Where Can I Get Health Insurance

Health insurance is a crucial aspect of healthcare access and financial protection. With rising healthcare costs, it is essential to understand your options and make informed decisions about your health coverage. This comprehensive guide will explore various avenues where you can obtain health insurance, providing you with the knowledge to navigate the complex world of healthcare and insurance.

Understanding the Importance of Health Insurance

Before delving into the sources of health insurance, it’s imperative to grasp why health insurance is a necessity. Health insurance serves as a financial safety net, protecting you from the potentially catastrophic costs of medical treatments, hospitalizations, and prescription medications. It ensures that you can access necessary healthcare services without facing overwhelming financial burdens.

Moreover, health insurance promotes preventive care, encouraging individuals to seek regular check-ups, screenings, and vaccinations. This proactive approach to healthcare not only improves overall well-being but also helps detect and manage health issues early on, often leading to better health outcomes and reduced long-term costs.

Exploring Sources of Health Insurance

There are several avenues through which you can obtain health insurance coverage. Each source has its own eligibility criteria, coverage options, and enrollment periods. Let’s explore these sources in detail.

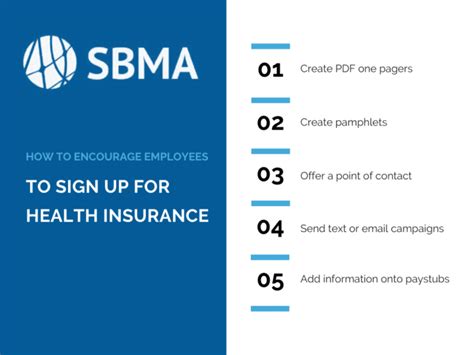

Employer-Sponsored Health Insurance

One of the most common ways to access health insurance is through your employer. Many employers offer health insurance plans as part of their benefits package. These plans are often more affordable as the employer contributes a significant portion of the premium. Additionally, employer-sponsored plans may provide a broader range of coverage options, including dental, vision, and prescription drug benefits.

To determine if you are eligible for employer-sponsored health insurance, check with your human resources department. They will provide information on the available plans, enrollment periods, and any necessary documentation. It's important to note that eligibility may vary based on your employment status, hours worked, and the specific policies of your employer.

The Affordable Care Act (ACA) Marketplace

The Affordable Care Act, also known as Obamacare, established health insurance marketplaces where individuals and families can shop for and purchase health insurance plans. These marketplaces, available at the federal level and in some states, offer a range of plans with different levels of coverage and cost. The ACA aims to make health insurance more accessible and affordable by providing subsidies and tax credits to eligible individuals.

To explore your options on the ACA marketplace, visit HealthCare.gov for federal plans or your state's official marketplace website. During the annual open enrollment period, typically lasting from November to January, you can compare plans, calculate costs, and enroll in a plan that suits your needs. Outside of the open enrollment period, you may qualify for a special enrollment period if you experience a qualifying life event, such as losing other coverage or having a baby.

Medicaid and CHIP

Medicaid is a federal and state-funded program that provides health coverage to eligible low-income individuals and families. Each state administers its own Medicaid program, and eligibility criteria can vary. However, certain groups, such as children, pregnant women, individuals with disabilities, and seniors, are typically covered.

The Children's Health Insurance Program (CHIP) is another government-funded program that provides low-cost health coverage to children in families who earn too much to qualify for Medicaid but cannot afford private health insurance. CHIP often covers a wide range of services, including doctor visits, hospitalizations, dental care, and mental health services.

To determine your eligibility for Medicaid or CHIP, visit Medicaid.gov or contact your state's Medicaid agency. They will guide you through the application process and provide information on the benefits and services covered by your state's program.

Short-Term Health Insurance Plans

Short-term health insurance plans are temporary coverage options designed to bridge gaps in health insurance. These plans typically have lower premiums and offer more limited coverage compared to comprehensive health insurance plans. They are suitable for individuals who are between jobs, waiting for their employer’s insurance to take effect, or facing a short-term lapse in coverage.

It's important to note that short-term plans often have restrictions and exclusions, and they may not cover pre-existing conditions or provide the same level of preventive care as other plans. Additionally, the duration of these plans is usually shorter, ranging from a few months to a year.

You can explore short-term health insurance plans by visiting insurance company websites or using online comparison tools. Ensure that you carefully review the plan details, including covered services, exclusions, and any waiting periods, to make an informed decision.

Medicare for Seniors

Medicare is a federal health insurance program for individuals aged 65 and older, as well as certain younger individuals with disabilities. It is divided into different parts, each covering specific healthcare services.

- Part A covers inpatient hospital care, skilled nursing facility care, and some home healthcare services.

- Part B covers outpatient medical services, including doctor visits, lab tests, and some preventive care.

- Part C, also known as Medicare Advantage, is an alternative to original Medicare, combining Parts A and B and often including additional benefits like prescription drug coverage and vision care.

- Part D covers prescription drug benefits and is available as a standalone plan or as part of a Medicare Advantage plan.

To qualify for Medicare, you must meet certain eligibility criteria, including being a U.S. citizen or permanent resident and having worked for a certain period of time (usually 10 years) in Medicare-covered employment. You can learn more about Medicare and enroll in the program by visiting Medicare.gov or contacting the Social Security Administration.

Individual Health Insurance Plans

Individual health insurance plans are purchased directly by the consumer, typically through insurance brokers or online marketplaces. These plans offer a wide range of coverage options, including major medical insurance, short-term plans, and catastrophic plans. Individual plans provide flexibility in choosing a plan that aligns with your specific healthcare needs and budget.

