Farm Bureau Insurance Companies

Farm Bureau Insurance Companies, often referred to as simply "Farm Bureau Insurance," is a renowned group of insurance providers that has become a household name in the United States, especially within rural communities. With a rich history spanning over a century, this network of insurance companies has established itself as a trusted partner for countless individuals and families across the nation. In this comprehensive article, we delve into the intricate world of Farm Bureau Insurance, exploring its origins, its expansive range of services, its unique approach to community engagement, and its unwavering commitment to providing tailored insurance solutions for its valued clientele.

A Legacy of Service: The Farm Bureau Insurance Story

The roots of Farm Bureau Insurance Companies can be traced back to the early 20th century, a time when American agriculture was undergoing significant transformations. In 1911, a group of visionary farmers in New York state came together to form the first Farm Bureau. Their primary objective was to address the unique challenges faced by farmers, including the lack of accessible and affordable insurance options. This initiative sparked a movement that quickly spread across the nation, with farmers in various states establishing their own Farm Bureaus.

By the 1920s, the need for insurance tailored to the agricultural community became even more apparent. In response, several Farm Bureaus began offering mutual insurance programs, providing coverage for farms and their assets. This marked the birth of what we now know as Farm Bureau Insurance Companies. Over the decades, the company expanded its offerings to include a comprehensive range of insurance products, catering not only to farmers but also to the broader public.

A Comprehensive Suite of Insurance Solutions

Farm Bureau Insurance Companies has evolved into a one-stop shop for all insurance needs. Its extensive product portfolio encompasses a myriad of coverage options, ensuring that individuals and businesses can find the right fit for their specific requirements.

Auto Insurance

The company’s auto insurance offerings are tailored to provide comprehensive protection for vehicles, whether it’s a daily driver or a classic car. Policies can be customized to include features such as roadside assistance, rental car coverage, and accident forgiveness, ensuring a seamless and stress-free experience for policyholders.

Home Insurance

Farm Bureau Insurance understands that a home is more than just a physical structure; it’s a sanctuary. Their home insurance policies are designed to offer protection against a wide range of risks, including fire, theft, and natural disasters. Additionally, the company provides coverage for personal belongings and liability, giving homeowners peace of mind.

Life Insurance

Life insurance is a crucial aspect of financial planning, and Farm Bureau Insurance offers a variety of options to suit different needs. Whether it’s term life insurance, whole life insurance, or universal life insurance, the company provides tailored solutions to protect families and loved ones in the event of an untimely demise.

