers adhere to strict guidelines, offering transparency and protection to consumers. Australia’s car insurance market is highly competitive, with numerous providers offering a wide range of policies to suit different needs and budgets.

One unique aspect of car insurance in Australia is the presence of compulsory third-party (CTP) insurance, which is mandatory in all states and territories. CTP insurance covers the cost of personal injury claims resulting from a motor vehicle accident, regardless of who is at fault. This ensures that all motorists have access to some level of financial protection in the event of an accident. However, CTP insurance only covers personal injuries and does not provide any protection for vehicle damage, which is where comprehensive, third-party property, and fire and theft insurance come into play.

Policy Types and Coverage

In Australia, there are primarily four types of car insurance policies:

- Comprehensive Car Insurance: This is the most comprehensive type of car insurance, offering the highest level of protection. It covers damage to your own vehicle, regardless of fault, as well as damage to other vehicles and property. Comprehensive insurance also provides cover for theft, fire, and other events like hail, storms, and vandalism. This type of insurance is ideal for new or expensive vehicles, as it offers the broadest range of protection.

- Third-Party Property Insurance: Also known as 'third-party only' insurance, this policy covers damage to other vehicles or property that you cause in an accident. It does not provide any cover for your own vehicle, making it a more budget-friendly option for older or less valuable cars. However, it is important to note that this insurance does not cover personal injury claims, which are covered by CTP insurance.

- Fire and Theft Insurance: As the name suggests, this policy provides cover for damage caused by fire and theft of your vehicle. It also covers certain events like storms, hail, and vandalism. However, it does not cover accidents or collisions, making it a limited form of insurance. This type of insurance is suitable for individuals who want basic protection for their vehicle but do not require comprehensive coverage.

- Compulsory Third-Party (CTP) Insurance: As mentioned earlier, CTP insurance is mandatory in Australia and covers personal injury claims resulting from a motor vehicle accident. It is a state-based scheme, with prices varying depending on the state or territory. CTP insurance is an essential component of Australian car insurance, providing a safety net for all motorists.

Each of these policy types has its own set of features, benefits, and exclusions. It is crucial to carefully review the policy document and understand the specific terms and conditions before purchasing car insurance. Some policies may also offer additional benefits, such as new car replacement, hire car cover, or roadside assistance, which can further enhance the protection provided.

Factors Influencing Car Insurance Costs

The cost of car insurance in Australia can vary significantly depending on several factors. Understanding these factors can help motorists make informed decisions and potentially save on insurance premiums.

Vehicle Value and Usage

The value of your vehicle is a significant factor in determining the cost of car insurance. Generally, newer and more expensive vehicles tend to have higher insurance premiums. This is because they are more costly to repair or replace in the event of an accident or theft. Additionally, the make and model of your vehicle can also impact insurance costs, as some vehicles may have higher repair costs or be more prone to theft.

The usage of your vehicle also plays a role in insurance costs. Insurance providers consider factors such as the annual mileage, the purpose of the vehicle (personal, business, or pleasure), and the number of drivers. Vehicles that are driven frequently, especially for business purposes, may incur higher premiums due to the increased risk of accidents.

Driver Profile and History

Your personal driving history and profile are key factors in determining insurance costs. Insurance providers assess your age, gender, and driving experience to gauge the level of risk you pose as a driver. Younger drivers, especially those under 25 years old, are often considered higher-risk and may face higher insurance premiums. Similarly, individuals with a history of accidents, traffic violations, or claims may also see increased insurance costs.

However, it is worth noting that no-claims bonuses can also influence insurance costs. Many insurance providers offer discounts or reduced premiums to drivers who have not made any claims during a certain period. This incentivizes safe driving and can lead to significant savings over time.

Location and Risk Factors

The location where you reside or park your vehicle can also impact insurance costs. Areas with higher crime rates or a history of natural disasters may have higher insurance premiums due to the increased risk of theft or damage. Additionally, the proximity to emergency services and repair facilities can also influence insurance costs, as quicker access to these services may result in reduced premiums.

