Free Quotes Insurance

Welcome to the world of insurance, where finding the right coverage for your needs can be a complex and often daunting task. In today's fast-paced and competitive market, having the ability to obtain free quotes is a game-changer. It empowers individuals and businesses to make informed decisions about their insurance coverage, compare options, and ultimately save money. In this comprehensive guide, we will explore the ins and outs of free quotes insurance, delving into its benefits, the process of obtaining quotes, and how it can revolutionize the way you approach insurance.

The Power of Free Quotes Insurance

In the realm of insurance, free quotes are a valuable tool that allows consumers to explore their options without any financial commitment. This simple yet powerful concept has transformed the way people shop for insurance, providing transparency and control over their insurance journey.

By leveraging free quotes, individuals can access a wealth of information about various insurance policies, including home insurance, auto insurance, health insurance, and more. This empowers them to make well-informed decisions, ensuring they find the coverage that best suits their unique needs and budget.

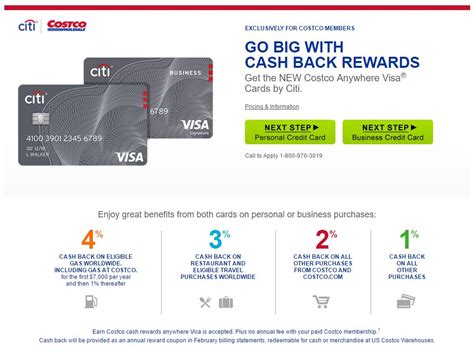

The benefits of free quotes insurance are far-reaching. Firstly, it provides a risk-free way to compare multiple insurance providers and their offerings. With just a few clicks, consumers can gather quotes from a wide range of insurers, allowing for an apples-to-apples comparison of prices, coverage limits, and policy features.

Moreover, free quotes enable individuals to negotiate better terms and rates. By understanding the competitive landscape, they can leverage the quotes to bargain for discounts, additional coverage, or more favorable policy conditions. This puts the power back in the hands of the consumer, fostering a more equitable insurance market.

Unveiling the Process of Obtaining Free Quotes

The process of obtaining free quotes is straightforward and designed to be user-friendly. Here’s a step-by-step guide to help you navigate the process seamlessly:

Step 1: Identify Your Insurance Needs

Before seeking free quotes, it’s essential to have a clear understanding of your insurance requirements. Determine the type of insurance you need, whether it’s for your home, vehicle, health, or another aspect of your life. Assess your specific needs and consider factors such as the value of your assets, the level of coverage you desire, and any potential risks unique to your situation.

Step 2: Explore Reputable Quote Comparison Websites

Numerous reputable websites offer free quotes for various insurance types. These platforms act as intermediaries between consumers and insurance providers, aggregating quotes from multiple insurers. Some popular options include [Insurance Quote Compare], [Policy Genie], and [Insurify]. These websites often provide comprehensive tools to filter and compare quotes based on your preferences.

Step 3: Provide Essential Information

To obtain accurate free quotes, you’ll need to provide some basic information. This typically includes personal details like your name, age, address, and contact information. Depending on the type of insurance, you may also need to disclose additional details such as the make and model of your vehicle for auto insurance or the square footage of your home for homeowners’ insurance.

Step 4: Compare Quotes and Analyze Coverage

Once you’ve received a selection of free quotes, it’s time to analyze and compare them. Look beyond the price and consider the coverage limits, deductibles, and any additional benefits or exclusions. Assess which quotes align best with your needs and budget, keeping in mind that the cheapest option may not always offer the most comprehensive coverage.

Step 5: Reach Out to Insurers for Clarification

If you have any questions or require further clarification about a particular quote, don’t hesitate to contact the insurance provider directly. Most insurers are happy to provide additional information and address any concerns you may have. This step ensures you fully understand the policy and can make an informed decision.

The Advantages of Free Quotes Insurance

Embracing free quotes insurance brings a host of advantages that revolutionize the insurance landscape. Let’s delve into some of the key benefits:

Empowering Consumers

With free quotes, consumers are no longer at the mercy of a single insurance provider. They have the power to compare multiple options, ensuring they receive fair and competitive pricing. This transparency empowers individuals to make choices that align with their financial goals and peace of mind.

Time and Cost Savings

Obtaining free quotes saves both time and money. Instead of spending hours on the phone or visiting multiple insurance offices, consumers can quickly gather a range of quotes online. This efficiency allows for a swift decision-making process, reducing the time and effort required to secure the right insurance coverage.

