Car Insurance In The Us

Car insurance is a crucial aspect of vehicle ownership in the United States, providing financial protection and peace of mind to drivers across the nation. With a vast and diverse automotive landscape, understanding the intricacies of car insurance and its variations is essential for every motorist. This comprehensive guide delves into the world of car insurance in the US, offering an in-depth analysis of policies, coverage types, and factors influencing rates.

Understanding Car Insurance Policies

Car insurance policies in the US are designed to offer protection against a range of potential risks and liabilities associated with owning and operating a motor vehicle. These policies typically encompass various types of coverage, each catering to specific needs and circumstances. Let’s explore the key components of car insurance policies and their significance.

Liability Coverage

Liability coverage is the cornerstone of any car insurance policy. It provides financial protection in the event that the policyholder is found legally responsible for causing injuries or property damage to others in an accident. This coverage typically includes two main components: bodily injury liability and property damage liability.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other costs incurred by individuals injured in an accident caused by the policyholder. It helps ensure that the insured is protected from potentially devastating financial consequences resulting from a serious accident.

- Property Damage Liability: Property damage liability coverage pays for repairs or replacement of damaged property, such as another person’s vehicle or even structures like fences or buildings. This coverage is essential to protect the policyholder from claims seeking compensation for property damage.

Collision and Comprehensive Coverage

While liability coverage focuses on protecting others, collision and comprehensive coverage are designed to safeguard the policyholder’s own vehicle. These coverages offer protection against a range of risks that can lead to damage or loss of the insured vehicle.

- Collision Coverage: As the name suggests, collision coverage provides protection for damage to the insured vehicle resulting from a collision with another vehicle or object. This coverage can be particularly valuable for drivers who wish to protect their investment in their vehicle.

- Comprehensive Coverage: Comprehensive coverage offers protection against a wide range of non-collision incidents, including theft, vandalism, natural disasters, and even damage caused by animals. It provides a comprehensive safety net for the insured vehicle, ensuring that it is protected from various unforeseen events.

Medical Payments and Personal Injury Protection

Medical payments and personal injury protection (PIP) coverage are designed to provide additional medical benefits for the policyholder and their passengers in the event of an accident. These coverages can help cover medical expenses, lost wages, and other related costs, regardless of who is at fault in the accident.

- Medical Payments Coverage: Medical payments coverage, often referred to as MedPay, helps cover medical expenses for the policyholder and their passengers after an accident. It can provide quick and efficient access to medical care, ensuring that injuries are promptly addressed.

- Personal Injury Protection (PIP): PIP coverage is a more comprehensive form of medical coverage, often including not only medical expenses but also lost wages, funeral expenses, and other related costs. It provides a broader safety net for policyholders and their passengers, ensuring they receive the necessary support after an accident.

Uninsured/Underinsured Motorist Coverage

Despite the legal requirement for drivers to carry insurance, some motorists choose to drive without adequate coverage. Uninsured/underinsured motorist coverage is designed to protect policyholders in such situations. This coverage can provide compensation for injuries and property damage caused by an uninsured or underinsured driver.

- Uninsured Motorist Coverage: This coverage steps in when an at-fault driver in an accident does not have insurance or has insufficient coverage to compensate for the damages caused. It ensures that the policyholder is not left financially burdened by the actions of an uninsured driver.

- Underinsured Motorist Coverage: Similar to uninsured motorist coverage, underinsured motorist coverage provides protection when the at-fault driver’s insurance coverage is insufficient to cover the full extent of the damages. It bridges the gap between the other driver’s coverage and the policyholder’s actual losses.

Additional Coverages and Endorsements

Beyond the core coverages, car insurance policies often offer a range of additional options and endorsements to cater to specific needs and preferences. These can include rental car reimbursement, roadside assistance, gap insurance, and more. Policyholders can tailor their coverage to their unique circumstances, ensuring they have the protection they require.

Factors Influencing Car Insurance Rates

Car insurance rates in the US are influenced by a multitude of factors, each playing a role in determining the cost of coverage. Understanding these factors can help policyholders make informed decisions and potentially find ways to reduce their insurance premiums.

Vehicle Type and Usage

The type of vehicle being insured and its intended usage are significant factors in determining insurance rates. Different vehicles have varying levels of risk associated with them, and how the vehicle is used can also impact the likelihood of accidents and claims.

- Vehicle Type: Sports cars, luxury vehicles, and SUVs often come with higher insurance premiums due to their increased risk of accidents, higher repair costs, and greater potential for theft. On the other hand, smaller, more economical vehicles may be associated with lower insurance rates.

- Vehicle Usage: The purpose for which a vehicle is used can also influence insurance rates. Vehicles primarily used for commuting to work or personal travel may have different rates compared to those used for business purposes or as commercial vehicles. The frequency of driving and the number of miles driven annually can also be considered.

Driver’s Profile and History

The personal characteristics and driving history of the policyholder are crucial factors in determining insurance rates. Insurers assess these factors to gauge the level of risk associated with the driver and adjust premiums accordingly.

