Health Insurance In Mi

In the state of Michigan, health insurance plays a crucial role in ensuring residents have access to essential medical care. The healthcare landscape in Michigan is diverse, with various insurance providers offering a range of plans to cater to the needs of individuals, families, and businesses. This article aims to delve into the intricacies of health insurance in Michigan, exploring its key aspects, coverage options, and the impact it has on the well-being of Michiganders.

Understanding Health Insurance in Michigan

Health insurance in Michigan is governed by state and federal regulations, aiming to provide affordable and comprehensive healthcare coverage to its residents. The state’s insurance market is highly competitive, with numerous insurance carriers offering a wide array of plans. This competitive environment often results in better rates and a broader selection of options for consumers.

One of the key aspects of health insurance in Michigan is the state's Individual Market, which caters to those who are self-employed, unemployed, or do not have access to employer-sponsored plans. The Affordable Care Act (ACA) has significantly influenced the Individual Market, introducing mandates and subsidies to make insurance more accessible and affordable.

Additionally, Michigan has a robust Employer-Sponsored Market, where businesses provide health insurance plans as a benefit to their employees. This market segment plays a vital role in ensuring a large portion of the population has access to healthcare. The state also offers public insurance programs, such as Medicaid and Medicare, to cater to specific populations, including low-income individuals, the elderly, and those with disabilities.

Coverage Options and Plans

Michigan residents have a multitude of coverage options and plan types to choose from, each tailored to meet diverse healthcare needs and budgets. These plans typically fall under the categories of Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and Point-of-Service (POS) plans.

Health Maintenance Organizations (HMOs)

HMOs are popular in Michigan and often provide more affordable premiums. These plans typically require members to choose a primary care physician (PCP) who coordinates all their healthcare needs. Referrals are necessary for specialized care, and out-of-network services may not be covered.

| Key Features of HMOs |

|---|

| Affordable premiums |

| PCP-centered care |

| Limited coverage for out-of-network services |

Preferred Provider Organizations (PPOs)

PPOs offer more flexibility than HMOs, allowing members to choose from a network of preferred providers. Members can visit any in-network provider without referrals, although out-of-network services are typically more expensive. PPOs often come with higher premiums but provide broader coverage options.

| Key Features of PPOs |

|---|

| Flexibility in provider choice |

| No referrals needed for in-network services |

| Higher premiums compared to HMOs |

Exclusive Provider Organizations (EPOs)

EPOs are similar to PPOs but with a more restricted network of providers. Members must use in-network providers to receive coverage, and referrals are usually required for specialized care. EPOs strike a balance between the affordability of HMOs and the flexibility of PPOs.

| Key Features of EPOs |

|---|

| Restricted provider network |

| Referrals needed for specialized care |

| Offers affordability with some flexibility |

Point-of-Service (POS) Plans

POS plans combine features of both HMOs and PPOs. Members typically choose a PCP and receive coverage for in-network services. However, they have the option to use out-of-network providers with increased costs. POS plans offer flexibility while maintaining cost-effectiveness.

| Key Features of POS Plans |

|---|

| Combination of HMO and PPO features |

| PCP-centered care with out-of-network options |

| Balances flexibility and cost-effectiveness |

Navigating the Michigan Insurance Market

Understanding the Michigan insurance market and selecting the right plan can be complex. Here are some key considerations and resources to assist in this process:

Assessing Your Needs

Before choosing a plan, it’s crucial to evaluate your healthcare needs and budget. Consider factors such as the frequency of doctor visits, prescription medication requirements, and potential specialized care needs. Understanding these aspects will help narrow down the most suitable plan options.

Researching Providers and Plans

Researching insurance providers and their offered plans is essential. Compare coverage, network providers, and customer reviews to ensure you find a plan that aligns with your needs. Online resources and comparison tools can simplify this process.

Understanding Plan Costs

Health insurance plans come with various costs, including premiums, deductibles, copayments, and coinsurance. Understanding these costs and how they work is vital to making an informed decision. Consider your budget and potential healthcare expenses when selecting a plan.

Utilizing Resources and Support

Michigan residents have access to various resources and support to navigate the insurance market. The state’s Department of Insurance and Financial Services provides valuable information and guidance on insurance-related matters. Additionally, non-profit organizations and insurance brokers can offer assistance in understanding and selecting appropriate plans.

The Impact of Health Insurance on Michiganders

Health insurance plays a pivotal role in the overall well-being and financial stability of Michigan residents. By providing access to essential healthcare services, insurance coverage ensures that individuals and families can receive the medical attention they need without facing devastating financial burdens.

Furthermore, health insurance fosters preventive care, encouraging Michiganders to take a proactive approach to their health. Regular check-ups, screenings, and vaccinations are often covered by insurance plans, helping to identify and manage potential health issues early on. This preventive focus contributes to improved health outcomes and reduced healthcare costs in the long term.

In addition to individual benefits, health insurance in Michigan also has a significant impact on the state's economy. A healthy and productive workforce is crucial for economic growth, and insurance coverage ensures that employees can stay healthy and continue contributing to their professions. Moreover, insurance providers and healthcare facilities create jobs, stimulating economic activity and development within the state.

Addressing Challenges and Looking Ahead

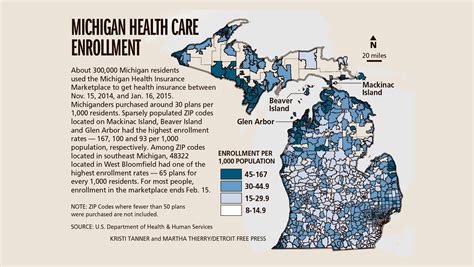

Despite the progress made in improving health insurance accessibility, Michigan, like many other states, faces challenges. Rising healthcare costs, varying insurance coverage across regions, and the need for continuous improvement in insurance plans and regulations are areas of focus for policymakers and stakeholders.

Looking ahead, Michigan is committed to enhancing its healthcare system and ensuring that residents have access to high-quality, affordable healthcare. Ongoing efforts include exploring innovative solutions, such as value-based care models and expanding telemedicine services, to improve healthcare delivery and patient outcomes.

What is the average cost of health insurance in Michigan?

+The average cost of health insurance in Michigan can vary based on several factors, including age, location, and the specific plan chosen. According to recent data, the average monthly premium for an individual can range from 400 to 600, while family plans can cost upwards of $1,200 per month. It’s important to note that these averages can vary, and shopping around and comparing plans can help find more affordable options.

Are there any subsidies or financial assistance available for health insurance in Michigan?

+Yes, Michigan residents may be eligible for financial assistance through the Affordable Care Act (ACA). Subsidies are available to individuals and families with incomes between 100% and 400% of the federal poverty level. These subsidies can significantly reduce the cost of insurance premiums, making coverage more affordable.

How can I find the best health insurance plan for my needs in Michigan?

+Finding the best health insurance plan involves assessing your specific needs and researching available options. Consider factors such as your healthcare requirements, budget, and preferred providers. Online resources, insurance brokers, and Michigan’s Department of Insurance and Financial Services can provide valuable guidance and comparisons to help you choose the right plan.