Insurance providers also consider the overall risk profile of the area, including factors like traffic congestion, accident rates, and the presence of high-risk driving behaviors. Areas with a higher concentration of these factors may see increased insurance costs.

Real-World Examples and Case Studies

To better understand the practical implications of car insurance in Australia, let’s explore some real-world examples and case studies.

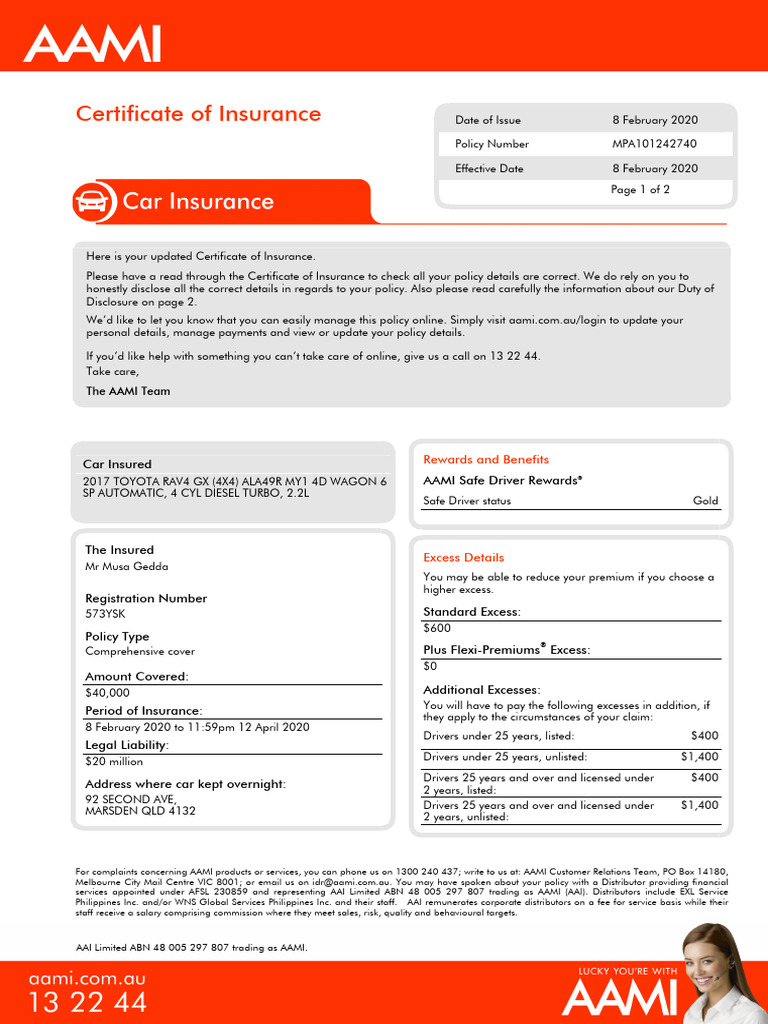

Case Study: Comprehensive Insurance for a New Car

Let’s consider the case of Sarah, a 30-year-old professional who has just purchased a brand-new sedan. She wants to insure her vehicle with comprehensive coverage to protect her investment. After researching various insurance providers, she finds a policy that offers the following features:

- Comprehensive cover for her vehicle with a market value of $40,000.

- A premium of $1,200 per year, which includes a 10% no-claims bonus.

- Excess amounts of $750 for accidental damage and $500 for theft or fire.

- Additional benefits like new car replacement for the first two years and hire car cover up to $75 per day.

With this comprehensive insurance policy, Sarah can drive her new car with peace of mind, knowing that she is protected in the event of an accident, theft, or other unforeseen circumstances. The no-claims bonus and additional benefits further enhance the value of her insurance coverage.

Case Study: Third-Party Property Insurance for an Older Vehicle

Now, let’s look at the case of John, a student who owns an older hatchback with a market value of $5,000. John is on a tight budget and only requires basic insurance coverage. He opts for third-party property insurance, which offers the following:

- Third-party property cover for damage caused to other vehicles or property.

- A premium of $450 per year, with no excess.