- Age and Gender: Younger drivers, particularly those under the age of 25, are often considered higher-risk due to their lack of experience and higher propensity for accidents. Similarly, gender can also play a role, with some insurers offering different rates based on statistical differences in accident rates between males and females.

- Driving Record: A clean driving record, free from accidents and traffic violations, is generally associated with lower insurance rates. On the other hand, drivers with a history of accidents, speeding tickets, or other traffic violations may face higher premiums. The severity and frequency of these incidents can significantly impact insurance costs.

- Credit History: Surprisingly, an individual’s credit score can also be a factor in determining insurance rates. Many insurers use credit-based insurance scores as a predictor of risk, assuming that individuals with lower credit scores may be more likely to file claims. This practice is controversial and not universally adopted.

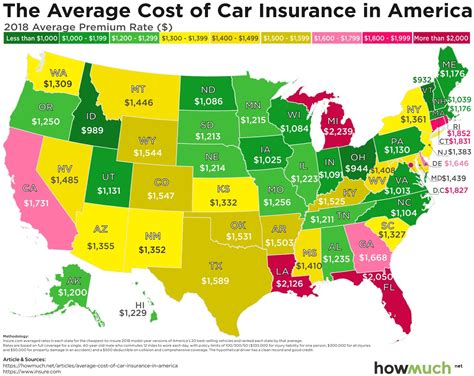

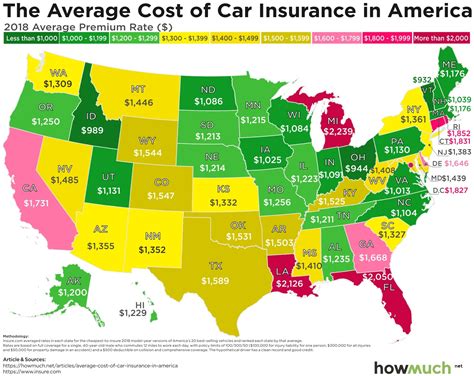

Location and Geographical Factors

The location where a vehicle is primarily driven and insured can have a significant impact on insurance rates. Geographical factors, such as population density, traffic congestion, crime rates, and weather conditions, can all influence the likelihood of accidents and claims.

- Urban vs. Rural Areas: Insurance rates tend to be higher in urban areas, where traffic congestion, higher crime rates, and increased potential for accidents are more common. In contrast, rural areas may offer lower insurance rates due to lower population density and reduced traffic risks.

- Weather and Natural Disasters: Regions prone to severe weather conditions, such as hurricanes, tornadoes, or frequent hailstorms, may face higher insurance rates. The increased risk of damage from these events can drive up insurance costs.

- Crime Rates: Areas with higher crime rates, particularly those with a higher incidence of vehicle theft or vandalism, may also see increased insurance premiums. Insurers take into account the likelihood of these events when setting rates.

Coverage Options and Deductibles

The coverage options chosen by policyholders and the associated deductibles can also influence insurance rates. Higher levels of coverage and lower deductibles typically result in higher premiums, as they represent a greater financial commitment from the insurer.

- Coverage Levels: Opting for higher coverage limits, particularly for liability coverage, can lead to increased insurance premiums. Policyholders who choose comprehensive and collision coverage with lower deductibles may also see higher rates, as these coverages provide broader protection.

- Deductibles: Deductibles are the amount the policyholder must pay out of pocket before the insurance coverage kicks in. Choosing a higher deductible can result in lower insurance premiums, as it reduces the insurer’s financial exposure. However, it’s important to strike a balance, as a higher deductible may mean more out-of-pocket costs in the event of a claim.

Discounts and Bundling

Insurance providers often offer a range of discounts and bundling options to help policyholders reduce their insurance costs. Taking advantage of these opportunities can lead to significant savings on car insurance premiums.

- Discounts: Insurers may offer discounts for various reasons, such as safe driving records, loyalty, multiple vehicles insured, or even specific occupations or affiliations. Policyholders should inquire about available discounts and ensure they meet the eligibility criteria.

- Bundling: Bundling multiple insurance policies, such as car insurance with home or renters insurance, can often lead to substantial savings. Many insurers offer discounts when customers choose to bundle their policies, recognizing the convenience and loyalty associated with such arrangements.

Tips for Choosing the Right Car Insurance

With the multitude of car insurance options available in the US, choosing the right coverage can be a daunting task. Here are some tips to help you navigate the process and make informed decisions.

Assess Your Needs

Before selecting a car insurance policy, take the time to assess your specific needs and circumstances. Consider factors such as the value of your vehicle, your driving habits, and any additional coverages you may require. Understanding your needs will help you choose a policy that provides the right level of protection without unnecessary expenses.

Compare Multiple Quotes

Don’t settle for the first insurance quote you receive. It’s essential to compare quotes from multiple insurers to ensure you’re getting the best value for your money. Online comparison tools and insurance brokers can be valuable resources for obtaining multiple quotes and assessing the market.

