Auto Insurance Buy

Maximizing Auto Insurance Savings: A Comprehensive Guide

When it comes to auto insurance, finding the right coverage and the best rates can be a challenging task. With a multitude of options and factors to consider, it's easy to feel overwhelmed. However, with the right knowledge and strategies, you can navigate the insurance landscape and secure significant savings on your policy. In this comprehensive guide, we will delve into the world of auto insurance, offering expert insights and practical tips to help you make informed decisions and maximize your savings.

Understanding Auto Insurance: The Fundamentals

Auto insurance is a vital financial protection for vehicle owners. It provides coverage for various situations, including accidents, theft, and damage to your vehicle. Understanding the basics of auto insurance is crucial to making informed choices. Here's a breakdown of the key components:

Liability Coverage

Liability coverage is a fundamental aspect of auto insurance. It protects you financially if you are found at fault in an accident, covering the costs of injuries and property damage caused to others. This coverage is typically divided into bodily injury liability and property damage liability.

| Liability Coverage | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages for injured parties in an accident you caused. |

| Property Damage Liability | Pays for repairs or replacement of others' property damaged in an accident you caused. |

Collision and Comprehensive Coverage

Collision and comprehensive coverage are optional but highly recommended. Collision coverage helps pay for repairs or replacement of your vehicle after an accident, regardless of fault. Comprehensive coverage, on the other hand, covers non-accident-related damages, such as theft, vandalism, and natural disasters.

| Coverage | Description |

|---|---|

| Collision Coverage | Covers repair or replacement costs after an accident, including your own vehicle's damage. |

| Comprehensive Coverage | Protects against non-accident-related losses, including theft, fire, and weather-related damages. |

Additional Coverages

Auto insurance policies can offer a range of additional coverages to suit your specific needs. These may include:

- Uninsured/Underinsured Motorist Coverage: Protects you if you're involved in an accident with a driver who has little or no insurance.

- Medical Payments Coverage: Covers medical expenses for you and your passengers after an accident, regardless of fault.

- Rental Car Reimbursement: Provides coverage for rental car expenses while your vehicle is being repaired.

- Gap Insurance: Covers the difference between your vehicle's actual value and what you owe if it's totaled.

Researching and Comparing Auto Insurance Providers

The auto insurance market is highly competitive, with numerous providers offering a wide range of policies. Conducting thorough research and comparing different providers is essential to finding the best coverage and rates. Here's how to get started:

Online Quotes and Comparison Tools

Utilize online quote comparison tools to get a quick overview of the market. These platforms allow you to input your information once and receive multiple quotes from different insurers. Compare not only the prices but also the coverage limits and deductibles offered.

Check Provider Reputation and Financial Stability

When considering an insurance provider, it’s crucial to assess their reputation and financial stability. Check customer reviews and ratings on independent review websites. Additionally, review financial strength ratings from reputable agencies like AM Best, Moody’s, or Standard & Poor’s. A strong financial rating indicates the provider’s ability to pay claims.

Consider Specialty Insurers

While traditional insurance companies cater to a broad range of drivers, specialty insurers focus on specific demographics or vehicle types. For example, classic car owners might benefit from insurers specializing in classic car coverage. These specialty providers often offer tailored policies and competitive rates.

Factors Influencing Auto Insurance Rates

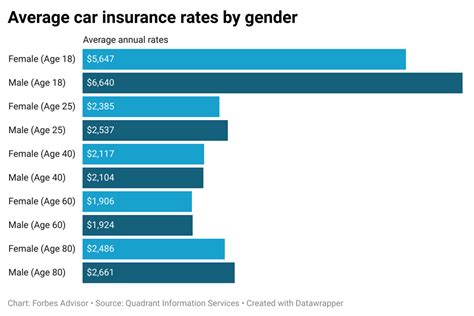

Auto insurance rates can vary significantly based on numerous factors. Understanding these factors can help you identify areas where you might be able to negotiate better rates or make adjustments to lower your premiums. Here are some key factors to consider:

Driving History

Your driving record plays a significant role in determining your insurance rates. A clean driving history with no accidents or violations typically results in lower premiums. On the other hand, a history of accidents, speeding tickets, or DUI convictions can lead to higher rates.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can impact your insurance rates. Sports cars and luxury vehicles often have higher premiums due to their higher repair costs and potential for theft. Additionally, the primary purpose of your vehicle (e.g., personal use, business use, or pleasure driving) can affect your rates.