When shopping for individual health insurance, it's crucial to compare plans based on factors such as monthly premiums, deductibles, copayments, and the scope of coverage. You may also have the option to customize your plan by adding optional benefits like dental or vision coverage.

Comparing Health Insurance Plans

With so many options available, comparing health insurance plans can be overwhelming. Here are some key factors to consider when evaluating different plans:

- Premium: The amount you pay monthly for your health insurance coverage. Consider your budget and balance the premium cost with the level of coverage provided.

- Deductible: The amount you must pay out of pocket before your insurance coverage begins. Higher deductibles often result in lower premiums, but you'll pay more upfront for medical services.

- Copayments and Coinsurance: Copayments are fixed amounts you pay for specific services, like doctor visits or prescriptions. Coinsurance is a percentage of the cost you pay for covered services after meeting your deductible.

- Network of Providers: Health insurance plans typically have networks of preferred providers, including doctors, hospitals, and pharmacies. Check if your current healthcare providers are in-network to ensure seamless coverage.

- Covered Services: Review the scope of coverage, including inpatient and outpatient care, prescription drugs, mental health services, and specialty treatments. Ensure that the plan covers the services you anticipate needing.

- Out-of-Pocket Maximum: This is the maximum amount you will pay out of pocket for covered services in a year. Plans with lower out-of-pocket maximums provide more financial protection.

Tips for Choosing the Right Health Insurance Plan

Selecting the right health insurance plan requires careful consideration of your healthcare needs, budget, and personal preferences. Here are some tips to guide you through the process:

- Assess your healthcare needs: Evaluate your current and anticipated medical needs. Consider any ongoing conditions, prescription medications, and the frequency of doctor visits. Choose a plan that provides adequate coverage for your specific requirements.

- Compare premiums and deductibles: Balance the cost of premiums with the amount you can afford to pay out of pocket. Higher deductibles may result in lower premiums, but they can also lead to higher costs if you require extensive medical care.

- Review network providers: Ensure that your preferred healthcare providers are in-network to avoid higher out-of-network costs. Check the plan's directory of providers to confirm their participation.

- Understand coverage exclusions: Carefully read the plan's summary of benefits and coverage to identify any exclusions or limitations. This will help you avoid unexpected gaps in coverage.

- Consider optional benefits: Some plans offer optional benefits like dental, vision, or wellness programs. Assess whether these additional benefits are worth the extra cost based on your personal needs.

The Impact of Health Insurance on Healthcare Access

Having health insurance not only provides financial protection but also improves access to healthcare services. With insurance coverage, individuals are more likely to seek regular medical care, receive preventive screenings, and manage chronic conditions effectively. This proactive approach to healthcare can lead to better health outcomes and reduced long-term healthcare costs.

Moreover, health insurance coverage reduces the financial barriers that often prevent individuals from seeking necessary medical care. By covering a portion or all of the cost of medical services, health insurance makes healthcare more affordable and accessible to a wider population.

Future Trends in Health Insurance

The landscape of health insurance is constantly evolving, influenced by advancements in technology, changing demographics, and policy reforms. Here are some future trends to watch:

- Telehealth Integration: The COVID-19 pandemic accelerated the adoption of telehealth services, and this trend is expected to continue. Health insurance plans are increasingly covering telehealth visits, providing convenient and accessible healthcare options, especially for routine consultations and follow-up appointments.

- Value-Based Care Models: Value-based care models focus on delivering high-quality healthcare while controlling costs. These models incentivize healthcare providers to improve patient outcomes and reduce unnecessary treatments. Health insurance plans are increasingly incorporating value-based care strategies to enhance efficiency and patient satisfaction.

- Emphasis on Preventive Care: With the understanding that preventive care can lead to better health outcomes and reduced costs, health insurance plans are placing greater emphasis on preventive services. This includes covering a wider range of preventive screenings, immunizations, and wellness programs to encourage proactive health management.

- Personalized Medicine: Advancements in genomics and precision medicine are enabling more tailored treatment approaches. Health insurance plans may increasingly cover genetic testing and personalized treatment options, improving patient outcomes and reducing the need for trial-and-error approaches.

Frequently Asked Questions

Can I apply for health insurance outside of the open enrollment period?

+

Yes, you may be eligible for a special enrollment period if you experience a qualifying life event, such as losing other coverage, getting married, or having a baby. Check with your state’s marketplace or the federal marketplace to determine if you qualify for a special enrollment period.

What happens if I don’t have health insurance and need medical treatment?

+

If you don’t have health insurance and require medical treatment, you will be responsible for paying the full cost of the services provided. This can result in significant financial burdens. It’s important to explore your options for obtaining health insurance to ensure you have coverage and protect yourself from unexpected medical expenses.

Can I keep my health insurance plan if I change jobs or move to a different state?

+

If you have employer-sponsored health insurance, your coverage may change or end when you leave your job. However, you may be eligible for COBRA coverage, which allows you to temporarily continue your employer’s plan. If you move to a different state, you can explore health insurance options through the new state’s marketplace or seek individual plans.

How do I know if I’m eligible for Medicaid or CHIP?

+

Eligibility criteria for Medicaid and CHIP vary by state. Visit Medicaid.gov or contact your state’s Medicaid agency to determine your eligibility. They will guide you through the application process and provide information on the benefits and services covered by your state’s program.

What is the difference between HMO and PPO health insurance plans?

+

HMO (Health Maintenance Organization) plans typically require you to choose a primary care physician (PCP) and obtain referrals from the PCP for specialist care. They often have lower out-of-pocket costs but may have more limited provider networks. PPO (Preferred Provider Organization) plans offer more flexibility, allowing you to see any provider within the network without a referral. PPO plans may have higher out-of-pocket costs but provide broader access to healthcare services.