Understand Coverage Limits

When comparing quotes, pay close attention to the coverage limits included in each policy. Ensure that the limits align with your needs and provide adequate protection in the event of an accident or other covered incident. Higher coverage limits generally offer greater financial protection but may also result in higher premiums.

Consider Deductible Options

Deductibles play a significant role in determining insurance premiums. Choosing a higher deductible can lead to lower premiums, but it’s important to consider your financial ability to cover the deductible in the event of a claim. Strike a balance between affordable premiums and a deductible you can comfortably afford.

Review Discounts and Bundling Opportunities

Take advantage of any available discounts and bundling opportunities to reduce your insurance costs. Insurers often offer discounts for safe driving records, multiple vehicles insured, or even certain occupations. Additionally, bundling your car insurance with other policies, such as home or renters insurance, can lead to substantial savings.

Read the Fine Print

Before committing to a car insurance policy, take the time to carefully review the fine print. Understand the exclusions, limitations, and any specific conditions or requirements associated with the policy. This step is crucial to ensure you fully understand the coverage you’re purchasing and avoid any surprises down the line.

Seek Expert Advice

If you’re unsure about the best car insurance options for your needs, consider seeking advice from an insurance professional or broker. These experts can provide personalized guidance based on your circumstances and help you navigate the complex world of car insurance.

The Future of Car Insurance

The car insurance industry in the US is constantly evolving, driven by technological advancements, changing consumer expectations, and emerging trends. Here’s a glimpse into the future of car insurance and how it may impact policyholders.

Telematics and Usage-Based Insurance

Telematics technology, which involves the use of sensors and data transmission to monitor driving behavior, is gaining traction in the car insurance industry. Usage-based insurance (UBI) programs, also known as pay-as-you-drive or pay-how-you-drive insurance, leverage telematics to offer insurance rates based on an individual’s actual driving habits and patterns.

- Benefits of UBI: UBI programs can provide incentives for safe driving, as policyholders who exhibit good driving behavior may be rewarded with lower insurance premiums. This approach encourages safer driving practices and can lead to reduced accident rates.

- Challenges and Privacy Concerns: While UBI offers potential benefits, it also raises concerns about privacy and data security. Policyholders must carefully consider the trade-off between lower premiums and the potential intrusion of telematics technology into their driving habits.

Autonomous Vehicles and Insurance

The rise of autonomous vehicles (AVs) is poised to revolutionize the car insurance industry. As AVs become more prevalent, the traditional liability model of car insurance may need to evolve to account for the changing dynamics of vehicle ownership and operation.

- Liability Shifts: With AVs, the question of liability shifts from the driver to the manufacturer, software provider, or even the vehicle itself. Insurers will need to adapt their policies to address this shift and ensure appropriate coverage for all parties involved.

- Data-Driven Insurance: AVs generate vast amounts of data, which can be leveraged by insurers to gain insights into vehicle performance, maintenance needs, and potential risks. This data-driven approach may lead to more accurate risk assessments and potentially lower insurance premiums for AV owners.

Emerging Technologies and Coverages

As technology continues to advance, new risks and opportunities arise in the car insurance landscape. Insurers are exploring innovative coverages to address emerging technologies and changing consumer needs.

- Cyber Insurance: With the increasing connectivity of vehicles, the risk of cyberattacks and data breaches becomes more prominent. Cyber insurance coverage can provide protection against these emerging risks, ensuring policyholders are protected in the event of a cyber incident.

- Electric Vehicle (EV) Insurance: The growing popularity of electric vehicles (EVs) is prompting insurers to offer specialized EV insurance policies. These policies may include coverage for unique EV-related risks, such as battery replacement or charging station liability.

Conclusion

Car insurance in the US is a complex and ever-evolving landscape, offering a range of coverage options to protect drivers and their vehicles. From liability coverage to innovative emerging technologies, policyholders have a wealth of choices to tailor their insurance to their specific needs. By understanding the various factors influencing insurance rates and staying informed about industry trends, drivers can make informed decisions and navigate the world of car insurance with confidence.

What is the average cost of car insurance in the US?

+The average cost of car insurance in the US varies significantly based on numerous factors, including the policyholder’s location, driving record, and coverage options. According to recent data, the national average annual premium for car insurance is approximately $1,674. However, this average can vary widely, with some states having much higher or lower premiums.

Are there any ways to lower my car insurance premiums?

+Yes, there are several strategies to potentially reduce your car insurance premiums. These include maintaining a clean driving record, choosing a higher deductible, bundling policies with the same insurer, taking advantage of available discounts, and considering usage-based insurance programs if they are offered in your area.

How often should I review my car insurance policy?

+It’s recommended to review your car insurance policy at least once a year, especially after significant life events such as a move to a new location, purchasing a new vehicle, getting married, or changing jobs. Regular policy reviews ensure that your coverage remains adequate and aligned with your current needs and circumstances.