Credit Score

In many states, insurance companies use your credit score as a factor in determining your rates. Generally, individuals with higher credit scores are considered lower risk and may qualify for lower premiums. Improving your credit score can potentially lead to significant savings on your auto insurance.

Location and Mileage

Where you live and how much you drive can also affect your insurance rates. Urban areas with higher traffic and crime rates often result in higher premiums. Additionally, the number of miles you drive annually can influence your rates, as lower mileage typically indicates lower risk.

Tips for Negotiating and Saving on Auto Insurance

Now that you have a better understanding of the factors influencing auto insurance rates, it's time to explore strategies to negotiate better deals and maximize your savings. Here are some expert tips:

Bundle Policies

If you have multiple insurance needs, such as auto, home, or life insurance, consider bundling your policies with the same provider. Many insurers offer discounts for customers who bundle multiple policies, as it reduces administrative costs and simplifies the claims process.

Increase Deductibles

Increasing your deductibles can lead to significant savings on your premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you take on more financial responsibility, which often results in lower premiums.

Explore Discounts

Insurance providers offer a variety of discounts to attract and retain customers. Some common discounts include:

- Safe Driver Discount: Rewarding drivers with clean records who haven't had accidents or violations for a certain period.

- Multi-Policy Discount: Offering lower rates when you bundle multiple insurance policies (e.g., auto and home) with the same provider.

- Good Student Discount: Providing discounts to students with good academic standing, encouraging academic excellence.

- Anti-Theft Device Discount: Offering lower rates for vehicles equipped with anti-theft devices, as they pose a lower risk of theft.

Maintain a Good Credit Score

As mentioned earlier, your credit score can impact your insurance rates. Taking steps to improve your credit score, such as paying bills on time and reducing debt, can potentially lead to substantial savings on your auto insurance.

Shop Around and Negotiate

Don’t be afraid to shop around and negotiate with different insurance providers. Obtain quotes from multiple companies and compare the coverage and rates they offer. If you find a better deal elsewhere, use it as leverage to negotiate with your current insurer. Many providers are willing to match or beat competitors’ offers to retain customers.

Managing Your Auto Insurance Policy

Once you've secured your auto insurance policy, it's important to regularly review and manage it to ensure it continues to meet your needs and provide the best value. Here are some key considerations:

Regularly Review Coverage Limits

Your insurance needs may change over time, so it’s essential to review your coverage limits periodically. Ensure that your liability limits are sufficient to protect your assets in the event of an accident. Consider increasing your limits if your financial situation has improved or if you’ve acquired new assets.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, uses technology to track your driving behavior and offer customized rates. These programs often reward safe drivers with lower premiums. If you’re a cautious driver, usage-based insurance could be a cost-effective option.

Keep an Eye on Mileage

If your annual mileage decreases significantly, inform your insurer. Lower mileage often translates to lower risk, which can result in reduced premiums. Conversely, if your mileage increases, you may need to adjust your coverage accordingly.

Regularly Update Your Policy

Life changes, such as getting married, purchasing a new vehicle, or moving to a different location, can impact your auto insurance needs. Make sure to update your policy information and review your coverage whenever significant life events occur.

FAQs: Common Auto Insurance Questions

How often should I review and compare auto insurance rates?

+It's recommended to review and compare auto insurance rates at least once a year, preferably during your policy's renewal period. This allows you to stay informed about any changes in the market and take advantage of potential savings.

What are the consequences of not having auto insurance?

+Driving without auto insurance is illegal in most states and can result in severe penalties, including fines, license suspension, and even imprisonment. Additionally, you'll be financially responsible for any damages or injuries caused in an accident.

Can I switch auto insurance providers mid-policy term?

+Yes, you can switch auto insurance providers at any time. However, be aware that some providers may charge a fee for canceling your policy early. Make sure to compare the benefits and costs of switching before making a decision.

How does my credit score impact my auto insurance rates?

+Insurance companies use credit scores as a factor in determining insurance rates. Individuals with higher credit scores are often considered lower risk and may qualify for lower premiums. Improving your credit score can potentially lead to significant savings on your auto insurance.

By understanding the fundamentals of auto insurance, researching and comparing providers, and implementing smart strategies, you can maximize your savings and secure the best coverage for your needs. Remember, auto insurance is a crucial investment in your financial well-being, so take the time to make informed decisions and stay protected on the road.