- No additional benefits, as this is a basic insurance policy.

With this policy, John can drive his older vehicle with a sense of security, knowing that he is protected against causing damage to others. The lower premium makes it an affordable option for students or individuals with limited budgets.

Expert Insights and Tips

As an industry expert, here are some valuable insights and tips for individuals looking to navigate the world of car insurance in Australia:

Future Implications and Industry Trends

The car insurance industry in Australia is constantly evolving, and several trends and developments are shaping its future.

Telematics and Usage-Based Insurance

Telematics technology, which uses data from sensors and GPS to monitor driving behavior, is gaining traction in the Australian car insurance market. Usage-based insurance policies, also known as pay-as-you-drive or pay-how-you-drive, use telematics data to offer more personalized and potentially cheaper insurance options. These policies reward safe driving habits by offering lower premiums to drivers who exhibit good driving behavior.

Digital Transformation and Online Insurance

The digital transformation of the insurance industry is well underway in Australia. Many insurance providers are embracing online platforms and mobile apps to enhance the customer experience and streamline the insurance process. Online insurance allows for quicker quotes, easier policy management, and faster claims processing. This digital shift is making car insurance more accessible and convenient for consumers.

Emerging Technologies and Autonomous Vehicles

The rise of autonomous vehicles and advanced driver-assistance systems is expected to have a significant impact on the car insurance industry. As these technologies become more prevalent, they may reduce the number of accidents and change the risk profile for insurers. This could potentially lead to lower insurance premiums and new coverage options tailored to autonomous vehicles.

Sustainable and Green Insurance

With growing environmental concerns, the concept of sustainable and green insurance is gaining momentum. Some insurance providers are offering incentives and discounts to motorists who drive electric or hybrid vehicles or adopt eco-friendly driving habits. This trend aligns with the broader shift towards sustainability and could encourage more environmentally conscious driving behaviors.

Conclusion

Car insurance in Australia is a complex yet essential aspect of vehicle ownership. Understanding the different policy types, coverage options, and factors influencing costs is crucial for making informed decisions. By staying informed, shopping around, and maintaining a safe driving record, motorists can navigate the Australian car insurance landscape with confidence and find the best coverage to suit their needs.

Frequently Asked Questions

How do I choose the right car insurance policy for me?

+Choosing the right car insurance policy involves considering several factors. Firstly, assess your needs and the level of coverage you require. If you have a new or expensive vehicle, comprehensive insurance may be the best option. For older or less valuable cars, third-party property insurance or fire and theft insurance may suffice. Additionally, compare policies from different providers, taking into account factors like premiums, excess amounts, and additional benefits. Don’t forget to read the policy document thoroughly to understand the coverage and exclusions.

What is the difference between comprehensive and third-party property insurance?

+Comprehensive insurance is the most extensive type of car insurance, offering coverage for your own vehicle, regardless of fault, as well as damage to other vehicles and property. It also covers theft, fire, and other events like storms and vandalism. On the other hand, third-party property insurance, or third-party only insurance, covers damage to other vehicles or property that you cause in an accident. It does not provide any cover for your own vehicle, making it a more budget-friendly option for older or less valuable cars.

How can I reduce my car insurance premiums?

+There are several ways to potentially reduce your car insurance premiums. Firstly, maintain a good driving record by following traffic rules and avoiding accidents or violations. This can help you qualify for no-claims bonuses and lower your premiums over time. Additionally, consider increasing your excess amount, as this can lower your premiums, although it means you’ll pay more out of pocket in the event of a claim. Finally, shop around and compare policies from different providers to find the best deal.

What happens if I make a claim on my car insurance policy?

+If you need to make a claim on your car insurance policy, the process typically involves the following steps: (1) Contact your insurance provider and notify them of the claim. (2) Provide details of the incident, including any relevant documentation and photos. (3) Cooperate with the insurer’s investigation and provide any additional information they may require. (4) Depending on the policy and the nature of the claim, the insurer will assess the damage and determine the value of the claim. (5) Once the claim is approved, the insurer will pay out the agreed amount, minus any applicable excess.