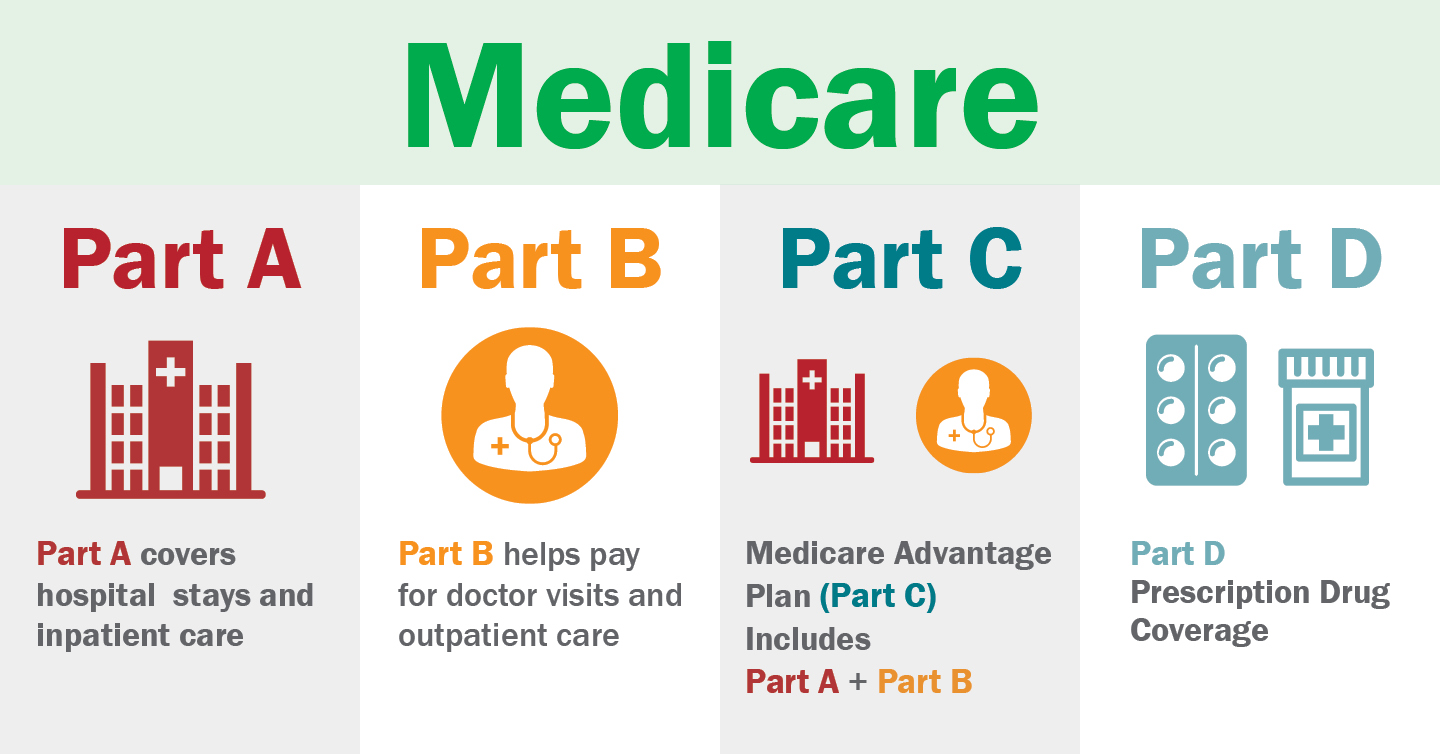

Health Insurance

With the rising cost of healthcare, having the right health insurance coverage is essential. Farm Bureau Insurance offers a range of health insurance plans, including individual and family policies, as well as employer-sponsored group plans. These plans aim to provide affordable and comprehensive medical coverage, ensuring access to quality healthcare when it’s needed most.

Business Insurance

Farm Bureau Insurance extends its services to the business community, offering a wide array of commercial insurance solutions. From general liability insurance to workers’ compensation and property insurance, the company helps businesses mitigate risks and protect their assets. Customizable policies ensure that businesses of all sizes and industries can find the right fit.

Community Engagement and Beyond

Farm Bureau Insurance Companies’ commitment to its customers extends beyond providing insurance solutions. The company has a long-standing tradition of community engagement and philanthropy, actively contributing to the well-being of the communities it serves.

Through various initiatives, Farm Bureau Insurance supports local charities, educational programs, and community development projects. This dedication to giving back is a core value of the company, reflecting its commitment to making a positive impact beyond its core business operations.

Education and Youth Development

One of the key focus areas for Farm Bureau Insurance is youth development and education. The company sponsors and supports numerous programs aimed at empowering young people and fostering their growth. These initiatives include scholarships, leadership development programs, and agricultural education initiatives, all of which contribute to building a brighter future for the next generation.

Disaster Relief and Recovery

In times of crisis, Farm Bureau Insurance steps up to provide support and assistance. The company has a long history of aiding communities affected by natural disasters, offering financial relief and resources to help with recovery efforts. This commitment to disaster relief showcases the company’s dedication to its customers and the communities it serves.

Performance and Customer Satisfaction

Farm Bureau Insurance Companies consistently ranks among the top insurance providers in terms of customer satisfaction and financial stability. Independent rating agencies regularly praise the company for its strong financial performance and commitment to policyholders. With a solid track record of paying claims promptly and efficiently, Farm Bureau Insurance has earned the trust of its customers.

The company's customer-centric approach is evident in its claim handling process. Farm Bureau Insurance prioritizes prompt and fair claim settlements, ensuring that policyholders receive the support they need when it matters most. This dedication to customer service has contributed to the company's high retention rate and positive reputation.

Looking Ahead: The Future of Farm Bureau Insurance

As the insurance landscape continues to evolve, Farm Bureau Insurance remains committed to innovation and adaptability. The company is investing in technology to enhance its services, streamline processes, and provide customers with a seamless digital experience. From mobile apps for policy management to advanced analytics for risk assessment, Farm Bureau Insurance is staying at the forefront of the industry.

Additionally, the company is expanding its reach and diversifying its offerings to cater to an increasingly diverse customer base. By staying true to its core values of community engagement and customer service, Farm Bureau Insurance is well-positioned to continue its legacy of success and remain a trusted partner for generations to come.

| Insurance Category | Key Offerings |

|---|---|

| Auto Insurance | Comprehensive coverage, roadside assistance, accident forgiveness |

| Home Insurance | Protection against fire, theft, natural disasters, personal belongings coverage |

| Life Insurance | Term life, whole life, universal life insurance |

| Health Insurance | Individual, family, and group health plans |

| Business Insurance | Liability, workers' compensation, property insurance for businesses |

What sets Farm Bureau Insurance apart from other insurance providers?

+

Farm Bureau Insurance’s unique selling point lies in its deep-rooted connection to the agricultural community and its unwavering commitment to community engagement. The company’s comprehensive range of insurance products, coupled with its focus on customer satisfaction and financial stability, sets it apart from competitors.

How can I become a Farm Bureau Insurance agent?

+

To become a Farm Bureau Insurance agent, you typically need to meet certain qualifications, such as holding a valid insurance license and completing the company’s agent training program. The company values agents who embody its core values of integrity, customer service, and community involvement.

What is the claim process like with Farm Bureau Insurance?

+

Farm Bureau Insurance prioritizes a seamless and efficient claim process. Policyholders can report claims online or over the phone, and the company aims to provide prompt and fair settlements. The claim handling team is dedicated to ensuring a positive and stress-free experience for customers.

Does Farm Bureau Insurance offer discounts on its insurance policies?

+

Yes, Farm Bureau Insurance offers a variety of discounts to its policyholders. These may include multi-policy discounts, good student discounts, safe driver discounts, and loyalty discounts. The company believes in rewarding its customers for their loyalty and responsible behavior.