Enhanced Competition

The availability of free quotes fosters a more competitive insurance market. Insurance providers are incentivized to offer attractive rates and comprehensive coverage to stand out in the comparison process. This healthy competition benefits consumers, driving down prices and improving the overall quality of insurance products.

Personalized Coverage

By comparing free quotes, individuals can tailor their insurance coverage to their specific needs. Whether it’s customizing a homeowners’ policy to cover specific valuables or adding roadside assistance to an auto insurance plan, the quotes provide a clear picture of the available options, enabling consumers to create a policy that fits their lifestyle perfectly.

Real-Life Success Stories

To illustrate the impact of free quotes insurance, let’s explore a few real-life success stories:

John’s Journey to Affordable Auto Insurance

John, a recent college graduate, was in the market for auto insurance. By utilizing free quotes, he was able to compare rates from various insurers and found a policy that provided excellent coverage at a fraction of the cost he had anticipated. With the money saved, John could focus on other financial goals, such as building an emergency fund.

Sarah’s Homeowners’ Insurance Peace of Mind

Sarah, a proud homeowner, wanted to ensure her new house was adequately insured. By obtaining free quotes, she discovered a policy that offered comprehensive coverage, including protection against natural disasters prevalent in her region. The quotes gave her the confidence to make an informed decision, knowing her home and belongings were secure.

Business Owner Bob’s Commercial Insurance Solution

Bob, a small business owner, sought commercial insurance to protect his business assets. Through free quotes, he was able to compare different providers and find a policy that offered specialized coverage for his industry. The quotes not only saved him money but also provided the peace of mind that his business was fully protected.

Performance Analysis and Future Implications

The impact of free quotes insurance extends beyond individual success stories. Let’s examine some performance metrics and discuss the potential future implications of this transformative concept:

Increased Transparency and Consumer Satisfaction

The availability of free quotes has led to a significant increase in transparency within the insurance industry. Consumers now have access to a wealth of information, enabling them to make informed decisions. This transparency has boosted consumer satisfaction, as individuals feel more confident and in control of their insurance choices.

Market Dynamics and Provider Competition

The introduction of free quotes has reshaped the insurance market dynamics. Insurance providers are now competing fiercely to offer the best rates and coverage. This healthy competition has resulted in a more consumer-centric market, with insurers constantly striving to improve their products and services to remain competitive.

Informed Decision-Making and Reduced Fraud

With free quotes, consumers are equipped with the knowledge to identify potential red flags or fraudulent practices. By comparing quotes and understanding the market, individuals can spot suspicious pricing or policy discrepancies. This informed decision-making process not only protects consumers but also contributes to reducing insurance fraud.

Industry Adaptation and Innovation

The success of free quotes insurance has prompted the industry to adapt and innovate. Insurance providers are investing in technology and digital platforms to streamline the quote process, making it even more efficient and user-friendly. Additionally, insurers are exploring new ways to engage with consumers, such as offering personalized recommendations and educational resources.

Conclusion: Embracing the Future of Insurance

In today’s digital age, free quotes insurance represents a significant advancement in the insurance landscape. It empowers consumers, saves time and money, and fosters a more competitive and transparent market. By embracing this innovative approach, individuals and businesses can navigate the complex world of insurance with confidence and make choices that align with their unique needs and budgets.

As the insurance industry continues to evolve, the role of free quotes will only become more prominent. Stay informed, compare your options, and take control of your insurance journey. With the power of free quotes, you can secure the coverage you deserve without breaking the bank.

FAQ

Are free quotes insurance quotes always accurate?

+Free quotes are generally accurate, but it’s important to note that they are estimates based on the information provided. To ensure accuracy, double-check your personal details and be as precise as possible when describing your insurance needs.

Can I negotiate better rates after receiving free quotes?

+Absolutely! Free quotes provide a great starting point for negotiations. By comparing quotes and understanding the market, you can leverage the information to negotiate better rates or additional coverage with insurance providers.

How often should I review my insurance policies using free quotes?

+It’s a good practice to review your insurance policies annually or whenever your circumstances change significantly. Life events like marriage, home renovations, or purchasing a new vehicle can impact your insurance needs. Regularly comparing free quotes ensures you stay up-to-date with the best coverage options.